Spencer Platt/Getty Images News

In early December, I detailed the bear case for Robinhood (HOOD) stock. Less than two months later, with HOOD down about 40%, that bear case seems to have played out to a ‘T’.

To be clear, I’m not patting myself on the back here. The bear case I detailed wasn’t the only case at the time. Indeed, I didn’t short, or recommend a short, of Robinhood stock, in part because that bear case seemed too easy. The risks to Robinhood from reduced trading volumes, lower equity prices, and particularly the pullback in so-called “memecoins” all were obvious. So was the likelihood of a disappointing, sharply unprofitable Q4.

But after a delayed reaction to those risks — risks which seem confirmed by the Q4 release — the market has bid HOOD stock back up following fourth quarter numbers and 2022 guidance. To at least some extent, the lower HOOD stock price is a contributing factor to the buying. The question now is if a bottom really is in, or if this is just a so-called “dead cat bounce” ahead of more struggles in 2022 and beyond.

From here, even this modest post-earnings rally looks like too much, even if it has more logic than might first appear. The results and guidance show how much work Robinhood has left to do, yet the valuation still doesn’t seem to reflect the long road ahead.

How Were Robinhood Stock Earnings?

What’s interesting about last month’s fourth quarter report is that, despite the volatility in Robinhood stock, neither results nor guidance seems to change the investment case here all that much.

Indeed, in early December, I wrote that it was critical to understand that Robinhood Markets Inc. is not primarily a stock brokerage. And I — and many, many others — pointed to a retreat in crypto trading as a huge near-term risk.

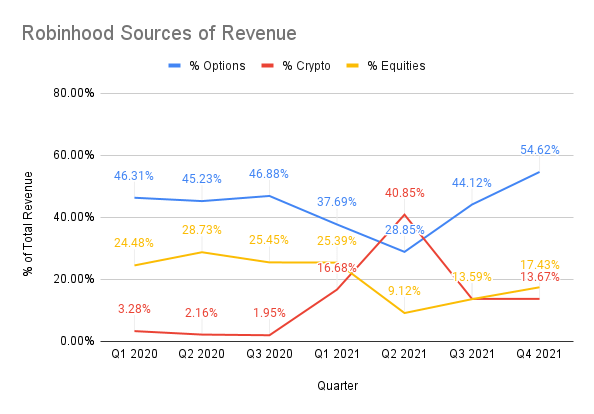

Q4 2021 numbers, which also gave a first look at Q4 2020 performance by category, only support both of those arguments:

author from Robinhood filings and press releases

source: author from Robinhood Markets filings, or for Q4 2020/2021 figures from recent press release (totals are rounded). Total revenue adds back interest expense, which is netted out in Robinhood’s reporting. Figures do not equal 100% as RH has other revenue streams.

It’s overwrought to describe the equities business as immaterial, but it certainly isn’t paying the bills. Robinhood generated $52 million in equities revenue in Q4 2021. That figure hasn’t budged at all in the last three quarters, and declined 35% year-over-year. Meanwhile, guidance for 2022 operating expenses (excluding share-based compensation) to increase ~15-20% suggests quarterly opex in 2022 in the range of $400 million.

The equities business simply can’t get Robinhood to profitability, or anywhere close. Meanwhile, crypto revenues have absolutely collapsed from $233 million in Q2 to $48 million in Q4. And it doesn’t appear either business is headed for a strong Q1. Robinhood guided for less than $340 million in revenue this quarter against $362.7 million in Q4, and the company wrote that even that soft outlook “assumes some incremental improvement in trading volumes versus what we have seen so far.”

For now, this is an options business, and that alone seems absolutely terrifying in a market crushing so many stocks that retail traders loved to gamble on from March 2020 to (roughly) the beginning of this year. Though there was the deflating last year of what I called “a quiet bubble” in many of those stocks (think SPACs or electric vehicle names), 2022 trading has been worse.

That trading hasn’t yet been reflected in results. Robinhood AUC (assets under custody) per MAU (monthly active user) actually increased about 13% sequentially in Q4, which suggests that portfolios did grow. (The departure or even zeroing-out of smaller accounts may have been a factor as well.) But given YTD market performance, it seems highly likely that metric will see pressure in Q1.

Indeed, it’s close to impossible to see any positives in the quarter, or any real change in the bear case from last year other than a lower stock price. If anything, the quarter and the outlook only confirm what a dangerous spot Robinhood Markets Inc. occupies at the moment.

This is a business that, at least in Q4, generated more than half its revenue from options trading by accounts with an average size under $6,000. That options-driven revenue — $163 million — was nearly 2% of assets under custody at the end of the quarter. There is no way that small retail traders can or will continue paying those spreads in perpetuity; yet in this same quarter Robinhood posted an Adjusted EBITDA margin of -24%.

To be blunt, this is not a viable business model. That was the bear case coming into the Q4 report, and it seems strengthened coming out.

HOOD Stock Key Metrics

It’s true the HOOD stock price is lower than it was at the beginning of the year, and far lower than it traded not long after last year’s initial public offering. But even ignoring the concerns about how Robinhood is generating its revenue at the moment, the lower price doesn’t necessarily look cheap.

