ra2studio

Investment Thesis

I have written about Eli Lilly (NYSE:LLY) – the US’ second largest pharmaceutical company by market cap valuation – several times over the past 18 months, however the last time I gave the company a buy recommendation was back in March 2021, when its stock traded at $208.

Since then, Lilly’s share price has risen by an incredible 50%, to >$330 at the time of writing. Frankly, that is higher than I ever believed the stock could go. I warned investors in August 2021 that ” Superb Recent Progress May Be Baked Into The Share Price“, and in January, June and July this year I continued to warn investors that Lilly stock was trading at the absolute limit of its potential.

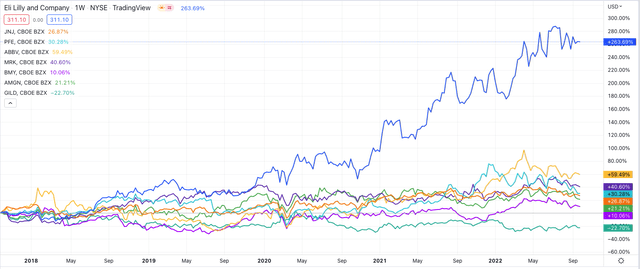

Let’s briefly recap the evidence for this. First of all, let’s look at the share price performance of Lilly versus the rest of what I like to refer to as the “Big 8” US Pharmas, which are, in order of market cap valuation, Johnson & Johnson (JNJ), AbbVie (ABBV), Pfizer (PFE), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN), and Gilead Sciences (GILD).

Share price performance of “Big 8” US Pharmas – past 5 years. (TradingView)

As we can see, Lilly’s share price performance is in a different league to the rest of the sector that has performed reasonably well, with 6 of the remaining 7 companies making gains of between 10% – 60%. Next, let’s take a look at some fundamental aspects of Lilly’s business in comparison with the others.

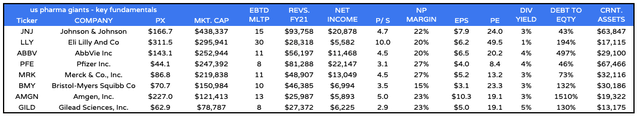

Investment fundamentals of “Big 8” US Pharmas. (my table – data from TradingView & Google Finance)

As we can see, Lilly had a market cap valuation of $295bn at the end of last week, behind only Johnson & Johnson’s $438bn. In terms of revenues generated in 2021, Lilly is only the 6th highest – last year, Pfizer earned nearly 3x more than Lilly’s $28.3bn, and AbbVie earned 2x more.

In terms of price to sales, Lilly has the highest ratio, where a low ratio is generally considered favorable, and the same applies to Price to Earnings ratio – Lilly’s is nearly 2x higher than the other 7, another indication the business is overvalued. Lilly’s net profit margin is about average, at 20%, and its dividend yield is the worst in the sector, at ~1%, whilst only Gilead Sciences has lower current assets.

In short, based on its present-day business, Lilly’s market cap valuation ought to be similar to Amgen’s or Gilead’s in terms of revenue generation and profitability, but in fact, it is nearly 2.5x Amgen’s, and nearly 4x Gilead’s.

The only explanation for Lilly’s incredible share price growth is that the market is expecting something extraordinary to happen to Lilly’s business in the future, because quite clearly, Lilly does not deserve the valuation it has based on current performance.

The market is actually expecting 2 extraordinary things to happen, and that is the approval and commercial launch of 2 drugs with double-digit billion sales potential. The first has already happened – Lilly’s drug candidate Tirzepatide has already won approval as a 6-injection regime to treat Type 2 diabetics and is marketed and sold as Mounjaro.

A second approval is likely to follow soon in the treatment of obesity, and data has proven that the drug ought to be more than a match for rival Novo Nordisk’s -once-weekly semaglutide subcutaneous injection, approved for type 2 diabetes as Ozempic, and for Weight Loss as Wegovy. That has led some analysts to predict peak sales of a staggering $25bn for Tirzepatide across its 2 indications.

