alvarez

On Wednesday, August 24, 2022, liquefied natural gas shipping giant FLEX LNG Ltd. (NYSE:FLNG) announced its second quarter 2022 earnings results. The market seemed reasonably impressed with these results as the stock spiked on the initial release, although it very quickly started to taper off. This is despite the fact that the company missed the expectations of analysts in terms of both revenues and earnings.

Despite the miss, though, these results were actually very impressive and clearly show the strength of the liquefied natural gas industry right now. Fortunately, the best may be yet to come as there are some real reasons to expect the demand for liquefied natural gas to surge over the coming years. This will naturally benefit carrier companies like FLEX LNG since somebody will have to transport the incremental product from the producer to the end consumer. FLEX LNG is a decent way to play this trend, especially because the company is rewarding its investors in the form of a 14.06% annualized yield. The company proved its dedication and commitment to the dividend in the second quarter by declaring a special dividend, but it still remains a good yield play even in the absence of the special payment.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from FLEX LNG’s second quarter 2022 earnings results:

- FLEX LNG brought in total revenues of $84.158 million in the second quarter of 2022. This represents a 27.82% increase over the $65.843 million that the company brought in during the prior-year quarter.

- The company reported an operating income of $48.452 million during the reporting period. This compares very favorably to the $29.748 million that the company brought in during the year-ago quarter.

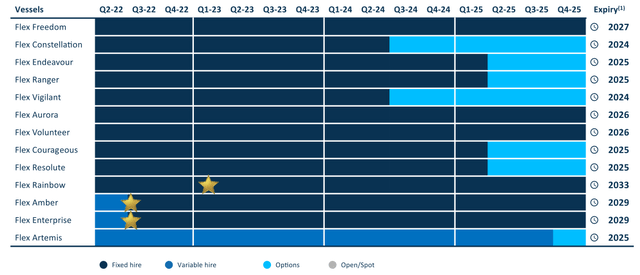

- FLEX LNG secured a ten-year time charter for the Flex Rainbow that begins in the first quarter of 2023.

- The company declared its regular $0.75 per share quarterly dividend along with a $0.50 per share special dividend. Thus, shareholders will be receiving a total of $1.25 per share for this quarter.

- FLEX LNG reported a net income of $49.260 million in the second quarter of 2022. This represents a very impressive 286.83% increase over the $12.741 million that the company reported in the second quarter of 2021.

It seems essentially certain that the first thing that anyone reading these highlights will notice is that every measure of financial performance improved compared to the prior-year quarter. The company also showed considerable improvement compared to the first quarter as revenues came in about $10 million higher quarter-over-quarter. Although management did not provide any specific reasons for the increase, this is a very clear sign of the strengthening in the liquefied natural gas market. We can see this in the contracts that the company was able to obtain during the quarter.

There are two ways in which a tanker can be paid for its services. The first way is that the customer can pay a ship to carry a single cargo between two points. The second way is that the customer can put the vessel under a long-term contract to regularly run cargo between an origin and a destination point. Naturally, an income-focused investor will generally prefer the latter option because it provides the company with a stable and recurring source of revenue and cash flow over an extended period of time. This makes it much easier for the company to pay out a large proportion of its cash flows to the investors since it does not have to be as worried about where it will get the money to pay its bills next quarter.

The steady cash flows also make it easier for the company to do financial planning so management tends to like doing business under long-term contracts as well. As stated in the highlights, FLEX LNG enjoyed some success in securing long-term contracts for some of its ships during the quarter. The company managed to secure a ten-year contract for Flex Rainbow that is scheduled to start in the first quarter of 2023 after the vessel’s current contract ends. This is an exceptionally long contract for a liquefied natural gas tanker, so it helps to support the assertion that the market for these ships is quite strong since there would be no reason for the customer to lock up the ship for such a long time unless it feared that it may have difficulty securing a vessel to carry its cargo at a reasonable price in the future.

This is certainly not the only long-term contract that FLEX LNG possesses. In fact, all thirteen of the company’s vessels have contracts that extend out until the middle of 2024:

As we can see, twelve of the vessels are chartered under fixed-dayrate contracts. This further supports the statement that I made earlier about these providing the company with a great deal of stability. This is because it knows exactly how much it will be receiving from each of these contracts and thus can very project its revenues for at least the next eight quarters. It also means that FLEX LNG has almost no exposure to market-based fluctuations in day rates. When we consider factors such as the American economy entering a recession, the energy crisis in Europe, and the rather unpredictable nature of the COVID-19 measures in China, such insulation looks very attractive.

