Chinnapong

A Quick Take On Jupiter Neurosciences

Jupiter Neurosciences, Inc. (JUNS) has filed to raise $15 million in an IPO of its common stock, according to an S-1/A registration statement.

The firm is developing treatment candidates for various types of neuroinflammation conditions.

While I wish JUNS well, the firm is pursuing very challenging lines of research, appears to be thinly capitalized, and has no major pharma firm collaborations or institutional life science venture capital investors.

I’m on hold for the Jupiter Neurosciences IPO.

Jupiter Overview

Jupiter, Florida-based Jupiter was founded to develop resveratrol-based treatments for neuroinflammation, lysosomal storage diseases, ataxias and mitochondrial disorders.

Management is headed by co-founder, Chairman and CEO Christer Rosén, who has been with the firm since inception in 2016 and was previously founder and CEO EffRx Pharmaceuticals where he led development and approval of the osteoporosis treatment Binosto.

The firm’s lead candidate is JNS101 being tested for the treatment of Friedreich’s Ataxia. The drug is currently preparing for Phase II trials.

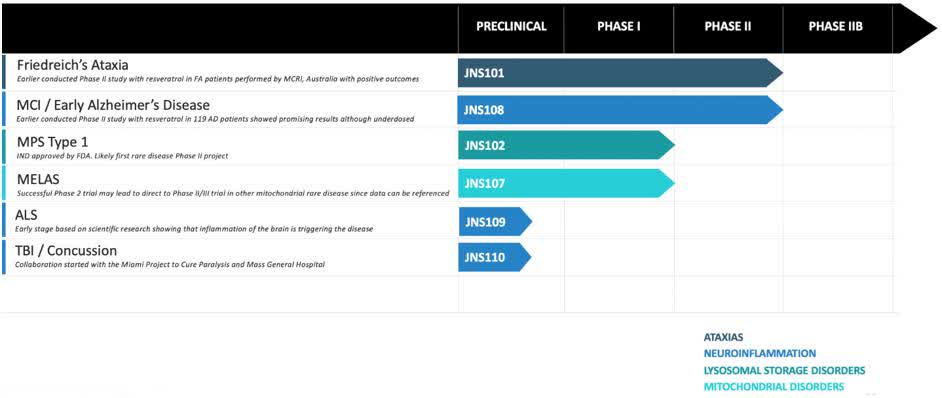

Below is the current status of the company’s drug development pipeline:

Company Pipeline (SEC EDGAR)

Jupiter has booked fair market value investment of $9.3 million as of June 30, 2022 from investors.

Jupiter’s Market & Competition

According to a 2022 market research report by Coherent Market Insights, the global market for treatments for Freidreich’s ataxia is an estimated $777 million in 2022 and is forecast to reach $2.06 billion in 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 13.0% from 2022 to 2030.

Key elements driving this expected growth are continued development of approved treatment options along with inorganic business collaborations and acquisitions.

Also, by region, North America is expected to hold the largest demand for treatments during the forecast period through 2030.

The company is pursuing drug treatment testing for other multi-billion dollar size markets.

Major competitive vendors that provide or are developing related treatments include:

-

Sanofi

-

RegenexBio

-

Sigilon Therapeutics

-

Sangamo Therapeutics

-

Reata Pharmaceuticals

-

Minoryx Therapeutics

-

Larimar Therapeutics

-

Cyclerion Therapeutics

-

Abliva

-

Amylyx

-

Eledon Pharmaceuticals

-

Biogen

-

Eli Lilly

-

Others

Jupiter Neurosciences Financial Status

The firm’s recent financial results are somewhat typical of a development stage biopharma but they feature some federal contract revenue.

