Maddie Meyer

Price Action Thesis

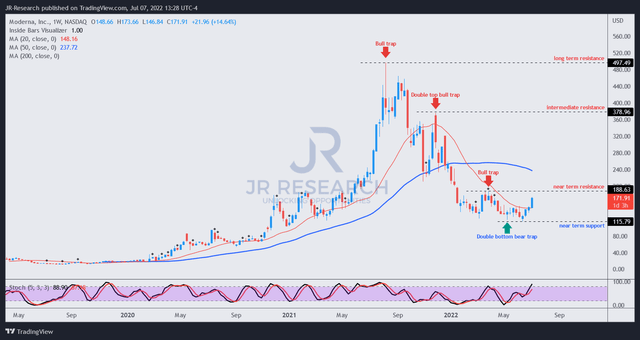

We present a timely update to our previous article on Moderna, Inc. (NASDAQ:MRNA), as there were significant developments in its price structures over the past month.

Notably, our Speculative Buy thesis has played out accordingly and met our near-term price target (PT) of $170, up close to 30% at writing. However, MRNA is also closing in fast onto its near-term resistance of $190, which previously formed a bull trap (significant rejection of buying momentum) in March.

Therefore, we believe the risk/reward profile is no longer attractive. As such, we revise our rating on MRNA from Speculative Buy to Hold as we await the re-test of its near-term resistance.

Investors who bought at its May and June bottoms can consider layering out with trailing stops. If a subsequent bull trap forms, they should consider cutting more exposure and not hold the bag, given the speculative nature of our Buy thesis.

MRNA Reached Our Near-Term PT, As Posited

MRNA price chart (TradingView)

In our previous article, we urged investors to pay close attention to price structures for speculative stocks like MRNA. In addition, we highlighted that MRNA had already formed a potent double bottom bear trap (significant rejection of selling momentum) in May.

Following our article, its double bottom support level was re-tested, and the market absorbed further selling pressure resolutely. As a result, it corroborated the resilience of its near-term support, despite the negative press and news around the mRNA vaccine leaders.

Notwithstanding, Moderna also recently rode on some positive developments for the mRNA COVID vaccine makers. The FDA “advised COVID-19 vaccine developers to update their shots, adding a component to protect against the latest subvariants of Omicron” in late June.

Pfizer-BioNTech (PFE) (BNTX) also reportedly raised their prices in their recent deal with the US government by 27% (from July 2021’s pricing). Therefore, we believe it demonstrated that the mRNA vaccine leader continues to have strong pricing leadership in the market.

Also, the FDA’s advisory proves that the US government remains confident in the robustness of the mRNA vaccines in our battle against future variants. Therefore, we believe it has lent further credence to the durability of the COVID vaccines beyond what the consensus estimates have projected.

Notwithstanding, our analysis suggests that the Street remains convinced that we would continue to observe a substantial revenue and profitability decline post-FY22. As a result, from a fundamental perspective, Moderna could find it challenging to outperform the market moving forward.

Is MRNA Stock A Buy, Sell, Or Hold?

We revise our rating on MRNA from Speculative Buy to Hold. Notably, holding the bag is not encouraged until Moderna proves that it can deliver a robust revenue-generating portfolio that can convince the Street to upgrade its estimates.

Therefore, we urge investors to continue being nimble on MRNA, leveraging opportunities to go long/short based on appropriate price action analysis.

Despite the pessimism exhibited in May and June on MRNA, we were confident that the worst was over and then reiterated our rating. Therefore, investors could glean highly valuable insights by focusing on price action dynamics. Notably, it helps investors improve their set-ups’ risk/reward profile markedly.

Notwithstanding, we believe the risk/reward profile is less attractive for investors who missed our entry point previously to add now.

Instead, we encourage investors to start layering out with trailing stops and closely watch the near-term resistance re-test. Investors should observe signs of a possible bull trap, as it could indicate a higher potential of a steeper fall subsequently.

Be the first to comment