Mathier/iStock via Getty Images

Dear Partner,

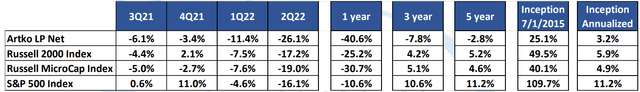

For the second calendar quarter of 2022, an average partnership interest in Artko Capital LP was down 26.1% net of fees. At the same time, investments in the most comparable market indexes—Russell 2000, Russell Microcap, and the S&P 500—were down 17.2%, 19.0%, and 16.1% respectively. To date, for the 2022 calendar year, an average partnership interest in Artko Capital LP was down 33.4% net of fees.

At the same time, investments in the most comparable market indexes—Russell 2000, Russell Microcap, and the S&P 500—were down 23.4%, 25.1%, and 20.0% respectively. Our detailed results and related footnotes are available in the table at the end of this letter. Our results this quarter came from Currency Exchange International while the rest of the portfolio declined with the broader markets.

Secular Tailwinds vs Cyclical Headwinds

This year continues to be one of macro uncertainty-based volatility as the market continues to adjust to a substantial economic regime change from one of free unlimited capital to one where capital has an actual cost. Despite the substantial stellar results and re-affirmation of future growth and profitability from our portfolio holdings, we saw a -26% 2nd quarter.

While these price swings are certainly frustrating, it should be noted that in the 3rd quarter, so far, the portfolio is up over 20%, and our strategy remains focused on avoiding the noise of short-term price swings and macroeconomic-based news cycles and more on secular themes and fundamental results.

We wait until our companies report results to report our own, especially during times of economic uncertainty, and we are excited to report our companies’ results for the 2nd quarter of 2022 and guidance for the rest of the year, with one exception, are outstanding and somewhat oblivious to the dire economic forecasts of the mainstream business media. We discuss Acorn Energy and HireQuest in the paragraphs below, but as the title of our intro indicates, our companies’ secular tailwinds continue to outweigh the macroeconomic headwinds that usually come with two quarters of negative GDP growth. A few examples:

- Northern Technologies (NTIC) – despite a 10% drop in revenues from China, reported 23% growth in revenues in 2Q22, on the strength of ~50% growth in its two newly developed products: ZERUST Oil & Gas, which prevents corrosion in oil tanks; and Natur-Tec, a recycled bioplastics product portfolio on the strength of continued wide demand for recycled plastic product solutions. As such, the company guided for further growth and increasing profitability for its last fiscal quarter in 2022, as well as seeing continuing growth trends into 2023.

- Currency Exchange International (OTCPK:CURN) – reported 108% growth in revenues for the last quarter with their Banknotes segment growing at 105% and the strategically important Payments segment growing at 127%. While the most important summer quarter is yet to be reported, we continue to believe the company can grow revenues to over 90% and close to $60mm in 2022 with a high 20s/low 30s percent operating profit margin and deliver over $20mm in EBIT over the next 12 months as the company’s currency exchange software for banks and corporate customers continues to gain mass adoption in the US and Canada.

- Potbelly (PBPB) – delivered 17.2% same-store sales (SSS) and 19% revenue growth in 2Q22, including record Average Unit Volume (AUV) at shop levels. The company reaffirmed its 2022 guidance which should result in nearly 20% revenue growth and sustainable cash flow generation. More importantly, the company’s continued commitment to having at least 25% of its locations be refranchised in the next couple of years while growing the overall location base, should result in substantial cash inflows and business model profitability. This was reaffirmed with the signing of a major delivery partnership with REEF, the largest operation of virtual restaurants, and reporting a healthy pipeline of new franchise candidates.

By design, being a value investor involves being a contrarian and making investments in companies that have a healthy degree of negative sentiment or a substantial misunderstanding of the opportunity set by the market. Since 2019, we have experienced two short but aggressive market cycles: the manic growth bubble of 2020 and 2021 and the flight-to-safety cycle of 2022. Neither one of these has been beneficial to the market prices of stocks of value-oriented micro- and nano- capitalization companies.

