NicoElNino/iStock via Getty Images

A Return To My Thesis

I first covered Endava (NYSE:DAVA) in March 2021. Since then, the share price is essentially flat, but the price doubled and subsequently fell by 50% in that time. I would recommend reading the original article as I cover the company front to back. This article will revisit the company and dive deeper into the financial data I can find. However, there is one catalyst that continues to hinder the share price, the war in Ukraine. I hypothesize that this is actually a tailwind for Endava.

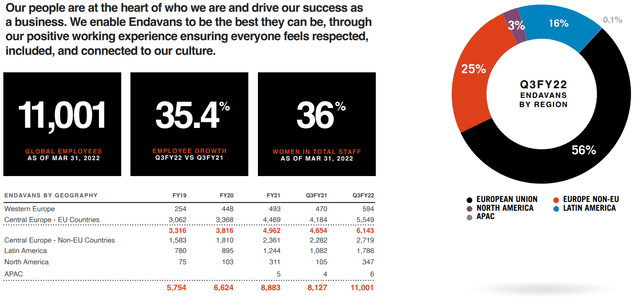

The fact is that most application software consultants have operations in Ukraine, Russia, or Belarus, all countries that are currently in the midst of war and sanctions. This has led to companies such as EPAM (EPAM) spending time and resources assisting their staff in the region. While the peer group as a whole sells off, Endava has the benefit of being based outside of those three countries. In fact, Endava already has operations in many of the areas where Ukrainian and Russian tech workers are taking shelter: Romania, Serbia, Moldova, and Bulgaria.

While the full extent of the financial and operational declines for conflict impacted companies is unknown, I assume that these impacts either miss Endava or provide a small boost to revenue growth. An example I can think of is the hesitancy to establish contracts with companies that have operations in conflict regions, leading to an increase in contracts for Endava as clients seek a safer operational base. Also, many in the IT industry, including researchers and developers, may be fleeing the region and seeking new employment, and a company that has no ties to conflict regions may be a choice for some. This allows Endava to have the opportunity to outperform in terms of revenues and staff quality. Considering Endava already had financial performance that was competitive or even outperforming peers prior to the invasion of Ukraine, I find my bullish thesis to be supported to an even higher degree.

