Justin Sullivan

Williams-Sonoma (NYSE:WSM) continues to see strong results but the momentum is likely to slow in the near term. Long term prospects however are positive.

Bucking the retail trend

Despite supply chain bottlenecks, a climate of rising inflation, and weakening consumer confidence, American consumer lifestyle brand Williams-Sonoma has so far been bucking the retail trend with strong performance over the past few quarters. Net revenues for Q2 2022 (quarter ended July 2022) were up 9.7% YoY to USD 2.1 billion, accelerating from Q1 2022 when revenues were up 8.1% YoY. The company’s topline performance outpaced the industry (US furniture retail sales rose just 2% in the nine months to September 2022), while rivals such as Wayfair (W) and Overstock (OSTK) have been seeing consecutive YoY revenue declines over the past several quarters.

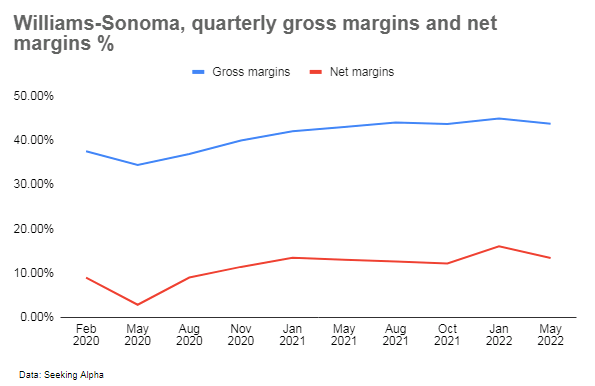

Williams-Sonoma’s gross profits rose 8.2% YoY to USD 928 million, while net profits rose 8.5% YoY to USD 267 million. Margins however continued to decline sequentially; gross margins dropped to 43.5% in Q2 2022 from 43.8% in Q1 2022, and 44.9% in Q4 2021. Net margins dropped to 12.5% in Q2 2022, from 13.4% in Q1 2022, and 16.1% in Q4 2021.

Author

Soft near term prospects likely

High inflation along with rising interest rates is crimping America’s house buying activity and an anticipated recession suggests a soft outlook near term as consumers cut back on discretionary spending. Moreover, pandemic related tailwinds are receding and with a number of purchases made during the pandemic, buying activity is likely to slow in the near term. Challenging macro conditions could limit top line growth in the near term.

On the cost side, supply chain challenges and inflationary conditions are expected to continue to persist in H2 2022 which could impact margins.

Several growth drivers to support long term performance

Longer term however, there are reasons to be optimistic about the company’s prospects. Williams-Sonoma targets an upper-middle to affluent demographic who are relatively immune to economic headwinds and even if so, they are more likely to recover faster from any economic slowdowns. Long term prospects for the industry are intact; furniture is a growing market with projections expecting a low mid-single digit percentage growth in the U.S and a mid-single digit growth worldwide over the coming years.

Key strengths include growing brand portfolio, and growing brand equity

The company enjoys several strengths; within their target demographic, Williams-Sonoma offers a growing portfolio of brands catering to subsegments; West Elm, the company’s stylish yet affordable brand targets quality-conscious millennials while Williams-Sonoma targets a more affluent, mature demographic and Pottery Barn sits in the middle. Not only does this increase the company’s addressable market but it also opens cross-selling opportunities; cross-brand customers account for 60% of total sales in 2021, and the management believes they can capture greater wallet share from their existing customers.

The company continues to build on their multi-brand strategy with emerging brands such as Rejuvenation and Mark and Graham, both of which appear to be enjoying strong traction (double digit comps in Q2 2022).

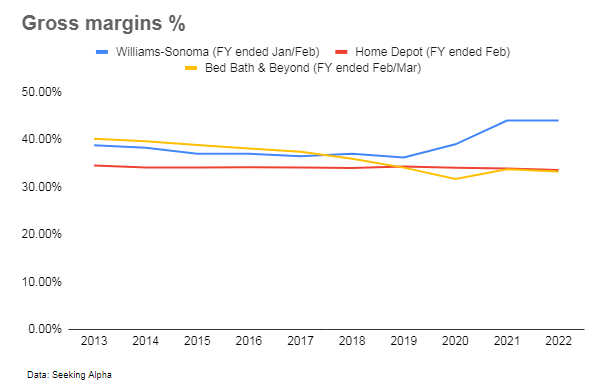

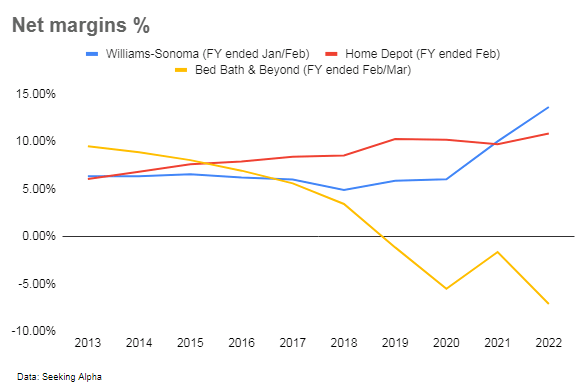

While expanding their collection of brands, the company is also building their existing stable of brands and their pricing power; management continues to highlight their efforts to eliminate site-wide promotions, and those efforts appear to be bearing fruit with the company’s margins on an uptrend over the past few years, notably even in 2021 when inflation, supply chain dislocations, and heavy promotions impacted margins for many rival retailers such as Home Depot.