However, while the market sentiment has changed from extreme euphoria to extreme fear, our strategy and commitment to our investment process have not. We did not make major pivots to high-growth tech in 2020 nor to the safety consumer staples in 2022 and we continue to invest with the same process as when we started the partnership in 2015: holding for the long-term companies with clean balance sheets, incentivized management teams, and substantially underpriced growth opportunities.

It does not feel good to underperform during these market cycles; however, our confidence in our process; decades of success in the value strategy, despite long periods of underperformance, by its followers; and the continued phenomenal results by our portfolio companies ensure we sleep well at night. We hope our confidence and calmness through the volatility also help you to sleep well.

Portfolio Updates

Acorn Energy (OTCQB:ACFN)

In what we consider one of the most important portfolio developments this quarter Acorn Energy announced a partnership with CPower Energy Management in June 2022. As a reminder, Acorn Energy owns 99% of its subsidiary OmniMetrix, which provides hardware and monitoring services for standby electric generators. This has been a nice business, growing roughly 20% per year for the last few years, with $8mm+ in annual cash revenues split between hardware and monitoring revenues.

The monitoring revenues are very sticky, with a 95%+ renewal rate, highly diversified at over 30,000 customers – and are a relatively small absolute dollar customer expenditure with a monthly subscription cost of approximately $10 with the annual Average Revenue Per Customer (ARPU) being in the low $100 range. More recently this $22mm market cap company has reached an operating leverage inflection point where it has begun to generate ~$1mm in annual growing cash flow – which we always expected to substantially increase.

To take a birds-eye view of the business model, OmniMetrix has the ability to monitor and control tens of thousands of standby electric generators, a true Internet of Things (IOT) business. To take this even further, one can view the generators as standby energy producers on the grid. The innovation of the last decade has allowed for millions of people to begin utilizing their assets to generate revenue: from personal cars becoming taxis or rentals, to spare guest rooms becoming hotel rooms.

This is why the agreement with CPower is such an important milestone for OmniMetrix, as it now allows a substantial number of the existing and virtually all new customers to participate in the demand response program which involves annual payments from utilities and ISOs (Independent System Operators) to generator owners (and, of course, dealers and service providers).

Demand response rewards energy users who conserve energy or switch to standby generators to help grid operators or utilities meet periodic increases in electrical power demand. Across the US, CPower manages more than 5.3 GW of capacity for nearly 2,000 customers at more than 12,000 sites to help the grid when and where it is needed most through its demand response solutions.

CPower’s demand response solutions, enabled by OmniMetrix’s wireless remote generator monitoring and control, will automatically shift the power load to enrolled customers’ standby generators during peak demand hours, when the grid is stressed and energy prices are high, without any action on the part of the generator owner.

The generator owner not only has peace of mind of knowing that their generator is monitored and therefore, will work when needed for reliable power during extreme weather events, but additionally they will now be compensated for allowing their generators to be on call to potentially avoid power outages for their community through demand response.

How does this translate into an economic benefit for ACFN? While this is somewhat unprecedented some economic numbers are starting to become available. For example, an ISO may pay between $1,500 to $2,500 on an annual basis just to have access to a generator. This amount will be split between the generator owner, the dealer, and OmniMetrix. In other words, the company with a ~$100 customer ARPU may see ARPUs rise by $100s of dollars in the near future, while dealers will now be substantially incentivized to sell generators that have the hardware and software to participate in the program.

In July 2022, the OmniMetrix CPower partnership announced their first deal with the Electric Reliability Council of Texas (ERCOT) that connects Briggs and Stratton generators with OmniMetrix hardware/monitoring software. This is still the early days but we believe this is a substantial economic event that will significantly improve the long-term revenue growth and profitability of this company.

