owngarden/E+ via Getty Images

Patterson Companies, Inc.’s (NASDAQ:PDCO) recent guidance update came in better than expected, as revenue growth and margin numbers across both segments (dental and animal health) surprised to the upside. Most impressively, PDCO’s pricing power is holding firm through the macro doom and gloom, supporting growth across both segments as well as 10-30bps of margin expansion.

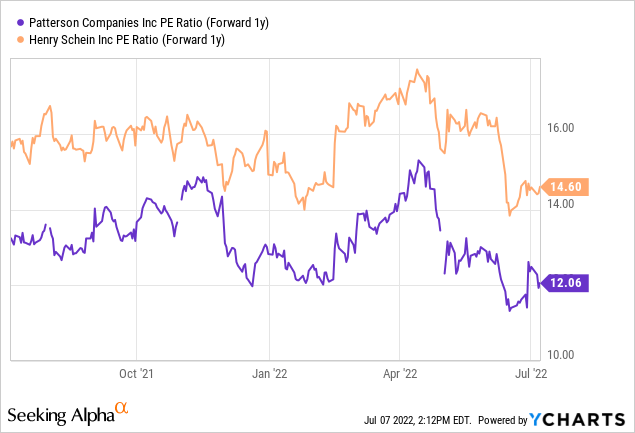

The only real blemish from the quarter was the more back-half weighted EPS, which could leave guidance numbers vulnerable should we see a demand slowdown amid worsening economic conditions. Still, expectations are low, particularly with the elevated recession risk and inflationary pressures still top of mind. Plus, the stock trades at a discounted valuation relative to the closest peer Henry Schein (HSIC) and historical levels, skewing the risk/reward favorably.

Bright Spots Emerging in Dental Equipment

On an internal basis, dental consumables sales offered little cheer this quarter, declining ~0.8% YoY amid a ~19% decline in infection control products. While demand has stabilized here, pricing has yet to recover since declining from the pandemic high. On the other hand, non-infection control consumable product sales picked up the slack at +2.9% YoY in 4Q22 on resilient traffic and customer relationships. Internal sales of dental equipment also rose strongly at +14.3% YoY, driven by double-digit growth in computer-aided manufacturing/design as well as low-single-digit growth in core equipment.

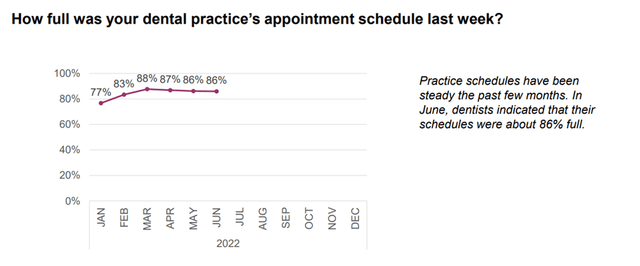

On balance, this was a good outcome for the dental business, given the latest monthly American Dental Association (ADA) survey had practitioners’ schedules at ~86% capacity in May and June (vs. ~87% in April and ~88% in March).

ADA Health Policy Institute Monthly Report

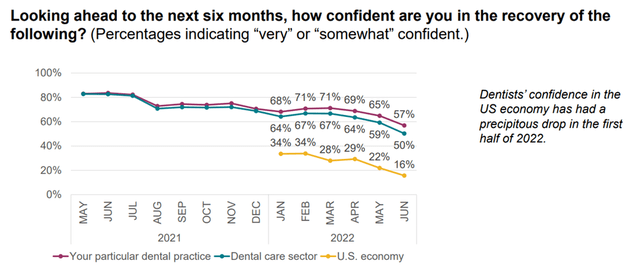

Even if core equipment continues to be weighed down by supply chain disruptions into 2022/2023, PDCO has a robust backlog of previously purchased (but pending installation) equipment. Plus, management cited no order cancellations – a key positive given the current macroeconomic challenges. PDCO should also be able to lean on its pricing power to pass on any cost pressures, particularly in dental consumables, where the company has successfully taken +4-5% of pricing. Maintaining this pricing power will be key, as the latest monthly ADA survey also indicates practitioners are increasingly concerned about the economy – the proportion of respondents “very” or “somewhat” confident the U.S. economy would recover in the next six months now stands at ~16% (vs. ~29% in April and ~28% in March).

