NanoStockk

Without a doubt, automation remains one of the most promising mega trends in the business world. Especially the most modern platforms that automates manual processes by emulating people using machine learning and AI technologies. One of the leaders in this industry, if not the number one leading company, is UiPath (NYSE:PATH). It already has more than ten thousand customers around the world, an annualize renewal run-rate of approximately a billion dollars, and a dollar based net retention rate of ~138%. In other words, it has plenty of customers, that are spending significant amounts on its products, and that are increasing their spending.

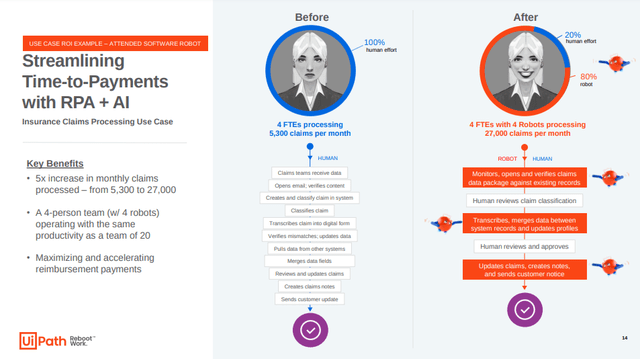

A good example of its technology in use is shared below, where using robotic process automation enables a team of humans to automate several of the tasks needed to process insurance claims, with the end result being that humans + robots manage to process a much higher number of claims per month compared to humans working by themselves. It augments their capabilities significantly, while removing some of the more repetitive and boring work. The business, the workers, and the customers all benefit from it.

