olm26250/iStock via Getty Images

Introduction

Goldman Sachs (NYSE:GS) is one of those stocks that has continued to elude my portfolio, as whenever it neared interesting territory, there was always something higher on my priority list, but having seen the stock trend downwards along with the general market it was time to give it an in-depth look. Goldman was due for a good pullback; its market cap having ridden the extremely strong financial performance it delivered during FY2021. In this look at Goldman, I conclude that the current share price offers a fair entry point, but one must also be considerate of the current economic cycle, where a potential recession will have negative impacts for banks including Goldman.

Goldman’s Business

Most of us understand the workings of a traditional retail bank. Customers make deposits, and the bank leverages those deposits via lending, the end. There is of course more to it, but that is basically how such a corporation works. An investment bank is a different piece of machinery and I believe it’s worth understanding that in a bit more detail, which is the purpose of this section.

Goldman Sachs is more than 150 years old and is today primarily an investment bank. If I were to make one note in regard to recent history, then it would be that Goldman used to be an independent securities firm, which changed in the wake of the financial crisis, where both Goldman and Morgan Stanley (MS), the two remaining U.S. investment banks, became traditional bank holding companies in order to gain access to government emergency funding upon approval by the Fed, meaning they fall under Fed regulation as opposed to SEC these days. This has of course impacted Goldman as a company since then and up until today. Anyway, an investment bank in a nutshell, is a corporation who help clients, both institutional and retail, to take risks. They are the mediator who makes things happen so to say. This can take form in a number of ways, but to keep it high level, it can take form in the following ways.

- The investment bank can assume risk on its own balance sheet, e.g., by underwriting an IPO, being a counterpart in a securities transaction such as assuming risk on behalf of their client or otherwise.

- The investment bank can match risk by transferring risk between parties, e.g., related to commodities such as oil, corn, soy bean etc. where a given party wants to protect itself against a drop in a given commodity while another party wants to protect itself against a rise in that same commodity. The investment bank then sits between these parties and offers the infrastructure, creating the marketplace so to say.

- The investment bank can source risks, e.g., by offering structured products such as derivatives for clients who want to take on a certain risk exposure.

As such, what Goldman Sachs specialised in is quite different from traditional wholesale, commercial and retail banking which often is a lot less complex. Taking commercial banking as an example, however, it’s not unusual for some of the offerings aimed at large commercials to include either of the three above, but depending on size and complexity, it could be handled by the client’s incumbent bank or by a specialist like Goldman.

Having briefly touched upon the fact, that a company like Goldman makes risk taking possible for its clients, it’s little surprise that FY2021 turned into a record year for Goldman both in terms of revenue and net income, as 2021 was characterised as a year where global risk appetite was massive – with 2021 being a record year for IPOs not least due to SPACs, the tech craze (dare I say bubble?), new investment products, etc. This also means that Goldman is to be considered a cyclical business, which is also evident by the fact that FY2022 revenue is expected to be well below that of 2021, but roughly 10% above that of 2020 with the following years providing low growth in line with general GDP expectations, or roughly so. In other words, when the economy is booming and companies are aggressive within M&A, IPOs and similar, business is booming for investment banks such as Goldman.

Goldman operates through four different divisions, being.

- Global Markets: Offering sales and trading for equities, fixed income, etc. while making up roughly 35%-40% of Goldman’s total revenue seen over a period of time. Goldman drives earnings via its function as a market maker, earning from the spread between connecting buyer and seller. Additionally, Goldman secures earnings related to financing, margin lending in brokerage as well as different forms of lending.

- Investment Banking: Goldman’s M&A and advisory arm also offering equity and debt underwriting, making up roughly 20%-25% of Goldman’s total revenue seen over a period of time. A highly profitable part of Goldman’s business as Goldman drives earnings via taking a cut of overall transaction volumes in relation to IPO and debt offerings. Depending on the size of a given deal, it can be in the matter of a few percentage points for IPOs while being a matter of basis points for debt offerings. M&A earnings sits somewhere between collecting roughly half a percentage point, again depending on size of a given deal. Goldman has a particularly strong market position within its investment banking division seen from a global perspective.

