Michael Vi

Palantir (NYSE:PLTR) delivered its Q2’22 earnings report two days ago which sent the stock into a tailspin. Palantir’s shares dropped 20% after the software analytics company reported a larger than expected loss and, unfortunately, fundamentally changed the game for investors by trimming its revenue outlook for FY 2022. Palantir has been valued chiefly based on its prospects for aggressive top line growth, both in the commercial and the government sectors, and slowing growth is going to be a major problem for the stock!

Palantir whiffs on earnings, again

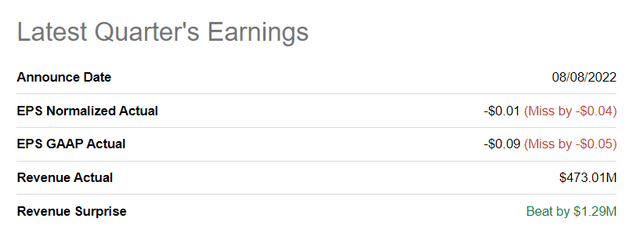

After two consecutive misses on EPS in Q4’21 and Q1’22 I believed Palantir could perform a little better this time due to expected progress made regarding the monetization of the firm’s customers, but I was disappointed yet again: Palantir reported second-quarter non-GAAP EPS of $(0.01) compared to an expectation of $0.03. This was the third consecutive time that Palantir missed EPS predictions by at least $0.02 per-share. Revenues, on the other hand, were slightly better than expected: actual Q2’22 revenues were $473.0M vs. a prediction of $471.7M.

Seeking Alpha: Palantir Q2’22 Results

Palantir’s Q2’22: Decelerating top line growth and weakening customer monetization

Two performance indicators are critical for the evaluation of Palantir: (1) the firm’s top line growth in both the government and commercial business and (2) customer monetization.

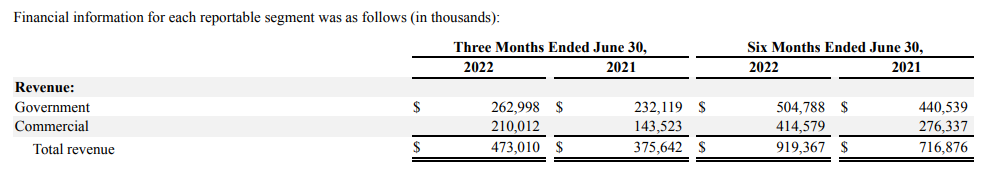

Palantir’s Q2’22 government revenues grew 13% year over year to $263.0M while commercial revenues increased 46% year over year to $210.0M. In total, Palantir generated $473.0M in revenues in the second-quarter, showing 26% year over year growth. Revenues of $473M were slightly better than guidance which called for base-case revenues of $470M while I expected revenues between $470-475M.

Palantir: Q2’22 Revenue Breakdown

Palantir’s growth decelerated in the second-quarter and the firm’s commercial business no longer saw a revenue acceleration. Palantir’s commercial revenue growth accelerated in the previous four quarters and the company saw a revenue growth rate of 54% year over year in Q1’22. Although a 46% revenue growth rate in Q2’22 is not bad, Palantir is no longer riding on an accelerating growth curve in its most promising business. Government revenue growth also decelerated to 13%, down from 16% in Q1’22.

Turning to customer monetization.

