Yarygin

The Canadian cannabis sector remains littered with land mines and Aurora Cannabis (NASDAQ:ACB) is one of the largest ones. The LP has been in a race to the bottom in the Canadian cannabis space with massive cost cuts only leading to lower revenues over time. My investment thesis remains Bearish on the stock with the path to positive adjusted EBITDA not guaranteed under a scenario of ongoing massive cuts to operations.

More Cuts

For a couple of years now, Aurora Cannabis has aggressively cut SG&A expenses in order to turn the company profitable after a scenario where massive adjusted losses were generated each quarter. The company is in the midst of the latest cost cutting plan of C$150 to C$170 million in annualized cost savings with C$140 million achieved to date. Yet, Aurora Cannabis still reported another quarter with an adjusted EBITDA loss of C$8.7 million.

The major problems with cutting costs is that revenues tend to leave in the process, thereby lowering gross profits and the benefits of cutting costs. The best solution to generate profits is to limit cost increases while revenue grows, but Aurora Cannabis has never been able to generate meaningful sales without over spending.

The general segments of the business highlight this issue. The medical cannabis sales fell 14% sequentially to C$31.6 million and the business was down 23% from the prior year.

The consumer cannabis business was down 9% sequentially to only C$13.7 million with a 28% decrease from the prior FQ1. Aurora Cannabis hardly even has a consumer cannabis business anymore considering some retail stores in the US individually produce more revenues.

A big part of the benefits from the costs cuts were lost with cannabis revenues falling by C$10.8 million during the quarter. Aurora Cannabis has lost C$43.2 million in revenues and C$20+ million in gross profits over the year.

At the same time, SG&A costs were only down C$3.5 million YoY in FQ1. The R&D expenses were slashed by C$2.1 million, but all of the cost savings aren’t showing up in the actual financials of the business with the costs savings more relative to inventory levels.

Management predicts reaching adjusted EBTIDA profitability by December 31, but the target definitely doesn’t appear achievable in the quarter. SG&A expenses still approximate total net revenues C$49.2 million in the quarter. Even when excluding one-time costs, the SG&A costs for the quarter were C$33.4 million, far above gross profits of C$25.0 million.

Aurora Cannabis Is Still Burning Lots Of Cash

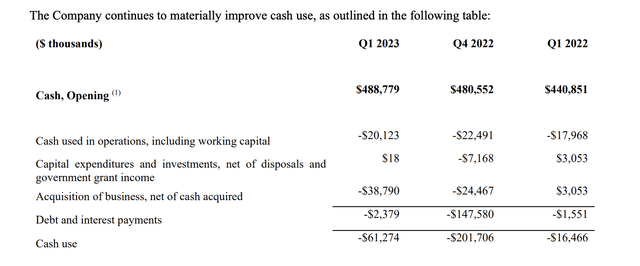

Even with the smaller EBITDA loss, Aurora Cannabis still managed to burn C$20.1 million during the quarter from operations. The Canadian cannabis company is spending C$2.4 million on debt/interest payments and another C$38.8 million on acquisitions for a total cash burn of C$61.3 million for the quarter.

Source: Aurora Cannabis FQ1’23 earnings release

All of the work to cut costs and Aurora Cannabis still burns a large amount of cash in the quarter. The company has an impressive cash balance now of C$428.3 million, so Aurora Cannabis now has the balance sheet to handle a scenario where the company continues to fail to reach EBITDA positive, though one clearly can see being EBITDA breakeven won’t stop the cash burn.

The Canadian LP has total debt of C$325.6 million, so the company isn’t completely in a financial position to wildly burn cash going forward. The business really needs to show how cutting C$170 million in costs actually leads to positive cash flows. After all, the Canadian cannabis business is well established now with annual revenue topping C$4.5 billion.

The stock just isn’t attractive with Aurora Cannabis selling another 23.7 million shares since the quarter end to raise just C$40.2 million ($29.4 million). Despite the stock barely budging above $1, management continues to wildly dilute shareholders.

Aurora Cannabis is worth only $400 million, but the revenue estimates for FY23 remain far below $200 million. The stock trades above 2x sales when US MSOs with large EBITDA profits and positive cash flows in some cases trade at similar, if not lower, forward P/S multiples. A lot of the top MSOs can be purchased for 10x EBITDA targets while Aurora Cannabis is still having to sell shares to fund EBITDA losses and other working capital issues.

Takeaway

The key investor takeaway is that Aurora Cannabis still hasn’t solved the historical problem of figuring out how to profitably sell cannabis in Canada. The company hardly has a consumer cannabis business anymore and the stock valuation isn’t attractive with big questions remaining on whether the business gets to adjusted EBITDA profitable, especially when the company continues to sell shares.

Be the first to comment