UiPath Financials

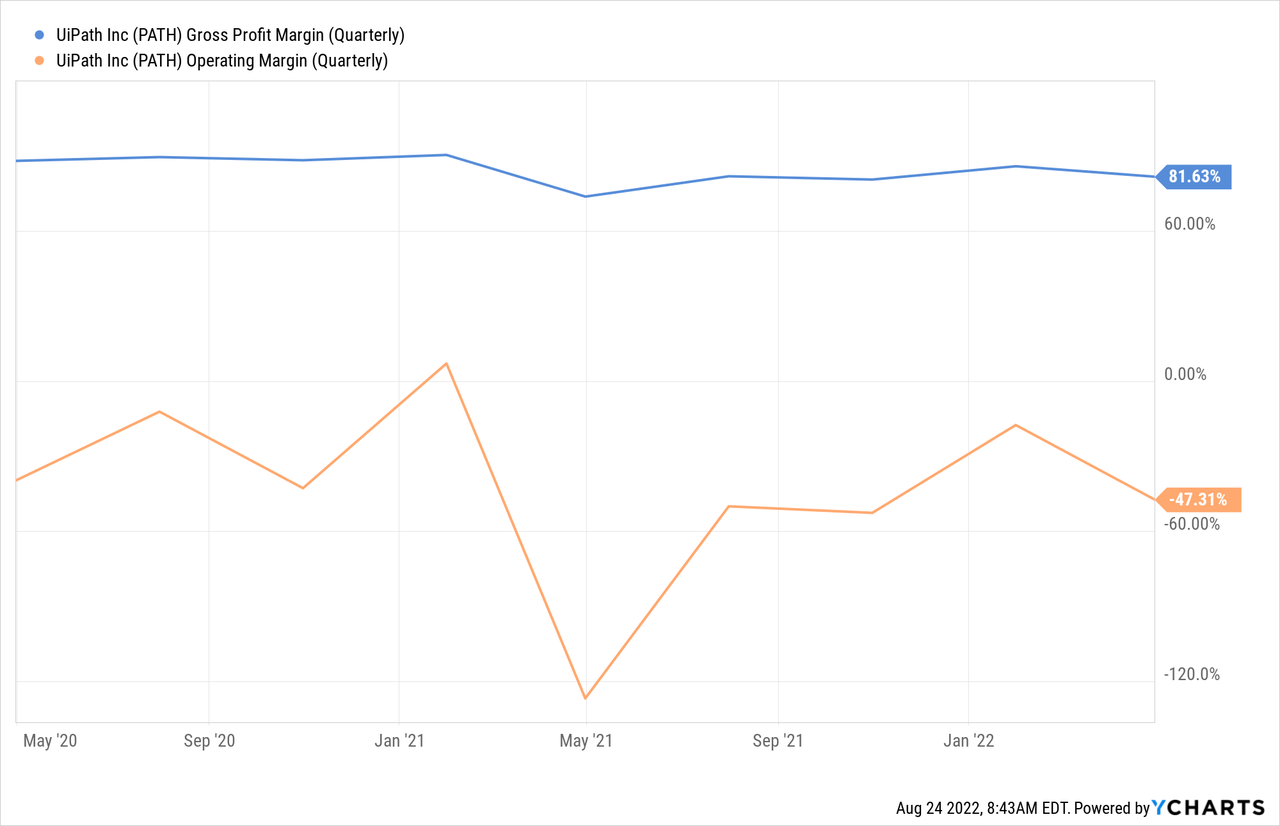

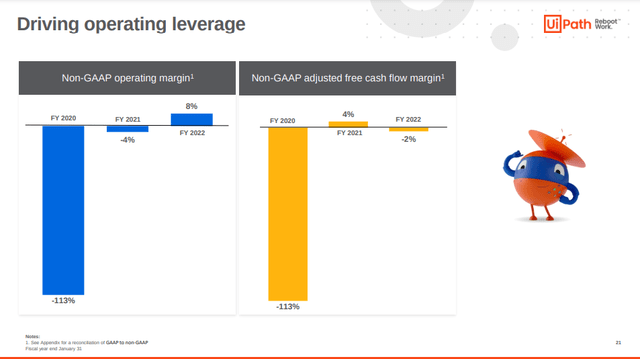

As you probably can tell, we find UiPath very promising, but we have a problem with the current valuation and the financials. The graph below shows the GAAP profit margins, and it’s clear the gross profit margin is quite high at ~80%. The company is, however, still losing a lot of money with a very negative operating margin of -47% in the last quarter. We see two problems here, one is that the company is far from being profitable, and second, we do not see clear operating leverage. It seems the company is not being very disciplined with its cost growth, therefore despite growing revenues margins are not shoring significant improvement.

