baranozdemir/E+ via Getty Images

The year 2022 has been a difficult one for many growth-oriented companies as the effects of a war, soaring inflation, fears of a looming recession, and rising interest rates have negatively impacted the bottom lines of businesses across many industries. One company that has been able to grow the business and outperform the majority of stocks in the market this year with greater than 90% YTD growth in their share price, is CECO Environmental (NASDAQ:CECO).

With a history dating back more than 150 years when the company began as the Dean Brothers Pump Company in 1869, CECO (whose ticker symbol changed on November 7, 2022 from CECE to CECO) has grown to an environmental industry leader with over 20 brands comprised of known and trusted companies that provide solutions that protect people, the environment, and industrial equipment. CECO now has a global reach with more than 900 employees in locations across 8 countries and 11 US states serving customers in more than 40 countries across the globe.

The company’s products and services are offered through two key business segments – Engineered Systems and Industrial Process Solutions. Major end markets for the company products and services include automotive, industrial waste, chemical and petrochemical, mining and metals, industrial water, commercial, defense, aerospace, and marine, energy transition, oil and gas, pharma, power, and food and beverage.

CECO Environmental Corp was incorporated in 1966 and is headquartered in Dallas, Texas. Although the company has been around for many years, they struggled to maintain the growth and profitability that shareholders demanded until they hired the current CEO, Todd Gleason, in July 2020. In the past two years the company has performed a major turnaround in its business strategy and operational performance, resulting in double digit growth this year that is expected to continue into 2023.

Recent Growth in Diverse Markets

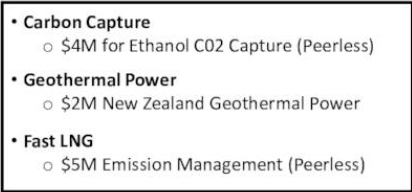

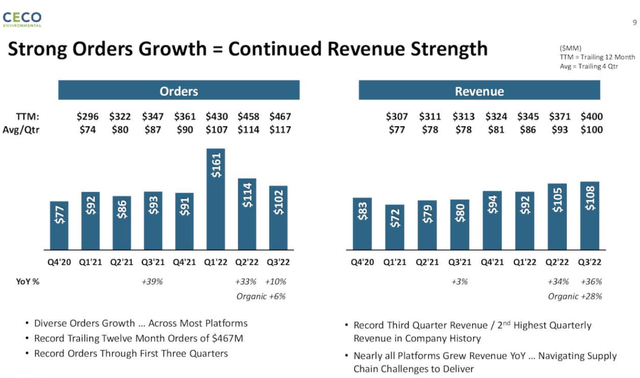

As illustrated in the Q3 earnings presentation, CECO has experienced broad growth across a diversity of end markets.

That growth in revenues and earnings resulted in record Q3 revenues and EBITDA, and the third consecutive quarter with new orders exceeding $100M. The orders for the company YTD amounted to $376M which is an increase of 39% over the previous year. Adjusted EBITDA of $29.3M YTD is an increase of 80% compared to the previous year. Sales during the 3rd quarter amounted to $106M, a 36% YOY increase. Adjusted diluted EPS of $0.53 YTD represents a YOY increase of 194%.

Industrial Air Market

The industrial air filtration market represents roughly 50% of the CECO portfolio. The estimated size of the global industrial air filtration market was estimated at more than $7 billion in 2021 and is expected to increase at a 6% CAGR until 2030 according to Grand View Research.

The global industrial air filtration market size was valued at USD 7.12 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.0% from 2022 to 2030. The rising need to control industrial air quality across various industries, including cement, food & beverage, metal, and power along with industrial air quality regulations is expected to augment market growth over the forecast period.

The COVID-19 pandemic has had a negative impact on several end-use sectors such as manufacturing, food & beverage, and cement due to disruptions in the raw material supply chain and the temporary shutdown of production facilities across the globe. Following the pandemic, it is expected that supply chain normalization, the relaxation of strict measures, an increase in retail consumption, and stabilization of manufacturing activities will improve economic activity and thus increase demand for industrial air filtration.

CECO is reaping the benefits of the post-pandemic relaxation of strict measures such as the end of Covid lockdowns in China, and as manufacturing begins to ramp back up while supply chains normalize this growth is likely to continue well into 2023 and beyond. Some recent examples of project wins as noted in the Q3 earnings report highlight this trend.

