Darren415

This article was first released to Systematic Income subscribers and free trials on Sep. 26.

The market environment this year has been very tough for the CEF market, with about three-quarters of CEF sectors down by 20% or more. As a double whammy, most CEFs are also facing reduced income-generating capacity as a result of rising leverage costs, deleveraging or both. In this article, we highlight five types of funds whose incomes have remained resilient this year and even improved.

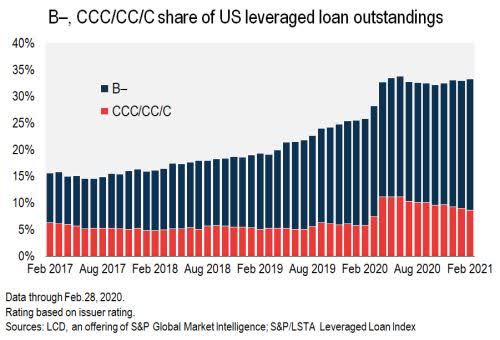

One way to understand what is happening to the income-generating capacity of a typical CEF is to have a look at the chart below. The left-hand chart shows the yield disaggregation of a high-yield corporate bond leveraged CEF at a zero Fed Funds policy rate. We can see that at the current roughly 9% high-yield corporate bond yield this fund can generate an additional 3.86% on its leveraged portion which is offset by about 0.63% in leverage cost (these numbers are on net assets).

The right-hand chart shows what this picture will look like at the expected peak Fed Funds rate of 4.5%. At that level, the leveraged portion will generate little if any additional yield for investors after leverage costs, in effect, providing only additional volatility for investors and additional fees for managers. We also see that the resulting yield on net assets available to investors falls from 10.8% to 7.75% as a result of this rise in leverage costs.

This is clearly not a great outcome for investors. And although these numbers will differ for different sectors they are broadly representative for funds that have fixed-rate assets and floating-rate liabilities, which is the majority of credit CEFs.

Below we highlight a number of CEF types which will not see this kind of income drop and may even see a rise in income levels.

The first type of CEF whose income-generating capacity has benefited in the recent rise in short-term rates will not be a surprise to anyone – funds with floating-rate assets such as bank loan CEFs. The main reason why these funds have enjoyed stable or rising income is for the simple reason that they have more floating-rate assets than floating-rate liabilities.

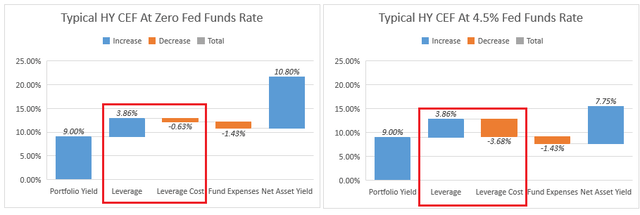

That said, there are a few things to watch out for. First, some “loan” CEFs have a mix of floating and fixed-rate assets – a combination of bank loans and high-yield corporate bonds is quite popular. Second, higher short-term rates put additional pressure on loan borrowers, lowering their ability to continue to make payments. Also, the quality of bank loans has worsened over time as the chart below suggests. This means that bank loans are not necessarily a slam dunk asset holding in a period where the economy appears to be moving closer to recession. This is why we think investors should diversify their floating-rate holdings across various asset classes.

S&P

For more defensive investors, we like the Angel Oak Financial Strategies Income Term Trust (FINS) at an 8.5% yield, which holds primarily floating-rate investment-grade bonds. For more aggressive investors, we like the mixed loan / CLO equity fund XAI Octagon Floating Rate Alternative Income Term Trust Fund (XFLT), which trades at a 14.2% yield.

The second type of CEF that will see its income level remain more resilient is one with fixed-rate liabilities. Investors often focus much more on the asset-side of the balance sheet but the liability side can sometimes be more important for the fund’s income trajectory, particularly for funds with fixed-rate assets and floating-rate liabilities – the most common credit fund profile.