Financial Breakdown

Revenues

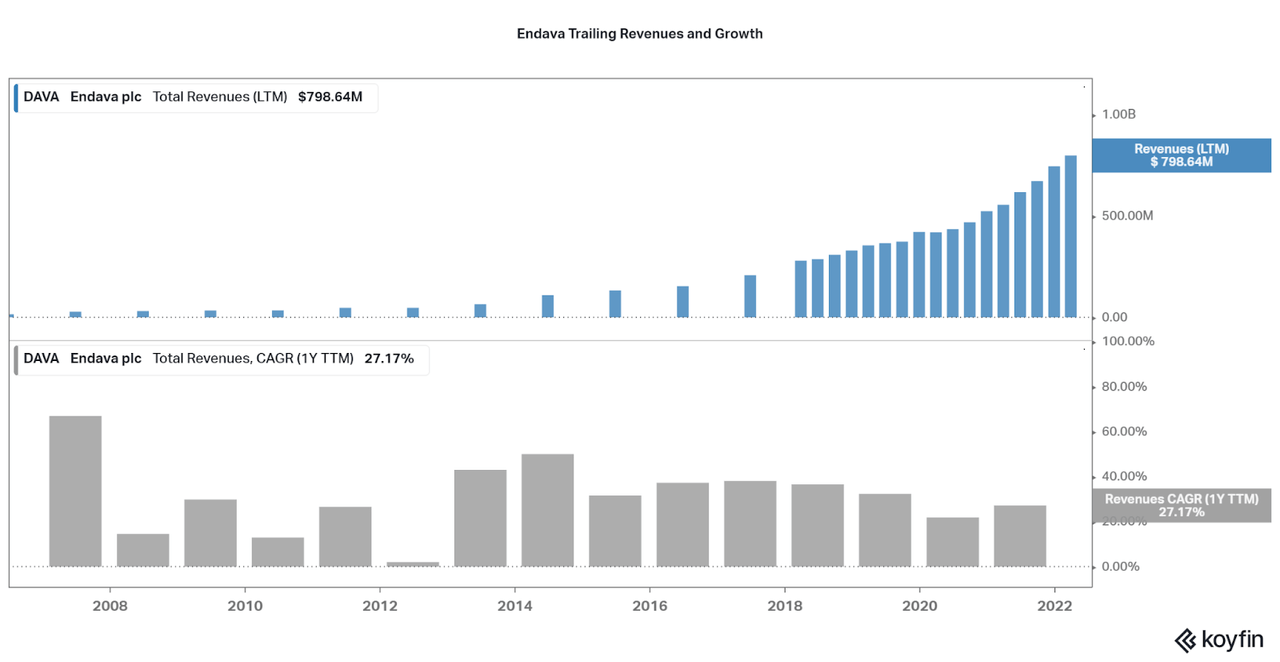

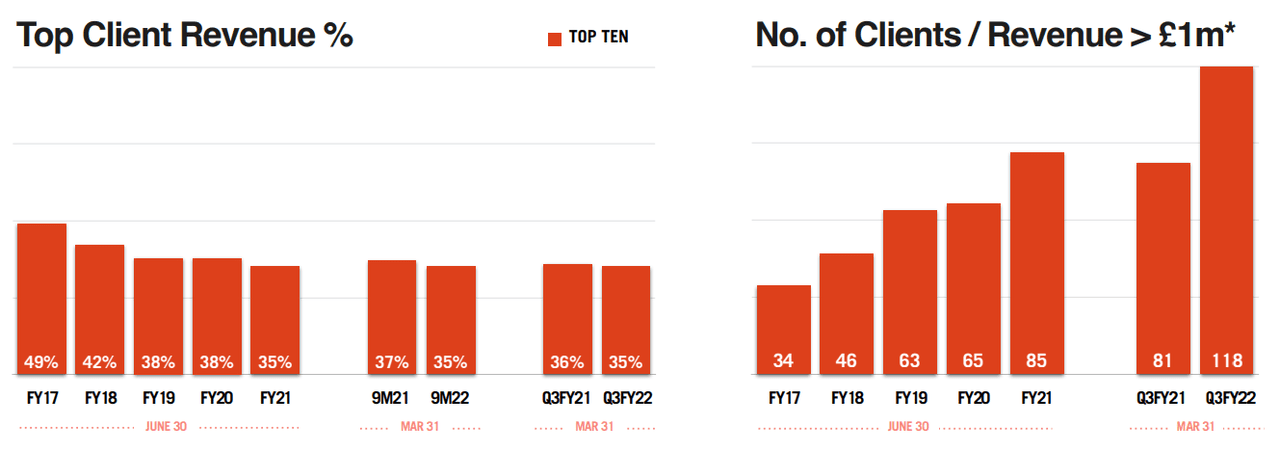

Unknown to most, Endava has a long history of performance. This is reflected in the revenue data rather than the earnings data due to being private. However, we can see that revenues saw stable upward momentum since at least 2007. The rate of growth has reached 30.6% per year over the past three years, although growth is subsiding slightly below 30%. While revenues may be slowing at a minor rate, we can see Endava’s client base is strong with increasing customer count and revenue per customer, plus a reduced reliance on the top ten customers. Along with providing a diverse range of services and serving a wide range of geographies, revenue growth remains the main driver of value for the company.