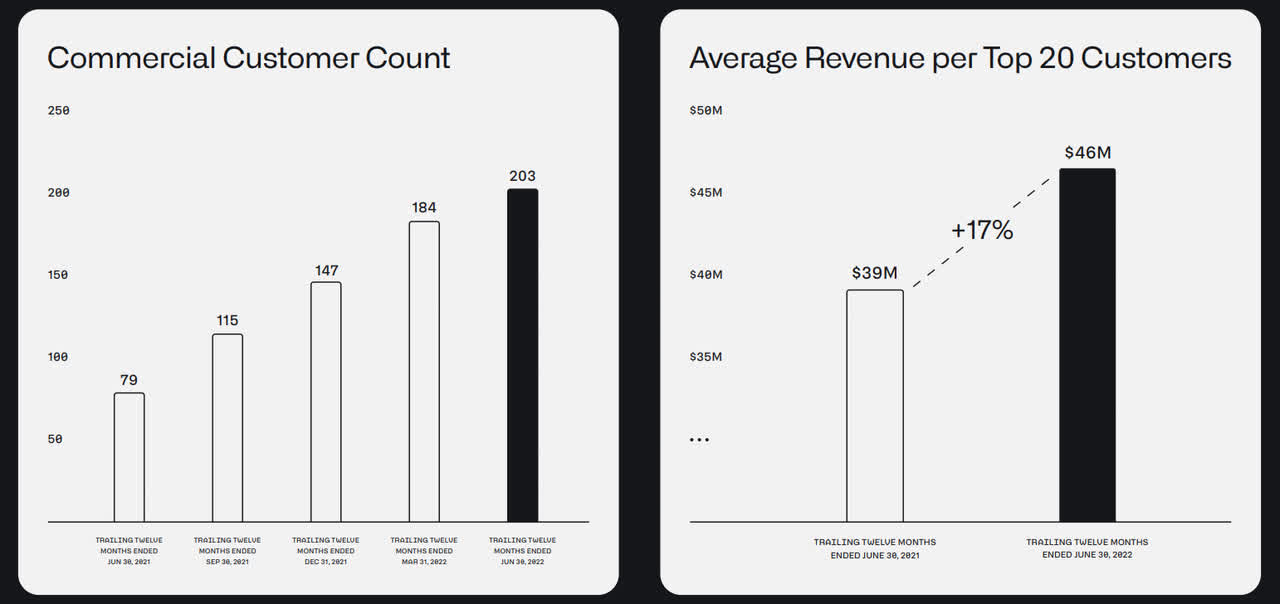

After adding 40 net new customers in Q1’22, Palantir added 27 net new customers in Q2’22, implying that the rate of customer acquisition also slowed from 17% to 10% quarter over quarter. Customers using Palantir’s products and services totaled 304 at the end of Q2’22 while customers in the commercial business hit 203. Both counts exceeded my minimum expectations of 300 (total) and 200 (commercial) accounts by the end of the quarter.

Palantir’s average revenue per top twenty customer grew from $45M in Q1’22 to $46M in Q2’22 and fell into my estimated range of $45M to $47M. Although Palantir grew revenues per top twenty client quarter over quarter, growth in monetization is slowing as well: Palantir’s growth rate in average revenue per top twenty customer slowed from 24% in Q1’22 to 17% in Q2’22.

Palantir: Q2’22 Customer Metrics

The game-changer: Trimmed growth outlook

Nothing could have hurt Palantir’s stock prospects more than a trimmed revenue outlook, but this is exactly what Palantir did. The software analytics company previously guided for 30% annual top line growth rates until FY 2025. The outlook for FY 2022 now, however, is based on revenues of $1.90-1.902B, implying only 23% year over year growth.

For Q3’22, Palantir sees $474-475M in revenues, meaning for the first time they are not expected to grow by any significant amount quarter over quarter: the implied growth rate is just 0.3% relative to Q2’22.

The company blamed “lumpy” government work on Palantir’s cut revenue guidance, but it has changed nevertheless everything for Palantir and the stock’s prospects for revaluation. This is because Palantir’s shares are chiefly evaluated based on expectations of aggressive top line growth, especially in the commercial market which is where Palantir has made significant inroads in the last year. Palantir has also repeatedly confirmed that it plans to generate 30% annual revenue growth until FY 2025 so the guidance down-grade is a major disappointment for investors.

