remco86/iStock via Getty Images

Human history has been flavoured by some great comebacks over the centuries. In the domain of sport, there’s the Red Sox win that finally ended the “curse of the Bambino.” We also can’t forget the great Tom Brady taking the Patriots from a 28-3 deficit to a Super Bowl win against the Falcons. Military history, too, is littered with comebacks, from the defeat of the Spanish Armada to Saratoga. Commercially minded folk, many of whom peruse this website, may remember the Apple or General Motors comebacks among many others. We love these stories because they remind us that the human spirit can overcome unfathomably bad odds. I love such stories, but in my view, one story stands out above all the others like a colossus. Doyle’s bearish Xylem call must be ranked at, or very near the top of, the list of the greatest comebacks in human history.

We now know that since Doyle put out his bearish call on Xylem Inc. (NYSE:XYL), the shares are down about 13.6% against a gain of ~21.75% for the S&P 500. It wasn’t an easy ride for him, though. The price was ~$101 when Doyle put out his bearish call, but the market ignored him as it very frequently does, and drove the shares about 32% higher before turning. Did Doyle crack under this pressure? He did not. Did the price moves of the stock alter his bearish perspective on this name? They did not. Doyle held fast, as the living embodiment of his family motto: fortitudine vincit (“he conquers through fortitude”). The shares cracked and began the grinding descent to where they are today.

I clearly have a healthy self image, and who doesn’t love people who brag excessively or speak of themselves in the third person? Although I’d love to continue to indulge in this way, I’m sure you’re not here for yet another dose of my self-aggrandizements. I’ve been bullish on this business in the past, and I’m open to being so again. After all, a stock trading at $86 is definitionally less risky than that same stock when it’s trading at $101. I’ll determine whether or not I want to buy back in by looking at the most recent financial history here, and by looking at the stock as a thing distinct from the underlying business. Finally, I hope I’m not spoiling the surprise, but I will be writing about put options, too.

If it isn’t obvious by now, my writing can be “a bit much” for reasons too numerous to list. For that reason, I put up a “thesis statement” near the beginning of my articles in order to expose readers to as little of my stuff as absolutely necessary. I do this for all of you. Not every hero wears a cape. Anyway, in my view, shares are still too expensive, especially in light of the fact that the most recent financial performance has been mixed. I like the fact that the dividend rose, and I like the fact that it’s reasonably sustainable. The valuation trumps all, though, and I can’t buy at current prices. Just because the shares aren’t worth it yet doesn’t mean there’s nothing to be done here, though. I’ve earned about $10 per share in put premia on this name, and I plan to add to the pile today. In particular, I’ll be selling the October puts with a strike of $65. I consider this to be a “win-win” trade. If the shares remain above $65 over the next seven months, I’ll add the premium thus earned to the whiskey acquisition fund. If the shares fall in price, I’ll be obliged to buy, but will do so at a 24% discount to the current level, at a dividend yield of ~1.8%. There you have it. That’s my thesis statement, meaning that you can leave this article now, having received most of my, uh, “wisdom.” That means that if you read on, that’s on you. I don’t want to read any whining in the comments section about my terrible jokes or odious self aggrandizement that I get up to beyond this point.

Financial History

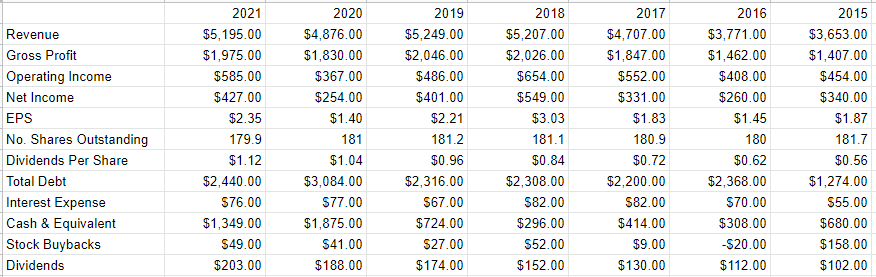

I’d characterize the most recent financial performance here as being a “mixed bag” relative to the past two years. While revenue was about 6.5% greater in 2021 than it was in 2020, it was actually about 1% lower than it was in 2019. Net income was much higher than the previous two years, which was more a function of the fact that there were no goodwill impairment or restructuring and asset impairment charges in 2021 relative to the previous two years. In spite of that softness, management rewarded shareholders with a 7.7% uptick in dividend payments over the year. The company also reversed the deterioration we saw in the balance sheet in 2020. Specifically, long term debt is down about 21% from 2020, which I think reduces the risk here significantly.

