Alex Wong

Published on the Value Lab 11/7/22

BMW (OTCPK:BMWYY) is a classic stock that has some more innovative elements that keep it ahead of the narrative in mobility. With mobility recovery happening globally as COVID-19 concerns take a backseat to economic concerns, aspects of the BMW business have mitigated macroeconomic headwinds and create a margin of safety for investors. In the meantime, the company has managed the supply chain issues well thanks to mix effects, as well as leveraging the valuable Rolls-Royce brand. While BMW has levers to pull, consumer durables is an area of concern in the markets given the macroeconomic situation. We pass on them because of the leverage required to purchase cars.

BMW Q1 Results

Plaguing the automotive industry are supply chain issues brought on by an overheated goods market. Logistic bottlenecks but also definite shortages of key semiconductors have damaged automotive companies’ ability to fully capitalize on the goods boom and benefit from investment in private mobility, reflecting in the hot used car market. However, BMW has had levers to pull during this period thanks to Rolls-Royce, their most luxury and highest margin exposure that has helped improve margins despite overall falls in deliveries.

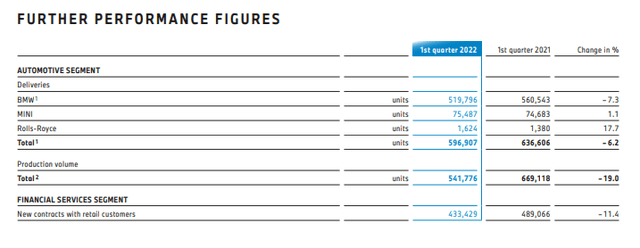

Unit Deliveries (Q1 2022 Pres)

Unit deliveries fell about 6% YoY for the first quarter, while Rolls-Royce units offset worse declines with their own unit growth. BMW has the ability to adjust order intake slotting into segments like Rolls-Royce which offers higher margins, and also to better apply limited inventory of semiconductors between their various brands.

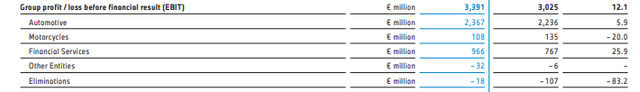

BMW Segment EBIT (Q1 2022 Pres)

Comprehensive group operating profit figures rose nicely by about 12% saved from declines by improving pricing mix due to the increased presence of RR which increased sales by about 17%, challenged slightly by input cost inflation, in the automotive segment. The automotive segment alone had flat operating profit evolutions despite volume effects. The other driver of overall operating profit improvement was contribution from the financial services segment, which thanks to an active used car market was able to sell profitable leases at higher rates and volumes since Q1 of last year.

Mobility Recovery

With mobility recovery in major BMW markets, service revenue has been able to contribute nicely as well to bolster margins and provide stability. While we expect incremental improvement in service revenue in Europe, China, which as of the Q1 had not shown meaningful declines yet, is going to be a general concern. Unit deliveries to China only declined by 10% as of the closing of the first quarter, but with lockdowns having persisted and continuing even now during the Q2 period, we expect that this substantial market, accounting for almost 50% of BMW deliveries, is going to present an issue for financials in the coming quarter. With China’s vaccination situation being what it is, a continuing zero COVID-19 policy is going to be a problem in the future, while in Europe and the US it’s more in the rearview.

Mobility recovery will continue to improve the situation with Free Now, which is the J.V that BMW has with Daimler (OTCPK:DMLRY) and is a major force for urban taxi in Europe, especially where stronger Taxi unions than in the US will continue to be a structural issue for the likes of Uber (UBER). The renaissance in tourism will grow GMV further, and the business which would have likely commanded a high value in the VC market prior to the recent crash continues to create a margin of safety for investors as a valuable holding that can be liquidated in the future. We think it could be worth as much as $9.2 billion, and with GMV growth since that figure was produced, the value could be closer to $15 billion now, or about 25% of the market cap. While VC markets might be drying up a little, the passing of COVID-19 concerns at least improves the recovery value from this holding.

Conclusions

China is already a concern for the Q2, and with consumer confidence metrics trending downwards as a recession envelops the west, we think that even with released pressure on the supply side, the demand side could crumple a bit for consumer durables where declines across the board can be expected just on the basis of macroeconomic developments. Financed by debt, consumer durables like cars are subject to major fluctuations in macroeconomic scenarios like our current one, driven by the increasing cost of credit. While RR has been a help on the margin side, it will likely not offset general declines in the BMW businesses. With higher fuel costs combined with the expectation of higher unemployment, servicing needs might also decline, or at least stop growing. Characterized by operating leverage, we worry about automotive prospects from here on out.

The BMW dividend yield is great at 7.75%, and we believe in income propositions now to get a head-start on what will be languishing capital appreciation prospects for companies. It is also rather well covered with a more normalized earnings yield at around 18%. While service should be more resilient, consumer durable segments are generally exposed, and we’d prefer a dividend that even at a low payout ratio is covered better by the direction of the company’s financials. BMW is a great company that we will continue to watch, but from afar. The Free Now exposure continues to be an excellent source of margin of safety, but with the stock still trading above pre-COVID levels, we think some sort of correction could be coming as the economic situation has deteriorated as of today relative to 2019 due to definite value destruction from trade disintegration.

Be the first to comment