m.czosnek

Osisko Mining Inc. (OTCPK:OBNNF) expects to deliver soon new tests of mineralization, and may perhaps receive more authorization to explore new areas. Besides, I think the Windfall Gold Deposit was not correctly assessed by market participants. In my view, if the company successfully produces the expected production of 19 million tons, and the ore grade is as large as expected, the company would be valued at CAD5.7 per share. Yes, I am aware of the potential risks from lower ore grades than expected and the fact that measured reserves are not that large. With that, the current stock price does seem too low.

Osisko Mining

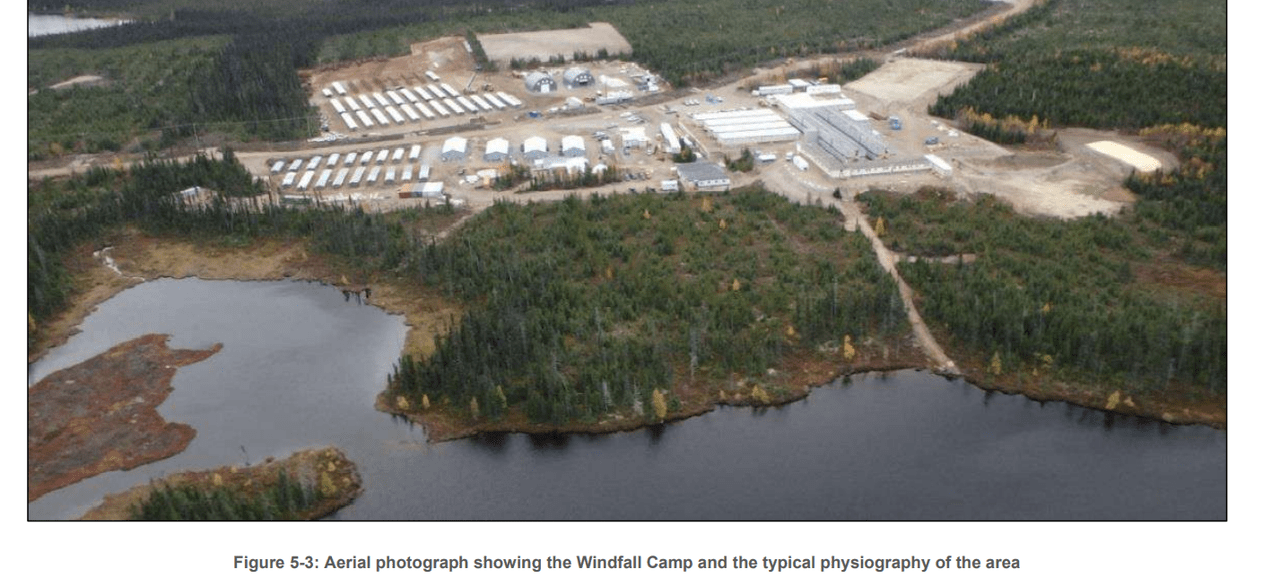

Osisko’s flagship project is the Windfall Gold Deposit located in Québec, Canada.

Technical Report

In this article, I mainly assessed the valuation of the Windfall Gold Deposit, however the company also holds interests in the Urban-Barry area and the Quévillon area. Further exploration or development in these new areas could lead to larger mineral reserves and perhaps more production.

