Hispanolistic/E+ via Getty Images

Investment summary

Investors have punished U.S. Physical Therapy, Inc. (NYSE:USPH) following an updated revision to guidance in its last earnings call. The company foresees cost pressures extending into the second half of FY22, and potentially further. Shares have been sold off from highs of $130 to 52-week low ranges of $83 on last check.

Exhibit 1. USPH 6-month price action

However, the company enters this phase with strong fundamental momentum and an extensive history of compounding capital above the hurdle, as we show. Moreover, cost pressures are being felt across all service-heavy business models in healthcare, and isn’t necessarily unique to the company. Therefore, we estimate the market has overshot its selloff of USPH, as it tends to in downside situations. Keeping us trigger shy are valuations, which advocate a hold rating.

Operating costs mounting

Second quarter earnings were mixed vertically throughout the P&L. Net patient revenue grew ~440bps YoY to $118 million. An additional $22 million in comprehensive revenue was recognized. Physical therapy turnover came in $119 million, a gain of 430bps YoY. It produced an operating margin of 22% despite operating costs increasing to ~$93 million. Newly acquired clinics booked ~580bps of revenue ($0.53/share).

Total visits gained 570bps to 1.145 million driven by an additional 41 clinics in the portfolio. This pulled through to daily patient volumes of ~29.5, up 1.6 patients from FY21. Costs per visit rose 600bps YoY to $81.09 producing a net rate for physical therapy operations of $103.18. This is down on Q2 FY21’s $104.46, but not alarming, as stems from Medicare changes from January FY22 and the 1% sequestration impact from 1 April.

Moving down the P&L, and the company saw a 418bps headwind at the SG&A line to ~$59 million, leading to a $4 million decrease in gross margin to $30 million. Operating costs made up nearly 78% from revenue and climbed over 5 percentage points YoY. This narrowed operating margin by 500bps YoY and ~80bps sequentially.

Shift to injury prevention pleasing

Meanwhile, injury prevention revenues printed an all-time high of $19.4 million – up ~94% YoY. This is an underexploited area with serious risk capital yet to be unlocked in the US. Comparing to the Australian market, for instance, where Workers Compensation is deeply ingrained into the healthcare/medical system, large Physical therapy providers mitigate injury risk premiums for large enterprise by providing on-site clinics.

Instead of an ‘injured’ worker entering the workers comp system, they are first examined by on-site therapists, and placed on ‘light duties’ with a return to work plan at work. Instead of paying for a per-consult basis, companies pay an hourly rate for clinic time, whereby therapists can see 2-3 patients per hour. At an average $100 per visit, companies pay $100 per hour to see 2-3 patients, saving an effective $200-$300 per patient.

Over an average 8,400 claimable incidents, this results in a $2.5 million per year saving at the upper end. Results are a substantial decrease in saving in company fees towards worker rehabilitation costs and an artificial ceiling on injury risk premiums. Advantages are that revenue is recurring and contract based, and that savings are so large from an opportunity cost perspective a large premium can be obtained. The c.95% YoY growth in this segment for USPH is exemplary of this.

Investors might be overreacting to guidance news

In its Q2 FY22 earnings management revised adjusted EBITDA to $73-$75.4 million, bringing this down to operating results of $34.4-$35.8 million ($2.65-$2.75/share). It attributes this to an increased interest expense stemming from a higher 4.655% rate on its $150 million of fixed rate debt. However, it entered into a swap to fix its 1 month term SOFR at 2.81% for 5-years, providing a great deal of certainty in the forward-looking regime. The fair value of the swap wasn’t revealed but changes in fair value will be booked in other comprehensive income. It also foresees wage and labor costs continuing to increase throughout the year.

When the company announced the update, investors punished the stock and it’s caught sellers from $126 all the way down to its 52-week lows of $80 this week. Taking a step back for a second, and the macro theme still remains that of inflation and central bank tightening. Hence it’s no surprise to see the market run for the hills on a projected increase in operating costs. In addition, the execution risk for USPH lies in that its operating model is capital intensive. It has a number of fixed operating costs in the form of facility overhead and staffing. These aren’t going away either, and if compounding, could present a risk to earnings.

