YULIIA LAKEIENKO/iStock Editorial via Getty Images

Investment thesis

Whilst there are undeniable challenges for all auto manufacturers, Subaru (OTCPK:FUJHY) remains an attractive recovery story. Foreign currency markets and supply chain issues will continue to persist in the medium term. However, on low valuations and a strong balance sheet providing defensive qualities, we reiterate our buy rating.

Quick primer

Formerly known as Fuji Heavy Industries, Subaru was founded in 1953 producing and repairing aircraft. The current automobile line-up includes the Legacy, Forester, and Outback. The business originally had a close alliance with Nissan Motor (OTCPK:NSANY), but since 2005 has been part of the Toyota Motor (TM). Toyota Motor has a 20% stake in Subaru.

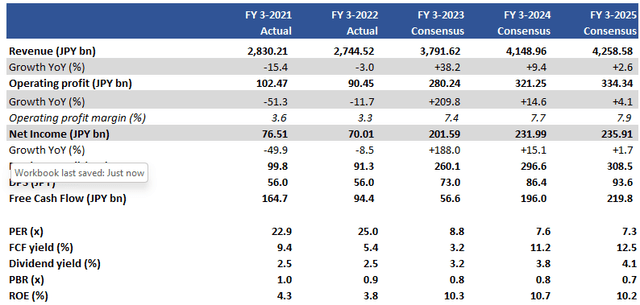

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv, prepared by Karreta Advisors)

Our objectives

We want to re-assess our buy rating from February 2021 based on a cash-rich balance sheet and PBR at 0.9x, given a 25% share price correction. With global semiconductor and electrical steel shortages continuing to impact the automotive industry, we review Subaru’s position in terms of production capability, forex impact, and the manufacturer’s strategy with BEVs (battery electric vehicles).

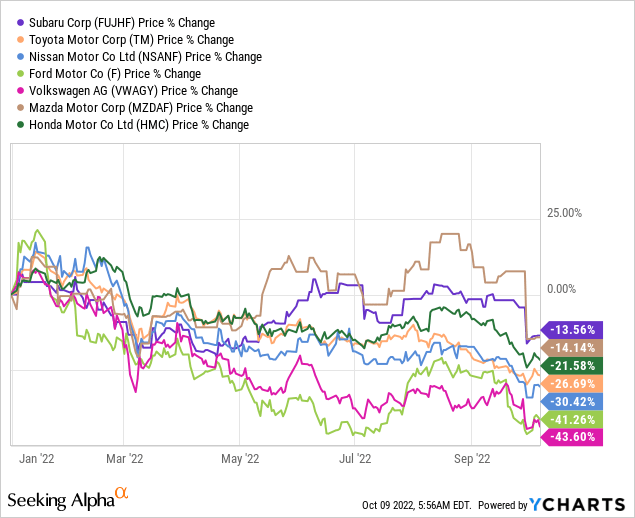

In terms of share price performance versus key peers, Subaru has relatively outperformed based on a strong balance sheet and a demand profile that is relatively unaffected by macro conditions versus manufacturers with a wider-ranging customer base such as Ford (F), Volkswagen (OTCPK:VWAGY), Nissan and Toyota.

Production capability under pressure

At FY/2022 reporting in May 2022, Subaru management outlined its plan to produce 1 million units (+27.3% YoY) in FY3/2023. Whilst this was seen to be on the aggressive side, management did mention that this was more of an aspiration, given the continued pressure from lockdowns in Shanghai.

During Q1 FY3/2023 the company did not change this production target, and also maintained the annual sales volume forecast of 940,000 units. However, the ongoing supply shortage in semiconductors and lockdowns in Shanghai resulted in a temporary suspension of operations at domestic production bases for a total of four days.

In terms of raw materials, all auto manufacturers have been increasing inventory in order to prevent shortages resulting in line stoppages. Precious metal prices have fallen significantly YoY, but unfortunately other steel materials, aluminum, and resins are currently all on the increase. Consequently, there may be new procurement issues as well as inflating manufacturing costs in order to meet volume targets.

There will be no dramatic changes in the supply chain or normalization of raw material pricing into H2 FY3/2023. Consequently, we conclude that in the short to medium term that Subaru will have limitations over its manufacturing output. This is unfortunate from two perspectives. Firstly, back orders (orders for products not available in stock) in the key US market are said to be high. Secondly, despite rising concerns about consumer sentiment, there appears to be no urgent need for the company to review pricing or increase incentives.

The longer-term challenge for Subaru is a strategic shift to basing dedicated production in Japan for the next generation e-Boxer EV cars. Capex is expected to increase significantly from FY3/2024, and consequently, this will place some pressure on free cash flow generation. This project will take time to come to fruition, with production expected to start in 2027.

Keep an eye on the FX

As the company reports in the Japanese yen, the rapid depreciation of the currency should be seen as a positive for this part-exporter. However, any business with a global footprint will face challenges if foreign currency rates have moved as aggressively as they have done over the last 6 months. Management was surprisingly open when they commented that from Q1 FY3/2023 results it was difficult to be “optimistic or pessimistic”.

The weakened yen has resulted in an increase in provision expenses for product warranties, and cars held in stock had to be upwardly revalued in yen wiping out unrealized gains. However, what is clearly positive was that Subaru managed to sell 20,000 more units YoY versus the same period last FY. Underlying demand appears firm, but FX fluctuations may prove to be a decisive factor into the end of the financial year.

The continued depreciation of the Japanese yen will mean sustained booking of increasing product warranty costs. Whilst raw material costs will increase in yen terms (as most are procured in US dollars), overall cost pressure will likely result in an increase or an adverse adjustment to product pricing which may negatively impact demand, together with more favorable incentive terms.

On a positive note, Subaru has guided for an increase of JPY104.2 billion/USD0.7 billion in raw material costs for FY3/2023, versus the actual expense of only JPY17.1 billion/USD0.12 billion for Q1 FY3/2023. Although we expect FX to have a negative impact on profits into H2 FY3/2023, it does look like Subaru has some buffer built into its guidance although one suspects nobody expected the dollar to be trading at JPY145 as it is today (company assumption is currently unchanged at JPY120).

Valuation

Consensus forecasts for FY3/2023 remain significantly above company guidance (sales JPY2,000 billion, operating profit JPY200 billion). On these numbers, the shares are trading at PER FY3/2024 7.6x with a free cash flow yield of 11.2%. Subaru’s balance sheet remains vastly over-capitalized with over 50% of market capitalization as net cash (excluding the car financing book).

Valuations remain cheap, and although consensus forecasts may be too bullish, we believe that as the auto industry continues to adapt and adjust its supply chain, niche product makers such as Subaru will continue to recover.

Risks

Upside risk comes from a stabilizing currency market, resulting in a slow return to normalized trading conditions. Although it will still take time, Subaru demonstrating the ability to manage its supply chain more proficiently will be a positive catalyst for its sales cycle.

For downside risk, continued yen weakness will wreak havoc with costs for Subaru both for procurement as well as product warranties. The other concern is the health of the consumer in the key US market, and whether demand will remain relatively robust in the face of a recessionary environment.

Conclusion

Whilst there are undeniable challenges for all auto manufacturers, Subaru remains an attractive recovery story. Its specialist offering in off-road utility/SUV vehicles remains in demand and its product pipeline for BEVs is getting clearer. While we would not recommend an overweight allocation to the auto sector, exposure to Subaru feels more defensive than its peers. We reiterate our buy rating.

Be the first to comment