Q322 earnings presentation

In the second quarter of 2022 the acquisition of Western Airducts was closed, adding to the CECO industrial air capabilities with an estimated $5M of annual revenues from this UK-based company that offers dust and fume extraction systems.

Industrial Water Market

Industrial Water solutions make up about 25% of the CECO portfolio and that business is also growing organically and by acquisitions. The industrial wastewater treatment market is estimated to reach $174.9 billion by 2029 according to this research report from Meticulous Research.

The major benefits of using wastewater treatment systems in the industrial sector are waste reduction, energy production, fertilizer production, and the provision of clean and processed water.

The growth of the industrial wastewater treatment market is attributed to stringent water treatment regulations, lack of freshwater resources, and the increasing prevalence of waterborne diseases. Furthermore, the growing demand for energy-efficient and advanced water treatment technologies and increasing demand for wastewater recycling, reuse of water, and biogas generation are expected to create significant opportunities for the players operating in this market. However, the high installation, maintenance, and operational costs are expected to restrain the growth of this market to a certain extent. The aging of existing water infrastructure is one of the major challenges to the growth of the industrial wastewater treatment market.

General Rubber, acquired by CECO in the first quarter of 2022, adds expansion joints, penetration seals, pinch valves, check valves, and various other piping related product offerings with approximately $13 million in annual revenues.

In the second quarter of 2022 the acquisition of Compass Water Solutions was closed, adding another $10 million in annual revenues from the US based company that offers solutions for industrial oil-water separation, seawater reverse osmosis, and other water treatment technologies.

The closing of the acquisition of the Korean company, DS 21 in the 3rd quarter of 2022 adds water treatment technology for Asian countries to the CECO portfolio. The DS 21 contribution is expected to include an additional $10 million in annual revenues to the mix.

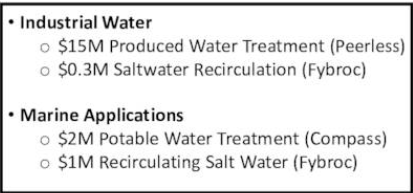

Some of the recent wins in the industrial water and marine segments are highlighted in the Q3 earnings presentation.

Q3 earnings presentation

Energy Transition Market

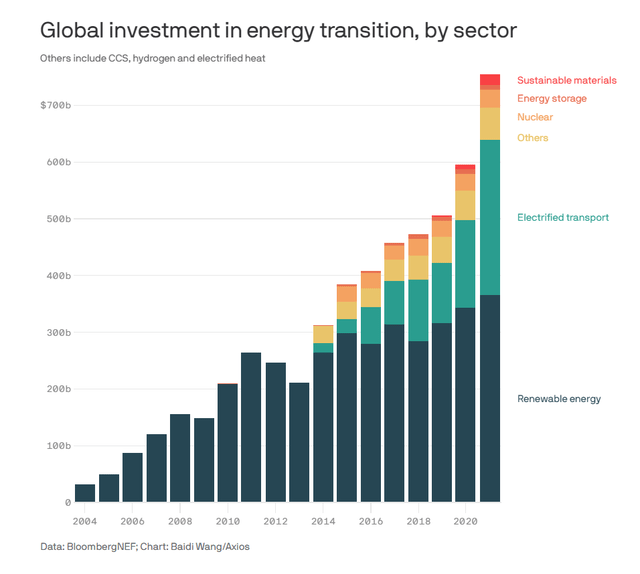

A report from Axios earlier this year discusses the rapid growth in the energy transition market, with a record $920 billion in global investments in 2021. With about 25% of the CECO portfolio offering products and solutions for energy transition markets, this represents another outstanding growth opportunity.

The report shows that global energy investment for the deployment of clean energy totaled $755 billion last year, up from $595 billion in 2020, while finance for new climate tech came to $165 billion.

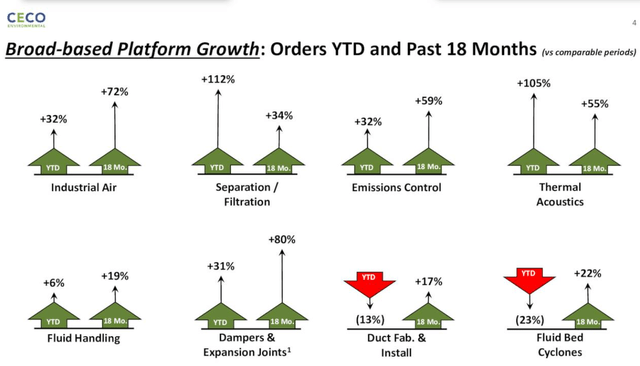

Some recent wins for CECO as shown on the Q3 earnings presentation include new orders for carbon capture, geothermal power in New Zealand, and Fast LNG emission management.