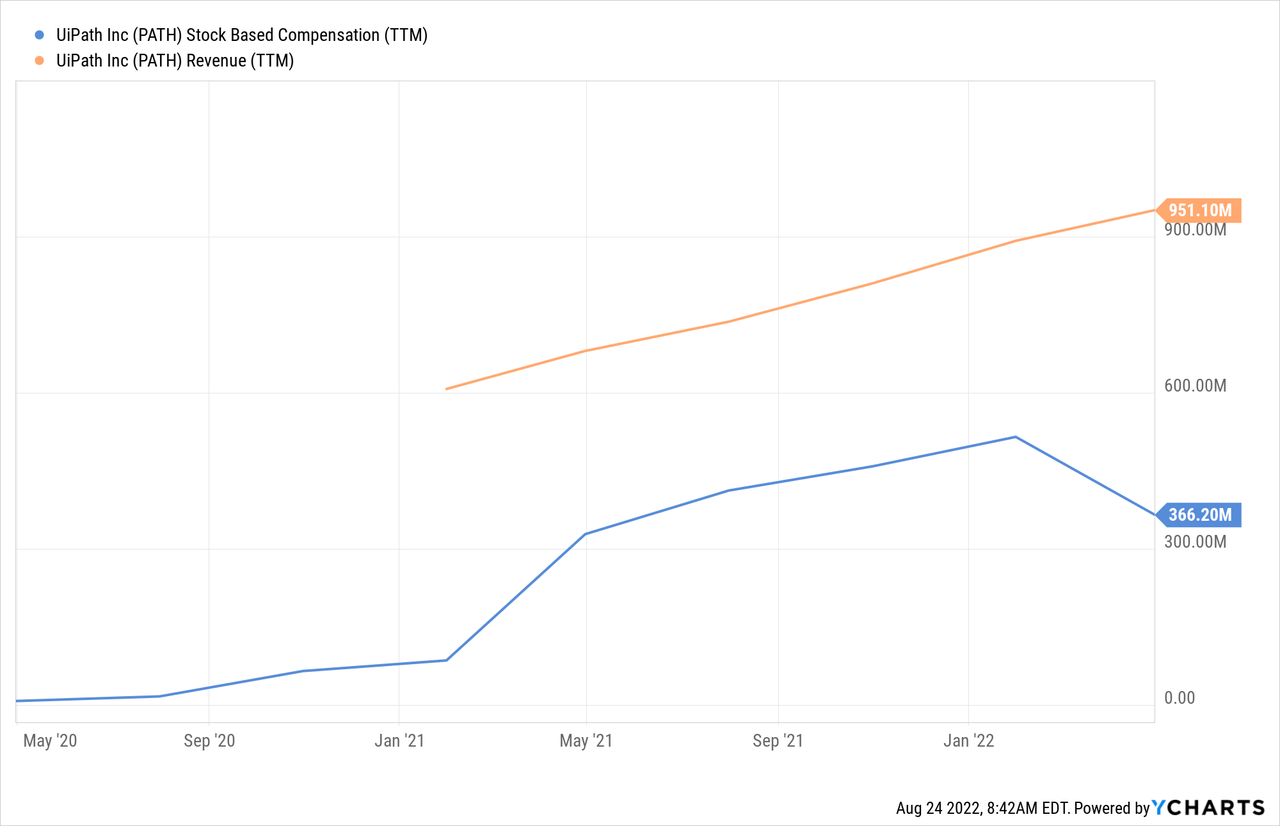

If one only looks at the company’s slides, it would appear that they are operating near break even. Unfortunately the non-GAAP numbers ignore very significant stock-based compensation that the company is giving out. We view this as a real expense, as it dilutes shareholders, and therefore do not believe it should be ignored by investors.

In fact, UiPath is one of the most aggressive companies we have even seen in terms of giving out stock-based compensation. For the trailing twelve months UiPath has given out an amount that is almost as much as ~40% of its trailing twelve months revenues in stock based compensation.

