sshepard

Investment Summary

Portfolio construction in FY22 should now mirror the distribution of potential outcomes for the global economy. This increasingly includes the prospects of economic recession, meaning a constant weighting to resiliency and quality is paramount to survive the storm.

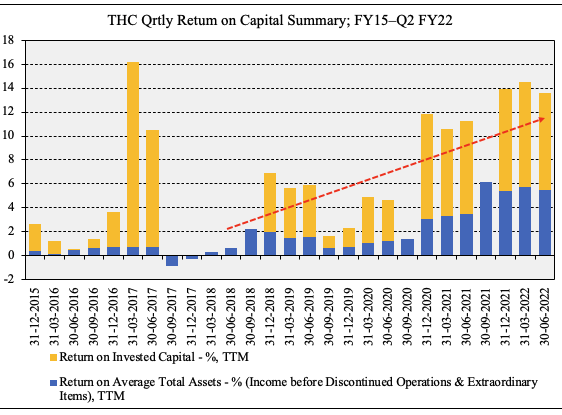

Alas, our examination of Tenet Healthcare Corporation (NYSE:THC) reveals there is a lack of equity premia available to harvest in our mandate. Our findings indicate a tightening of quarterly operating performance in recent years, despite a healthy schedule of ROIC. As such, idiosyncratic risk factors are light in this name, and we believe any near to mid-term upside will likely be sector beta, given healthcare has caught a bid since H2 FY22.

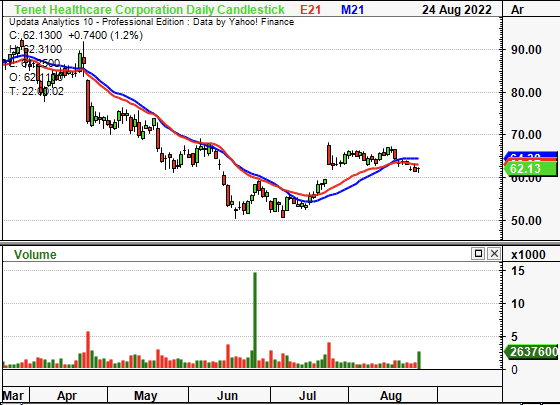

Exhibit 1. THC 6-month price action

Data: Updata

Q2 earnings insightful for full-year outcome

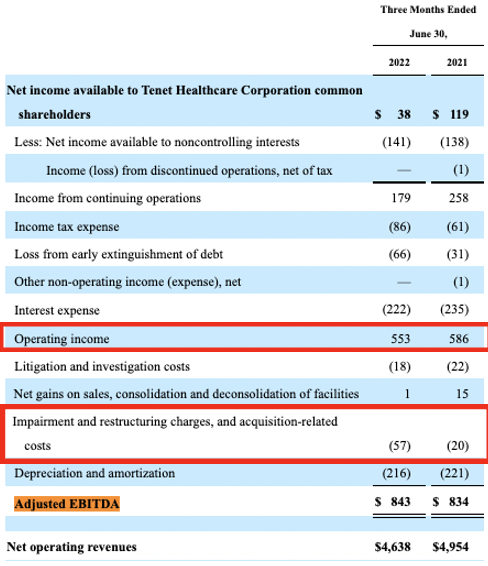

Second quarter earnings were mixed with downsides at the top-line relative to consensus. Net operating revenue narrowed 600bps YoY to $4.6 billion, whilst non-GAAP EBITDA gained 107bps YoY to $843 million. Noteworthy is that operating income was down ~560bps YoY to $553 million. However, the larger EBITDA result in Q2 FY22 stemmed from higher impairment, restructuring, and acquisition related expenses in THC’s reconciliation of net income to non-GAAP EBITDA, as seen below.

Exhibit 2. THC reconciliation of net income/operating income to non-GAAP EBITDA – Q2 FY22

Data: HB Insights, THC 10-Q Q2 FY2022

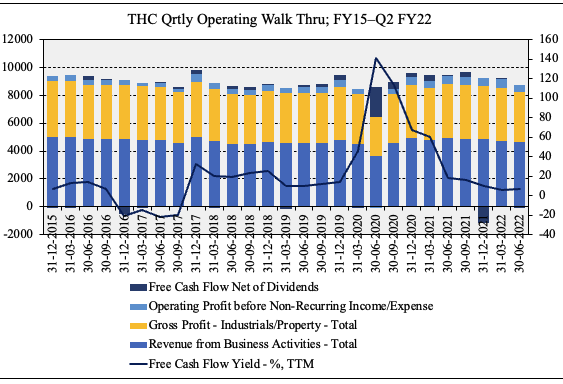

As seen in Exhibit 3, operating results have incurred a sequential declined from Q3 FY21. Revenue volumes have declined QoQ since FY21 followed by a tightening in gross profit and operating income. It carried the $553 million in operating profit down to a total net income of $179 million, down 30% YoY from $258 million. It also realized a substantial 55% YoY decline in CFFO from $779 million to $347 million. The bulk of this related to changes in accrued expenses on the balance sheet.

