Drazen Zigic/iStock via Getty Images

Chegg (NYSE:CHGG) recently authorized an additional $1 billion in share buybacks. This authorization comes on the heels of a nearly-completed $1 billion buyback from 2021. The company is positioned to buy back nearly half of all its shares. Additionally, despite macro concerns, Chegg has seen free cash flow growth for several years and has the balance sheet to carry out this enormous buyback. Between the buyback and a potential buyout from an Indian company, Chegg may be a buy.

A Massive, Massive Buyback

On June 2, Chegg announced that the company is increasing its buyback authorization by $1 billion. This comes after the previous $1 billion authorization has been almost fully exhausted down to $65 million (following the company’s $300 million repurchase in February).

As of the first quarter, Chegg has $267.7 million in cash and $915 million in short-term investments for an aggregate of $1.182 billion on hand that could be easily used to carry out the newly-authorized $1.0 billion buyback. Together with the remaining former authorization, Chegg is looking at repurchasing 41.4% of the company at its current market cap of $2.57 billion – an outstanding percentage.

An obvious question when you see a buyback such as this is, “well, is that really the best use for the company’s cash?” In Chegg’s case, it might be. When you look at Chegg’s 1-year share price chart, you can see its shares have fallen by an enormous amount. It is not hard to see why management might see their own company’s shares as undervalued.

Chegg 1 Year Chart (Seeking Alpha)

Additionally, given Chegg’s digital subscription-based service, the company’s expected CAPEX is relatively low, with $120-130 million expected for 2022. The question then must turn to the company’s debt load, which in Chegg’s case is fairly large: $1.679 billion in convertible senior notes. However, it is worth examining the specifics of Chegg’s debt before we rule out buybacks as more attractive.

Its two main debt issuances, in 2019 and 2020, were in the form of convertible debt with interest rates of 0.125% and 0% respectively, on $700 million and $1 billion in debt. The risk of conversion appears to be low, at least for now, since the 2019 debt was issued when shares were trading for nearly double what they are trading for now and the 2020 debt was higher by nearly a factor of four.

Essentially, the company took extraordinarily cheap debt. As such, it can afford to keep the debt on its balance sheet and cannibalize shares at a low valuation with its significant cash balance. Given its current share price of $21, this seems like a smart move.

Potential Takeover Target To Boot

In addition to its own buyback, Byju’s may soon offer to buy Chegg outright. Byju’s, an Indian education tech startup valued at $22 billion, is reportedly looking for a US-based acquisition. The deal could be worth around $2 billion, according to people familiar with the discussions. If Byju’s ends up coming for Chegg, that number would have to go up significantly given the company’s current market cap and willingness to buy back 41% of itself. In any case, investors should be on the lookout in the coming weeks for Byju’s to make an offer on Chegg or 2U (TWOU). Such an offer may benefit both companies’ stocks and spur further conversation about their undervaluation.

The Underlying Business

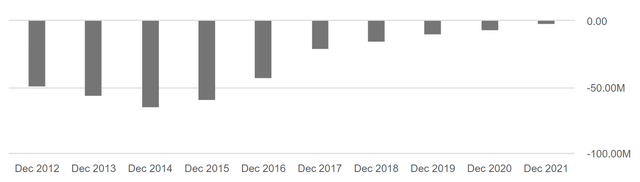

There is, of course, underneath the headline buyback, an actual company. While Chegg’s quarterly earnings seem to shift between booms and busts, the larger picture for the company has been solidly improving over time. This is what you would expect from a software business with a subscription model. Over time, Chegg’s userbase grows, as does its number of questions answered and thus its value to subscribers. Consequently, the company’s net income has solidly improved to the point where the company is finally profitable over the past 12 months.

Chegg Annual Net Income (Seeking Alpha)

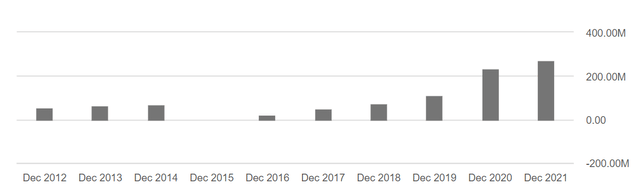

The company also boasts a very strong operating cash flow. With $279.7 in operating cash flow for the past 12 months, it is clear Chegg can afford its buybacks.

Chegg Annual Operating Cash Flow (Seeking Alpha)

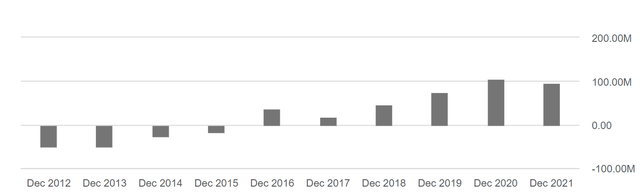

The company’s free cash flow is also good, with a levered FCF of $142 million for the past 12 months.

Chegg Annual Levered Free Cash Flow (Seeking Alpha)

That isn’t to say the company is untroubled. Chegg faces a number of headwinds from decreasing enrollment, slowing economic growth, and inflation. As a result, the company had to cut its guidance for 2022 during its first quarter conference call. Nonetheless, the company’s product seems to have attracted a strong subscriber base and as a result, Chegg is now profitable.

Conclusion

Chegg clearly has risks, especially as the company had a fantastic Covid run-up. Despite this, shares are still half their pre-covid levels and any macro risks are heavily tempered by the fact that the company is buying back more than 40% of itself. Even if Chegg isn’t necessarily the kind of long-term investment that you want to make (though I won’t absolutely rule that out), the company deserves some bullishness as a buyback/buyout trade.

Be the first to comment