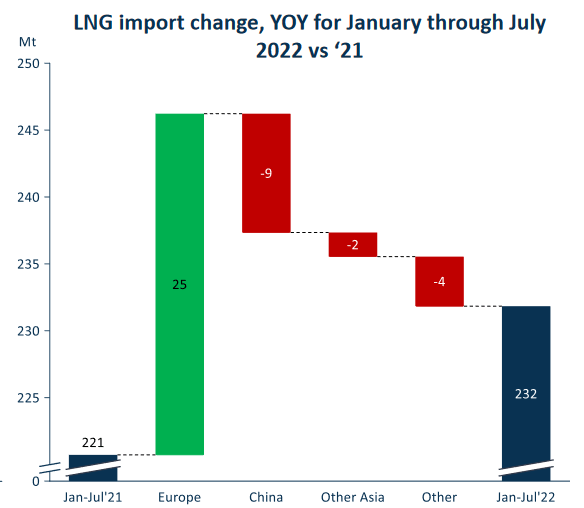

We can see further evidence of the strength in the market for liquefied natural gas by looking at shipment volumes. In the first seven months of 2022, the global volumes of liquefied natural gas being transported by ocean-going vessels, such as the ones operated by FLEX LNG, were up 5% compared to the equivalent period of 2021. As might be expected, this increase in volumes was driven primarily by European import demand:

FLEX LNG

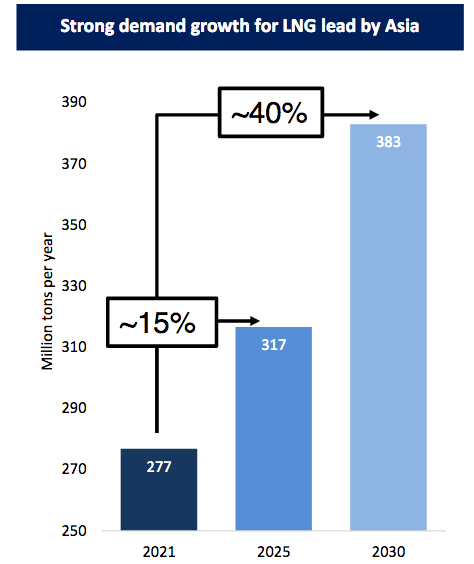

In fact, we can see that all of the demand growth was caused by an increase in European demand. This is largely due to the European energy crisis as Russia has sharply curtailed its shipments of natural gas to the continent in response to the sanctions that the Europeans have levied on it. All other areas have reduced their imports, but this is not especially surprising considering the extensive lockdowns there in response to COVID-19. Over the long-term though, it is Asia that is likely to drive the growth in the liquefied natural gas industry, with demand expected to increase by 40% by 2030:

Golar LNG

This could prove to be a major benefit for FLEX LNG going forward. This is because carrying all of this incremental natural gas will require the construction of several new tanker ships to transport it. After all, any given liquefied natural gas carrier is only capable of transporting a very limited amount of product. All else being equal, the larger the company’s fleet, the more revenue, and cash flow it can generate since every vessel earns money. With that said though, FLEX LNG has made no move as of yet to take advantage of this since the company does not currently have any vessels under construction following the three that began operation last year. We do sometimes see customers enter into charters for unbuilt ships though, particularly in times when the balance between supply and demand is very tight. If this starts to occur, then we might see the company construct new carrier ships.

FLEX LNG may be preparing itself for this possibility as the company took some steps to shore up its balance sheet during the second quarter. In particular, it executed sale-leaseback transactions for Flex Constellation and Flex Courageous with an Asian-based lease provider. This transaction netted the company $320 million, which it used to pay off some of its existing debt. The company also engaged in a few other transactions to improve its balance sheet and financial flexibility, but admittedly nothing else to this degree. In the end, though, the company increased its cash holdings by $111 million, bringing its cash on hand at the end of the quarter to its highest level ever:

FLEX LNG did not, admittedly, specify exactly what it intends to use this cash for. However, management did confirm that liquefied natural gas shipments are climbing so the firm might be preparing for an expansion program. That is by no means certain, however.

In addition to its medium-term to long-term growth prospects, FLEX LNG has some near-term growth prospects. In fact, the second half of 2022 will likely see better performance than the company experienced in the first half of the year. One of the reasons for this is that the charter contracts for Flex Enterprise and Flex Amber got changed in June. During the second quarter, these two vessels were earning a day rate that varied with the market rate for liquefied natural gas carriers. However, beginning in the third quarter, they will begin earning a fixed day rate for the duration of their contracts. This should prove to have a very beneficial effect on the company because it further insulates the firm against market fluctuations. We discussed the advantages of this earlier in the article. In addition to this, the tight supply-demand balance for tankers being caused by European imports as the continent prepares for winter could prove to have a positive impact on market day rates. This will benefit Flex Artemis, which is the sole remaining vessel on a variable rate contract that results in higher revenues when market day rates increase. Overall, things are looking very good for FLEX LNG.

In conclusion, FLEX LNG’s results continue to drive home the point that I have been making in several previous articles that the liquefied natural gas sector is currently incredibly strong and has not yet even begun to show its full potential. As such, it may make sense to include it in your portfolio. FLEX LNG offers a very good way to do this given its highly stable cash flows, growth potential, and shareholder-friendly management (referring to the special dividend). Overall, there is a lot to like here.

Be the first to comment