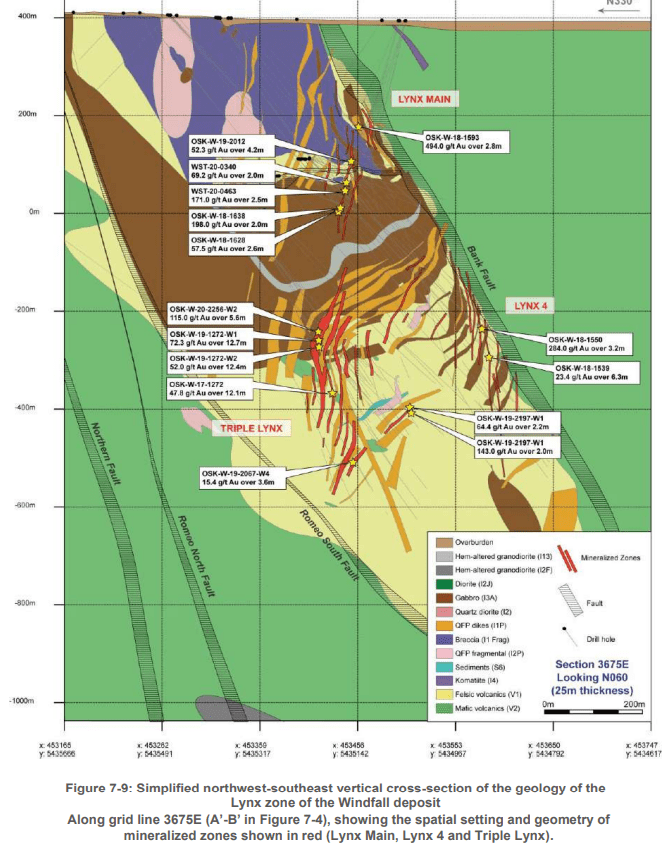

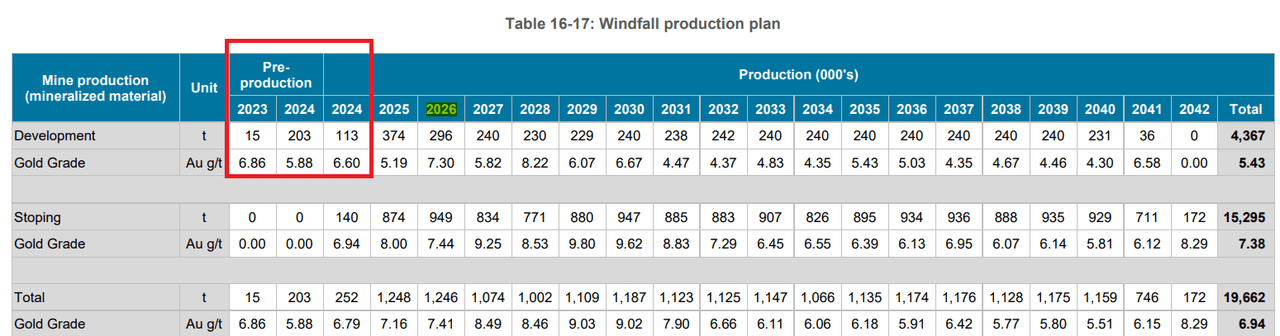

The following diagram was obtained from a recent technical report. Let’s note that the company’s flagship project has a significantly high gold grade.

Technical Report

I wanted to cover the company because I believe that the work is quite advanced, and we may receive information about new mineral reserves soon. In the last quarterly report, the guidance was positive. Management is already discussing new production locations and expansion of its activities:

Osisko expects its portfolio to generate between 130,000 and 140,000 GEOs in 2026. The outlook assumes the commencement of production at the San Antonio, Cariboo, Windfall and Back Forty projects amongst others. It also assumes that Mantos will have reached its nameplate capacity following the recent expansion of its activities, as well as increased production from certain other operators that have announced planned expansions. Source: Quarterly Report