The second transformative drug in development that Lilly has is Donanemab, an Alzheimer’s therapy for which Lilly is hoping to secure an accelerated approval based on its Phase 2 TRAILBLAZER clinical study that met its primary endpoint of improvement on the Integrated Alzheimer’s Disease Rating Scale (iADRS).

A Phase 3 trial is underway from which Lilly will submit data to the FDA piecemeal, which it hopes will support conclusions from TRAILBLAZER. It should be noted that the endpoint used in TRAILBLAZER is not the usual endpoint for an Alzheimer’s study – which is another cognitive assessment scale known as ADAS-Cog – and not everybody believes Donanemab is truly an effective drug against Alzheimer’s.

Nevertheless, for the purposes of this analysis, I am going to make the assumption that Donanemab is approvable, and that unlike Biogen’s (BIIB) approved AD drug Aduhelm, the Centers for Medicaid and Medicare (“CMS”) will agree to provide reimbursement. If that were to happen, then theoretically at least, Donanemab could achieve peak sales in the double-digit billions.

Besides these 2 drugs Tirzepatide and Donanemab, Lilly has several other drugs – either recently approved or in Phase 3 clinical studies – that could generate perhaps a further $10bn of sales per annum at their peak, which will likely arrive towards the end of this decade.

I have used financial modeling to try to establish whether, in an optimal scenario in which all of Lilly’s new drugs reach their peak sales potential, the company deserves its sky-high valuation, which I present below.

Spoiler alert – despite being as generous as I felt I could possibly be towards Lilly and its products and pipeline, I simply cannot get close to justifying a target price for Lilly stock higher than $250.

Following the news – announced this morning – that Biogen’s latest Alzheimer’s drug Lecanemab has successfully shown that it can lower the rate of cognitive decline in Alzheimer’s patients by 27% versus placebo, Lilly stock appears to be about to surge again, given Donanemab has a similar mechanism of action to Lecanemab.

That gives me even less confidence that Lilly can maintain its current valuation. As much as I want to believe the Lilly hype, I am afraid I am making a bear case once again.

Lilly – Modeling Sales to 2030

I have modeled product and pipeline sales to the end of the decade for AbbVie, Biogen, Bristol Myers Squibb, Gilead Sciences, Merck, and Pfizer, and used discounted cash flow to arrive at a target price for the stock, and generally speaking, the target price is at a premium to current traded price, resulting in a bullish outlook.

In the case of Lilly, I cannot draw that same conclusion, even when making very bullish product sales forecasts. Let’s begin by looking at the Diabetes franchise.

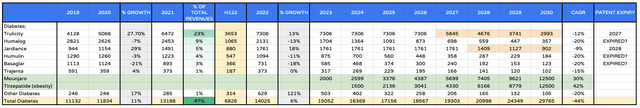

Lilly Diabetes division sales forecasts to 2030. (my table and assumptions)

In the above table, I show product sales between 2019 – 2021, showing year-on-year growth between 2020 and 2021. I also show what percentage of total revenues each product’s sales represent.

Next, I show revenues generated for each product in H122, and I simply double this figure to get to my FY22 estimate, which handily fits with management’s own guidance for ~$28.8 – $29.3bn when all divisions are accounted for. I show forecast year-on-year growth for 2022, then I use one of several techniques to map forward sales forecasts.

In the case of new drug launches, I establish a realistic peak sales figure for 2030, estimate likely first-year sales, and calculate a CAGR between the 2 dates, which I use to increase sales in each year to 2030. In the case of drugs whose patent protections have expired, I typically reduce sales revenues by 20% per annum, or by the rate at which they had fallen in the previous year (if already expired). For other products, I try to follow the recent trend, or establish a peak sales figure and trend towards that.

Obviously, there is a subjective element to my estimates but I believe they are based on tangible evidence and generally agreed assumptions. So, for example, although Trulicity earned $6.5bn of revenues in 2021, and I am forecasting for >$7bn in 2023, the drug will go off patent in 2027, and it will also likely lose market share to Tirzepatide, meaning by 2030, I am expecting sales to drop to $3bn.