While we initially anticipated a ~$2mm Free Cash Flow number by 2023, growing to ~$3mm in 2024, we believe this program will begin to contribute $1-2mm in high-margin revenue within a year, with potentially a $4$5mm Free Cash Flow by 2024. This increases our near-term price target from $1.20 to over $2.00, with a longer-term $5.00 per share valuation going from possible to probable.

HireQuest (HQI)

What recession? On the heels of the July 2022 jobs report that showed 528,000 jobs added, a 3.5% unemployment rate, and a 5.2% wage growth number HireQuest, a staffing branch franchisor, reported 41% organic revenue growth and 63% overall revenue growth number this past quarter. A tight demand market for labor, higher wages, and the company’s franchise operator model continues to deliver on all cylinders. HQI continues to highlight the difficulty in predicting macro factors to fundamental results.

While we have now had two quarters of negative GDP growth there are nearly 2x as many open jobs as there are people who are employed seeking to fill them. According to HireQuest’s CEO, Richard Hermanns, it will take quite a few layoffs or cutbacks on planned hirings before “we get to a point that our overall demand will be affected. Demand has remained very strong and frankly, beyond our capacity to fill it. I would say that our abilities to fill orders are improving somewhat …but not enough to offset the gap between what our orders are and what our supply is.”

On the other hand, the company’s strategy of expanding both via M&A (five acquisitions in the last year completed and integrated) and organically, (new offices opened in Boston and Chicago, by existing franchisees) continues to deliver. With an acquisition target market of 44,000 staffing companies in the US, we believe that we are still in the very early innings of HireQuest’s growth.

We expect the $220mm market cap company to deliver over $21mm in Free Cash Flow in 2022. The macroeconomic uncertainty leaves our projections at what we consider conservative: $25mm and $30mm for 2023 and 2024 ($32.5mm/$39mm EBITDA) and a near-term price target of $26.00, or 80% upside from here. The current valuation, at what we consider a sustainable 10% Free Cash Flow yield, provides a significant margin of safety. We are likely to see more upside to these numbers with stabilization and more confidence in the fundamental economic factors as well as additional M&A.

Subsequent Events

As of the publication of this letter, in the second week of August 2022, our portfolio appreciated approximately 20% of its June 2022 quarter end lows. While we generally do not like to publish mid-period updates, given the volatility and the unfortunate timing of the quarter end values we felt it would be important to have this mid period update that better reflects our portfolio value today.

Partnership Updates

We welcomed one new partner to the partnership this quarter, bringing our total to 43 at the end of June. Despite the current economic challenges, we are excited about the stability in our partnership to weather and thrive through volatility and are thankful for your business.

Next Fund Opening

Our next partnership openings will be September 1, and October 1, 2022. Please reach out for updated offering documents and presentations at info@artkocapital.com or 415.531.2699.

Appendix A: Performance Statistics Table

|

Artko LP Gross |

Artko LP Net |

Russell 2000 Index |

Russell MicroCap Index |

S&P 500 Index |

|

|

YTD |

-34.2% |

-34.5% |

-23.4% |

-25.1% |

-20.0% |

|

1 Year |

-39.9% |

-40.6% |

-25.2% |

-30.7% |

-10.6% |

|

3 Year |

-5.0% |

-7.8% |

4.2% |

5.1% |

10.6% |

|

5 Year |

-0.3% |

-2.8% |

5.2% |

4.9% |

11.3% |

|

Inception 7/1/2015 |

58.5% |

25.1% |

49.5% |

40.1% |

109.7% |

|

Inception Annualized |

6.8% |

3.2% |

5.9% |

4.9% |

11.2% |

|

Monthly Average |

0.8% |

0.5% |

0.7% |

0.6% |

1.0% |

|

Monthly St Deviation |

7.1% |

6.8% |

5.8% |

6.4% |

4.4% |

|

Correlation w Net |

– |

1.00 |

0.73 |

0.71 |

0.66 |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment