bloodua

Note:

I have covered Performance Shipping (NASDAQ:PSHG) previously, so investors should view this as an update to my earlier articles on the company.

Earlier this year, small Greece-based tanker operator Performance Shipping joined peer Imperial Petroleum (IMPP, IMPPP) and sister company OceanPal (OP) in diluting common shareholders at a tiny fraction of net asset value for the sole purpose of growing their respective fleets.

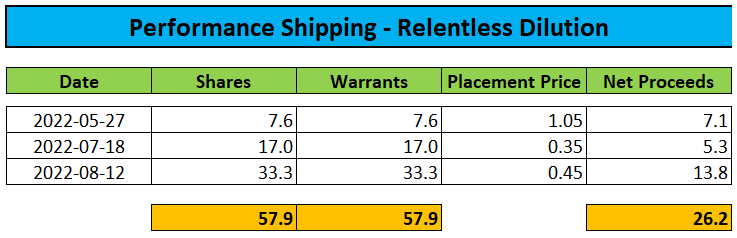

In recent months, the company has raised approximately $26.2 million in net proceeds from additional equity offerings including warrant sweeteners:

Company SEC-Filings

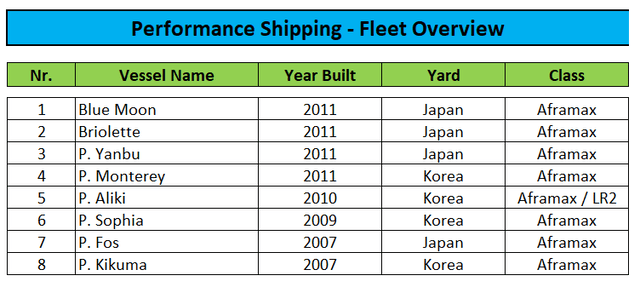

Performance Shipping has wasted no time putting the new funds to work thus expanding its tanker fleet by 60%:

That said, similar to peer United Maritime (USEA), the company recently decided to take advantage of highly elevated second hand market prices and sold the fifteen-year old Aframax tanker P. Fos to an undisclosed third party for an eye-catching $34 million:

Aframax tanker values have appreciated significantly during this year, and although the tanker market continues to enjoy strong fundamentals and prospects, we believe that the sale price we concluded for M/T P. Fos renders the disposal tactically advantageous and financially attractive. The sale is part of our fleet renewal process as we expect to use the net cash proceeds from this disposition estimated at US$25 million, along with a marginal level of new debt, to acquire a younger Aframax tanker with possibly higher specifications. With this sale, we also reduce the average age and increase the competitiveness of our fleet. These actions, when combined with the deliveries of our newly acquired tankers, M/T P. Aliki and M/T P. Monterey, anticipated to take place during the next two months, will position our Company to take advantage of the promising charter rate environment and generate strong cash flow going forward.

Indeed, in combination with a very strong charter rate environment, Russia’s ongoing efforts to accumulate sufficient capacity ahead of a proposed crude oil price cap appear to have contributed to soaring prices for older tonnage.

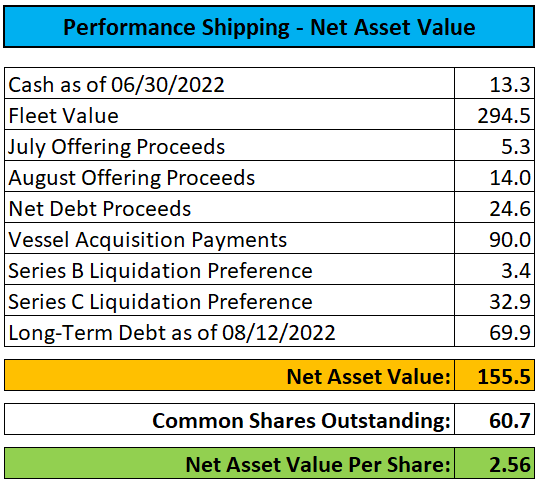

The massive appreciation in second hand vessel prices has resulted in net asset value (“NAV”) per common share increasing by 30% from my August estimate:

Company’s Press Releases and SEC-Filings / Compass Maritime

Considering the company’s assumed cash generation during Q3, NAV per share would be closer to $2.70.

Net asset value would be even higher without controlling shareholder Aliki Paliou’s recent move to exchange her holdings of the company’s Series B Convertible Preferred Stock in combination with some legacy debt into new supervoting Series C Convertible Preferred Stock:

On October 17, 2022, Performance Shipping Inc., a Marshall Islands corporation (…) entered into a stock purchase agreement (the “SPA”) with Mango Shipping Corp. (“Mango”) pursuant to which we agreed to issue to Mango in a private placement 1,314,792 Series C Convertible Cumulative Redeemable Perpetual Preferred Stock, par value $0.01 per share (the “Series C Preferred Shares”) in exchange for (i) all 657,396 Series B Convertible Cumulative Perpetual Preferred Shares (the “Series B Preferred Shares”) held by Mango and (ii) the agreement by Mango to apply $4,930,470 (an amount equal to the aggregate cash conversion price payable upon conversion of such Series B Preferred Shares into Series C Preferred Shares pursuant to their terms) as a prepayment by us of an unsecured credit facility agreement dated March 2, 2022 and made between us as borrower and Mango as lender, maturing in March 2023 and bearing interest at 9.0% per annum. We subsequently repaid the remaining amounts due and terminated the credit facility with Mango.