Finally, I think the dividend is reasonably well covered. For instance, the company has about 6.5 times more cash on hand than they spend on dividends every year. Additionally, of the company’s $2.44 billion of debt, fully 77% is due in 2026 or later. Given this, I’d be happy to buy back in at the right price.

Xylem Financials (Xylem Investor Relations)

The Stock

Some of you who follow me regularly for some reason know that it’s at this point in the article where I turn into a real killjoy because I start yammering on about how a great company can be a terrible investment at the wrong price. Phrases like “at the right price” reveal the fact that I’m simultaneously both a “fuddy” and a “duddy.” I treat the stock as something apart from the business, because I’m of the view that the former is governed more by the mood of the crowd than much that we can currently measure in the company. The change in stock price is governed by supply and demand for shares in general, what the market “feels” about the very long term prospects of a given company, etc. Thus, I think the stock is often a poor proxy for the changing fortunes at the business, so we need to consider it as a thing unto itself.

Rather than bore you more than is absolutely necessary, I’ll use Xylem stock itself to demonstrate the relevance of the stock itself to returns. The company released earnings exactly one month ago. If an investor bought early afternoon that day, they’d be down about 4.4% as of this morning. If an investor bought this stock on March 8th to pick a date completely at random, they’re up about 4%. Obviously not enough changed at the firm between February 25 and March 8 to warrant an 8% swing in returns. The investors who bought virtually identical shares more cheaply did better. This is why I try to avoid overpaying for stocks.

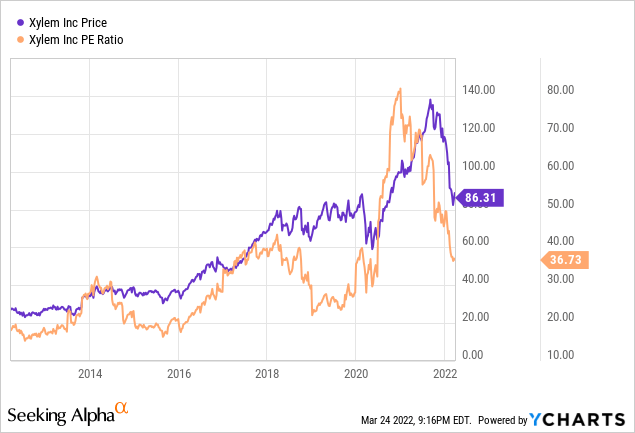

If you’re one of my “regulars”, you know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, I had to reach for one of my fainting couches because the price to earnings ratio was approaching 90 times, and a price to free cash flow of ~27.

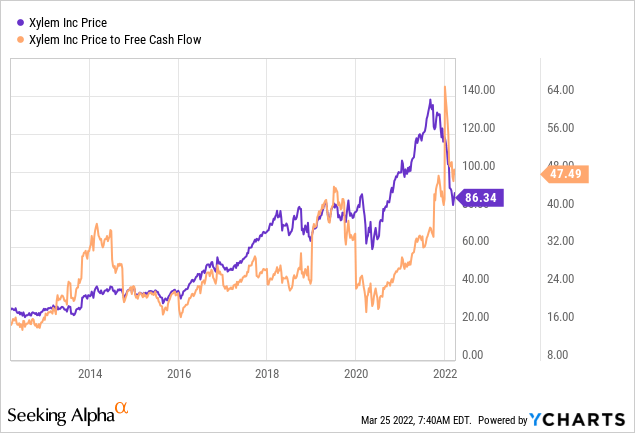

I think the situation has improved in some ways, and deteriorated in others, per the following:

Source: YCharts

Source: YCharts

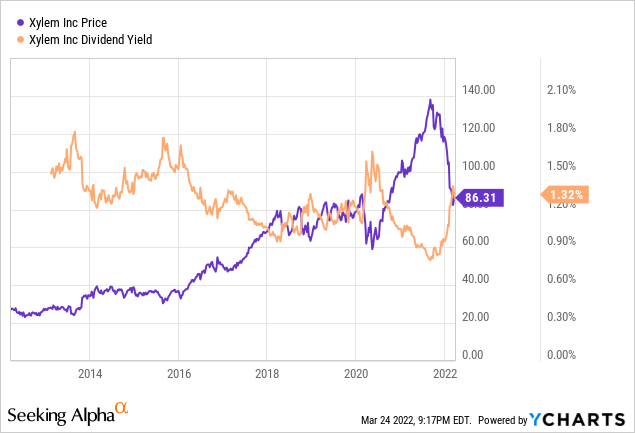

At the same time, though, thanks to the recent dividend increases, the yield is certainly approaching a more reasonable level in my view. This suggests that the company is certainly getting close to a price that I’d consider buying at.