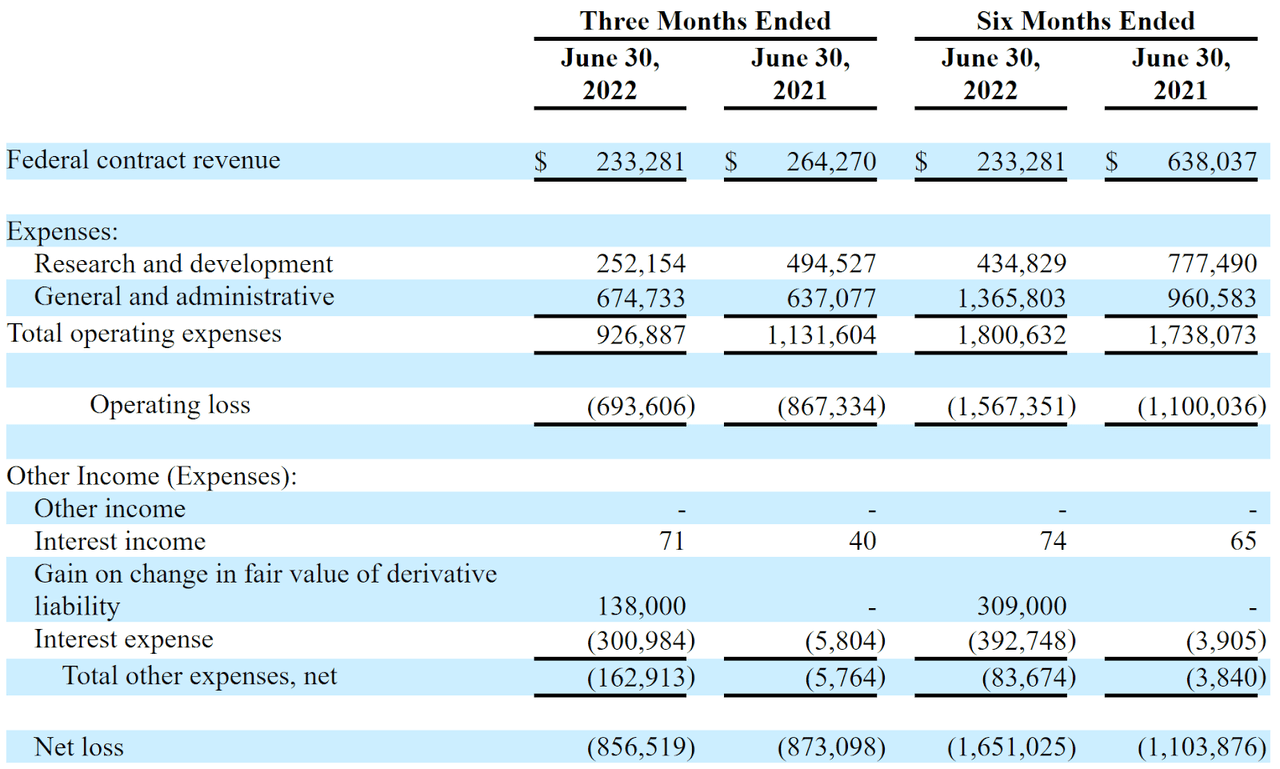

Below are the company’s financial results for the three and six months ended June 30, 2021 and 2022:

Statement Of Operations (SEC EDGAR)

As of June 30, 2022, the company had $598,543 in cash and $7.0 million in total liabilities.

Jupiter Neurosciences IPO Details

Jupiter intends to raise $15 million in gross proceeds from an IPO of its common stock, offering 2.5 million shares at a proposed midpoint price of $6.00 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $45.2 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 26.35%.

Management says it will use the net proceeds from the IPO as follows:

approximately $350,000 to fund IND submissions for Friedreich’s ataxia, MELAS and MCI/early Alzheimer’s Disease;

approximately $75,000 to pay the annual license fee to Aquanova AG;

approximately $900,000 to fund manufacturing of clinical trial supplies of JOTROLTM;

approximately $4,000,000 to fund Phases II clinical trials of our product candidate JOTROLTM in patients with MPS I later followed by an initiation of Phase II in MELAS and Friedreich’s ataxia in the first half of 2024;

approximately $250,000 to fund preclinical R&D for TBI/Concussion and ALS;

approximately $4,000,000 to establish and expand our business in China and South East Asia; and

the remainder to fund general research and development activities, working capital and other general corporate activities.

Based on our current operating plan, we believe that the net proceeds from this offering, together with our existing cash and cash equivalents, will be sufficient to fund our operations through at least the next 24 months.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm is being sued for non-payment in the total amount of $150,000 by a previously used communications and investor relations company.

The sole listed bookrunner of the IPO is Spartan Capital Securities.

Commentary About Jupiter’s IPO

JUNS is seeking public capital market investment to fund further development of its pipeline of neurological system drug candidates.

The firm’s lead candidate, JNS101, is being tested for the treatment of Friedreich’s Ataxia. The drug is currently preparing for Phase II trials.

The market opportunities for the various conditions and diseases the company is seeking to treat are large and expected to grow at moderate to fast rates of growth, although the firm faces material competition from major market participants.

Management has not disclosed any major pharma firm collaboration relationships, although it does have a relationship with a technology partner, Aquanova AG, for JOTROL.

The company’s investor syndicate does not include any widely known institutional life science venture capital firms.

Spartan Capital Securities is the sole underwriter and the two IPOs led by the firm over the last 12-month period have generated an average return of negative (64.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Management believes that its JOTROL program can cross the blood-brain barrier and deliver a therapeutically effective dose of resveratrol to the bloodstream without causing gastro-intestinal problems.

As for valuation, the IPO is valued at a level that is far below the typical institutional-backed biopharma.

While I wish JUNS well, the firm is pursuing very challenging lines of research, appears to be thinly capitalized, and has no major pharma firm collaborations or institutional life science venture capital investors.

I’m on Hold for the Jupiter IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment