sankai

Are you in search of a potential winner in the software space but want to avoid taking extreme risk? One large-cap player with somewhat predictable sales could be your play.

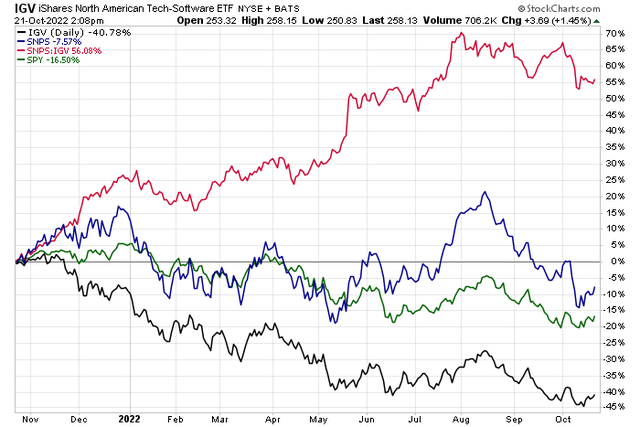

Synopsys (NASDAQ:SNPS) has outperformed both the Software ETF (IGV) and the broad market (SPY) in the last year. Impressively, it’s up 55 percentage points on IGV over the past 52 weeks. Is there more relative upside ahead for this large-cap? Let’s find out.

Software Sinks, But Synopsys Shares Holding Up

According to Bank of America Global Research, Synopsys is the largest provider of electronic design automation (‘EDA’) software and tools used to design, verify, and layout semiconductor chips and electronics systems. Synopsys is also the 2nd largest supplier of semiconductor intellectual property, and a recognized leader in the nascent market for tools and services which help to improve the security and quality of software code for a wide variety of enterprises.

The California-based $44.3 billion market cap Software industry company within the Information Technology sector trades at a high 44.7 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Synopsys has been a resilient company amid surging interest rates that have hurt so many software stocks. Moreover, exposure to China is an obvious headwind. Still, shares have simply traded sideways for much of the last year, not to downplay the steep 24.6% pullback off its 2022 peak. What’s helped the fundamental case for SNPS is its solid recurring revenue stream model that has proven to be durable during the downturn. Increased government investment into semiconductors would be bullish for the firm while a macro global recession would certainly pose significant bearish risks.

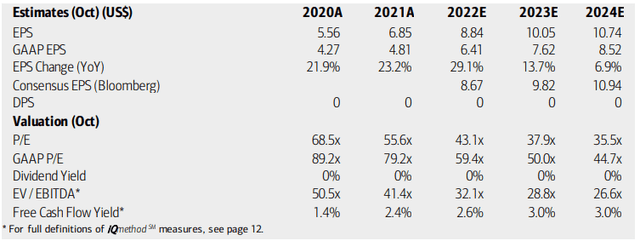

On valuation, BofA analysts see earnings growing sharply this year while moderating to a still-strong pace in 2023 and 2024. The Bloomberg consensus outlook is even more sanguine on SNPS’s per-share profits. Does that EPS growth warrant a lofty valuation to the tune of 38x next year’s bottom line? With a high EV/EBITDA multiple and low free cash flow yield, it indeed looks pricey. Seeking Alpha shows a reasonable 1.8 forward PEG ratio. Overall, the valuation looks fair.

Synopsys Earnings, Valuation, And Free Cash Flow Forecasts

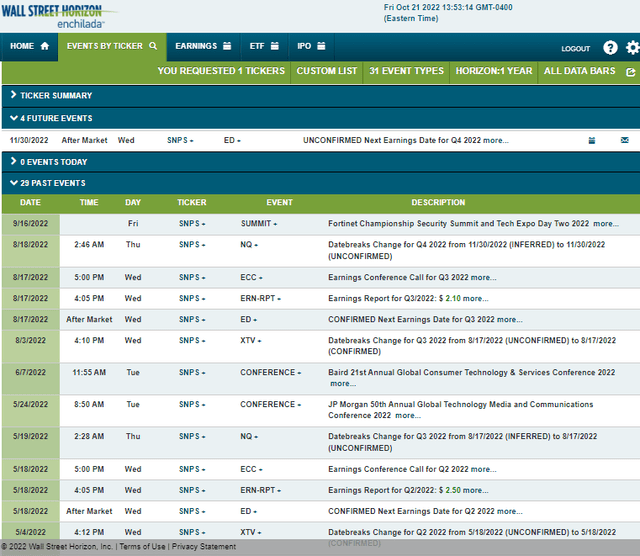

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 earnings date of Wednesday, November 30 after market close. The calendar is light aside from that.

Corporate Event Calendar

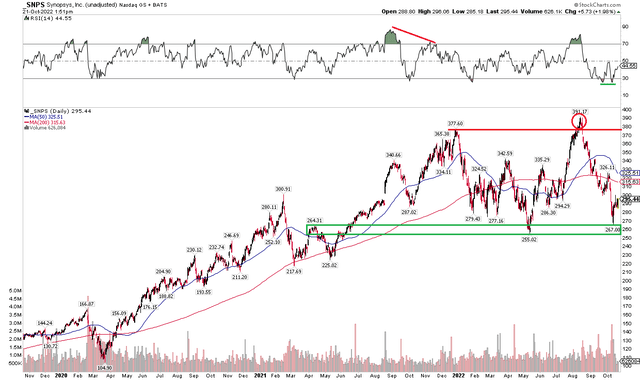

The Technical Take

Synopsys has been rangebound between $255 and $391 since the middle of last year. Notice in the chart below that the stock exhibited a bearish RSI divergence at the turn of the year before shares fell hard to their 2022 low in May. Then a bearish false breakout took place above $380 back in August. Sellers seem to pounce when the stock rallies to the upper $300s.

On the downside, there’s support in a zone between $255 and about $270. The stock has bounced sharply off that level in the last several days. Being long here with a stop under $255 makes sense. A slightly lower stop could also work, given a bit of a false breakdown in May, too. For now, a good risk/reward trade looks to be long shares and selling on an approach of the upper $300s.

SNPS: A Tradeable Range and Relative Strength

The Bottom Line

Synopsys is a growth stock in the volatile software industry, but its sales model is a bit different from some others. More reliable revenue streams help to buffer against cyclicality. The valuation is not cheap, but not expensive either given the growth. Its chart is also not a screaming buy but sets up for a decent risk/reward.

Be the first to comment