Balance Sheet

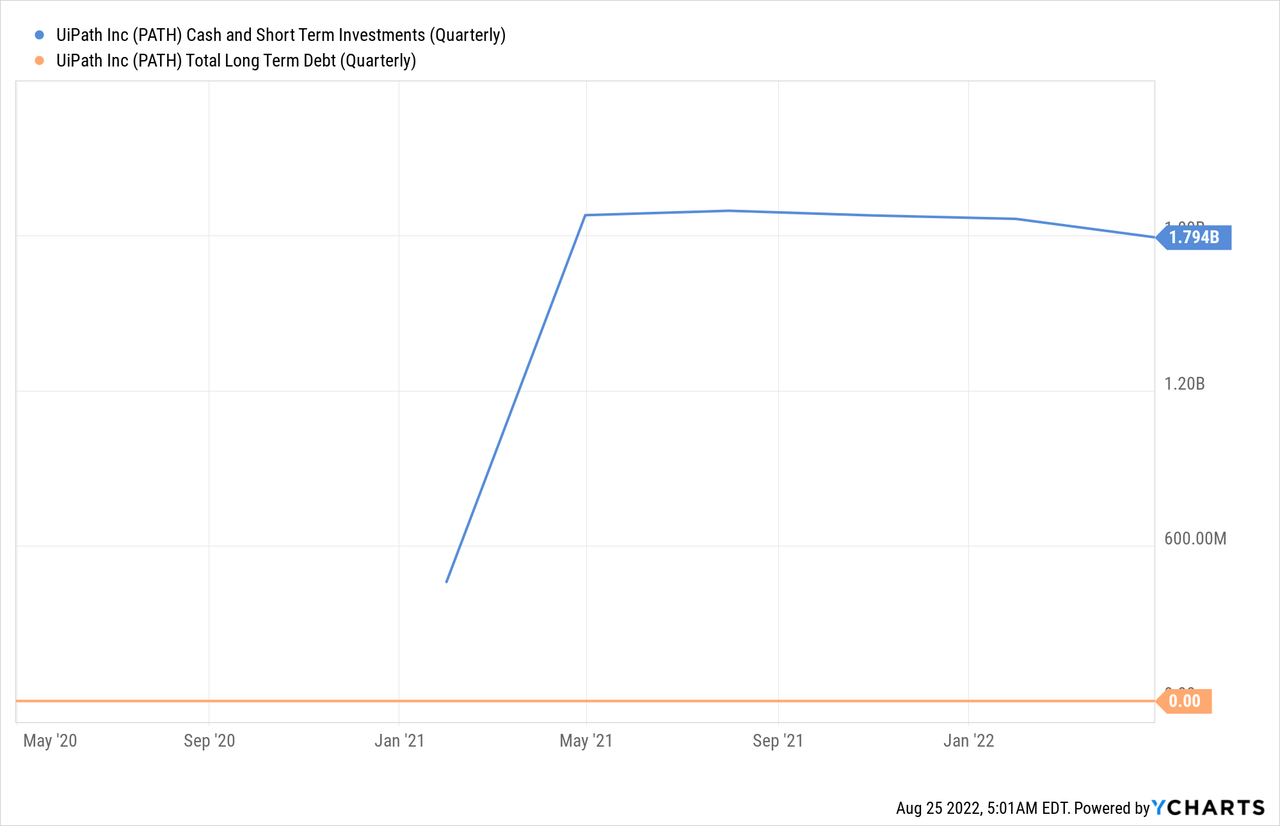

At least UiPath has a very solid balance sheet with plenty of cash and short-term investments that amount to ~$1.8 billion. The company has no long-term debt. This combination of significant liquidity with no long-term debt positions the company well to either accelerate growth through M&A, or to invest aggressively in its organic growth initiatives. It will be interesting to see how the company decides to use all this money.

Growth

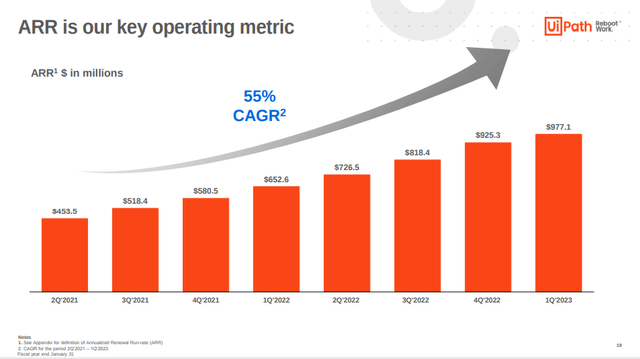

The company has been growing its key performance metric, annualized renewal run-rate, at ~55%. ARR is similar to recurring revenue, but given that UiPath’s contracts tend to be short in duration we believe they decided not to call the metric recurring revenue as there is no guarantee customers will renew. In any case, we find the metric very useful and the growth it has shown here to be impressive.