Q3 earnings presentation

Insider Buying and Share Repurchases

I am not sure that I have ever seen as much insider buying in one year as I am seeing with CECO. There is one small insider sell transaction in the mix (1,776 shares sold by the CEO on 3/30) and the rest are purchases by company officers and directors. Some of those buys likely represent stock-based compensation for company officers but some purchases were also made on the open market.

In addition to insider purchases, which are often a strong indicator of a potentially increasing future stock price, the company repurchased about 3% of outstanding shares in the second and third quarters. That total amounted to about $6M in share repurchases at an average purchase price of $7.69/share.

Strong Revenue Growth

Since the first quarter of 2021 revenues have been increasing, along with new orders and an increase in backlog to near record levels.

As indicated above, the revenue growth has been across the board with nearly every market segment and brand experiencing sales growth that is in the double digits over the previous year. The result is overall sales growth of 30% according to Chief Financial and Strategy Officer, Peter Johansson.

We now expect full year 2022 orders to exceed $475 million. This would represent a greater than 30% year-over-year increase and would be the second consecutive year that CECO has grown full year orders by 30% or more.

Our updated outlook for full year 2022 sales is to exceed $410 million, delivering over $100 million in revenue in the fourth quarter for a third consecutive quarter. This would represent a 26% year-over-year increase for the full year. We continue to expect full year gross profit margins of 30% which although down 100 basis points versus full year 2021, will allow us to exit the year with higher run rates in the first half of 2022.

What is the Risk from a Recession?

During the Q3 earnings call one of the analysts on the call, Amit Dayal from H.C. Wainwright, asked about the potential downside for CECO if a recession does impact the macro environment and how is the company equipped to handle it if such a situation arises. The CEO, Todd Gleason offered these remarks.

For us, however, we, as we stated, number one, we have a really balanced, diverse growth profile, across our platforms. And so, a very strong backlog, a really good pipeline. … I would also suggest that, for CECO and the investments we’ve made to really be more nimble to move from a market that might be kind of slowing down or even pulling back and move more quickly into another market that we think has a growth profile, for example, we all understand that there’s a going to be a large investment in the semiconductor space, we’re able to we feel, put ourselves in good position for opportunities there, for example.

2023 Outlook and Peer Comparison

The industry trends for environmental companies are favorable as infrastructure spending picks up again with the easing of supply chain constraints and despite a slowing global economy. The energy transition to renewables and electric vehicles, along with greater demand for industrial pollution controls due to stricter regulations in response to climate change provide opportunities for CECO and their peers to continue growing and expanding their offerings.

Heritage-Crystal Clean Inc (HCCI) is one company that could be considered a peer business although they are not direct competitors. The oil business segment drives most of the revenues for HCCI whereas CECO is not as dependent on oil prices or investment in oil and gas infrastructure.

Clean Harbors (CLH) operates hazardous waste landfills, incinerators, and other environmental cleanup facilities, so again not really a competitor.

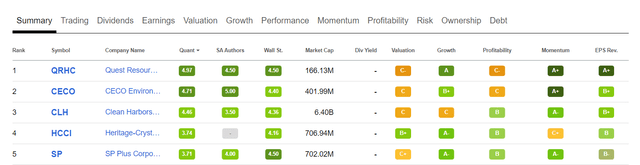

Quest Resource Holding Corp (QRHC) is the other peer company that is ranked slightly better than CECO using the SA Quant rating system, but again they are not a competitor to CECO as they operate landfills and provide waste and recycling services.

The top 5 ranked companies by Quant rating in the Environmental and Facilities Services sector are shown here.

With HCCI being the closest to a true peer based on market cap and its product offerings, I will compare their performance so far in 2022 to CECO.

On October 19, 2022, the 3rd quarter earnings report for HCCI indicated record revenues in the Environmental Services segment of $106.7 million, a 47.5% increase from the year ago quarter. Net income for the quarter was also a record for the company at $23.2 million, up 25% from the year-ago period. In June the company announced the acquisition of Patriot Environmental Services, boosting their wastewater treatment facilities.

While CECO is trading at a forward P/E of 17.5, the forward P/E of HCCI is only 8.8. However, the growth trajectory and price performance of CECO has significantly outperformed HCCI in 2022 so far.

