adventtr

Overview

Lilium N.V. (NASDAQ:LILM) is currently massively undervalued. LILM is a significant player in the electric vertical take-off and landing [eVTOL] business, which is expanding quickly. Due to the company’s lack of current significant revenue or profit generation and the fact that it still has a lot to demonstrate to the market, I believe there is a huge valuation gap between LILM’s current market price and its true worth (which translates to higher execution risk). I anticipate a favorable response from the market if the company can demonstrate that investors can put their faith in its management.

Business description

With the goal of creating a new kind of rapid air transport system for people and goods, LILM is concentrating on the creation of an electric VTOL aircraft. This system would speed up travel while also enhancing global communication. Plus, it would cause less pollution than regional air travel does now, be cheaper for most people, and be easy to use because there would be Vertiports near homes and workplaces.

Investments thesis

eVTOL is a huge market

A growing area of the transportation sector is the market for eVTOL aircraft. The development and effective implementation of eVTOL aircraft and networks-none of which are currently in commercial operation-are essential to the success of this business segment. According to a projection made by Morgan Stanley and quoted in LILM F-1:

“[T]he eVTOL market for transporting people and products might generate between $1 trillion (in the base scenario) and $4.5 trillion (in the bull case) in revenues by 2040.”

A transportation system that is unable to manage rising demand without experiencing delays, high infrastructure and maintenance costs, and negative environmental effects is what led to the significant eVTOL market opportunity. “Global passenger flows have expanded by more than 125% since 1990 across all main modes of transportation, while the volume of global trade has even increased by almost 200%,” according to LILM’s F-1. Governments throughout the world are investing a total of about $1 trillion per year-three times more than they did twenty years ago-into transportation infrastructure to combat the quickly rising demand for mobility and logistics. However, regional transportation systems have not substantially improved despite these investments.

- Traffic, speed limits, and capacity all contribute to the slowness of cars. For instance, the typical commuter spends more than 50 hours a year in traffic.

- Due to the high cost of building infrastructure and the long time it takes to build it, high-speed rail has only been able to create a small number of true high-speed connections.

- Conventional planes don’t make regional travel much faster because they take a long time to land and take off and because smaller airports are being closed in favor of larger hubs that are more profitable.

The transportation sector is responsible for a quarter of the world’s greenhouse gas emissions, which have been increasing over the past 20 years.

I believe that eVTOL technology combines the comfort of a car with the swiftness of an aircraft, as well as the added advantage of having low operating emissions. Because of these qualities, customers will prioritize time savings, convenience, and environmental effects over traditional transportation options, and they will choose eVTOL over other options. Management expects that vertiport networks will have low operating costs, low noise levels, low emissions, be strategically placed across cities and suburbs, operate around the clock, and have low initial infrastructure costs. Because of this, these networks are likely to grow much faster and for less money than traditional high-speed transportation infrastructure.

Proprietary technology

The majority of LILM rivals employ eVTOL systems with “open propellers.” LILM uses ducted electric vectored thrust [DEVT] technology, which is a unique propulsion system that has been improved over five years. It has four mission-critical advantages:

- Low Noise: The ducts installed around the fans act as sound deadeners, eliminating any rumble from the background. Acoustic liners will be installed by LILM inside the fan duct to further reduce noise levels. Company estimates show that Lilium Jets’ noise footprint at takeoff will be significantly lower than open propeller eVTOL configurations of comparable weight, allowing them to land more frequently and in more locations (where there are noise restrictions for communal areas) than competing aircraft. In my opinion, it will improve the company’s network density and make them more competitive.

- Commercial aviation has the highest market penetration for ducted fans: Ducted fan propulsion systems are found in 95% (source: S-1) of all commercial airliners and business jets. Fan ducts increase passenger and aircraft safety by reducing potential harm from blade loss and failure to the aircraft. Additionally, ducted fans produce less vibration than open propellers, which enhances the riding experience.

- Payload Capacity: Aircraft using ducted fans require ten to fifteen times less rotor surface area than an open-propeller aircraft of the same weight because of the compact nature of electric turbo fans compared to open-propeller eVTOL propulsion systems. By employing ducted fans, LILM is able to construct aircraft that are both heavier and more capacious in terms of passenger capacity and cargo capacity while still being able to land on a conventional helipad. It is expected that increasing the number of passengers and cargo will directly increase the amount of money that can be made per jet and the margins. This is because a lot of operating costs are fixed and don’t change when the number of passengers and cargo goes up or down.

- Footprint and Scalability: Open propeller eVTOL configurations cannot scale to heavier aircraft with greater payload without noticeably raising noise levels or the footprint (or tip-to-tip span) of the rotors. DEVT, on the other hand, has a smaller footprint and is, therefore, more flexible in scaling to, say, a larger equivalent eVTOL aircraft while still being able to take off and land on the most common helipads. If this extra payload was needed to deal with competition, it would also mean more money and profit per jet or, in the long run, lower prices for customers.