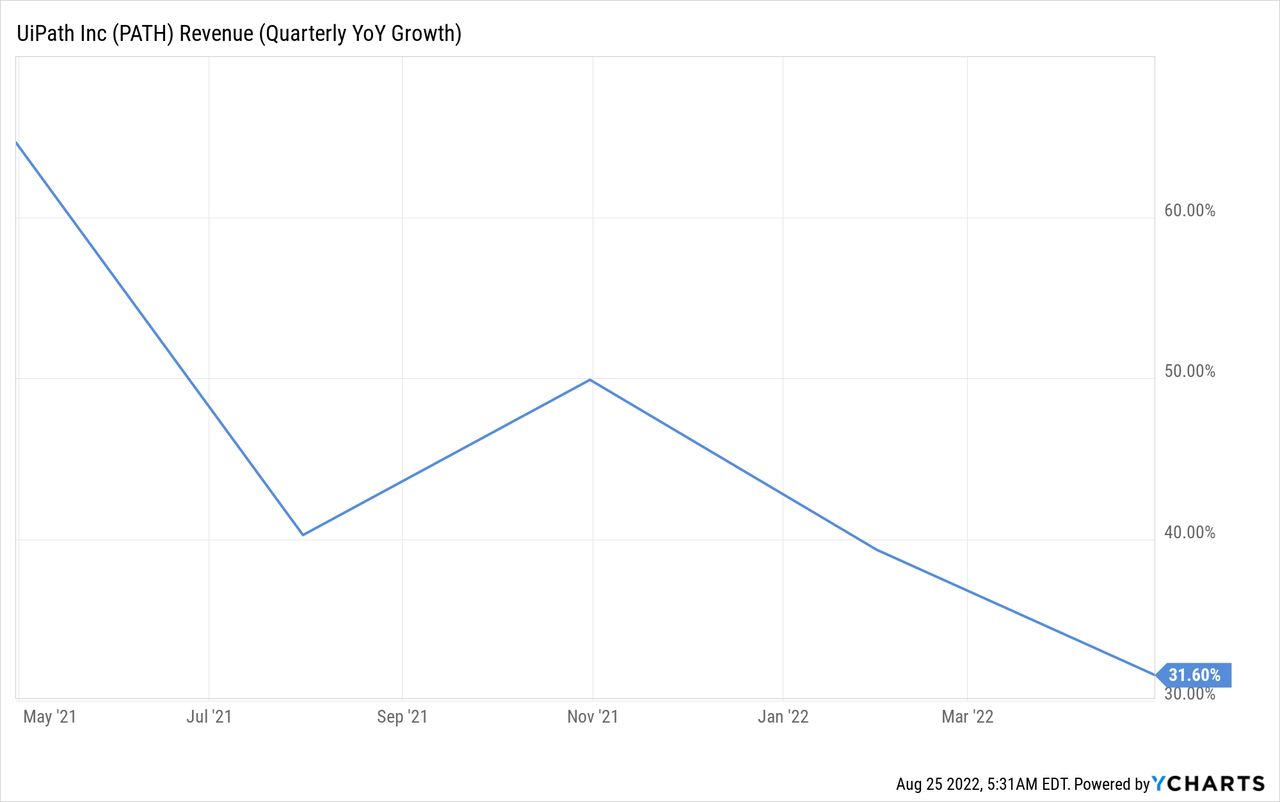

Looking at more detail at the most recent quarters, however, growth appears to be decelerating. Quarterly y/y revenue growth in the most recent quarter came in a only ~31%, much lower than the 55% average shown above.

PATH Stock Valuation

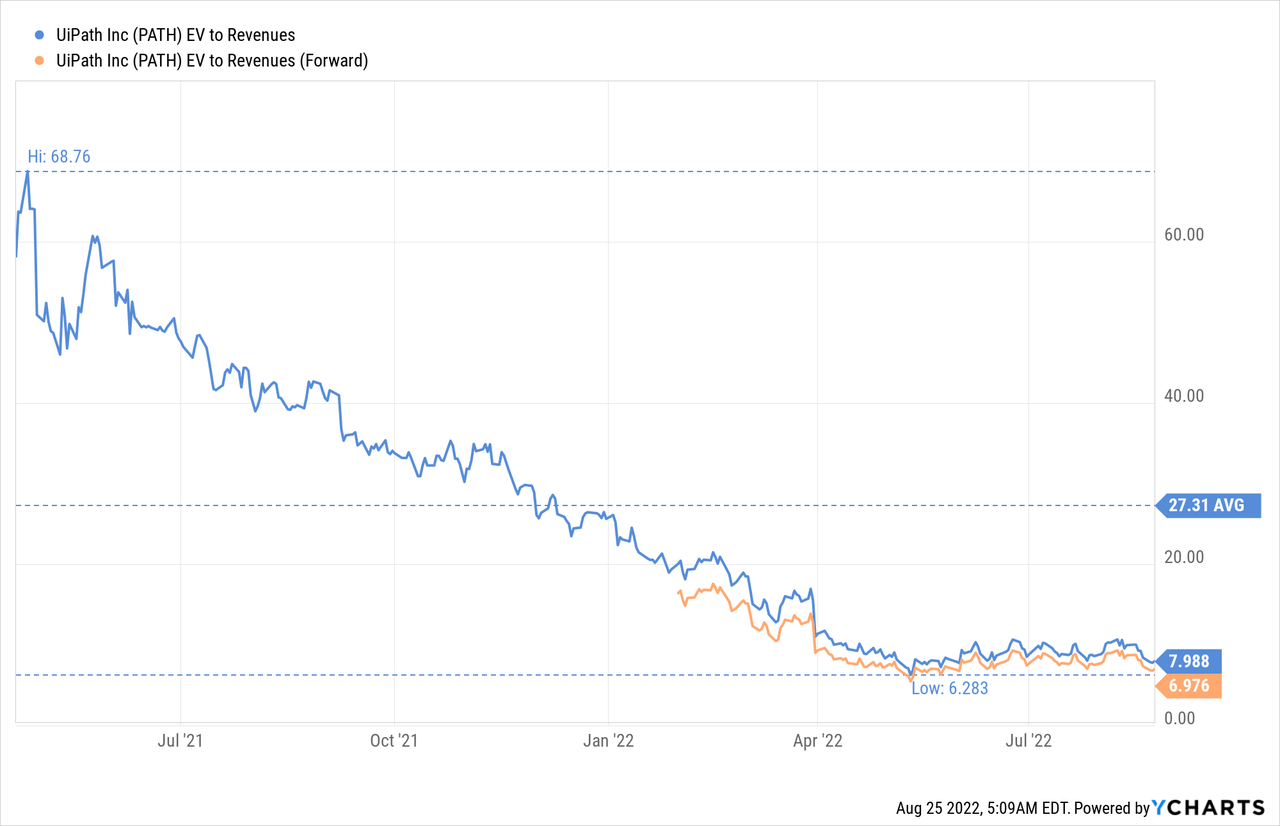

In our opinion the valuation has gone from absurd to just expensive. Some might even argue that at a forward EV/Revenues multiple of ~7x is cheap, and it is certainly looks cheap compared to the historical multiples the company has traded at. Given, however, the fact that the company is still losing money and that growth is decelerating, we find a ~7x EV/Revenues multiple still too expensive.