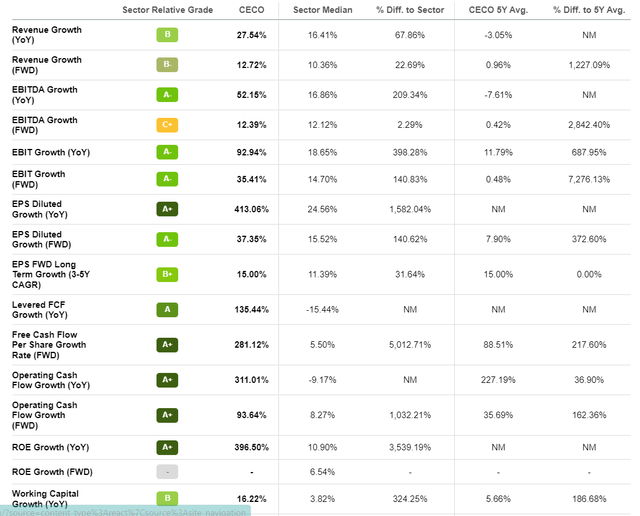

Even though HCCI has a better Growth grade than CECO (A vs B+), the growth in CECO’s operations has resulted in much better stock price performance. Digging deeper into some of the growth factors for CECO, we can easily see why that growth has translated into solid stock performance with strong free cash flow growth and earnings growth based on multiple metrics. This tells me that the company leadership is doing an excellent job of absorbing all the recent acquisitions and improving the bottom line across multiple business segments as described above, with that growth expected to continue into 2023.

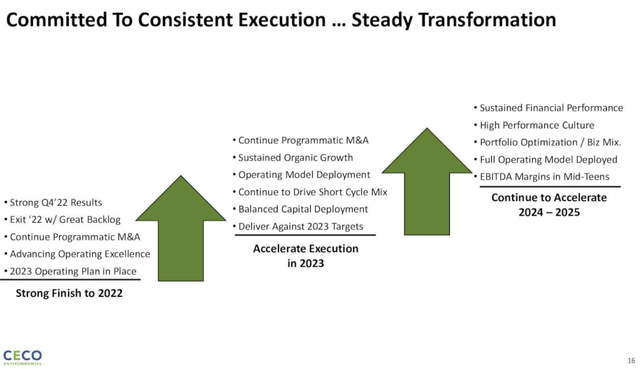

During the 3rd quarter earnings call the outlook for 2023 was described as exceeding expectations yet again, with anticipated sales of $450 to $475 million, up 13% YOY and adjusted EBITDA of $45 to $48 in 2023, up 19%. Expected free cash flow in the range of 50% to 70% of EBITDA is the target for CECO in 2023. As CEO Todd Gleason explained on the earnings call,

As we head into 2023 and move into 2024 and beyond, we expect to build upon the foundation we have put in place over the past two years, we will advance our operating model and continue to deploy capital where it creates the highest economic returns.

Ratings and Other Considerations

According to Wall Street, CECO gets a Strong Buy rating from 2 analysts and a Buy rating from 3 analysts. The SA quant rating is a Strong Buy (4.71 out of 5), and SA authors also rate it a Strong Buy with 2 authors (not including me) giving it that rating. There is a very small amount of short interest (less than 1.5%) which is another indication that the stock has good prospects for further upside potential in the share price.

Currently trading for just under $12, I believe that CECO stock should be trading for at least $15 in 2023, which represents about 25% appreciation. The average analyst price target according to Tip Ranks based on analyst projections is $15.33.

Risks and Conclusion

Because CECO is a small-cap growth stock there is likely to be volatility in the price action, especially as the market swings wildly due to macroeconomic events. If the global economy does sink back into a deep recession, all businesses are likely to be affected and it is possible that CECO will suffer too as a result. However, given the strong position that they find themselves in with a robust sales pipeline and record backlog heading into the end of 2022, they are more likely than other small-cap growth stocks to survive or even prosper in a recession.

With $36.2 million net cash as of 9/30/22 and $111.9 million in gross debt, they have a sustainable leverage ratio of 1.76 and roughly $97M in borrowing capacity. The summary slide from the Q3 earnings report sums it up with this graphic.

In conclusion, I am confident that CECO is a strong buy at a price under $12 and I have been building a small position in my own growth-oriented portfolio. As the company continues to execute on its plan and path forward, I believe that they can continue to manage the growth and improve cash flows and operating margins into 2023 and beyond.

Be the first to comment