Again, this is a company that has turned sharply unprofitable even on an Adjusted EBITDA basis. And with operating expenses, as noted, guided up 15-20% in 2022, this year does not look like it will be much different.

Yet HOOD still trades at ~6x revenue at a time when the top line isn’t growing. And, as a commenter correctly noted last week, a recent transaction in the industry suggests further downside ahead for Robinhood stock. Last month, UBS (UBS) announced a plan to acquire Wealthfront for $1.4 billion. That platform, similarly focused on younger customers, has assets under management of $27 billion. Apply the same multiple to Robinhood’s $98B AUC and Robinhood is worth a little over $5 billion — or $6-plus a share.

What Is Robinhood Stock’s Forecast?

And yet, the market reaction so far has been surprisingly favorable. HOOD stock closed the day of earnings at $11.61, already down 83% from its closing high reached in early August. The stock then dipped below $10 in after-hours trading following the release, and opened the following day off 14% from its prior-session close.

Then, surprisingly, buyers stepped in. From that below-$10 open on Jan. 28, HOOD has rallied 42% in five sessions. Buying from Cathie Wood’s ARK funds, including flagship ARK Innovation ETF (ARKK), no doubt helped. But Wood alone didn’t drive much of the dip-buying volume. Clearly, investors see some reason for optimism going forward, despite the disappointing results and guidance.

Broadly speaking, that reason is that even if the current Robinhood business model isn’t viable, that doesn’t mean the business isn’t viable at all. It does seem like the fourth quarter conference call sparked some confidence on that front, in large part because management painted a picture of a business that can and probably should be very different in a few years’ time.

On the equities side, Robinhood has launched ACATS-In (ACATS standing for ‘Automated Customer Account Transfer Service’) that will allow customers to pull in funds and securities from other brokerages. (Chief executive officer Vlad Tenev noted in the Q&A of the Q4 call that ACATS-In could help recapture customers lost after the platform’s outages early last year.) There will be more focus on longer-term investing, with tax-deferred retirement accounts “on the horizon,” as Tenev put it on the call. And Tenev was particularly bullish on the rollout of a fully-paid securities lending program, saying it could double or triple the current margin program (which generated ~$92 million in revenue in 2021).

In crypto, new agreements with market makers more than doubled Robinhood’s rebate. There’s room to expand internationally. Robinhood has launched a crypto wallet, and is working with U.S. regulators to add more coins. The options platform has new features, including an easy ability to roll contracts.

Higher interest rates can help as well: each 25 basis point increase in interest rates adds $40 million in net interest revenue, about 3% of 2021 revenue. That revenue stream so far has been relatively immaterial for Robinhood, but that’s not the case for more mature brokerages. For instance, net interest revenue drove 42% of total revenue for Charles Schwab (SCHW) in the first three quarters of 2021.

There is a way to model a relatively quick return to Adjusted EBITDA profitability. Securities lending can add $100 million-plus in revenue; IRAs potentially can add even more. Higher crypto rebates can offset some of the pressure from what appears to be more normalized trading. Net interest revenue too can be a nine-figure tailwind.

And the nature of the business is that these incremental revenue streams should drop to profitability at very high margins. Indeed, Robinhood’s business model already has shown as much in reverse, given how far its EBITDA has collapsed (from a $90 million profit in Q2 to an $87 million loss in Q4) as revenues fell over the past few quarters.

The investors buying HOOD stock over the past few sessions are taking the long view. It’s not unreasonable to do so.

Is HOOD Stock A Buy, Sell, or Hold?

But personally, I can’t quite get to that case, particularly given the rally since earnings. It’s certainly possible that, over time, Robinhood grows into and beyond the current $10 billion-plus market capitalization. At the end of the day, there are still 20 million-plus customers on the platform, with enormous opportunities in new geographies, new products, and new revenue streams. We truly don’t know what Robinhood Markets Inc. will look like in five or ten years, which in turn means that 2021 results are not dispositive in terms of the longer-term investment case.

But those results do matter. And one big concern is the fact that investors betting on the future are in turn betting on Robinhood management to navigate a volatile market and a competitive industry.

That seems a difficult bet to take. Even disregarding Robinhood’s missteps last January, this has not seemed like a well-run company of late. The customer service problems were largely self-inflicted wounds; offering options trading to retail investors without telephone-based service was an obviously risky decision, one that the company has since had to rectify. There’s a bit of the “founder’s dilemma” here at the moment; Tenev helped lead the company to admittedly impressive growth, but the next phase of the business will require more than a “move fast and break things” ethos.

Clearly, some investors see it differently. And if Robinhood can become a more mature, more profitable company, there admittedly is huge upside here. Charles Schwab has a market capitalization of $170 billion; a Robinhood that is a force in the financial services industry can deliver massive multi-year returns from here. It’s not a bet I’m personally willing to take yet, but it is a wiser bet, perhaps, than fourth quarter earnings might suggest.

Be the first to comment