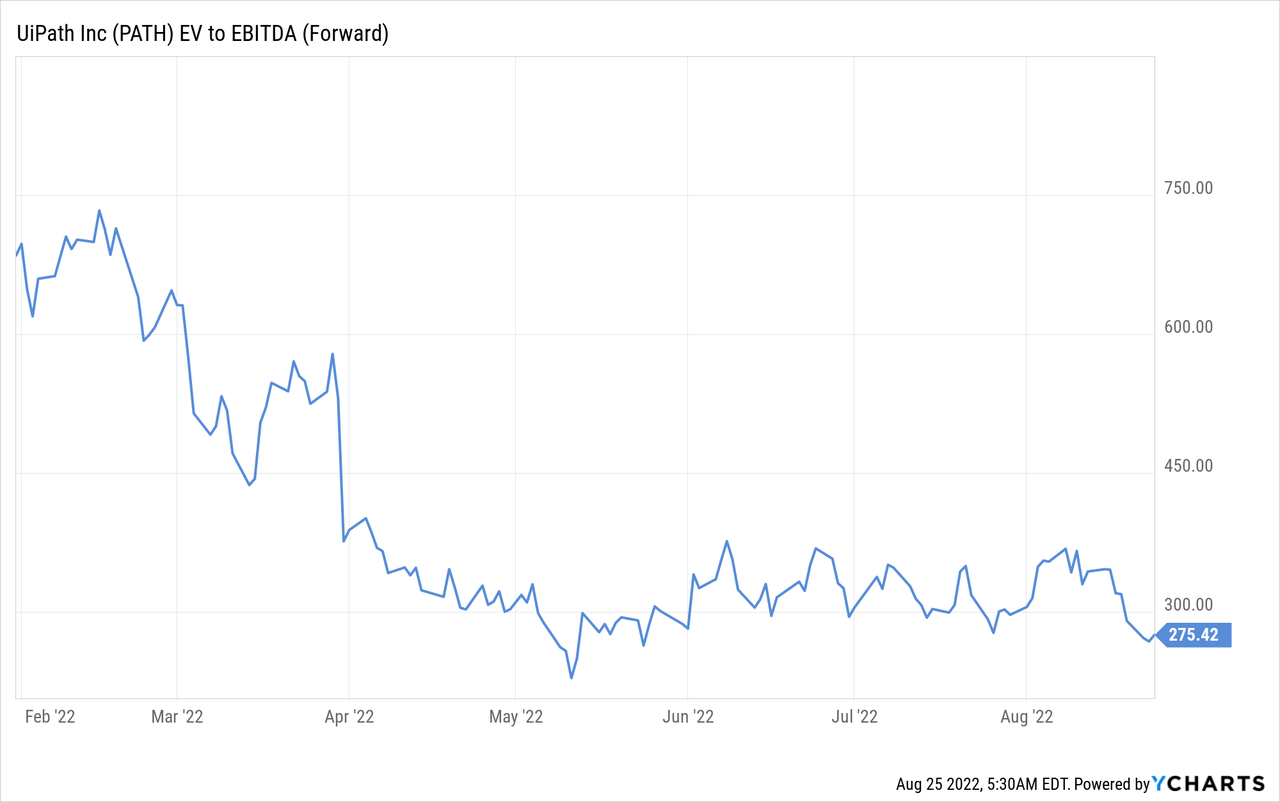

We much prefer valuation metrics based on profits, an looking at the forward EV/EBITDA, it remains in the triple digits, currently ~275x.

Risks

The main risks we see for UiPath investors are that the company still has not reached GAAP profitability, and that the valuation remains quite high. The valuation has improved significantly, but it remains extremely expensive in our opinion. Especially when considering that growth is moderating.

Conclusion

We believe UiPath is a company to keep on the watch list should it one day trade at a reasonable valuation. As the current leader in business process automation it probably has a long growth runway, and many opportunities to continue innovating and creating new products and services. We like the company’s potential, just not the valuation.

Be the first to comment