Before going through the remaining two divisions, it’s worth mentioning that the two above are the more cyclical parts of Goldman’s business, which is counterweighted a bit by the last two divisions. Goldman counts its clients’ assets under supervision in the trillions of dollars, while being somewhat of a more stable business build around management fees making it easier to estimate revenue and earnings over extended periods of time, as it doesn’t depend on the business cycle to the same extent as, for instance, IPOs and M&A advisory.

- Asset Management: The name gives it away, the division where Goldman manages somewhere between $2 and $3 trillion on behalf of clients. In the investment world, we often hear the term “assets under management”, but in the case of Goldman, we talk about “assets under supervision” which is an umbrella term covering AUM but also the fact that Goldman offers advisory services without being the actual manager of those assets, hence the term assets under supervision. This division makes up roughly 20%-25% of Goldman’s total revenue seen over a period of time, and the earnings come via management fees most likely in the range of twenty to thirty basis points considering size of wallet, etc., with given clients. This is also a division where Goldman traditionally, and this is not unusual for investment banks, has leveraged its balance sheet and inhouse competencies to carry out deals for its own profitability. This part of the asset management business is also where fluctuations can appear, as Goldman can accumulate both gains and losses from quarter to quarter. However, this in-house business is not a strategic priority for Goldman, meaning this part of the business will carry a lower footprint over time.

- Consumer & Wealth Management: Both the smallest and also most recent division, I consider it a consequence of Goldman having become a more traditional bank, at least in terms of its previously mentioned bank holding license, with management seeing the opportunity within such a division. Before it sounds too main street, it should be mentioned that this division amongst other things operates a high net worth, an ultra-high net worth private banking and wealth management offering. This division secures roughly 10%-15% of Goldman’s total revenue and drives earnings via fee structures.

In terms of competitive landscape, I’d summarise in a way that Goldman has grown larger over the last decade while consolidating its position. From my perspective, Goldman sits at the centre of the global financial system and the need for corporate advice isn’t going anywhere. Big has been getting bigger when it comes to M&A, equities, fixed income and so worth, also translating into a growing revenue for Goldman. With a growing amount of high net-worth individuals globally, Goldman should have opportunity to grow its business over time, perhaps also strengthened by a growing consumer & wealth management division.

Big is sometimes a risk for banking, especially when thinking back to 2007-2008 at the peak of the financial crisis. Can we end up in another global financial meltdown one day? Sure, we can, but can any one single individual predict a black swan event? No, I don’t believe so. We can all make references to Dr. Michael Burry who predicted the meltdown, but forgive me, can even he predict a catastrophe two times in a row? Anyway, the point being that regulators have pulled a lot of levers to secure ample amounts of liquidity in case of a difficult market event that can’t be foreseen. As such, big banks have on a wide scale become less exposed to potentially going belly-up as we saw more than a decade ago.

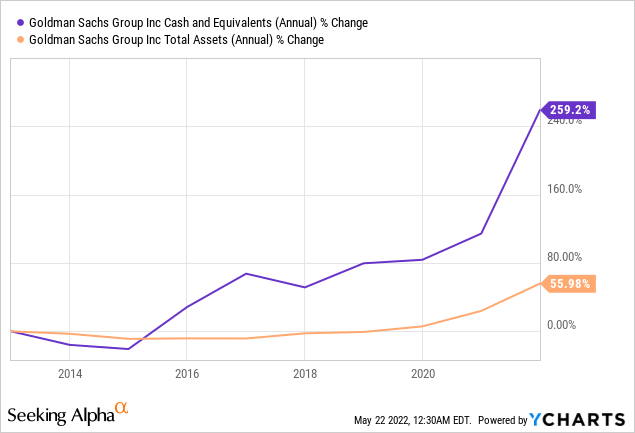

I believe a fair way to showcase this is to compare the development between Goldman’s balance sheet, which has grown to more than $1.5 trillion by FY2021 and then the growth in cash and equivalents on the balance sheet which stood at above $260 billion by end of FY2021. Both can be seen below in a percentage-based illustration.