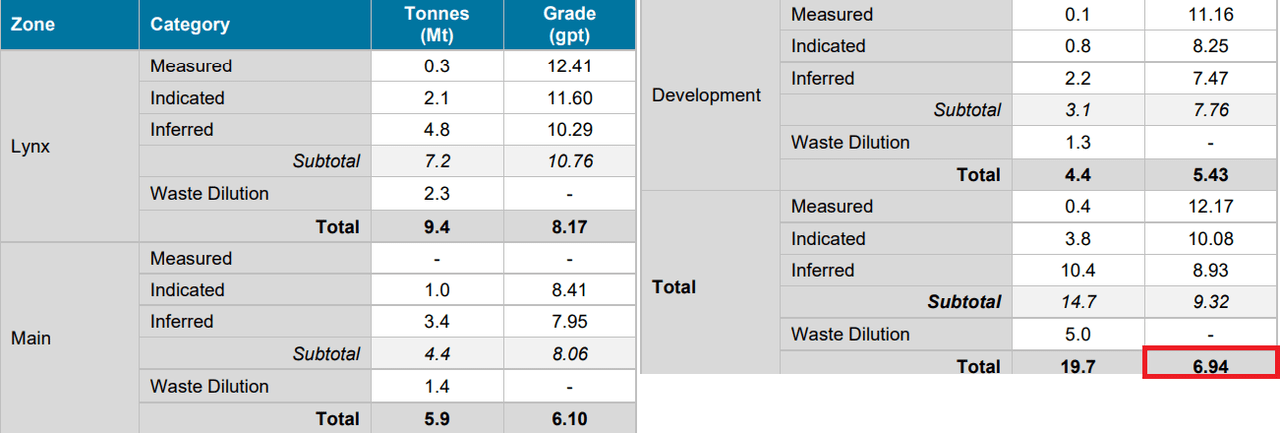

Mineral Resources And Balance Sheet

For the assessment of production, management used indicated, inferred, and measured mineral reserves. In total, we are talking about reserves of 19.7 million tons with a grade of close to 6.94 grams per ton. Let’s note that the total amount of measured reserves of gold are significantly lower than 19.7 million tons. Very conservative individuals would most likely use measured reserves to assume future revenue growth.

Technical Report

The company also made a valuation of its properties using a gold price of $1500 per ounce. I believe that management was fair when it decided to use such a price.

This PEA assumes a long-term CAD/USD exchange rate of 1.30:1.00, a gold price of USD1,500/oz and a silver price of USD21.00/oz to support the base case economic analysis as summarized in Chapter 22. Source Technical Report

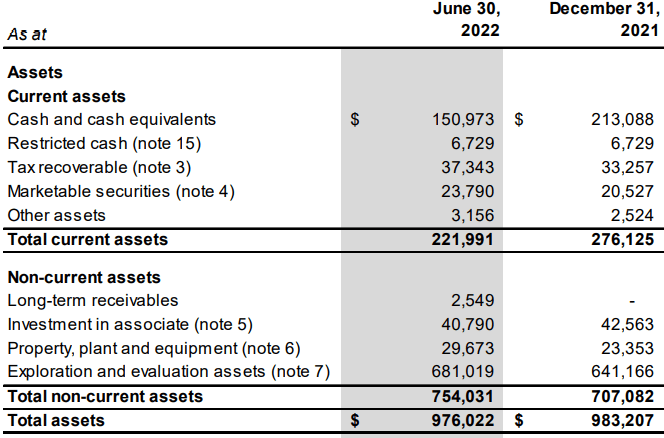

As of June 30, 2022, cash stands at close to CAD156 million, and exploration and evaluation assets are equal to CAD681 million, 6% more than that in December 2021. With the company reporting an increase in the number of assets thanks to exploratory activities, in my view, it is likely that further exploration leads to more mineral reserves. As a result, the number of assets would increase.

Quarterly Report

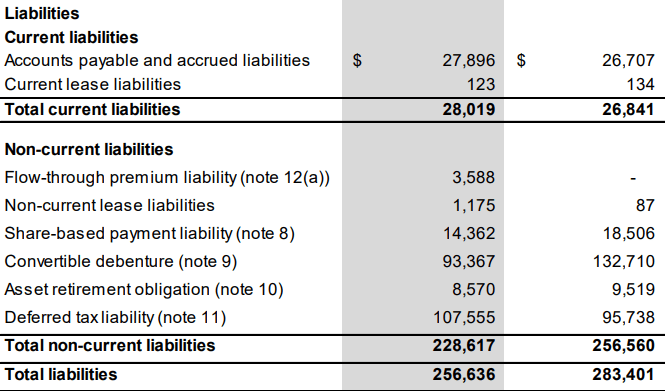

The debt does not seem significant. In my view, considering Osisko’s gold production, management will most likely receive more financing if necessary. Convertible debentures stand at CAD93 million.