Author Author

Omnichannel strategy could help drive market share gains

In line with their digital-first (but not digital only) strategy, Williams-Sonoma continues to strengthen their omnichannel capabilities, combining their offline store footprint with their online stores. Near term, their offline presence could help them capture share from online-only stores as consumers return to in-store shopping post pandemic (the trend is impacting online only retailers such as Wayfair for instance who is losing market share to omnichannel players), but longer term, an omnichannel strategy could help drive sales as consumers are increasingly expecting retailers to offer both online and offline paths to purchase. This is particularly true among digital-native younger buyers such as millennials and Gen-Z shoppers (who happen to be Williams-Sonoma’s fastest growing customer segment). Growing omnichannel strengths along with innovative products and proactive brand building efforts should help the company’s brands remain fresh and continue resonating with a younger audience, putting the company in a better position to capture a greater share of their wallet spend as they rise up the income ladder and upgrade to higher end brands.

Exploring new growth avenues with international growth ambitions and B2B business

The company has been exploring new growth avenues which should help drive growth and diversify revenue streams in the years to come; B2B delivered a solid 32% YoY growth in Q2 2022, and is on track to be USD 1 billion business this year. The company continues to focus on building this new business by diversifying its product offering; in November the company added commercial grade kitchen products for its B2B customers, and in October the company ventured into the corporate gifting market, creating a dedicated corporate gifting sales team comprising product experts ready to help customers put together personalized corporate gift sets. Corporate gifting is a USD 7 billion market, and the company’s brand recognition and resource advantages including its store presence, wide product offering, and human resources suggest the company is well positioned to capture a share of the high-end segment of this market.

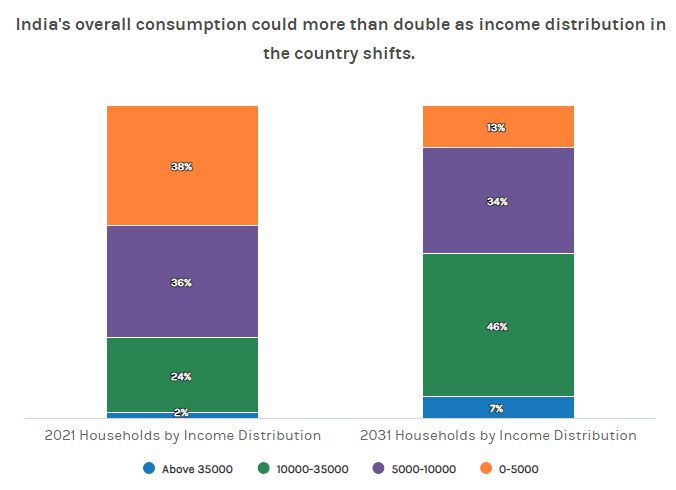

Meanwhile their overseas expansion efforts are ongoing. The majority of Williams-Sonoma’s revenues are generated in the U.S. which accounted for 94% of revenues in 2021. Notable efforts in this area include the company’s expansion into India; India’s consumer market is blossoming and with the country expected to become the world’s third largest economy by 2027, surpassing Japan and Germany according to Morgan Stanley, India’s consumer spending is expected to double as well with household goods expected to see increased consumer demand. Pottery Barn, Williams-Sonoma’s mid-tier brand and its biggest revenue generator (Pottery Barn and Pottery Barn Kids and Teen together accounted for 42% of revenues in 2021), which launched in India in 2021 where Pottery Barn enjoys some brand awareness owing to the popularity of 1990s sitcom FRIENDS in the country, could be well poised to capture a share of that spend. The Pottery Barn and Pottery Barn Kids website was launched in India in Q2 2022, with stores expected to open in Q3 2022 and further expansion in 2023.

Morgan Stanley

Decent financials

Williams-Sonoma has a decent financial position; the company has very little financial debt (most of their debt consists of capital leases). A decent financial position not only enables the company to weather near term economic headwinds, but it also better positions the company to invest in long term organic growth efforts such as brand building, portfolio expansion and overseas growth, as well as exploit any inorganic growth opportunities that may arise.