Source: YCharts

My regular victims know that in addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Applying this approach to Xylem at the moment suggests the market is assuming that this company will grow at a perpetual rate of ~7.5%, which I consider to be very optimistic. Given all of the above, the shares are still too rich for my blood, so I won’t be buying back in yet.

Options As An Alternative

Cast your minds back, if you will, to my earlier work on Xylem. In my previous missive on this name, I pointed out that I’ve earned about $10 from selling puts on this stock over time. When it was trading at $101, though, I couldn’t sell puts because the premia on offer for reasonable strike prices was too thin. Now that the shares are cheaper, and the dividend yield is higher, we’re back in business. I’m now able to earn a reasonable premium from put options, so I’m going to do just that. Before getting into the specifics, I’ll remind you, yet again, that I consider certain short puts to be “win-win” trades. If the shares remain above the strike price, I’ll simply add the premium thus earned to the whiskey acquisition fund. If the shares fall below the strike price, I’ll be obliged to buy, but will do so at a price that I’ve already decided is acceptable. Either outcome works well, hence, “win-win.”

Now that the not-so-subtle bragging and theory spiel are done, it’s time to get into specifics. I’m recommending selling the October puts with a strike of $65. These are currently bid at $1.00. I consider this sale to be a “win-win”, obviously, because I’m comfortable with either outcome. If the shares remain above $65 for the next seven months, I’ll throw this premium onto the pile. If the shares fall another 24% from current levels, I’ll be obliged to buy, but will do so at a price that lines up with a dividend yield of ~1.8%. Given that I think the dividend is safe, I’d be happy to buy at this rate.

It’s time to change tone a little bit. In case you’re the sort to take the word of a stranger on the internet, I have a moral obligation to rein you in a little bit by writing about risk. After all, it’s all well and good for me to characterize these things as “win-win” trades as I frequently do, but everything comes with some measure of risk, and short puts are no exception. I’m starting to divide the risks here between the economic and the emotional. Let’s review these in turn.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. For instance, I wasn’t willing to sell Xylem puts when the shares were trading at $101, because the premium was too thin. Had I done so, I may have picked up a few dollars in premium, but I’d be sitting on a fairly massive loss on the stock thus “put” to me. So, rule one is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short-put strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at Xylem, and the shares jump to $100 again this year. After all, people far smarter than me are growing bullish on the long term prospects for this stock. The short put only offers you the option premium. The return from the short put may be lower risk, but it’s certainly limited, and that can be emotionally painful for many.

Secondly, I can say from many years of painful experience that it can be emotionally painful when the shares crash below your strike price. While these trades have worked out well in the medium to long terms, largely because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. So, I can make a reasonable argument that Xylem shares are a bargain at $65, but if they drop to $50 because of a market meltdown, for instance, that will take an emotional toll. I think people who sell puts should be aware of these emotional risks before selling.

I’ll conclude this rather long, drawn out, ponderous discussion of risks by looking again at the specifics of the trade I’m recommending. If Xylem shares remain above $65 over the next seven months, I’ll simply add the premium to my winnings and move on. If the shares fall in price, I’ll be obliged to buy, but will do so at a price that lines up with a reasonable dividend yield and a PE of ~27.5, which is good for this stock. All outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” I know. It’s weird of me to end a discussion of short put risks by writing about how these reduce risk. If this is the first “weird” thing you’ve noticed in this article, you’re not paying any attention.

Conclusion

I think Xylem is a good business with a sustainable dividend. The problem is the valuation. In spite of the fact that I’m not willing to buy the shares at current levels, I think it’s possible to earn a decent return selling the puts described above. If you’re comfortable selling puts, I’d recommend this or a similar trade. If you’re not, I’d recommend you wait for shares to fall to a more reasonable level before pulling the trigger here.

Be the first to comment