Quarterly Report

New Developments And Conservative Assumptions Would Imply A Valuation Of Up To CAD5.7 Per Share

Considering the recent information about the production coming in 2022 and new tests to be delivered, I believe that the stock price could move up soon. Under this case scenario, I assumed that production will ramp up as expected by management:

Extraction of the Lynx 600 bulk sample (600 metre vertical level located in the Triple Lynx zone) is expected to be completed in early July 2022. Processing of the approximately 5,000 tonnes of material is expected to commence in Q3 2022 at a custom mill located near Timmins, Ontario. Results of the test are expected to be released in early Q4 2022. Source: Osisko Press Release

I also assumed new authorization from authorities, which would lead to more exploration activities from Q3 2022. Let’s also note that the company could be signing new agreements with stakeholders if permits are received.

The authorization, anticipated to be received in Q3 2022, will permit the Corporation to advance the exploration ramp to the high-grade Lynx 4 zone. The advance of the exploration ramp will give access to the fourth bulk sample, and will also be used to conduct a Stope School in partnership with local stakeholders. The Stope School will provide certified training programs in ore extraction for local community trainees from the Eeeyou-Itshee James Bay area. Source: Osisko Press Release

Finally, under this case scenario, I also assumed that more automation could lead to more production. The company will mine for more than 17 years, so we can expect certain advancements in the coming time:

Increasing the use of automation and technology could increase productivity and reduce operating costs in the mine and process plant. Source: Technical Report

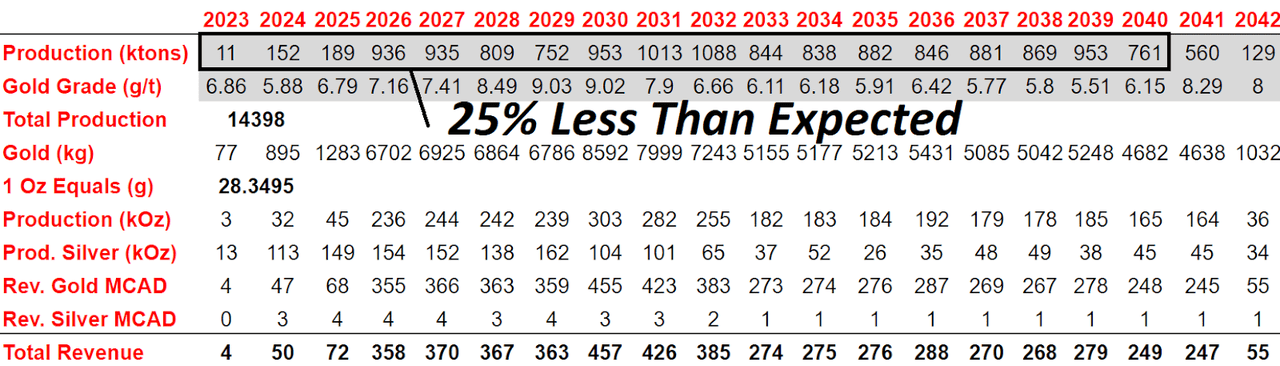

In a recent technical report, Osisko Mining reported production expectations ranging from 240 ktons in 2027 to 15 ktons in 2023. The company expects gold grade to be around 5.43 grams per ton. It means that revenue could start to flow from 2023 and 2024.