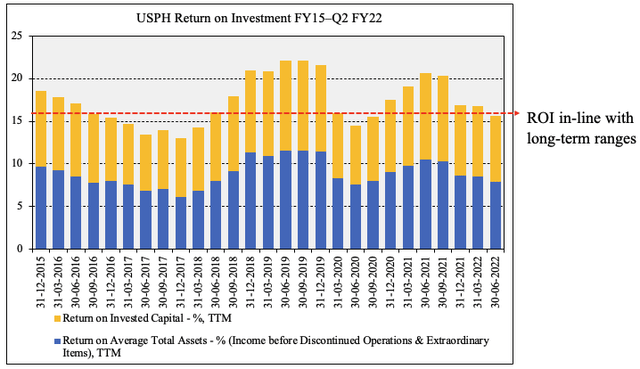

However, we have to dig deeper than that to make such drastic assumptions. Additional financial statement forensics reveal that USPH’s profitability and return on investment are key differentials in its investment debate. Long-term, we feel these characteristics will shine through. As seen in Exhibit 2, ROIC remains in-range with longer-term levels and came in at 7.7% last quarter, with ~8% ROA as well. With the pace of its acquisitions, and planned transactions ahead, compounding capital at ~8% is attractive.

Exhibit 2. Return on investment in-range and we now get 8% ROIC for the same market cap as in FY18 (ex-pandemic).

Data: HB Insights, USPH SEC Filings

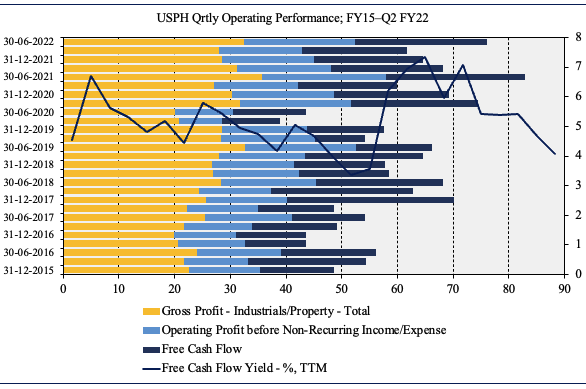

Operationally, we see longer-term seasonality trends in place with USPH’s earnings. Despite lumpy operating profit from FY15-date, it still converts steady levels of FCF that are accretive to its acquisition strategy and of course, cash conversion. FCF yield has been equally as seasonal over this time frame, as seen in Exhibit 3. This is important as what seems to have changed most apparently for the company is operating costs, not so much the quality of its business model by estimate. We continue to forecast 11% growth at the top and this to carry through to a 14% downstep in earnings. However, we also forecast ~$50 million in FCF for FY23 and FY24 respectively. Alas, given USPH’s fundamental momentum heading into H2 FY22 and FY23, we believe the revised guidance will be more of a misnomer to bottom-line fundamentals than what the market’s priced in.

Exhibit 3. Earnings quality heading into H2 FY22 would suggest that cost differentials have been overpriced by the market

Data: HB Insights, USPH SEC Filings

In short

We feel the market has overshot its selloff of USPH following the company’s revised FY22 guidance. Shares still trade at ~30x forward P/E, well above the GICS Industry median’s 13.8x. This implies the market is forecasting an above-sector result for the company. It’s also priced at 3.6x book value although has negative tangible book value of equity of $228 million. In fact, of the company’s $460 million in equity value, 116% or $535 million is made of intangibles – $442 million of that with respect to goodwill. This places a lot of faith in the company’s intangible value of its locations and brand.

However, the question is, are we are paying a fair price for this or not? Shares are also priced at 3.13x EV/book value, and at this multiple, we’d theoretically be paying $110, up to $127 at 3.6x book value. At 30x forward EPS estimates of $2,70 in FY22 and $3.40 in FY22 sets price targets of $81 and $90 (discounted at 12.5%) respectively. As such, we aren’t confident the stock is worth $110-$127, and believe its overvalued by ~31-57%. In light of all this data, we rate the stock a hold.

Be the first to comment