ADA Health Policy Institute Monthly Report

Animal Health Still Has Bite

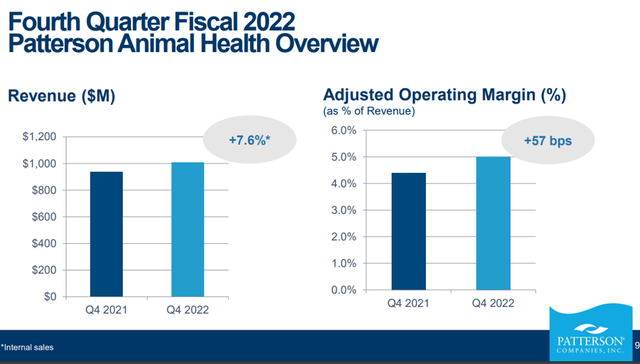

Despite fears of a post-COVID slowdown, the animal health segment again posted solid revenue growth numbers – internal sales growth of ~8% for the quarter comprised ~5% companion animal growth and ~11% in the production animal sub-segment. As expected, vet clinic traffic has moderated as the company cycles the strong YoY growth seen during the pandemic, in addition to labor constraints at the clinic level. That said, on a two-year stack, sales are still up significantly, and perhaps, more importantly, spending per visit has also increased – a nod to PDCO’s pricing power in the face of inflationary headwinds.

Going forward, collaboration efforts with strategic vendor partners as well as its omnichannel buildout could see PDCO continue to outpace the broader market, in my view, given it expands the opportunity set across channels. Other key growth areas include the companion animal equipment and private label categories, both of which sustained double-digit YoY growth through the latest quarter.

Initial FY23 Guidance Numbers Point to a Resilient Fundamental Outlook

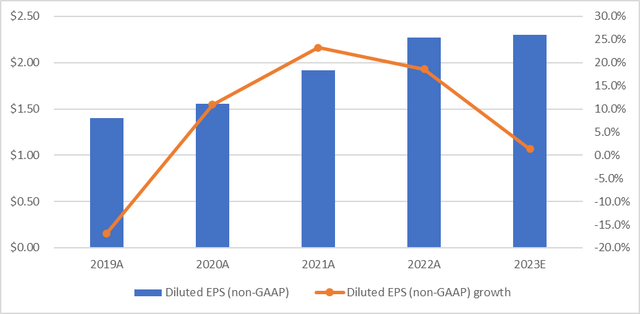

Building on the 4Q22 EPS upside, the robust performances across the animal health and dental segments look set to continue into FY23. Not only did the updated adj EPS guidance exceed consensus numbers, but it also incorporated conservatism to account for a potential recession and inflationary headwinds, as well as a post-COVID normalization in animal health. The positive low-single-digit % volume growth, for instance, adjusts for above-trend price inflation and a PPE (i.e., gloves) headwind of ~200bps in dental.

Putting it together, PDCO’s FY23 EPS guidance bridge implies a slowdown in adj earnings growth. Thus, this outlook embeds ample buffer against any adverse shifts in end-market trends, clearing the path for more beats and raises in future earnings reports.

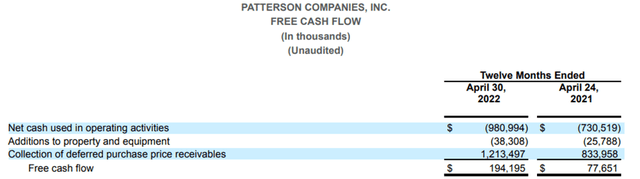

In contrast to the pessimism in dental and animal health today, I’d point out that PDCO still comes out ahead on a two-year internal growth stack (+53% for dental and +21% for animal health), with growth particularly strong in the dental equipment (+77%) and companion animal (+35%) sub-segments. Assuming vet demand sustains, the recent quarter’s ~60 bps YoY margin gain in the animal health segment could surprise as well, particularly with the benefits from accretive private label growth and cost containment only just starting to kick in. Finally, the strong FCF at ~$194m (up from ~$78m last year) should further de-lever the balance sheet over the coming months, allowing for incremental upside from capital deployment (via strategic M&A or accelerated buybacks).

Defying the Industry-Wide Pessimism

PDCO outperformed post-results, as the outlook for its dental and animal health businesses came in better than feared despite a softer macro backdrop. FY23 guidance numbers were surprisingly resilient as well, even after assuming modest demand headwinds across its core businesses. Plus, the lack of a slowdown in dental traffic YTD and the strong equipment backlog indicated the potential for upward revisions. The stock still trades at a wide relative discount to its closest peer HSIC and historical levels, likely pricing in most of the negatives (overhang from continued supply chain disruptions as well as a potential recession) and little positive (upside from its ongoing turnaround). Capital allocation will likely be the key near-term catalyst – while the ~$35m of buybacks completed in 4Q22 is a good start, there remains ample room for PDCO to tap into its balance sheet capacity for strategic M&A as well.

Be the first to comment