Goldman’s Financials

When observing Goldman’s financials, it’s worth going a bit back in time to Q4-2021 just to understand how favourable the market has been for Goldman up until now.

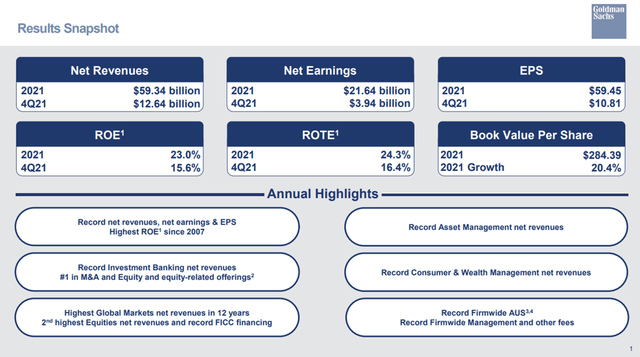

Goldman Sachs Investors Centre

The FY-2021 performance was published January 18th 2022, and if we look at the annual highlights, the word “record” appears in five out of six highlight boxes. As such, Goldman also secured its best return on equity since 2007, in other words, money was pouring in. Goldman ended the year with a net income of $21.6 billion up from $9.4 billion the year before, with the net income of $10.4 billion in 2018 being the best year in the recent decade. That was, until the FY2021 which in all ways was a very strong year for Goldman.

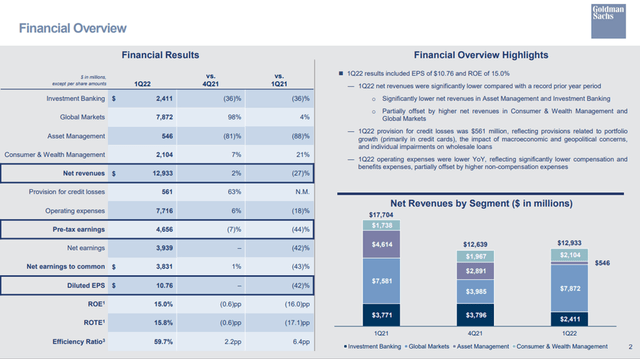

If we then move to present day, Q1-2022, we see a different picture as YoY revenue was down 27%. Going into the Q1-2022 earnings, Goldman was naturally not expected to deliver the same astonishing performance as the year prior, not least because of equity market volatility and reduced M&A activity, but by the simple fact that it’s more difficult for buyers and sellers to agree on a suitable price in an environment with significant inflation and tightening interest rates. The interest rate environment naturally provides some lift to performance, but more so in the direction of your bread-and-butter retail banks.

Goldman Sachs Investors Centre

Having said, despite being down by 27% YoY when measured on revenue, Goldman actually beat consensus revenue expectations by $1.17 billion being up 2% from Q4-2021. Similarly, Goldman beat expectations for its earnings per share with $1.78 above expectations, a substantial beat. The annualised return on equity was 15%, hitting the midpoint of Goldman’s own mid-term expectations of delivering 14%-16%, with FY2021 ROE coming in at 23%, again underlining how immaculate FY2021 was. Lastly, Goldman also delivered an efficiency ratio below 60%, which is the threshold I prefer to see banks stay below.

The one disappointing division was asset management, with chief financial officer Denis Coleman saying the following during the earnings call.

“Moving to Asset Management on page six, first quarter revenues were $546 million, materially lower than the first quarter of last year due to market headwinds in equity investments and lending and debt investments. Management and other fees totaled $772 million, up 4% sequentially.