Technical Report

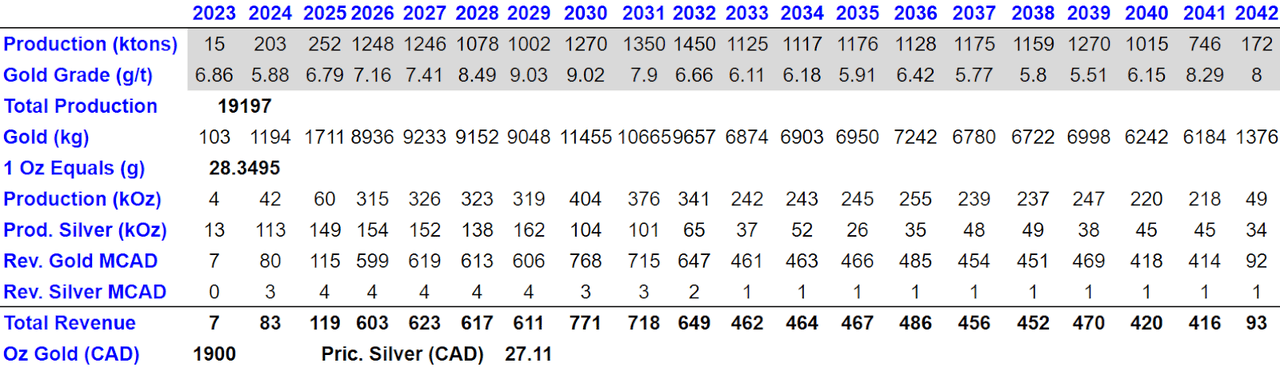

Under this case scenario, I used figures from the technical report from Osisko Mining. I believe that my figures are even more conservative than those in the report delivered by management. Total production of gold would be 19 million tons with gold grade close to 6-8 grams per ton. I also included production of silver, but what matters the most is the company’s gold. Total revenue including price of gold at CAD1900 per ounce and CAD27 per ounce would stand at close to CAD771 million in 2030.

Author’s Work

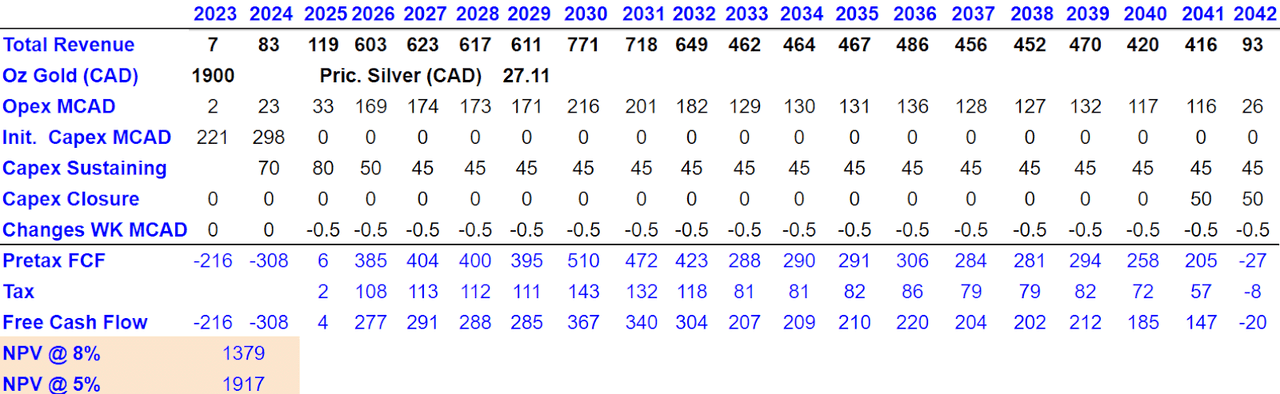

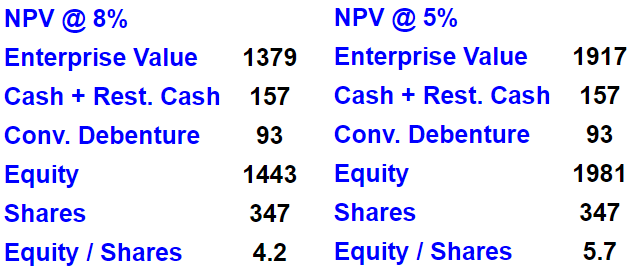

I used initial capital expenditures of close to CAD221-CAD298 million, conservative capex for closure of the mine, and sustaining capital expenditures at around CAD80 to CAD45 million. My results include free cash flow of CAD277 million in 2026, and a net present value close to CAD1.3 billion with a discount of 8%.

Author’s Work

If we add cash and restricted cash of CAD157 million, a discount of 8%, and convertible debenture of CAD93 million, the equity would be close to CAD1.44 billion. If we use a discount of 5%, like management did in its report, the equity valuation would stand at CAD1.9 billion. Finally, the equity per share would be around CAD4.2 and CAD5.7 per share.