International expansion

In the company’s opinion, regional air mobility [RAM] presents a sizable global business opportunity. They are maximizing this global opportunity by establishing the prerequisites for launching and rolling out their service in multiple significant areas around the world. Receiving LILM concurrent Type Certification with EASA and the FAA would be an important first step toward being able to operate in a large part of the rest of the world. This is because many national civil aviation authorities in different countries have bilateral agreements or ways of working together with EASA or the FAA.

The company has created a Vertiport roll-out plan for the Lilium Network (B2C) in Florida and Europe. To move these plans forward, they have made agreements with major infrastructure players. Additionally, China represents another significant market opportunity. LILM has started working with its investor Tencent (OTCPK:TCEHY, OTCPK:TCTZF) to look at the Chinese market and come up with a plan for how to enter it in the future.

Strong support from governments

Regulational incentives are one way that governments are showing their support for eVTOL research and development. In 2020, for example, a bill was introduced to Congress that focused on making it easier to move around in the air. The German Federal Ministry of Transport also started a funding program to help improve drone technology and air mobility services.

Government spending and corporate investments will ultimately influence how well technological advancement is received by the market. Similar to trends in the market for electrical and autonomous vehicles, technological advancement and allied services will drive the market for eVTOL aircraft. It is likely to benefit.

Targeting a scalable and capital-light business model

For the value chain’s capital-intensive and supplementary activities, such as airline and infrastructure operations, LILM plans to contract with several reputable aerospace and infrastructure companies. The company thinks that by using an outsourcing approach, it would be able to scale up quickly while maintaining a low capital expenditure. The company’s production strategy likewise reflects this capital-light approach. They intend to use Tier 1 aerospace suppliers for all the other systems and parts, but make the specialized technology subsystems themselves, such as putting together the battery and propulsion systems and putting the finishing touches on the plane.

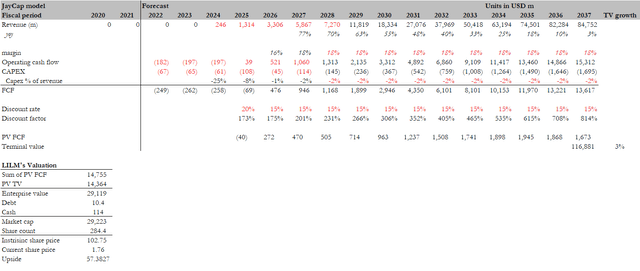

Forecast

I want to be clear that my model is inaccurate; no one should put any stock in my predictions for the future beyond the next decade. Nonetheless, the primary purpose of my model is to show what LILM could be worth if it achieves certain growth figures and margins. My forecast relies on the ideas that eVTOL will be successful and that EVTL will achieve management’s FY27 forecast. After that, growth will decelerate to a 3% terminal growth rate over the subsequent decade (inflation-like rate). My model hinges on the free cash flow (“FCF”) margin, which I expect to level off after FY27. Given its asset-light business model, there’s room for FCF to further expand here. However, I lack the information necessary to make an informed prediction, and a 16-year discounted cash flow (“DCF”) suggests conservatism.

I’ve taken the extra step of increasing the discount rate to 15% in my model to “justify” this investment, and even at this high rate, LILM is still significantly undervalued even at this high rate.

Red flags

Major questions mark if eVTOL can really take off

The future viability of the eVTOL aircraft business will depend on the industry’s capacity to advertise and sell advanced air mobility as a competitive alternative to more established transportation services. If the general population does not understand the advantages of advanced air mobility or chooses not to utilize it for safety or other reasons, such as cost, the market may not expand at all, grow more slowly than anticipated, or grow less than predicted. Each of these problems has the potential to hurt LILM’s business, finances, or bottom line.

LILM has not started commercial operations

LILM has not yet started its commercial operations, and the company anticipates that the acceptance of RAM and eVTOL vehicles by target customers will be a key factor in determining the company’s success. It believes that the public’s perception of the cost, convenience, and safety of LILM’s jets specifically, as well as the industry as a whole, will have an impact on these factors. Due to the lack of public awareness of RAM and eVTOL vehicles as a new business, LILM will need to conduct extensive media and marketing activities to efficiently and effectively target and engage their potential consumers. If the company can’t show that its jets are better than other ways to move commuters, cargo, airport shuttles, and regional travelers, its business, revenue, and operations could be in danger.

Conclusion

Investors must think that eVTOL adoption will rise in the future for them to invest in Lilium. If so, there is a huge potential gain compared to the stock’s present price. Like other eVTOL participants, LILM is not currently making any appreciable money, but the business does have a lot to offer the market, so its price carries a higher execution risk. I think that when Lilium N.V. proves that its management’s advice is accurate, investors will like it and the stock price will go up.

Be the first to comment