Kevork Djansezian/Getty Images News

This sort of company, like Sturm, Ruger (NYSE:RGR), isn’t the easiest sort of business to invest in, and I’m not talking from any moral considerations or concerns – though such concerns certainly could apply.

Instead, I’m talking about concerns of volatility, sales cycles, political pressures and risks as well as manufacturing and sales. There is, simply put, a lot of things that can go terribly wrong or amazingly right in a company such as this.

Selling firearms is a complex sort of business.

Let’s dive back in and see what we got, 6 months after my last piece.

Sturm, Ruger – Revisiting the company

As I wrote in my first article, Sturm, Ruger does guns – and they do them well. The company’s products encompass the range between bolt action, semiauto, single-shot, shotguns, pistols, and revolvers.

The company is the largest manufacturer in all of the US with annual revenues of over $650M, with around 1,800 employees. Despite a recent set of positive results, including a 28% sales increase YoY and a 109% RoR on operating assets, the company declined in terms of valuation.

Still, it’s my intention to emphasize how disconnected this recent share price action is to 2021 results, with tremendous opportunities in the Marlin brand, shipping its first Ruger-made rifle in December of 2021. The company brought several other new products to market, including the Ruger-57, the PC Charger, the MAX-9 Pistol, the Wrangler, and several others.

There was a lot to like about the year, including continued dividends, increased shareholder equity, and a declining COVID-19 headwind.

The company also very recently bumped its dividend by almost 9% on a quarterly basis, reflecting the good performance RGR has seen. Some underlying positives included that because the company started 2021 with almost no inventory, virtually all firearms sold in this past year were manufactured in 2021. The company has a very effective/streamlined inventory system, and also managed to bump production by 30% in the company’s factories, despite only a 10% increase in manpower, which of course translates extremely well into manufacturing efficiencies (despite a tight labor market and logistical challenges across the board).

Ending 2021, the company’s inventory was already significantly below pre-COVID-19 levels, and on the distribution side, inventories increased by 125,000 units in 2021, showcasing demand for the company’s products.

There are some remaining fundamental risks for Ruger. I go through these in my initial article, but they concern some of the more basic things we usually look at. Things like credit rating.

Ruger does not have an S&P credit rating. The company, with its current set of circumstances, has no real need for it. It has zero debt. The company also has the ability to pull on a $40M credit facility, which is currently unused. Aside from that, there is cash and short-term investments of $141M, which is enough to cover any short-term costs the company could face from its current obligations.

(Source: Ruger Seeking Alpha Article)

The second thing remains the company’s overall yield. With the current valuation, this is actually higher than when I previously wrote of the company – around 4.77% based on the recent quarterly dividend of $0.86. This is a very good yield for a company with zero debt and what I consider to be at relatively low risk.

Yes, the cyclical risk isn’t small. This company can go up and down like a Jojo, and indeed it will. However, the overall fundamental risk, that one is low. RGR holds a number of core brands, and its appeal isn’t just protection, but sport & leisure. The company also exports its products to the international market, albeit at a relatively low percentage of sales.

So when investing in this business, you really have to be aware of the dividend volatility, the somewhat seasonality of the business, the sensitivity to firearms regulations, and the political climate of the US – as the nation is the company’s only market that matters and likely will matter.

I spoke in my initial article about if you even should invest in firearms in the first place. At that time I made the clear stance that it’s an individual choice. I choose to invest in Firearms, and I have a position in RGR at this time. I foresee a decent upside for this business based on continued strong sales.

I foresee a societal climate changing more towards the volatile and unsafe – and this will be of net benefit to companies in this space. Just as I position myself in line with security/protection companies, military arms manufacturers, commodities companies, water companies and other things that people need, I choose to position myself with arms manufacturers like RGR.

It makes logical sense to do so.

Sturm, Ruger – The valuation

Just as with my previous article, I believe there are a few good ways to invest in RGR. You don’t have to buy the common share. In fact, it might be preferable not to do so given the risk you’re taking.

You could, if you like, go for options as well. Beginning with the common though, RGR has some upside here. It’s unlikely that the company will abandon its cyclical character, and indeed, the history and forecasts make this case. Analysts don’t even give us estimates beyond 2022E.