Funds that have fixed all or some of their liabilities are not facing an increase in leverage costs this year. Most of these funds have also fixed their liabilities sometime over the last couple of years when interest rates were much lower, which means their leverage cost is not just not going up, it is also much lower than what most funds are paying now.

For funds in this bucket we like the Western Asset Mortgage Opportunity Fund (DMO) at a 10.7% yield as well as the loan / bond / CLO fund About Ares Dynamic Credit Allocation Fund (ARDC) at a 10.1% yield.

The third type of CEF whose income should remain resilient in the face of higher short-term rates are funds that have interest rate hedges in place. Interest rate hedges for these funds typically do a double duty of hedging both their duration profile as well as their higher leverage cost. Hedging is quite common for CEFs with very long-duration assets such as preferreds, which also have floating-rate credit facilities. A pay-fixed / receive-Libor interest-rate swap reduces their duration exposure and offsets the Libor the fund pays on its facility. Most funds that do this have partial hedges in place.

For example, the Nuveen Preferred and Income Term Fund (JPI) which trades at a 8.3% yield hedges just over half of its leverage at a weighted-average rate of about 2% while unhedged leverage costs are running at about 4% for most credit funds and will rise further as the Fed is not done yet. We continue to like JPI for this reason as well as its higher-quality holdings and its term structure which should deliver a performance tailwind into 2024 when it’s likely to offer investors a tender at NAV as Nuveen has done for their term funds recently.

The fourth type of CEF whose income should remain relatively resilient is one that is less likely to deleverage. What allows these funds to avoid deleveraging most of the time is the fact that they don’t have very high levels of leverage in the first place and they also lack leverage caps. Funds in this bucket that we like are the preferreds Cohen & Steers pair of Limited Duration Preferred and Income Fund (LDP) and the Tax-Advantaged Preferred Securities and Income Fund (PTA). They trade at yields of 8.7% and 8.6% respectively.

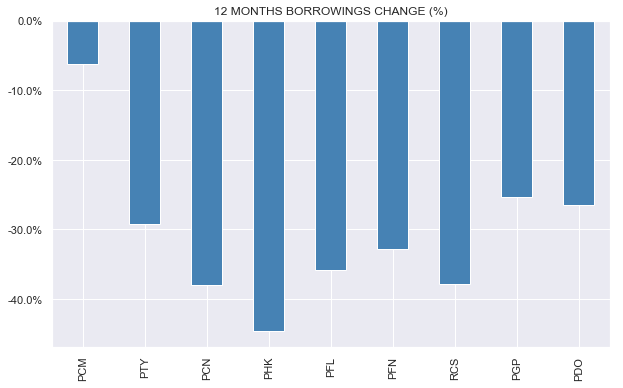

By contrast, funds like the popular PIMCO taxable CEFs have deleveraged sharply from their peak levels as many funds in the suite tend to run at very high leverage levels of 40%+ and also feature 50% leverage caps.

Systematic Income

The last bucket of CEFs whose income levels should remain relatively resilient are those that are unleveraged. These funds obviously don’t face deleveraging issues or higher leverage costs. Funds in this bucket are the Western Asset High Yield Defined Opportunity Fund (HYI) or the Nuveen Select Maturities Municipal Fund (NIM) which look fairly attractive now as well.

Finally, it’s important to say that these buckets are not mutually exclusive – there is significant overlap across some of them, which enhances the income resiliency of these funds. For example, DMO has both primarily floating-rate assets and fixed-rate liabilities, while PTA has a lower likelihood of deleveraging and hedges in place for most of its credit facility.

Our main takeaway here is that investors who pay attention to these key fund features are less likely to end up with a portfolio whose income profile degrades steadily under the stress of higher short-term rates. This can potentially avoid the outcome of capital losses and a significantly lower income stream to boot.

Be the first to comment