Koyfin Endava Endava

Profits

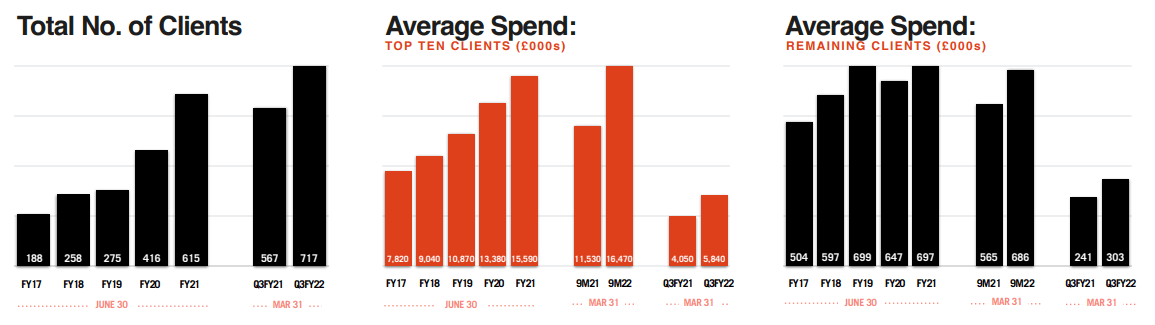

Along with stable revenue growth, earnings have grown at a tremendous rate over the past 5 years. In fact, Endava now offers profitability in line with the far larger peer, EPAM (EPAM). However, with over double the earnings growth potential, Endava remains the superior choice in the industry. At the moment, the EBITDA and Net Income margins are 19.5% and 11.9%, respectively. While pushing the upper end of available margins, based on mid-30% gross margins, strong returns will continue if margins are maintained at this level.