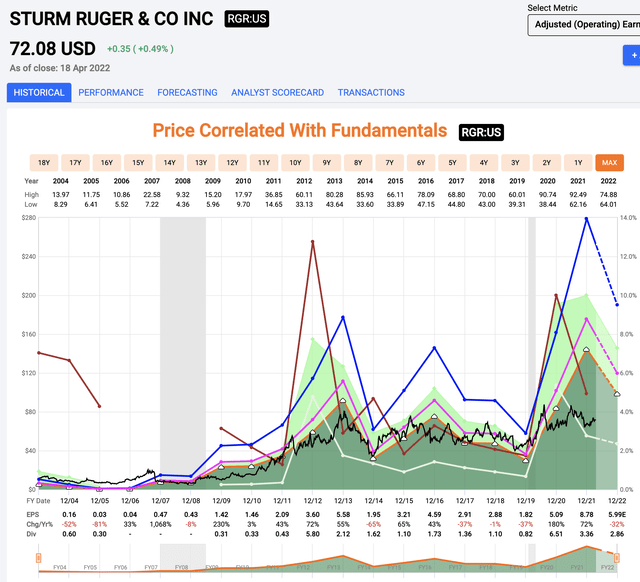

Sturm, Ruger Historical Data (F.A.S.T graphs)

I will tell you this, however. Long-term investors in RGR have averaged 12.5% annually, which is almost double the market average for the past 20 years. It seems not unlikely that a similar level of outperformance might be true in the future. As you can see though, the company’s dividends and earnings do come in at a very choppy pace, with upsides when the world is in peril.

The upside to a historical 5-year normalized P/E for Ruger is no less than 47% annually, though this is to 2022E, and it’s following a 32% EPS drop that’s likely to have an impact on the company’s valuation as well.

In short, it’s very hard to say where the company will go in terms of valuation. This sort of situation makes options investing a very good choice – that’s also why I went that route back in October and got the company at a very favorable price.

S&P Global considers the company to have a conservative upside of 15% from today’s valuation to an average share price target of $83/share, from a range of $70-94. While there’s uncertainty about the company’s targets, every indication from the analyst/market side of things points to a higher upside than the company currently has.

But instead of the common, let’s look at options.

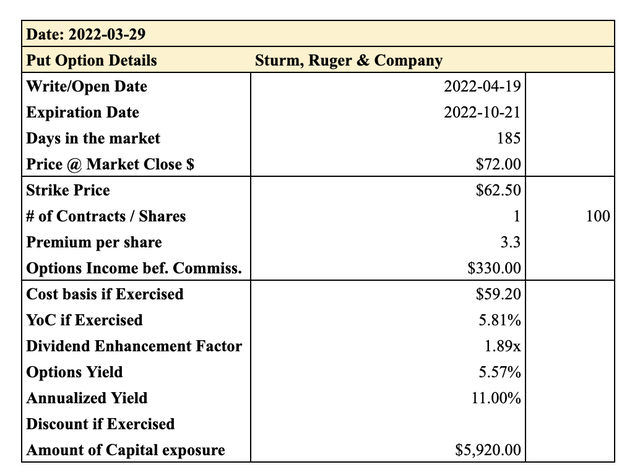

If you’re willing to put capital at risk – about $6000 or so, you’re able to get a fairly substantial, impressive upside of 11% annualized until October, while declaring yourself willing to buy RGR at a cost basis of below $60/share.

Ruger Options (Author’s Calculations)

This is honestly the path I’d take if I was interested in putting money on the line here. There are, to me, better upsides elsewhere to consider prior to Ruger, but this is an absolutely solid option that I would consider if I had the capital to spare in my IBKR account where I handle my options.

Overall, this is my current thesis for Ruger.

Thesis

My thoughts on Ruger are:

- This is an absolutely solid business despite the lack of a credit rating and the choppy, volatile earnings and dividend history.

- If bought at the right price, RGR is a proven candidate to deliver solid Alpha over both short and long periods of time. You’re investing in a timeless segment – don’t necessarily listen to what moral-oriented investors tell you here. As long as humans have been around, we have fashioned weapons to defend ourselves and our loved ones with, as well as for sport. This is a modern iteration of this.

- RGR is a “BUY” with a PT of $80. As such, I’m not changing my PT here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

RGR is a “BUY” with a PT of $80/share.

Thank you for reading.

Be the first to comment