LukaTDB

Investment Thesis

- I believe that Itaú Unibanco’s (NYSE:ITUB) digital bank iti Itaú will further increase its customer base by focusing on a younger target group that has not yet opened a banking account.

- Due to its strong brand image, which has been built throughout 97 years of history and driven by its digital transformation process as well as the strong customer growth of its digital bank, I expect Itaú Unibanco to be able to compete successfully against traditional banks, digital banks and fintechs in the future.

- The usage of relative valuation models such as the P/E Ratio shows that Itaú Unibanco is currently undervalued.

- In my opinion, the Itaú Unibanco stock is a buy. Itaú Unibanco has a very strong market position in Brazil and is increasingly focusing on the digital sector, which promises growth prospects.

Industry Overview of the Brazilian Banking Sector

Itaú Unibanco is a Brazilian full-service bank with 97 years of history. It is the largest Brazilian bank in terms of revenue. Operating through more than 4,100 physical branches, the company has a presence in 18 different countries worldwide (focusing mainly on Latin America). With more than BRL 2 trillion assets under management (AUM), Itaú Unibanco is the largest private asset manager in Latin America.

In a previous article for Seeking Alpha, in which I wrote about the Brazilian investment broker XP Inc (XP), I gave an introduction to the Brazilian banking sector. For that reason, I will only briefly cover the topic here: In Brazil, the 5 largest banks (Itaú Unibanco, Bradesco (BBD), Banco do Brasil (OTCPK:BDORY), Caixa Econômica Federal and Banco Santander Brasil (BSBR)) manage 82% of all assets within the country.

Business Model of Itaú Unibanco

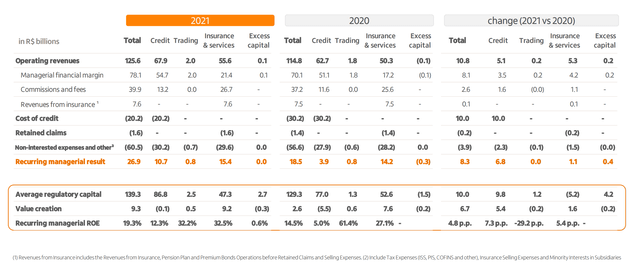

Itaú Unibanco’s business units can be divided into the following: credit, trading, insurance & services and excess capital. From its credit business unit, Itaú Unibanco generated revenue of BRL 67.9 billion in 2021 compared to BRL 62.7 billion in 2020, resulting in an increase of 8.3%. With the business unit of insurance & services, the bank generated revenue of BRL 55.6 billion in 2021 compared to BRL 50.3 billion in 2020, representing an increase of 10.5%.

The data shows us that the two business units of credit and insurance & services represent Itaú Unibanco’s most important business areas, as they are where most revenue is generated.

Revenue of Itaú Unibanco’s business units

Source: Itaú Unibanco Annual Report 2021

Itaú Unibanco’s Competitive Advantages

In 2008, Itaú merged with Unibanco and therefore consolidated its leading position among private banks in Brazil.

According to Interbrand, Itaú was the strongest brand in Brazil in 2021. A study conducted by Brand Finance also came to the same conclusion, with Itaú Unibanco being the only Brazilian company on their list of the 500 most valuable brands in the world. In comparison to 2020, the Brazilian bank gained 53 positions in the 2021 report and is currently the 335th most valuable brand in the world.

In January 2022, Itaú Unibanco announced the purchase of 100% of the stocks of the digital investment broker Ideal Holding Financeira S.A. According to Itaú Unibanco, this investment strengthens the commitment to their customers of seeking transformative solutions in a market that is rapidly expanding.

From my point of view, this acquisition is a further step forward for Itaú Unibanco on their path to digital transformation. The acquisition allows the company to further expand its digital offerings in order to be able to compete successfully against the digital banks and fintechs in Brazil.

Additionally, Itaú Unibanco has just agreed today to acquire control of Avenue, which is a brokerage that aims to provide Brazilians with access to foreign markets. Itau Unibanco will acquire 35% of Avenue for the amount of about 493 million reais ($92 million).

I see Itaú Unibanco’s broad distribution network of 4,100 branches in combination with its enormous brand strength as a long-term competitive advantage over traditional banks such as Banco do Brasil or Bradesco, and digital banks like Nubank.