Koyfin

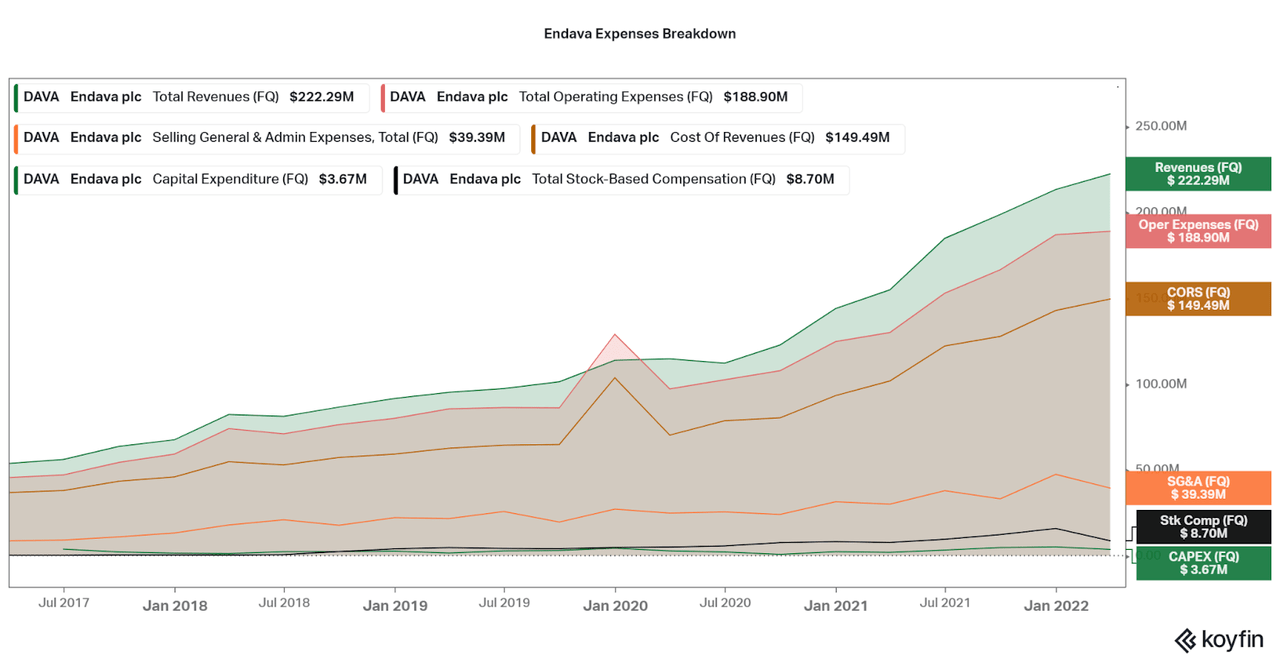

To support why I believe profit margins will remain strong, I broke down the operational expenses by type. As shown by the green highlight, positive profitability is the norm, rather than the exception. However, the overall profitability of the company relies heavily on the costs of revenues and will be the main driver of earnings growth. Thankfully, SG&A costs seem to not be growing in line with revenues, and this may signal that earnings growth may continue to rise faster than revenue growth. It is also good to see a pullback in SG&A spending over the past quarter, and this may be in anticipation of a slowdown in growth. While forward momentum relies more on earning new contracts or customers, recurring revenues from operations will support the company in the event of a recession or slowdown in the IT market.

Endava

Balance Sheet

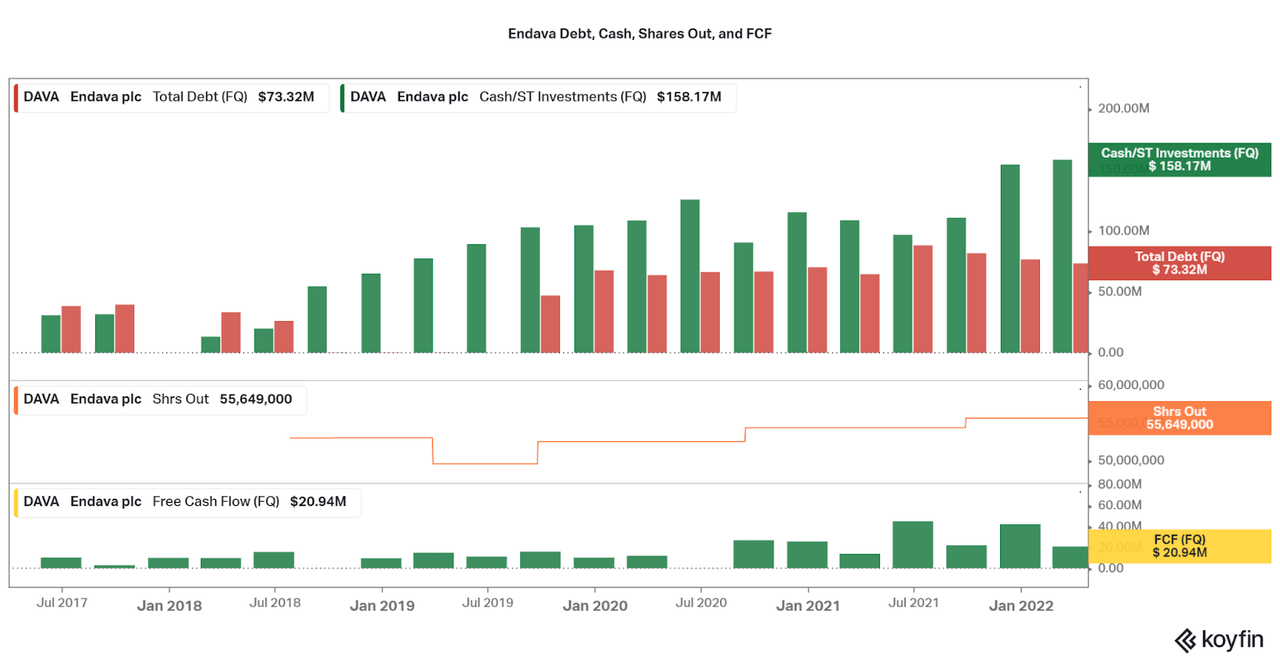

Thanks to strong profitability, leverage has been decreasing. This makes the current balance sheet quite strong as the economy sours worldwide. Some may find fault with the steadily increasing amount of shares outstanding, but the overall rate is less than 4% per year over three years. This contrasts with 47.5% earnings growth over the same time period. Further, it is good to see that the company has maintained positive free cash flow, even during times of limited or negative profitability. Thanks to the company’s experience and purchase of strong assets over the years, I find that there is a smart and conservative business structure in place that allows for safety even as growth remains high. Perhaps this should be one reason why the company deserves a premium valuation, and I will discuss the topic next.