Exhibit 3. Tightening of operating performance on sequential basis since FY21

Operating performance now rests below pre-pandemic levels as well

Data: HB Insights Global Investment Research, THC SEC Filings

Segmentally, the USPI acquisition delivered EBITDA growth of 15% over the year when excluding grants received under the CARES Act. Meanwhile, Conifer came in with a strong gross margin of ~28%, printing EBITDA of $93 million.

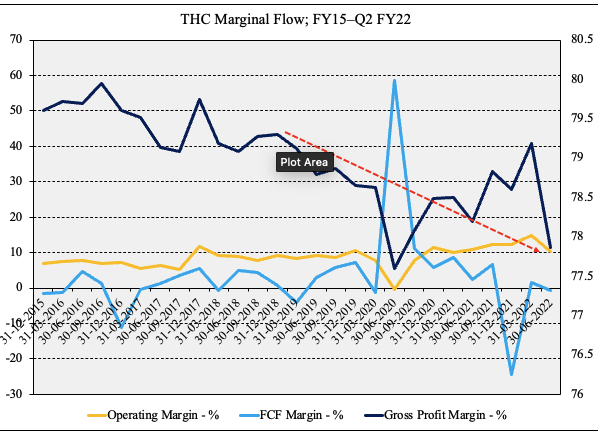

However, as seen below, FCF margins have been on a sequential decline over the past 2 years to date, having curled down off longer-term averages in FY20. Despite this, operating margins have remains buoyant and lifted from lows in the same year. This would be a dataset to watch for THC, particularly the spread between its top-to-bottom-line margins. Should operating margins continue to lift, this is conducive to higher free cash production and healthier FCF conversion below the bottom line.

Exhibit 4.

Data: HB Insights, THC SEC Filings

Whilst THC printed ~$250 million in FCF, the company also issued another $2 billion of 608 secured notes, paying a fixed coupon between 6.02% and 6.01%. These are set to mature in 2030, and proceeds were used to retire an existing $1.75 billion of liabilities due next year with paying interest at 6.75%.

Moreover, it acquired the remaining 5% interest in USPI voting stock from Baylor & Scott on a $406 million valuation. It is set to pay this down over 3 years with an $11 million [interest free] monthly payment.

THC says that it now boasts a market leading position in a “highly fragmented” ambulatory surgical space, claiming around 7% market share. It also noted the strategy to invest more than $200 million per year in ambulatory M&A on a forward-looking basis. To do this, it will need strong FCF conversion and return on invested capital. Management forecast ~$1.5 billion in FCF at the midpoint for FY22.

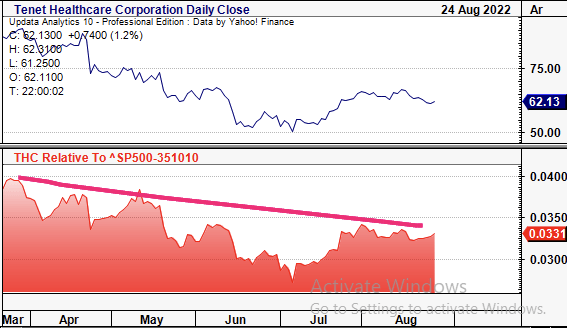

In addition, both ROIC and ROA have been curling upwards in recent quarters, laying a solid bedrock for the M&A strategy. As seen in Exhibit 5, ROIC in particular has spiked hard from FY20, following a series of portfolio management initiatives. It printed 8.1% in ROIC last quarter, well ahead of the ~6% in newly issued debt.

Exhibit 5. Return on investment continues to compound additional capital for THC

Data: HB Insights, THC SEC Filings

Cyber attack update

Recall that THC also suffered a cybersecurity incident in the week of April 18. It experienced a temporary disruption to a subset of its operations, however, from the earnings call, management estimate the impact to be ~$100 million on non-GAAP EBITDA for the second quarter.

Management noted it has filed an insurance claim and that it “continue[s] to insist on full payment from [its] insurance companies.”

