gleitfrosch/iStock via Getty Images

Thesis

How low can a stock go? How cheap can a valuation be? HUYA (NYSE:HUYA) stock is down 41% YTD and 90% from February 2021 levels. The company is now trading at negative $650 million enterprise value. Looking at such a valuation, an investor wonders: What is the market thinking?

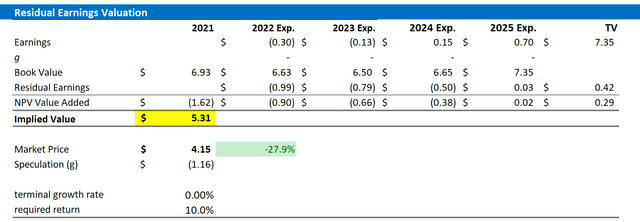

In this article I will look at HUYA’s fundamentals and structure a residual earnings framework to value the company-based on analyst EPS consensus, no terminal value growth, and a 10% WACC. I conclude my valuation with a buy recommendation and a $5.31/share target price.

About HUYA

HUYA is one of the leading live streaming platforms in China. As the No.1 streaming platform for gaming, HUYA regularly hosts e-Sports event organizers and collaborates with major game developers and publishers. In addition, HUYA has also expanded streaming services to other entertainment genres, such as talent shows, anime and outdoor activities. HUYA claims to have China’s largest, most active and most engaged video game live-streaming user-base with a MAU of 81.9 million and active paying users of 5.9 million. Monetization of the platform is based on three main drivers: advertising (1), commission fees from gifting/tipping (2), and paid subscription services (3). HUYA was established 2014 as a spin-out from YY-live. Tencent is the company’s largest shareholder and holds majority of the voting rights.

Financials

Although HUYA is currently trading like a no-growth value company, the company has enjoyed strong growth in the past. Revenues grew from $705 million in 2018 to $1,760 million in 2021, representing a 3-year CAGR of 61%. Moreover, HUYA has been profitable since 2019. In 2021, the company achieved net-income of $36 million. Investors should note, however, that HUYA recorded decreasing profitability ever since 2019 (8% net income margin in 2019 vs 2% in 2021). Cash provided by operations was $50 million.

The main argument for investing in HUYA is likely based on the company’s balance sheet. As of Q1 2022, the company is holding $1,652 million of cash and cash equivalents and only $12 million of debt. Thus, referencing a market capitalization of 988 million, HUYA is trading significantly below cash. The question is: Will shareholders get somehow access to the company’s the net-cash position, before the treasure is consumed by losses?

HUYA‘s Q1 was slightly above analyst consensus, and in my opinion, highly positive given the challenging macro-environment.

Here are the highlights as presented by the company

- Total net revenues for the first quarter of 2022 were RMB2,464.6 million (US$388.8 million), compared with RMB2,604.8 million for the same period of 2021.

- Net loss attributable to HUYA Inc. was RMB3.3 million (US$0.5 million) for the first quarter of 2022, compared with net income attributable to HUYA Inc. of RMB185.5 million for the same period of 2021.

- Non-GAAP net income attributable to HUYA Inc. was RMB46.6 million (US$7.4 million) for the first quarter of 2022, compared with RMB265.9 million for the same period of 2021.

- Average mobile MAUs of HUYA Live in the first quarter of 2022 increased by 8.5% to 81.9 million from 75.5 million in the same period of 2021.

- Total number of paying users of HUYA Live in the first quarter of 2022 was 5.9 million, compared with 5.9 million in the same period of 2021

Valuation

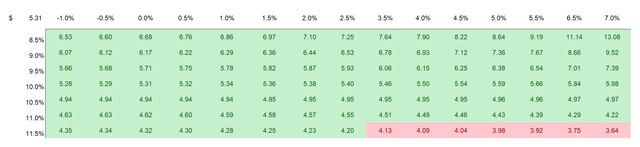

I believe a discounted earnings framework is the best valuation method to challenge the share price of a low/no growth asset such as HUYA. That said, I have constructed a Residual Earnings framework based on the EPS analyst consensus forecast until 2025, a conservative WACC of 10% and a TV growth rate equal to zero. I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination, so investors can value HUYA based on the scenario that best reflects their fundamental view. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to HUYA’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $5.31/share, implying that the stock is approximately 30% undervalued. Moreover, investors should note that most of HUYA’s value is based on the company’s current net cash-position. There is almost no added value from future EPS. That said, if the company were able to find back to 2019 net-income profitability margins of 8%, the fair valuation would jump easily to above $10/share.

Analyst Forecast, Author’s Calculation Analyst Forecast, Author’s Calculation

Downside risks

Although I find HUYA stock attractive at negative enterprise value, the investment is high risk, in my opinion. Specifically, investors should note the following downside risks: First, a significant economic slowdown in China, due to Covid-lockdowns, real estate crisis and inflation, could significantly impact HUYA users’ willingness to tip. Secondly, the gaming industry in China is significantly exposed to elevated regulatory risk. In the company’s Q1 report, HUYA noted:

On May 7, 2022, the PRC government issued the Opinion on Live Streaming Virtual Gifting and Enhancing the Protection of Minors (the “Opinion”). The Opinion stipulates that internet platforms shall, among other restrictions, (i) within one month of the publication of the Opinion terminate all billboard functions that rank users or broadcasters by the volume of virtual gifts that they send or receive, respectively, (ii) restrict certain interaction and engagement functions between 8:00 p.m. and 10:00 p.m. every day, and (iii) prohibit minors from purchasing virtual gifts.

Third, HUYA’s business operations currently have no/almost no profitability margin. If the trend continues, HUYA will destroy company and market value. Forth, the live-streaming industry in China is highly competitive-with DouYu (DOYU) and Bilibili (BILI) being major players. Fifth, much of HUYA’s share price is currently driven by investor sentiment towards risk assets, ADRs, and China equities. Thus, investors should closely monitor the market sentiment when taking buying/selling decisions for the stock.

Conclusion

HUYA’s negative 600 million negative enterprise value is too attractive to ignore. It is true that the company is facing multiple challenges, including economic slowdown in China, strong regulatory headwinds and loss of profitability. I do believe, however, that HUYA will eventually find back to profitability and the company will thus not only have the balance sheet value, but also added NPV value from earnings. That said, I feel HUYA’s current valuation makes no sense and I give HUYA a Buy/high risk recommendation with a base-case target price of $5.31/share.

Be the first to comment