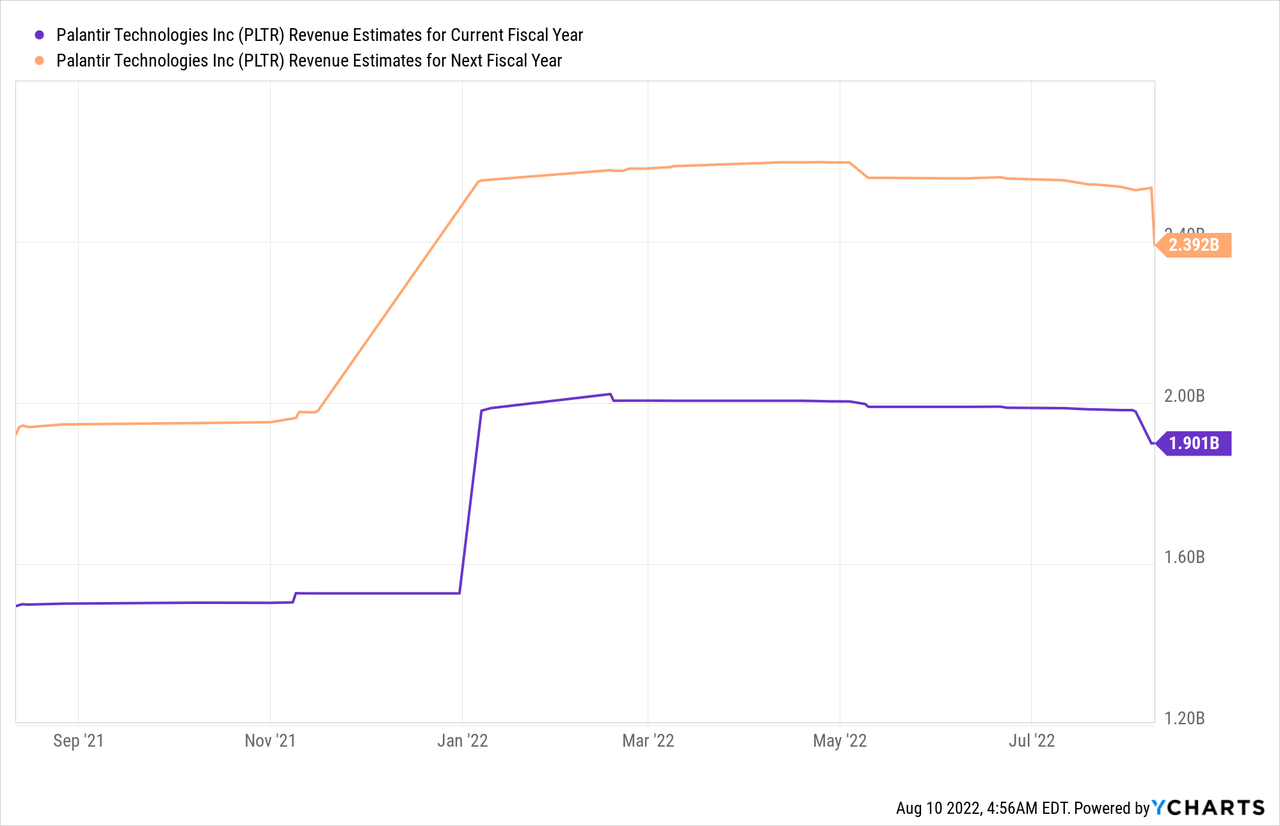

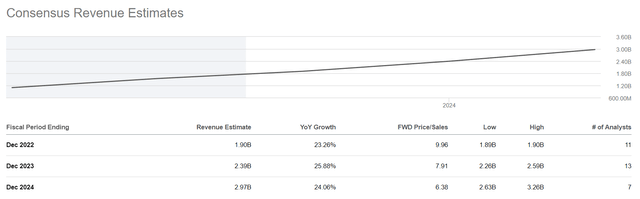

Palantir’s revenue estimates are set for down-grades

With Palantir effectively down-grading its revenue guidance, it is only a question of time until the market responds by lowering Palantir’s revenue estimates. Revenue estimates have already started to fall and I would expect that average revenue estimates for next year will be lowered by 5-10% in response to Palantir’s adjusted FY 2022 guidance.

With Palantir’s top line growth slowing and guidance getting a down-grade, Palantir may increasingly be viewed as a growth play that is too expensive. Based off of estimated FY 2023 revenue estimates of $2.39B, shares of Palantir have a price-to-revenue ratio of 7.9 X.

Seeking Alpha: Palantir Revenue Estimates

Risks with Palantir

Palantir may see a continual top line deceleration in both its government and its commercial business which is likely what will affect Palantir’s stock prospects the most. Customer acquisition rates have also slowed, suggesting that customer monetization may continue to weaken as well. The trimmed revenue outlook and weak Q3’22 top line forecast pretty much eliminate the possibility of Palantir moving into a new upleg. For those reasons, I have turned more bearish on the software analytics company and believe the risk profile has deteriorated significantly.

Final thoughts

Down-grading the revenue forecast from 30% to 23% is a game-changer for Palantir because prospects of strong top line growth have been a key reason for many investors to buy the stock in the first place. Now that Palantir has trimmed its FY 2022 revenue outlook at a time when customer monetization is also weakening, the software analytics company has lost a lot of its appeal as a growth play… which frankly changes everything. The risk profile is no longer favorable and the stock may experience more down-side pressure in the short term!

Be the first to comment