Per CEO Sam Sutaria on the Q2 earnings call:

“Unfortunately, the speed at resolving [the incident] is slow, but we are committed to driving this to a reasonable and appropriate resolution as quickly as possible. Importantly, this attack should be considered one-time impact. Our systems have been rebuilt and we have restored network operations. As such that we typically do not discuss individual monthly results, it is important to note that we saw significant recovery in June, which we believe creates optimism about the second half of the year.”

Market wind down

THC has also begun to weaken against the health care services and providers sector, as seen below. This is important in our estimate as we are seeking names that look set to outperform peers in the sector both fundamentally and on technically. With a continued weakening since March of this year, this places THC in the bottom percentiles in terms of performance – unattractive, seeing as the wider healthcare sector has caught a strong bid in H2 FY22.

Exhibit 6. THC continues to weaken against peers in the sector. Investors are punishing or overlooking the stock in favour of other names.

The question is why? Does it relate to corporate value, risk, earnings quality or otherwise?

Data: HB Insights, Updata

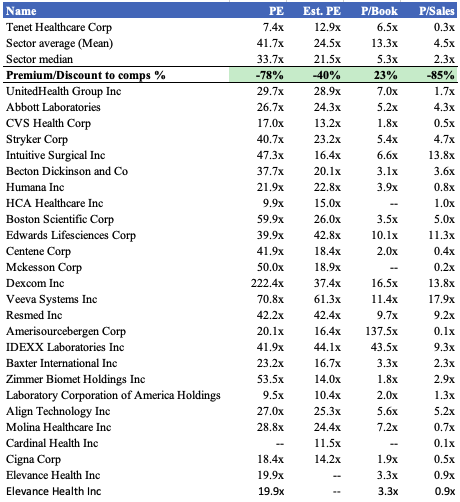

Valuation

Shares are trading at a discount to key multiples used in this analysis. Trading at 7.4x P/E and 0.3x sales appears attractive, however it will need further scrutiny – it can’t be that simple. Moreover, THC is richly priced at 6.5x book value. Further, it is priced at a 40% discount to GICS Industry peers on a forward P/E basis, suggesting the market is expecting a below-sector result from THC next year. THC needs to overcome this consensus viewpoint in order to generate positive alpha looking ahead.

THC also printed a TTM ROE of 173% last quarter, well ahead of the sector’s 15%. However, that is THC’s return on equity, we would be paying 6.5x book value, meaning out ROE would be 26%, still not a terrible absolute result. However, note two things. First, THC has negative tangible book value of $9.8 billion. Second, if we’d pay 6.5x the entire book value of equity, then we’d be paying $127, more than 51% premium to the current share price. Based on these factors, we estimate that THC should be fairly priced at $41.

Exhibit 7. Multiples and comps

Data: HB Insights.

Applying the market’s 12.9x forward P/E to our EPS estimates of $6.47 for FY22 sets a price target for THC at $83.45 per share, lending around 38% return potential at the time of writing.

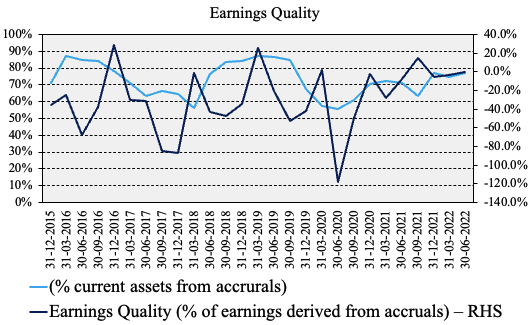

Examining the quality of THC’s earnings profile suggests there is a good deal of cash backing this valuation, and that a good portion of earnings is either derived from or set to be converted to real cash. However, the portion of accruals making up liquid assets has been curling up since FY20.

Exhibit 8. ‘Real’ earnings analysis – Percentage of cash earnings

Data: HB Insights

The question then becomes how to value THC, on the basis of earnings of corporate value. Blending the two estimates, we arrive at a valuation of $62, suggesting THC is fairly priced and supporting our neutral view.

In short

We rate THC a hold at the present time given a perceived lack of quality in its earnings profile. Operating performance has narrowed in recent periods and valuations are unsupportive of further upside in the near to mid-term. Management also revised full-year guidance after missing consensus estimates in the previous quarter.

We estimate that near to medium-term upside would likely be sector beta for THC considering the lack of idiosyncratic risk premia available to harvest. THC could form part of a basket of healthcare stocks for those investors looking to add an overlay of diversified resiliency into equity portfolios. However, there may be more defensible names on offer based on this examination.

Be the first to comment