April 20 will go down in the history books as a Black Monday event for energy investors. The price of a WTI crude oil barrel fell by more than 250%, sending the prices tumbling to the negative territory for the first time in history. How long can oil prices stay ridiculously low? This is the resounding question asked by every energy investor. In trying to find an answer to this question. I studied a few noteworthy oil price crashes. There’s no guarantee that history will repeat itself, but an investor can gain valuable insights by studying some of these catastrophic events. I uncovered similarities between the 1980s oil price crash and what we are experiencing today. However, a closer look at the fundamentals behind energy markets reveals promising signs of a recovery.

17 years! That’s how long oil traded at ultra-low prices in the 1980s

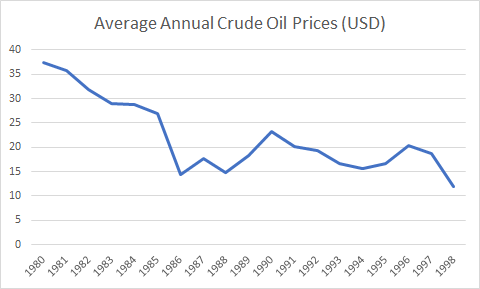

As unreal as it sounds, oil remained under pressure for almost 17 years starting from 1980 until the price of a barrel entered a historic bull run in 1998 that saw the prices breach the $100 mark. Below is a chart that every energy investor should pay attention to gauge a measure of how bad things can get for any precious commodity when the equilibrium between the demand and supply is skewed unfavorably.

Source: Eikon

Not one, but many factors were at play keeping energy prices depressed.

Eerie similarities

This might not be welcome news for investors, but there are eerie similarities between the 1980s crash and what is happening today.

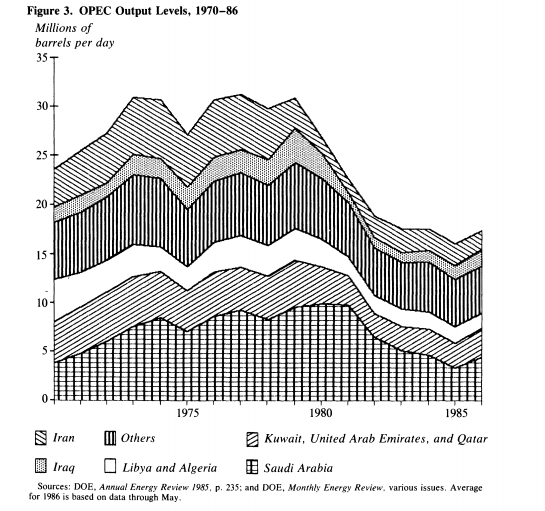

The primary reason behind the oil price crash more than 30 years ago was the oversupply of oil in the global market. A decline in demand for crude oil was threatening the stability of oil markets, and then came OPEC to the rescue. The cartel decided to cut the production by nearly a half from the peak production reached in 1980 in a bid to save oil prices from tumbling.

Source: Brookings Institution

One could assume that things would have gone well. It did, for a while, but then, Saudi Arabia realized that they were losing market share to other OPEC and non-OPEC members as none of the other countries cut production as much as the Saudis did. This led to an energy price war between Saudi Arabia and the others. Sounds familiar? In 1986, the oil giant decided to pump record amounts of oil into the market to secure its market share. The United Arab Emirates, Kuwait, and Nigeria followed suit in a bid to secure their share of the market. Needless to say, this led to a massive decline in oil prices as the supply of oil far outweighed the demand.

