onurdongel

Published on the Value Lab 20/8/22

Subsea 7 (OTCPK:SUBCY) is an interesting company in the oil supply chain, operating at its level in a nice oligopoly structure. We already thought the company was promising on the basis that oil investment has been at dismal levels for decades and required some support. However, due to the sensitivity of the company to oil dynamics, both on a fundamental and technical level, we held off. But we believed that the company was poised for margin expansion as projects neared their ends. We saw that this quarter, and with backlog swelling, those margins will be seen again in the not-too-distant future.

Key Dynamic and Q2

Subsea 7 was in a depression for years as oil investment fell to low levels, including tenders for full-suite work to set up subsea systems for oil producers. Two dynamics are in play, restoring the baseline fundamental picture in this new, commodity and energy boom environment.

- Contracts signed today, at larger rates swelling book-to-bill to 2.1x, are being signed in a better environment. The terms are fundamentally better and Subsea can think about inflation and supply chain disruption in the process.

- Contracts that are closer to completion contain more work that delivers higher margins. At contract completion, margins also jump on the basis of final milestones.

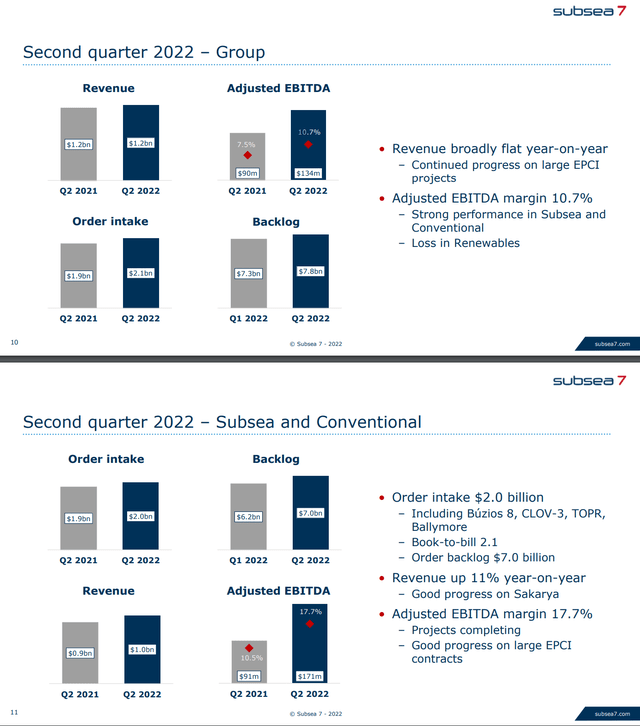

This quarter saw a 58% increase in EBITDA, and comprehensive margins have climbed meaningfully to 10% overall, and to almost 18% in the traditional subsea segment. On both a comprehensive basis and segment basis, margins expanded between 50-70%.

Conclusions

This performance is not immediately repeatable. A couple of major products in Saudi Arabia and the Gulf of Mexico had just finished, but other projects have also gotten to the pipelay stage which is when these full-suite contracts usually start picking up in terms of contribution. The major Sakaraya project in Turkey is at 50% progress, and this will be a backstop to the reversion of margins to previously seen levels. Moreover, the backlog is growing with contracts that are baseline better, negotiated in a better contracting environment for Subsea 7. Those will eventually also mature and start contributing majorly to the bottom line.

The renewable business is more challenged but thankfully fortunes in the Subsea conventional businesses have more than offset those issues. The renewable issues come from one off charges, so things should recover there, although the demand picture is less than impressive.

The company trades at a normalized run-rate EV/EBITDA multiple of 5.8x. That’s pretty low given the swelling backlog and the future EBITDA expansion as EPCD project start to mature over the next two years. The market has improved for them, and the locked in contracts will reward the company’s bottom line handsomely over the next couple of years. Trading at below book value and with a contracted multiple, serving an industry that is going to see some renaissance, we thing Subsea 7 is worth investor consideration.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment