David Becker

Investment Thesis

Alibaba (NYSE:BABA) is down all the way to its IPO price of $68. That is how little hope the stock now holds. After 8 long years, shareholders have seen nothing but pain and misery.

Throughout fiscal 2022 (ended March 2022), Alibaba deployed nearly $10 billion to buy back its stock. Repurchases were made at a share price that’s at least 100% higher than today. Was it a waste of capital?

Sometimes, spending capital looks one way on the surface, but it delivers quite another set of intangibles that aren’t immediately obvious.

By my estimates, Alibaba is priced at 11x this year’s non-GAAP EPS figures. This really prices in a lot of negativity.

What’s Going On?

I find it fascinating to watch investors’ sentiments towards China oscillate over time. A fascinating case study in and of itself. Even Charlie Munger’s moves into and out of the stock have been worth studying. It’s a movie that’s enthralling, with the final credits still many years away.

For their part, the Chinese government has decidedly stepped back to lessen its hold over the financials of Chinese companies. Nevertheless, this hasn’t stopped a massive slide in its share price.

Today, it’s difficult to imagine a scenario where anyone but the nimblest of investors has made any return from Alibaba.

Capital Allocation Strategy, Was It a Failure?

During fiscal 2022 (ended March 2022), Alibaba deployed $9.6 billion to repurchase shares at approximately $160 per share. Then, in fiscal Q1 2023, Alibaba deployed a further $3.5 billion to repurchase at approximately $90 per share.

With the share price today at $78 and showing no signs of abating its sell-off anytime soon, it’s easy to point a figure at what today can be seen as a waste of resources.

But was it a failure? I don’t know if one can answer this question so easily. Obviously that capital deployed throughout fiscal 2022 accounted for nearly 5% of its market cap today, and that only provided returns to shareholders looking to exit the stock.

On the other hand, nobody could have predicted the swings in China’s underlying economy. Could anyone have foreseen that China would be aggressively embracing yet another set of lockdowns, with such questionable results?

Perhaps, it could be argued, that even though those repurchases were clearly mistimed, they showed something else.

The repurchases show investors that not only Alibaba is a strong free cash flow generating company. But also, that it’s intent on bringing down its share count. Note, as of fiscal Q1 2023, its shares outstanding are down 3% y/y.

Meanwhile, how many tech companies in the US make proclamations about buying back their shares to mitigate ”employee dilution”, only for investors to see the number of shares increase over time?

BABA Stock Valuation — 11x This Year’s EPS

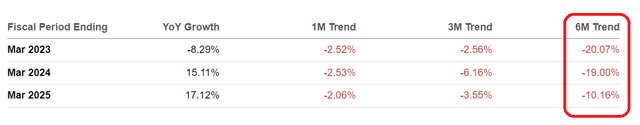

Consider the following table.

Analysts downwards revised EPS consensus

In the past several months, analysts’ estimates have been moving in one straight line. Analysts are resolutely downwards revising Alibaba’s EPS figures. It has got to the point that analysts can’t expect anything positive to come out of Alibaba for years to come. Could it be that analysts are now too bearish?

It could be the case that Alibaba’s EPS figure for fiscal 2023 could come down below $7.10. That’s possible. Alibaba’s non-GAAP EPS could even end up at $7 per share. But even in that case, investors are paying 11x this year’s non-GAAP EPS.

In the US, there are still today, despite the unrelenting bear market cloud companies priced at 10x forward sales. While in cybersecurity names, getting anything below 12x forward sales is considered a bargain.

Even though some of those companies still haven’t really figured out how their business models can reach sustainable GAAP profitability!

The Bottom Line

The mood today is unmistakably ”risk-off”. There are very few occurrences in financial markets when the mood towards Chinese stocks is as negative as it is right now.

This could be one of those generational opportunities. Where investors have to dig in hard and be honest with themselves and ask am I comfortable investing now and holding something that could be dead money for at least 2 years?

And to that question, I’ll go further. What is investing? If it’s not deferring capital today for something that may or may not be dead money for a period of time. Deferring hard-earned capital today for something that could come back in full plus something extra?

Even if that something extra turns out to be rather miserable once all the risks are considered, I nevertheless struggle to believe that investing in Alibaba today is such a risky proposition.

Be the first to comment