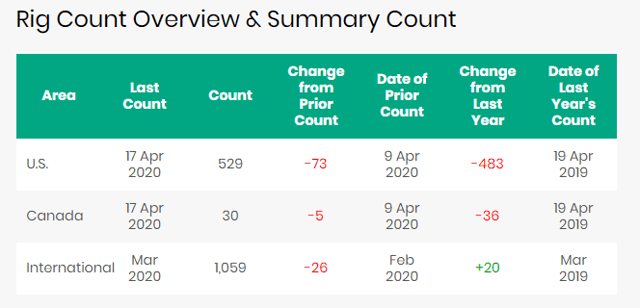

Now, to another similarity, but a fairly obvious one. When oil prices crashed in 1986, the number of drilling wells in the United States declined from 2,300 in 1985 to less than 1,000 in the following year. This led to a surge in the unemployment level in the oil and gas industry. According to an article published by the Los Angeles Times in 1986, the unemployment level has risen to over 7% as a result of this decline in drilling activities. Today, we are seeing a similar trend. The active number of drilling rigs has declined by more than half on a year-over-year basis in the United States.

Source: Baker Hughes

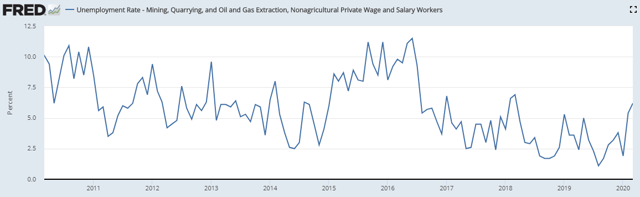

The unemployment level in the industry, on the other hand, is following the same path as the 1980s as well. From just 1.9% in January, unemployment has risen to more than 6% by the end of March.

Source: Federal Reserve

As you can see, there are similarities between the 1980s crash and what we are experiencing today. It all started with a decline in demand for oil, aggravated by an energy price war, and ended by leaving hundreds of thousands of people unemployed.

Is this going to be a repeat of the 1980s?

You never know because the industry dynamics can change in the matter of a few days. That’s what happened when Russia decided to maintain output at a higher level without complying with Saudi Arabia’s proposed production cuts in March, triggering an oil price war between the two nations. However, I think we are not in for a collapse that would continue for a prolonged time. There are a few reasons for me to conclude that we might get out of the waters by 2021.

First, America has skin in the game now, unlike in the 1980s. True, the United States was producing oil back in the days as well, but the country was well and truly a net importer of oil. In fact, the collapse in crude oil prices benefited the country and its economy during the latter half of the 1980s. The following excerpt from a New York Times article published on November 19, 1987, gives a summary of what happened back then.

The Commerce Department estimates that imports of crude oil and refined products will rise to $46 billion this year from $37.1 billion in 1986. That means that oil -the second-largest item after motor vehicles that the United States purchases from other countries – will account for 11 percent of the nation’s total import bill in 1987. The reasons are plain enough. Petroleum consumption, particularly gasoline, is rising as the economy grows. Domestic oil production, meantime, has fallen sharply over the last 18 months, and is continuing to drop. Conservation efforts have dwindled, and the price of crude oil seems to be settling at $18 to $20 a barrel – a level too low to discourage consumption. The price of oil would have to return to at least $28 a barrel for American oil companies to increase their production, according to a survey of the members of the American Petroleum Institute, an association of oil companies. Oil prices have not been that high since 1985.

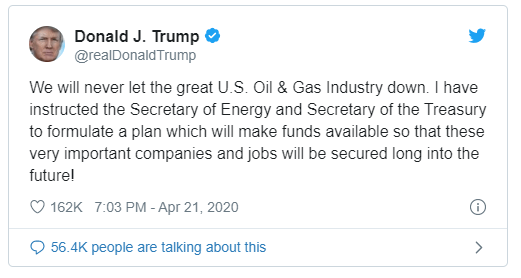

Fast forward to today, the United States has transformed into a net oil exporter. In November 2019, Bloomberg reported the United States posting the first month in 70 years as a net petroleum exporter. The economic costs of ultra-low oil prices outweigh the benefits. This was evident when President Trump called for a truce between Saudi Arabia and Russia earlier. When Mexico threatened the success of the proposed supply cuts, the U.S. intervened and agreed to reduce its output as compensation for Mexico’s losses. There’s mounting pressure on the federal government to save the oil and gas industry as well, and the Trump administration has assured the industry would be receiving federal aid to stay alive. The President took this to Twitter as well.