Even further massive dilution won’t have a major impact on her supervoting rights (emphasis added by author):

Each Series C Preferred Share will be convertible to Common Shares, at the option of the holder at any time and from time to time after 18 months from the date of issuance of such Series C Preferred Share, in whole or in part, at a conversion price equal to $5.50 per Common Share (adjusted for any stock splits, reverse stock splits or stock dividends). The conversion price shall be adjusted to the lowest price of issuance of common stock by the Company for any registered public offering following the original issuance of Series B Preferred Shares, provided that, such adjusted conversion price shall not be less than $0.50.

Should Aliki Paliou and her spouse, CEO Andreas Michalopoulos, elect to convert their preferred shareholdings back into common shares at some point going forward, outstanding common shares would approximately double from current levels.

Under normal circumstances, a highly profitable tanker operator trading at a 90% discount to NAV per share would make for a screaming buy but given the ongoing warrant overhang and high likelihood of further, dilutive equity offerings, long-term investors should continue to avoid the shares, particularly given the likely requirement to conduct another reverse stock split by January 9, 2023 at the latest point to regain compliance with the Nasdaq’s $1 minimum bid price requirement.

That said, I recently initiated a trading position in the company’s common shares going into the Q3 earnings release next month based on my expectations for very strong cash flow generation and the likelihood of a surprise dividend announcement.

Remember, Performance Shipping maintains a variable dividend policy:

In accordance with our dividend policy, and taking into account the above-listed factors, we expect to pay dividends only if during the preceding quarter Quarterly Cash Flow is positive and Quarter-End Excess Cash is also positive. As a general guideline, the amount of any such dividends is expected to be based on a pay-out ratio of the lower of i) Quarterly Cash Flow; and ii) Quarter-End Excess Cash. So long as our end of quarter outstanding debt exceeds our equity market capitalization our pay-out ratio is expected to be 50%. We will consider increasing the pay-out ratio gradually up to a maximum level of 90% that we may achieve when our end of quarter outstanding debt is less than 10% of our equity market capitalization. Quarter-End Excess Cash is defined as actual end of quarter Cash and Cash Equivalents over our Minimum Cash Threshold. Minimum Cash Threshold is defined as the sum of minimum liquidity pursuant to our loan agreements and $1.5 million per vessel. Our bank facilities currently require us to maintain minimum liquidity of $5.0 million.

In Q2, the company already generated sufficient cash flow for a potential dividend payment but cash and cash equivalents of $13.3 million remained below the $14.0 million minimum cash threshold at that time.

But with expectations for even better cash flow generation in Q3, Performance Shipping’s cash balance at the end of Q3 should be well above minimum cash threshold levels. According to my calculations, the quarterly dividend could be as high as $0.05.

Admittedly, there’s some uncertainty here as the company took delivery of the Aframax tanker P. Sophia at the beginning of the quarter and entered into agreements to acquire two additional vessels in August and September which usually result in the requirement for an immediate 10% down payment.

On the flipside, Performance Shipping secured a new $31.9 million credit facility to partially finance the acquisition of the P. Sophia and refinance an existing facility for the vessel P. Yanbu.

In addition, the company raised almost $20 million in net proceeds from the above-discussed equity offerings in July and August which should have been more than sufficient to pay for the remaining cash purchase price of the P. Sophia and required advances for the P. Aliki and P. Monterey which are both scheduled for delivery in the current quarter.

With the scrubber-fitted LR2 product tanker P. Aliki anticipated to join the fleet next month, the company’s average Q4 time charter equivalent (“TCE”) rate should increase even further as the vessel has been chartered by Trafigura Maritime Logistics for up to ten months at an impressive rate of $45,000. As a comparison, the company’s average TCE rate in Q2 was slightly below $25,000.

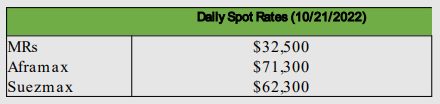

Please note that more recently, daily spot rates for Aframax tankers have eclipsed $70,000:

Imperial Petroleum Q3 Presentation

Bottom Line

While my perception of the company hasn’t changed by any means, the current tanker market bonanza is unlikely to go away anytime soon thus resulting in Performance Shipping generating outsized cash flows for at least the next couple of quarters.

Considering the company’s stated dividend policy, market participants might be surprised by a sizeable dividend announcement next month.

In sum, this speculative idea is very similar to my recent trading call on fellow relentless diluter Imperial Petroleum which played out nicely.

Given the potential, powerful short-term catalyst, highly speculative investors should consider a trade in the common shares going into the company’s Q3 earnings report next month.

As a result, I am upgrading the common shares from “Sell” to “Speculative Buy“.

Be the first to comment