Net revenues for equity investments were negative $360 our public and private portfolios, we experienced substantial losses tied to Russia-related positions, all of which have been written down to 0. More broadly, we experienced additional headwinds due to the overall market environment.

All in, we experienced roughly $620 million of net losses in our public portfolio, offset by approximately $255 million in net gains across our private portfolio, largely due to event-driven items, including asset sales and financing rounds.

We harvested $1 billion of on-balance sheet equity investments in the first quarter. We remain fully committed to reducing this portfolio over time and have line of sight on another $1 billion of incremental private asset sales corresponding to approximately $750 million of capital reduction.”

Chief Financial Officer, Denis Coleman

All in all, Q1-2022 proved to be a good quarter driven by strong results within global markets and consumer wealth. If we look ahead to the coming quarters, Goldman will probably have to rely on the diversification within its portfolio, as we can expect IPO and M&A activity to be low as long as the current market volatility and global uncertainty persists. As such, Goldman is expected to secure revenue of $11.95 billion for Q2-2022, which would be 22% below Q2-2021, which I already pointed out as being a very strong year. We have to look towards 2023 before Goldman is once again expected to be able to beat its year-on-year comparison revenue wise. However, banks are cyclical, so fluctuations are not unusual.

For FY2022, Goldman is expected to collect a net income of roughly $13.5 billion, slowly trending upwards towards FY2024 where current expectations are a net income of $14.4 billion. Estimating bank earnings even a couple of years into the future is fickle business, however, having previously pointed out of a net income of $10.4 back billion in 2018 was the best in the recent decade outside of FY2021, indicating that Goldman is expected to continue delivering earnings growth over time.

Valuation

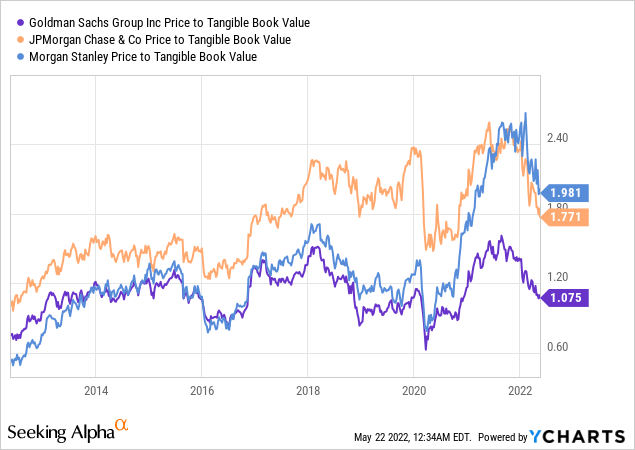

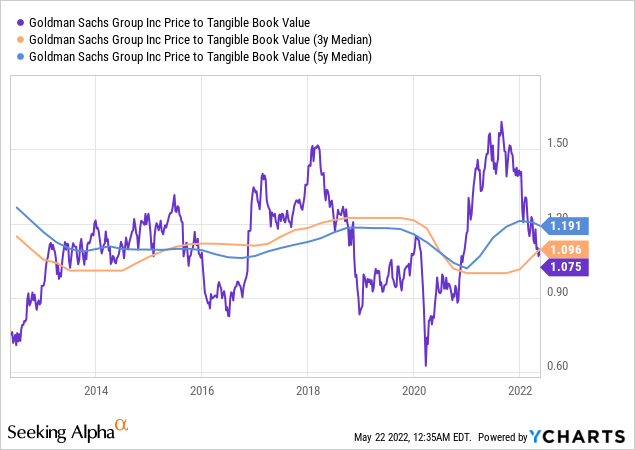

When we look at bank stocks, we always have to keep in mind that especially earnings can fluctuate, which makes the traditional P/E multiples mute. Instead, I look at price to book or price to tangible-book-value. P/TBV is advantageous as it only includes assets such as property, cash as well as the loans in its portfolio, which is in contrast to P/B that also includes intangible assets such as patents, brand name and goodwill. Stripping away these assets, we focus solely on the tangible assets which drive a bank’s earnings.