Koyfin

Valuation

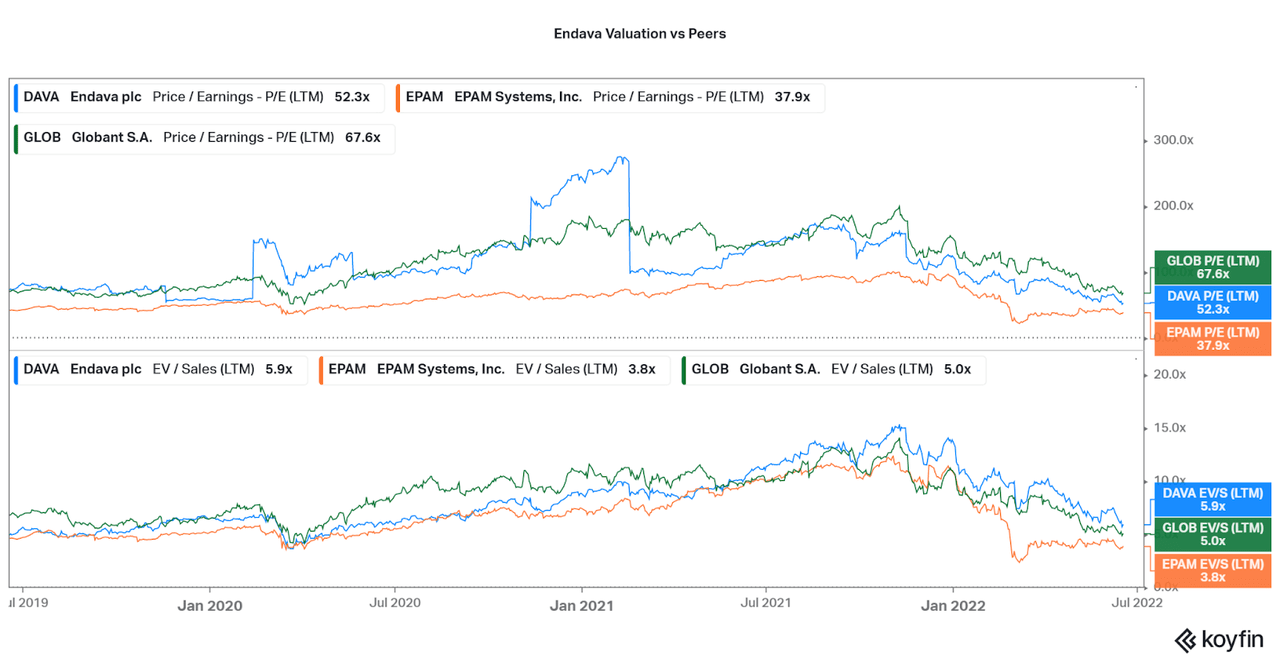

With strong performance comes high valuation. However, we can also see that DAVA has fallen in price by a significant margin recently. While I believe this is generally unfair, it does have overvaluation to blame as well. Although, the current 52x trailing P/E is now below peer Globant (GLOB), a firm that has issues with profitability, but higher revenue growth. At the same time, DAVA has a higher EV/S thanks to profit levels in line with peer EPAM. However, DAVA has far higher growth than EPAM, and less conflict risk, making the premium reasonable. As I believe DAVA is performing better than both peers overall, I believe the current share price to be undervalued, and will be adding to my position.

Koyfin

Conclusion

Endava checks a lot of boxes, strong balance sheet, secular market growth, earnings growth over 30%, and limited outside headwinds. As such, I continue to favor the company as my bet on digitization and app technology development. As a long-term investor, I will not be selling based on valuation or a slowdown in growth, but I will be keeping an eye on performance. As always, recurring investments will help limit the risk of volatility in the current market. Management remains optimistic about the environment, and I believe that transparency about their outlook will increase as the company matures. At the moment, enjoy investing in an underfollowed, but dominant, company set to thrive in the future.

Thanks for reading. Feel free to comment below.

Be the first to comment