Ozgu Arslan/iStock via Getty Images

“Pride is always a better lever against the nobility than reason.” – Patrick Rothfuss, The Wise Man’s Fear

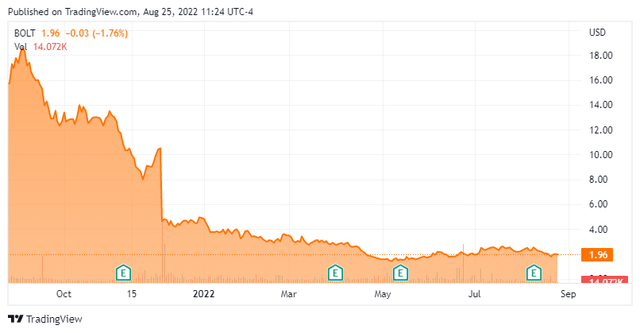

In our first article on biotech name Bolt Biotherapeutics, Inc. (NASDAQ:BOLT) back in September of last year, we concluded by saying the company had some “potentially intriguing technology” but it was not investment worthy at the time. We also promised we would check back in on this name to see how it was progressing. Today, we follow up on Bolt Biotherapeutics via the analysis below.

Company Overview:

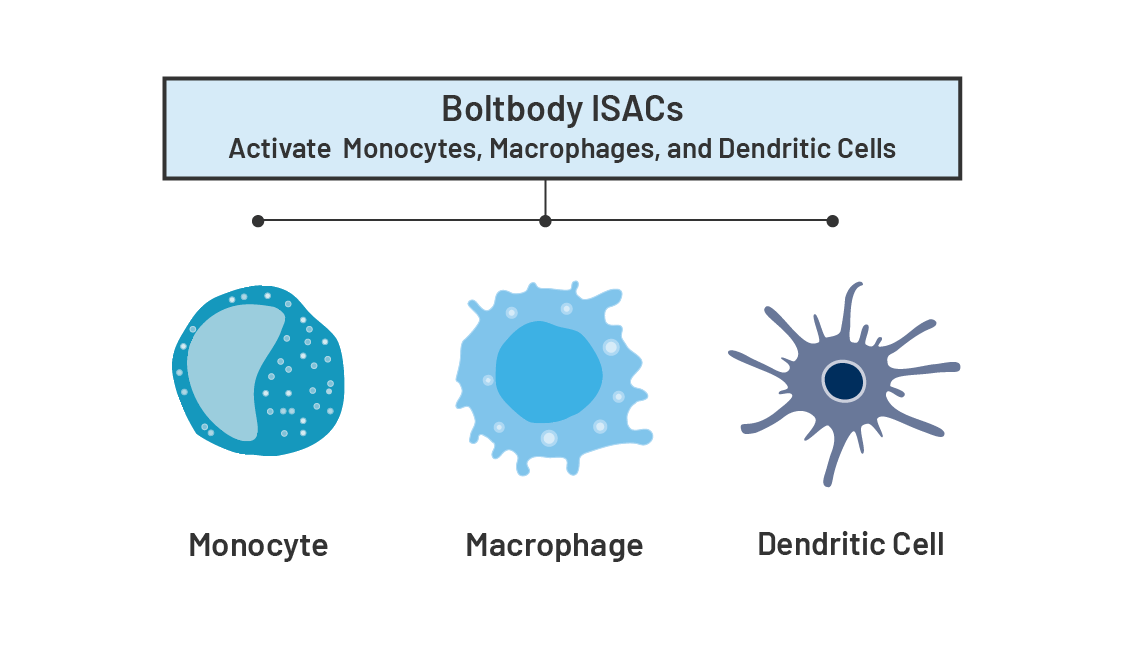

Bolt Biotherapeutics is headquartered in California. The company is developing drug candidates using its Boltbody immune-stimulating antibody conjugate (ISAC) platform. This technology is being applied to create a new category of immunotherapies that generate a robust anti-tumor immune response by combining the precision of antibody targeting with the strength of the innate and adaptive immune systems. By activating and recruiting myeloid cells, Boltbody ISACs re-program the tumor microenvironment to invoke a new anti-tumor immune response.

Company Website

Myeloid cells are a group of immune cells that belong to the innate immune system. They consist of cell types known as monocytes, macrophages, dendritic cells, and granulocytes. These cells serve many essential roles in the body’s immune system. When these cells are functioning properly, they can stimulate anti-tumor effects in the body. Including the activation of tumor-specific T cells to support durable anti-tumor immune responses and immunological memory. Immunosuppressive factors produced in the tumor microenvironment can impair the normal function of these cells.

The stock currently trades around two bucks a share and sports an approximate market capitalization of $75 million.

Recent Developments:

The biggest news around the company since we last peaked in on it occurred early in December of last year. Bolt Biotherapeutics presented interim clinical data from its Phase 1/2 study of BDC-1001, its lead candidate, at the European Society for Medical Oncology Immuno-Oncology Congress. Early data showed 13 of the 40 tumor evaluable subjects with one durable partial response maintained through 52 weeks and multiple subjects achieving stable disease for >12 weeks. BDC – 1001 is currently in clinical development for the treatment of patients with HER2-expressing solid tumors, including subsets with HER2-low tumors.