We need something to compare Goldman to, and I’ve decided to include Morgan Stanley and JPMorgan Chase (JPM) and just for the sake of it, if we did compare the three on forward P/E, Goldman stands at 8.1, Morgan Stanley at 10.5 and JPMorgan Chase at 10.5. As I mentioned, P/E is not my preferred tool to gauge the valuation of a bank and especially not in a time where we are facing an uncertain economic environment, however, these valuations wouldn’t immediately suggest overpricing territory. We should however just keep in mind that income of banks can collapse during a recession, something we aren’t sure is looming in the horizon as this very long bull market could come to its end.

Above, you’ll find the P/TBV comparison for the three aforementioned banks, and at a first glance, Goldman appears to be the more attractive. Morgan Stanley and JPMorgan Chase are, of course, different institutions, with a different balance sheet and focus, but also considerable titans within investment banking, and normally a price to tangible-book-value around 1 doesn’t scare me for a high-quality financial institution like Goldman. In Europe, we’ve gotten used to being able to pick up banks for below 1 in book value, meaning we obtain their assets at a discount, but that has not been the tradition for American banks as there hasn’t been the same instability in the banking sector as we’ve seen in Europe during the 2010s. Paying above 1 for P/B, and we pay a premium, and given the volatility of banks, I don’t personally like having to pay well above 1.0, but Goldman hovering around 1.0 is attractive in my eyes.

If we zoom in on Goldman, we see the current P/TBV is on point with both the 3y and 5y median.

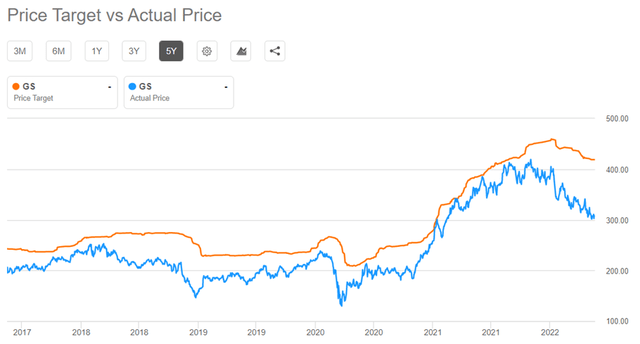

Observing the consensus Wall Street price target for Goldman, it has been down trending a bit since the beginning of 2022 where it stood at just below $460 per share in conjunction with the changing outlook for some of Goldman’s core services as already mentioned, meaning the consensus target today stands at $418 per share. Should the economic conditions continue to worsen, that target could be lowered quite a bit, pushing the stock price downwards, which today stands at around $306 per share. However, it doesn’t take much for Goldman to dip below P/TBV 1.0, and should it go below 0.9, Goldman would start to become a very obvious buy in comparison to its historical valuation. However, even here, at P/TBV 1.0, Goldman appears to be a fair buy.

What justifies an expanding price target is naturally the fact that Goldman has managed to elevate its net income seen over the past decade, while also on target to achieve a net income above that of FY2020 with the stellar FY2021 considered an outlier. Further, that Goldman is expected to continue to maintain and expand this next step of its net income staircase. Again, I just have to point out that there is a risk tied to that outlook changing on the short-term in connection with the global economic outlook, where we just don’t have clarity. As laid out earlier, Goldman has a strong position in its niche, and it has strengthened that position in the last decade, and as such I expect that Goldman indeed can maintain these profit levels over the mid- to long-term.

How Can An Investor Approach The Opportunity?

We can’t deny the fact that we don’t know if we are staring into a significant storm in terms of the economic outlook. Many economies are maintaining their GDP outlook for 2022, but we are seeing consumer sentiment dropping, with retailers like Target (TGT) and Walmart (WMT) disappointing massively as consumers are starting to switch to more economic options. A situation where economic sentiment worsens is never advantageous for banks, be it a retailer or investment bank.