It is a similar scenario for Jardiance, Humalog, Humulin, Basalgar, and Trajenta, but then comes Mounjaro, and also Tirzepatide for obesity. I am using the most optimistic forecasts of $25bn in peak sales, – $12.5bn each in diabetes and obesity – which is nearly $5bn higher than the best-selling non-COVID drug in 2021, AbbVie’s Humira, which earned just over $20bn in revenues. Overall, I have the diabetes division revenues – which accounted for 47% of all Eli Lilly’s revenues in 2021 – rising by a CAGR of 10%, from $15bn to $30bn by 2030.

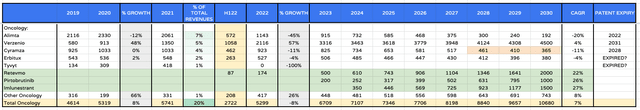

Lilly Oncology division sales forecasts to 2030. (my table)

Next, I created forward forecasts for the Oncology division, which accounted for 12% of total revenues in 2022. This division ought to benefit from 3 new approvals. The first is Retevmo – the drug has already been granted an accelerated approval by the FDA in patients with locally advanced or metastatic non-small cell lung cancer (NSCLC) with a RET gene fusion, however, on September 21st it was additionally approved for any tumor type in patients with RET driven cancers. As such, I have increased analysts’ peak sales estimates for the drug from ~$1.2bn to $2bn by 2030.

Next, Pirtobrutinib is close to seeking approval in both mantle cell lymphoma, and Chronic Lymphocytic Leukemia. I forecast for a modest $1bn in peak sales here, based on the smaller market opportunities, and progress being made treating blood cancers, most notably by recently approved cell therapies developed by the likes of Bristol Myers Squibb, Gilead, Novartis (NVS) and Legend Biotech. Gilead’s Tecartus, for example, has been approved to treat MCL.

Finally, Imlunestrant – an oral selective estrogen receptor degrader (“SERD”) indicated for metastatic breast cancer, I forecast for $1.5bn peak sales. At the same time, I grow sales of Verzenio, approved in breast cancer, to achieve peak sales of $4.5bn, in line with the more optimistic analyst estimates, whilst forecasting sales of Alimta to sink after the drug losses exclusivity/patent protection.

In summary, my forecasts suggest that Lilly’s oncology division grows from $5.3bn in size, to $10.7bn between 2022 and 2030.

Lilly Immunology, Neuroscience and Other division sales forecasts to 2030. (my table and assumptions)

Finally, for my forecasting, I look at immunology, neuroscience, and “other”. With Taltz and Olumiant sales looking likely to fall in 2022, I am not overly optimistic with my forecasting for either drug, both being older drugs competing within fiercely contested markets.

I am more optimistic on sales of 2 newcomers however in Lebrikizumab and Mirikizumab. Lebrikizumab has been compared to Sanofi’s Dupixent, itself forecast to achieve peak sales of ~$15bn by some optimistic analysts, and has even outperformed Dupixent in some studies, so perhaps I am being too conservative forecasting peak sales of just $4.5bn.

On the other hand, as mentioned, autoimmune markets are fierce and new therapies – notably AbbVie’s Skyrizi and Rinvoq – represent very tough competition. Mirikizumab, in Ulcerative Colitis, could generate $1bn in peak sales, and perhaps there are label expansion opportunities here too. Either way, this division is being reasonably generous, I believe, by forecasting revenues to grow from $3bn to $7.6bn, at a CAGR of 13%.

With patents apparently having expired for Cymbalta and Ztprexa, I expect sales to peter out, but the arrival of Donanemab – I am optimistically forecasting for $10bn in peak annual sales – make the neuroscience division growth even more dramatic, at a CAGR of 29%. I am not optimistic for ongoing sales of COVID antibodies as the disease (hopefully) becomes less severe and rarer.