This data was good enough to support initiation of the combination therapy study with nivolumab, also known by its brand name Opdivo from Bristol-Myers Squibb (BMY). That said, the data did not meet investors’ expectations as the market cut the stock in roughly half after interim results from the study became known. Weekly dosing with a study around a combination therapy with Opdivo has begun and should be noted.

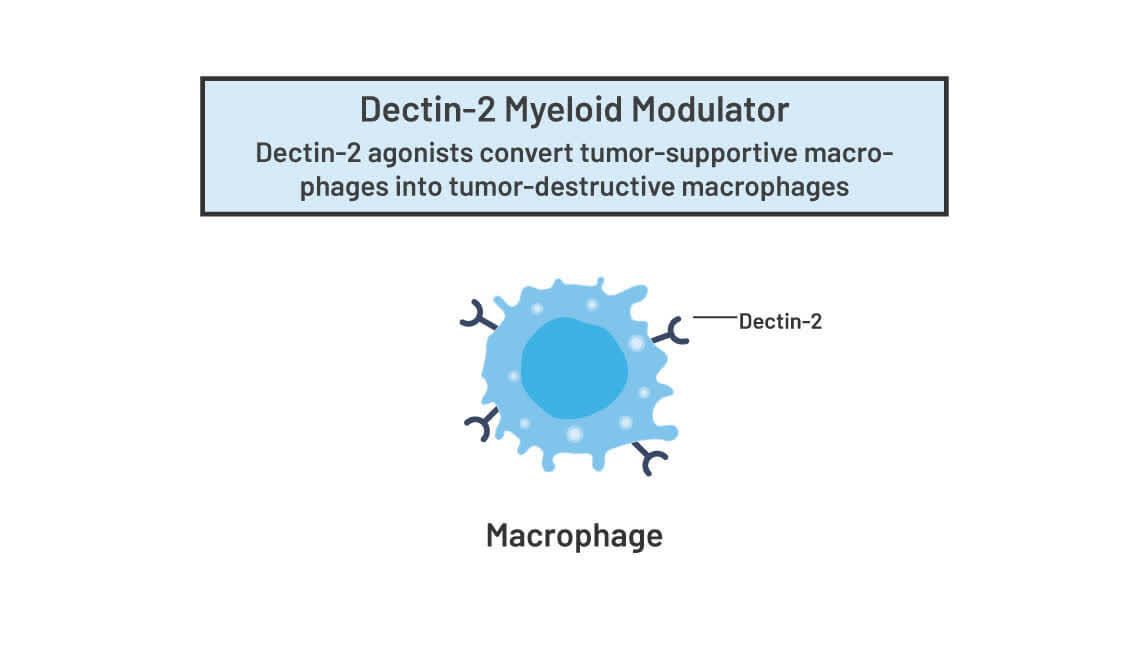

Company Website

The company has one other compound in development currently. It is called BDC-3042. This candidate is a myeloid modulating agonist antibody that reawakens myeloid cells to attack tumor cells. Specifically, BDC-3042 will stimulate a novel target called Dectin-2. This is found in tumor-associated macrophages across a broad range of solid tumors. Stimulating Dectin-2 leads to tumor macrophage reprogramming and anti-cancer activity in the company’s preclinical studies. BDC-3042 will target solid tumors with a high unmet lead. However, BDC-3042 is still in the pre-clinical phase and is currently in IND-enabling studies.

Analyst Commentary & Balance Sheet:

Analysts are mixed on Bolt’s prospects at the moment. Morgan Stanley has a Hold rating on the stock. On August 11th, SVP Securities downgraded Bolt from Outperform to Market Perform and slashed its price target in half to $4 a share. SVB’s analyst noted he sees “A long road to recovery” following the company’s announced discontinuation of second Boltbody candidate BDC-2034, which was previously on track to enter the clinic in 2023. The discontinuation was prompted by non-human primate fatalities observed at mid- to high-dose levels in toxicology studies.

That same day, both Stifel Nicolaus ($7 price target) and JonesTrading ($8 price target) maintained Buy ratings on Bolt Biotherapeutics. The company ended the second quarter with just over $220 million in cash and marketable securities on its balance sheet. Bolt burned through around $23 million during the quarter to fund all operations. The company has no long-term debt. Management has put in place measures to conserve cash as was summarized in its second quarter earnings press release.

We are winding down spending on BDC-2034, pausing other early-stage research programs, and prioritizing ISAC programs that bring forward the latest generation of our ISAC technology – including our collaboration programs. The combination of these strategic initiatives extends our expected cash runway an additional two years through 2025.”

A beneficial owner sold $1.6 million worth of shares on July 13th. That has been the only insider activity in this equity so far in 2022. Just under four percent of the outstanding float is currently held short.

Verdict:

The company has a couple of milestones on the horizon, including readouts from its BDC-1001 monotherapy and combination dose-escalation studies as well as moving BDC-3042 into clinical development in 2023. In addition, the company’s net cash is currently about three times its market capitalization. One would think there is little downside over the next year given that.

That said, given the early stage of development, the stock also could be “dead money” until encouraging data results come out from more advanced trials. This would make Bolt Biotherapeutics a potential ideal covered call candidate. Alas, there are no options available against this equity, making that simple options strategy unavailable.

And thus concludes our promised follow-up on Bolt Biotherapeutics.

“Pride slays thanksgiving … A prideful man is seldom a grateful man, for he never thinks he gets as much as he deserves.” – Henry Ward Beecher

Be the first to comment