In my own portfolio, I have an allocation for financials, and I already hold Royal Bank of Canada (RY), a financial-do-it-all company catering to clients across retail, corporate, investment and so on. I was fortunate to pick it up during the market turmoil related to Covid-19, and Goldman right now isn’t a steal as it was back in the same period, as also evident by its P/TBV at 0.6 during that crash. Therefore, combining the current market uncertainty and the fact that Goldman is attractive at this point, I would most likely dollar-cost-average my way into the stock by initiating a position, and then build it throughout the next 6-12 months as we get more clarity on the economic outlook globally.

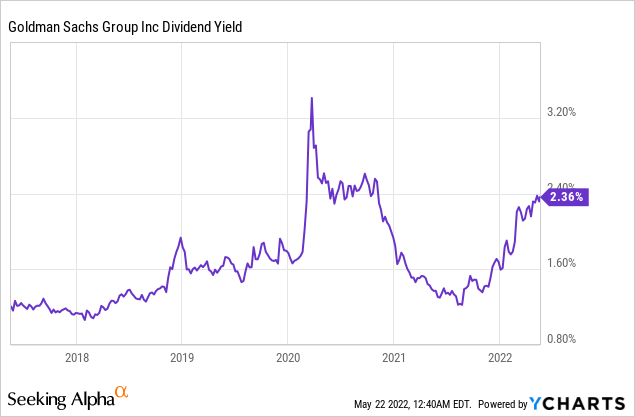

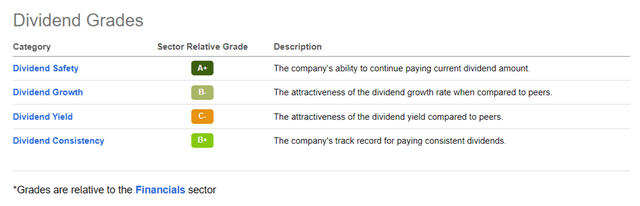

Additionally, picking up Goldman now would historically be interesting when considering the current dividend yield, coming in at 2.6% in a forward perspective, well above the historical average. However, beware, dividends are often slashed during recessions, and Goldman only holds a 5-year growing dividend streak as of today. To that story goes that the current dividend is well covered, also receiving a fairly strong overall score for its dividend compared to peers. However, if the dividend is the main point of interest, it should be noted that Goldman is consistently traded with a lower dividend than for instance Morgan Stanley, JPMorgan Chase and other banks as also evident from the dividend grading tool.

Conclusion

Goldman trades 27.6% off its most recent high and is down 22.4% YTD which has resulted in the stock having become interesting. Goldman had a stunning FY2021 causing the valuation to bloat and while FY2021 is not to be replicated as risk appetite peaked in global markets, Goldman still delivered a strong Q1-2022 and is on track to another satisfactory year, having so far delivered on its own key metrics including return on equity and efficiency ratio. The stock is currently trading at price to tangible-book-value just above 1, which is just below the 3-year and 5-year median and below that of peers Morgan Stanley and JPMorgan Chase. Sitting at the centre of the global financial system with a strong market position within its key segments, there is little to suggest Goldman won’t be churning out strong profits over the long-term. In terms of the economic cycle, it’s uncertain if the global volatility YTD will pick up with continued strong inflation and rising interest rates, which dampens interest for some of the activities driving profits for Goldman and its peers. This suggests that prospective investors may consider dollar-cost-averaging if they are to initiate a position, as to mitigate the potentially worsening market conditions for investment banks in general in the year to come. Taking the uncertain market conditions into consideration, Goldman would have to trend further downwards for it to be considered a strong buy. Should Goldman reach price to tangible-book-value 0.9, it would historically indicate a strong opportunity to go long the stock.

Be the first to comment