Lilly’s Target Price Using Discounted Cash Flow and EBITDA multiple analysis

Lilly – forecast income statement to 2030. (my table and assumptions)

As per the table above, I take my forecasts for topline revenues – growing from $28.8bn in 2022 to $60.5bn by 2030, at a CAGR of 11%, and plug them into an income statement.

I am reducing total operating expenses from 78% of revenues in 2021 to just 70% in 2022, and using a tax rate of 12%, to get to net income of $7.13bn, and earnings per share of $7.5, which matches Lilly’s forward guidance for a midpoint of GAAP and non-GAAP of $7 – $8. Over time I am decreasing operating expenses as a percentage of revenue still further, so that EPS in 2030 is $17.8, and forward PE ratio is 17.5x.

Eli Lilly – share price target using DCF / EBITDA multiple analysis. (my table and assumptions)

Finally, I present my working around a target share price. For the DCF analysis, I use a weighted average cost of capital (“WACC”) of 8.9%. Typically, I use 10% for Big Pharma companies when performing the same analysis.

My free cash flow generation by 2030 now stands at $24bn, compared to just $7.65bn in 2021. After applying my discounts, I eventually calculate a DCF firm value of $178bn and a target share price of $188. Using EBITDA multiples – 14.5x, which is also the same I use for all US Big Pharmas – I get to a target price of $248, for an average price of $218.

Conclusion – I Cannot Board the Hype Train No Matter How Hard I Try

The above analysis is not intended to be set in stone and I have made many assumptions that readers may not agree with, however, I am not sure I could have been much more generous when forecasting revenue growth at Eli Lilly to 2030. I am assuming that 2 drugs contribute ~$35bn in sales in 2030. Only Pfizer, with COVID drugs Comirnaty and Paxlovid, has ever extracted more value in a year from just 2 drugs.

Whilst it’s true that Paxlovod and Comirnaty will shrink as COVID therapies move from a public, pandemic-driven market to a private one, whilst Lilly’s Alzheimer’s and Diabetes/Obesity drugs could grow and grow their markets, even in my most optimistic scenario, Lilly simply doesn’t generate enough revenues, or profit, to be considered a >$300bn market cap company, as it is today.

At $218 per share – my calculated target price – Eli Lilly is a $200bn market cap company. Only Johnson & Johnson, Pfizer, AbbVie and Merck would be worth more, and each of these companies drives nearly, or more than 2x the revenues currently generated by Lilly.

Although the valuation of any company is more about what it may do in the next 5 years rather than what has been achieved in the past 5, it is still mystifying to me how Lilly can enjoy such a high valuation.

The company is not especially cash-rich, not especially profitable for a Big Pharma, so the valuation is almost entirely due to 1 drug that will have to generate >$25bn sales in order to meet expectations, in 2 markets where innovation has never been so rapid and diverse – diabetes and obesity – and another drug that may struggle to be approved at all in Alzheimer’s, and may not even be best in class even if it is approved, based on Biogen’s latest Lecanemab data.

There are some counterarguments to be made. Tirzepatide could achieve peak sales faster than I have projected. Donanemab’s market opportunity could be closer to $50bn per annum than $10bn, given the ~6m underserved Alzheimer’s patients in the US alone. Lebrikizumab could be a double-digit billion seller. Retevmo could be another Keytruda. Lilly’s new drugs may drive higher profit margins – similar to COVID vaccines – of >50%.

Even factoring all of this in however I find myself unwilling to board the Eli Lilly hype train. I set out to make a bull case for the stock when writing this article, to try to understand where my analysis was failing, and to adopt the position that an irrational market may simply get more irrational and continue to reward investors in Lilly stock.

Ultimately, I just couldn’t get close to $300 per share, however, and I continue to believe that Donanemab could be a real sticking point for the company, even if the share price is climbing today.

I will give Lilly yet another bearish rating, although I would not rule out buying if the stock drops to ~$270, perhaps on bad news for Donanemab, based on a next-generation Alzheimer’s therapy Solanezumab reviving that aspect of the valuation, the market’s irrationality, and the exciting prospect of a Tirzepatide approval in obesity.

Be the first to comment