Itaú Unibanco’s revenue growth in 2021 compared to 2020 (the operating revenue of Itaú Unibanco increased from BRL 114.785 billion in 2020 to BRL 125.601 billion in 2021), demonstrates their stable and robust business model as well as the excellent market position the bank has within Brazil. Driven by the fast-growing customer base of its digital bank and taking into account Itaú Unibanco’s strong competitive advantages and excellent market position in the Brazilian banking sector, I believe they will continue to grow in the coming years.

Growth Opportunities through Itaú Unibanco’s Digital Transformation and its Digital Bank

Itaú Unibanco is continuously improving the services in its digital areas in order to be able to compete with the traditional banks and fintech companies. In 4Q21, 63% of all products purchased by Itaú Unibanco’s customers were made digitally, according to the bank.

Itaú Unibanco’s digital bank offers its clients an account with no annual fees and in which they can carry out all their banking needs via the app. Throughout its digital bank, Itaú Unibanco aims to offer younger customers a less bureaucratic and more personalized banking experience.

The company is also including cards that are free of annual fees in its product portfolio. As an example, it has removed the fee from its Ayrton Senna Platinum card. This is another way that Itaú Unibanco competes with the digital banks and fintechs by lowering fees in order to be more competitive.

With open finance, which was introduced by the digital bank in the second quarter of 2021, clients were given the possibility of viewing their aggregate balance within the banking app. According to the bank, in the future it will be possible to consolidate the balance with other financial institutions.

In 4Q21, the digital bank iti Itaú acquired 4.7 million new customers, 86% of which had no prior relationship with Itaú Unibanco. This high figure is a sign that the company is succeeding in attracting new customers rather than existing customers switching from Itaú Unibanco to its digital offering. At the end of 1Q22, Itaú Unibanco’s digital bank already reached a total number of around 16.7 million customers.

Data from a study conducted in January 2021, showed that about 16.3 million Brazilians do not currently have a bank account. The study also revealed that the majority of people without a bank account are women between the age of 18 and 29 years. Through its digital bank, Itaú Unibanco is aiming to approach this target group. The fact that such a large number of people in Brazil don’t yet have a bank account indicates the growth potential which Brazilian banks, in general, still have.

In my opinion, Itaú Unibanco is well positioned within the traditional banking sector due to its strong brand image and its broad customer base. Additionally, it is competitive in the digital banking and fintech sector due to its low fee offerings via their digital bank, targeted at a younger group. Based on these factors, I assume that the bank will continue its revenue growth in the future.

Valuation

Relative Valuation Models

Itaú Unibanco’s P/E (FWD) Ratio

Itaú Unibanco’s P/E Ratio is currently 7.1. Compared to their average P/E Ratio of the last 5 years (which is 11.34) this is 37.35% lower. This indicator suggests that the company is currently undervalued.

When comparing Itaú Unibanco’s P/E Ratio of 7.10 with the sector medium of 10.04, we can see another indicator suggesting that the company is currently undervalued. Itaú Unibanco’s current P/E Ratio is 29.26% below the sector medium.

Itaú Unibanco’s Price / Book (FWD) Ratio

The Price / Book Ratio of Itaú Unibanco is 1.34. This is 24.06% higher than the sector medium of 1.13. Comparing Itaú Unibanco’s current Price / Book Ratio of 1.34 with its average Price / Book Ratio of the last 5 years, we can see that it’s currently 35.81% lower, thus, indicating an undervaluation of the company’s stock.

Itaú Unibanco’s Return on Common Equity (TTM)

Itaú Unibanco’s Return on Common Equity is currently 18.48%. When compared with the sector median of 12.46%, this demonstrates the enormous profitability of the bank in relation to stockholders’ equity. Itaú Unibanco’s Return on Common Equity is 48.29% higher than that of the sector median. Itaú Unibanco’s higher Return on Common Equity in comparison to the sector median is an indicator that the company is operating with a greater financial efficiency than most of its competitors. This is another indicator that strengthens my buy rating of the Itaú Unibanco stock.