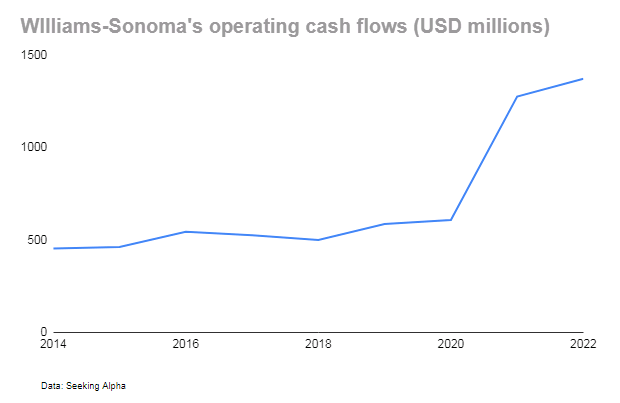

Operating cash flows have also been steady over the past decade. 2020 saw an unprecedented jump in operating cash flows as lockdowns prompted people to spend heavily on furniture during the pandemic, however this momentum normalized in 2021 and is likely to remain so going forward.

Author

Risks

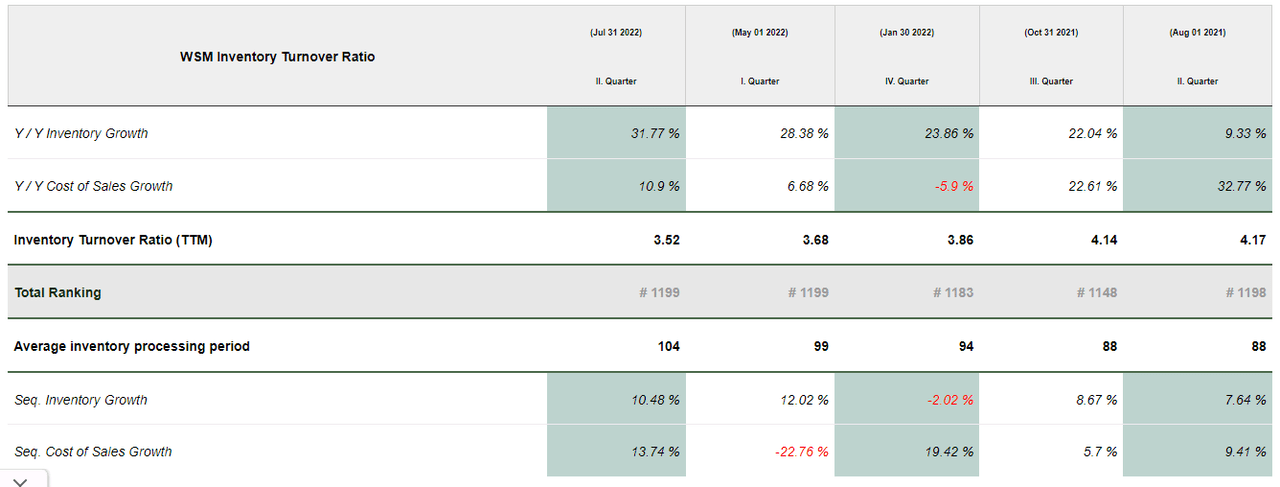

Inventory risks could potentially crimp near term performance. Inventory turnover has been dropping sequentially and the company’s inventory levels have been on the rise. Although this may have been a response to ongoing supply chain bottlenecks, it increases the risk of an inventory buildup which not only adds to warehouse costs but may further cut into margins if the company is forced to step up promotional discounts to move unsold inventory.

CSI Market

Williams-Sonoma’s stock currently has a high short interest, suggesting pessimism over the company’s near term prospects.

Summary

Premium furniture retailer Williams-Sonoma has so far delivered steady results despite challenging operating and economic conditions. Short term prospects however are likely to be soft with weakening house-buying activity potentially impacting revenues and supply chain bottlenecks and inflation impacting costs.

Longer term prospects for the furniture industry are intact with forecasts expecting steady growth and the company is poised to bank on several growth drivers including B2B sales, and international growth. The company’s efforts to strengthen their omnichannel capabilities could help capture market share, while their efforts to build their brand through quality products and limited promotions could improve pricing power and therefore margins as well.

With a P/E of 6.9, Williams-Sonoma is quite cheap, however with a relatively high short interest, investors may want to wait for a better entry point.

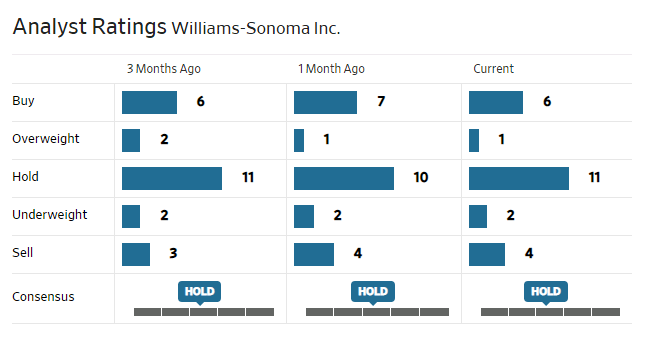

Analysts are mostly neutral on the stock.

WSJ

Be the first to comment