Author’s Work

Detrimental Conditions Would Lead To A Valuation Of CAD2.4-CAD2.5 Per Share

Under very detrimental conditions, management could find less reserves than initially expected, or the ore grade could be lower. The gold price could decline, or capital expenditures could be larger than expected. Let’s note that we made many assumptions with respect to the next 15-20 years, and they may not be correct. As a result, future revenue would be lower than expected, and the company’s fair valuation would decline:

The results of the economic analysis are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those presented here. The reader is cautioned that this PEA is preliminary in nature and includes the use of Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and, as such, there is no certainty that the PEA economics will be realized. Source: Technical Report

Changes in environmental regulation, supply chain issues, or inflation could reduce future production, or lead to opex or capex increases. As a result, Osisko Mining could report less free cash flow than expected, which would lower Osisko’s market capitalization.

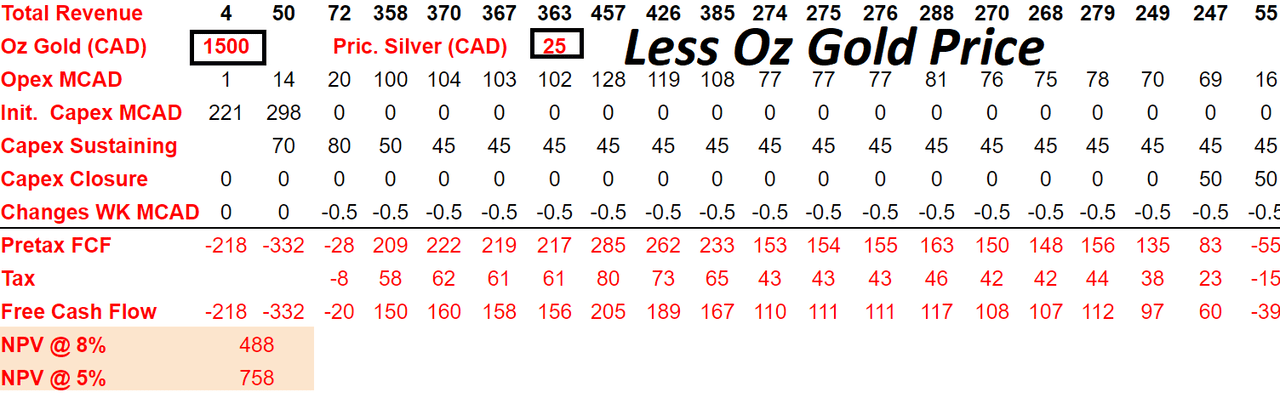

Under the previous conditions, I assumed a decline in production of around 25% less than initially expected. It means that total production of gold would result in 14 million tons. In 2023, the company would produce around 11 million tons, and in 2031, total production would stand at 1013 million tons.

Author’s Work

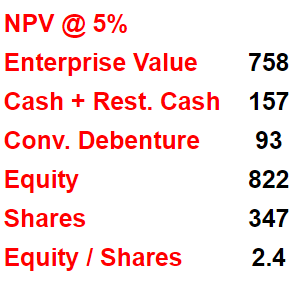

I also assumed that the gold price would reduce to CAD1500, and each ounce of silver would be CAD25. With changes in working capital of around -CAD0.5 million, the net present value of future free cash flow at 5% would be close to CAD755 million.

Author’s Work

By adding cash and restricted cash and subtracting debentures, I obtained a fair valuation of close to CAD2.4-CAD2.5 per share. With this figure in mind and previous results, I believe that the upside potential appears more significant than the downside risk.

Author’s Work

Conclusion

According to documents about Osisko’s flagship project, the company expects to produce more than 19 million tons. With a significant amount of cash, and quite beneficial technical reports, I believe that the market didn’t correctly assess the valuation of the company. Even considering major production risks and failed assessment of reserves, future production of inferred reserves would imply a valuation of close to CAD5.7 per share. In my view, as soon as management starts to deliver production reports and new revenue growth, the stock price will likely go to more reasonable price marks.

Be the first to comment