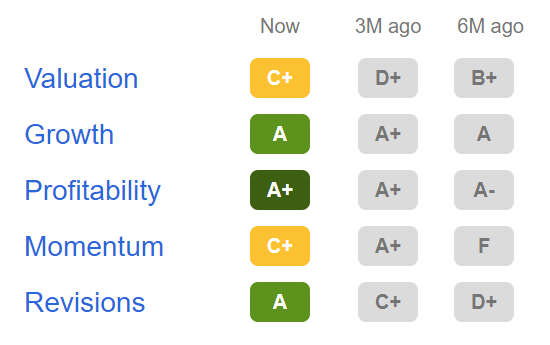

Itaú Unibanco According to the Seeking Alpha Factor Grades

The Seeking Alpha Factor Grades underline the attractiveness of Itaú Unibanco. The leading Brazilian bank is ranked with an A in terms of Growth, an A+ in terms of Profitability and with an A in terms of Revisions. For Valuation and Momentum, the bank gets a C+. Below you can see the overview of the Seeking Alpha Factor Grades:

Source: Seeking Alpha

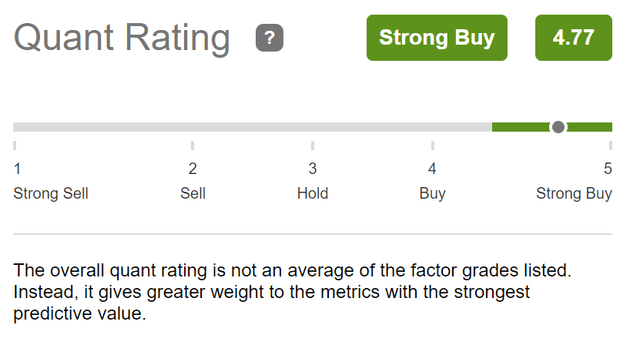

Itaú Unibanco according to the Seeking Alpha Quant Rating

According to the Seeking Alpha Quant Rating, Itaú Unibanco is currently a strong buy. This is yet another indicator showing the attractiveness of the company. Below you can see the rating of Itaú Unibanco according to the Seeking Alpha Quant Rating:

Risks

One of the main risks I see for Itaú Unibanco is the growing competition from digital banks and fintechs. For example, The digital bank Nubank (NU) is growing strongly and already has more than 40 million customers. I see Nubank as one of Itaú Unibanco’s main competitors in the coming years, in particular due to the fact that they have interesting offers from the customer’s point of view. For example, they do not charge any account management fees. Additionally, the bank is backed by star investor Warren Buffet. Parallel to Itaú Unibanco’s digital bank, Nubank also aims to focus on a younger target group who are yet to open a banking account.

Another risk for Itaú Unibanco is credit risk. Due to the fact that more than 50% of its revenue derives from the granting of loans, a possible increase in defaults could affect the profitability of the bank.

As already mentioned in my article about the Brazilian investment broker XP, I see the currency as an additional risk for investors outside of Brazil when investing in a company from South America’s largest country. A potential depreciation of the Brazilian real represents a risk for the investor.

Should inflation continue to remain high in Brazil, the real could depreciate further against the dollar. According to the Brazilian Institute of Geography and Statistics (IBGE), the inflation index of the country was 10.06% in 2021. This inflation was primarily driven by high gasoline prices due to the higher cost of crude oil. However, in 2022, Itaú Unibanco calculates a lower inflation rate of about 5.5%.

Additionally, a declining GDP in Brazil could be one of the reasons for future depreciation of the real against the dollar. In 2020, for example, GDP in Brazil declined by 3.9%, after being affected by the coronavirus outbreak. For 2022, Itaú Unibanco currently expects a GDP reduction of 0.5% in comparison to 2021.

The Bottom Line

Different relative valuation models such as the P/E Ratio suggest that Itaú Unibanco is currently undervalued. When comparing Itaú Unibanco’s P/E Ratio of 7.10 with the sector medium of 10.04, we can see that the company’s current P/E Ratio is 29.26% below the sector medium, indicating that the stock is currently undervalued.

In my opinion, the stock of Itaú Unibanco is currently a buy. Itaú Unibanco already has a very strong market position in Brazil and has been able to build an economic moat due to the strong brand image it has built throughout its 97 years of history. Driven by its digital transformation process and the strong customer growth of its digital bank iti Itaú, I expect the company to successfully compete against the traditional banks, digital banks and fintech companies in Brazil over the long-term. Based on these reasons, I see Itaú Unibanco as a long-term investment. However, especially due to the currency risks, as mentioned above, I would recommend that you don’t invest more than 3% of your investment portfolio.

Author’s Note:

Thank you for reading! If you have any questions regarding this article, you can leave a comment below.

Be the first to comment