Source: Twitter

The role that America plays in the global oil market has gone through radical changes in the last couple of decades, which differentiates the 1980s crash from today. To add to this, the Trump administration has taken bold measures to reduce the trade deficit as well, and importing ‘cheap’ oil does not seem to bode well with these plans. The supply cuts might remain in place for as long as the demand-side dynamics return to normalcy.

Second, the Saudi-led OPEC is much more proactive than they used to be. When oil prices crashed in mid-2014, many analysts claimed that the world was headed toward an era where oil would remain at historic lows. How wrong that prediction turned out to be. Take a look at the heading of an oil market analysis published by Morgan Stanley in April 2015.

Source: Morgan Stanley

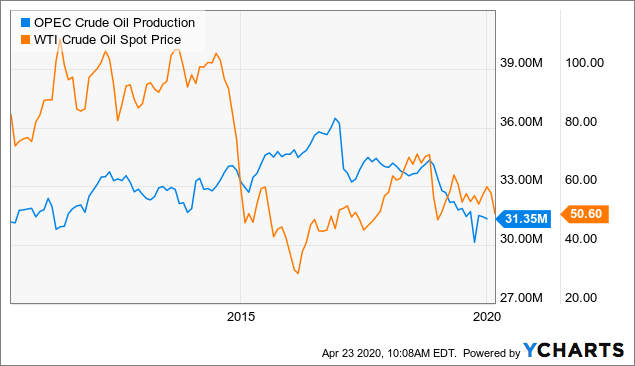

When everything seemed to be going well for the analysts who called for years of low oil prices, OPEC took a bold decision to cut the production to support higher oil prices. This led to a surge in oil prices over the last couple of years until COVID-19 crashed the party.

Data by YCharts

Data by YCharts

The cartel, however, momentarily lost its focus. This led to the recent energy price war. However, Saudi Arabia was quick to get the house in order and obtain the approval of energy ministers representing the oil cartel to reduce the output. Things won’t be smooth always, but this goes on to show that OPEC is much more proactive than it used to be during the 1980s. This will play a massive role in the recovery of oil prices in the coming months.

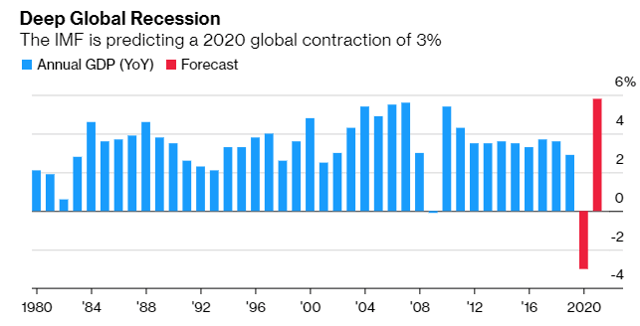

Third, a revival of economic growth is imminent by the next year. Global business activities have declined drastically as a result of the measures taken to curb the spread of the virus. However, if the rest of the world follows China, mobility restrictions will be lifted off within the next couple of months. This will lead to a surge in business activities, and the International Monetary Fund projects a historic bump in global GDP growth in 2021 to the tune of 5.8%.

Source: Bloomberg

Despite the similarities that we discussed earlier, there’s reason to believe that the demand for oil will surge in the latter half of this year while the United States and the OPEC+ alliance will keep production cuts in place to support higher oil prices.

Takeaway: embrace for more volatility, but be hopeful

Wild price swings could prove to be a feature of energy markets in the coming weeks. Storage facilities in Cushing, Oklahoma, are operating at unusually high utilization levels, an indication of the oversupply in the last few weeks. If we look beyond the virus-induced recession, it’s evident that oil prices will not remain depressed for a prolonged time as in the 1980s. My preferred method of betting on the recovery of oil prices is investing in equity securities of energy companies such as Exxon Mobil Corporation (NYSE:XOM) and Occidental Petroleum (NYSE:OXY), and I’m looking to accumulate shares of both these companies on every weakness.

If you enjoyed this article and wish to receive updates on my latest research, click “Follow” next to my name at the top of this article.

Disclosure: I am/we are long OXY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment