J. Michael Jones/iStock Editorial via Getty Images

Introduction

Synchrony Financial (NYSE:SYF) has seen a great bounce-back from its 2020 lows, with net income jumping by 205%. But as interest rates and inflation creep higher and higher, a very strong customer base is sure to weaken. In preparation for this, the bank has started to increase reserves again, which can be seen in the 56% increase in provision for losses in Q1 2022. These provision increases paired with the possibility of worsening credit metrics are reasons to believe the bank will see lower profits this year. While this may be the case, Synchrony trades at a very fair value and is a good buy for anyone adding to a position.

Past Few Years

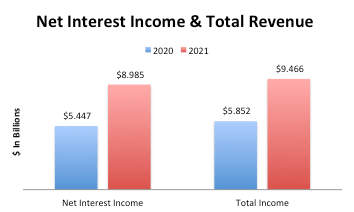

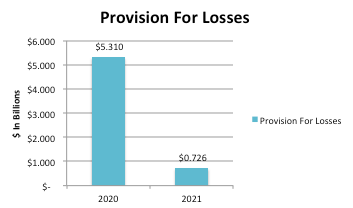

Synchrony Financial Revenue & Net Interest Income (SEC.gov) Synchrony Financial Provision For Losses (SEC.gov)

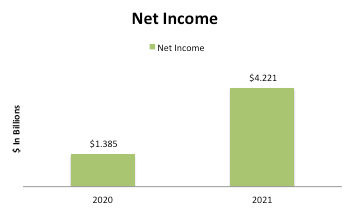

Synchrony Financial Net Income (SEC.gov)

Over the past two years, you can see Synchrony’s rebound from the pandemic. In 2021 the bank saw net interest income and total revenue increase by 65% and 62% each. This rebound in revenues, paired with the provision for losses declining 86% on the year, boosted the bottom line. Net income in 2021 jumped an astounding 205%. It is easy to say after such an uncertain time that the stars aligned for Synchrony.

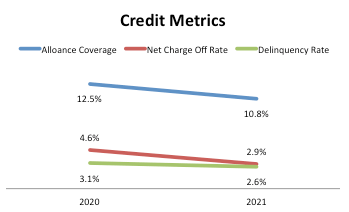

Synchrony Financial Credit Metrics (SEC.gov)

These results and rebounds have everything to do with the strong customers’ banks saw last year. Purchase volume increased by 19%, showing a consumer’s willingness to spend. And these customers are repaying their debts are record rates. The net-charge off rate dropped by 1.7%, while the 30+ day delinquency rate declined by 0.5%. These rates are very good for a retail card institution. This extremely strong customer has allowed the bank to lower reserves, thus posting lower provisions for losses. The allowance ratio decreased by 1.7% in 2021 and was only this high due to the overestimation of pandemic effects on the loan portfolio. A more normal rate is about 6-7% for the bank, and thus Synchrony still can lower reserves further. Overall, the rebound in 2021 was great, and the bank saw all metrics move in positive directions.

Q1 2022

Looking at the first quarter of 2022 should offer a gaze into what is expected ahead. Net interest income and total revenue grew 2% and 1%, respectively, but net income was down 9% year-to-year. The reason is a jump in provision for losses by 56%. So, why has the bank started to increase provisions for losses again? Well, looking at the quarter’s credit metrics shows a continued strong consumer. The charge-off rate and delinquency rates were 2.73% and 2.78%. This is a decline from Q1 2021 by 89 and 5 basis points each.

The issue is these metrics lag as they are reported after the fact. The reason Synchrony and most other banks are increased provision again is due to the economic environment abound. The Fed has continuously increased interest rates, and inflation has been rampant. Together, the assumption is customers will start to weaken. In preparation for this, the bank is increasing its reserves. The current allowance ratio is 10.96%, so Synchrony won’t have to increase provision for losses by too much this year. All in all, it is expected the bank post a lower net income in 2022 due to the reserve build, but things are not going south yet.

Valuation

As of writing, Synchrony is trading around the $30 price level. At this level, the bank trades at a P/E of 5.4x using the 2022 EPS estimate of $5.58. Synchrony also trades at a P/BV of 1.16x, with a book value per share of $25.80.

I like to buy banks trading close to book value, and Synchrony meets this criteria. I believe the bank is trading at a fair value, and if you already have a position, now may be a great time to add more.

Conclusion

Taking everything together shows that Synchrony has rebounded from pandemic lows and continues to see a strong customer in 2022. But there is wariness on the side of the bank, with interest rate increases and inflation, which has caused the institution to increase reserves again. This economic environment will probably weaken the consumers, but at the current valuation of 1.16x book value, the bank is trading at close to fair value.

Be the first to comment