Drazen_

Real Estate Weekly Outlook

U.S. equity and bond markets continued their rebound this past week after Fed Chair Powell signaled a downshift in the aggressive pace of monetary tightening while employment data showed further softening in labor markets. In the final major speech before the December FOMC meeting, Powell commented that “the time for moderating the pace of rate increases may come as soon as the December meeting” but cautioned that monetary policy is likely to stay restrictive until the Fed sees “clear progress on slowing inflation.”

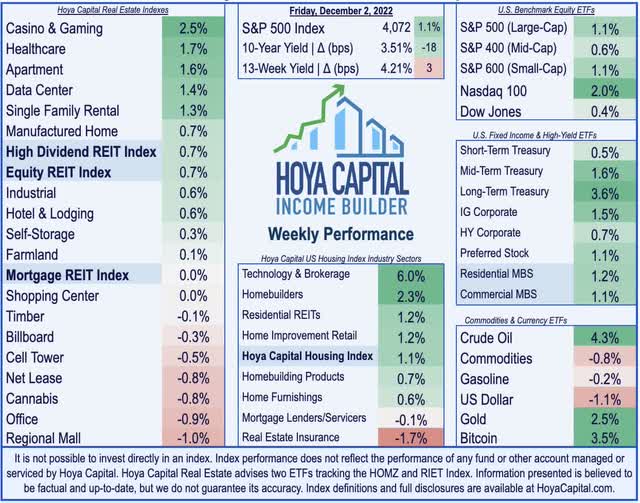

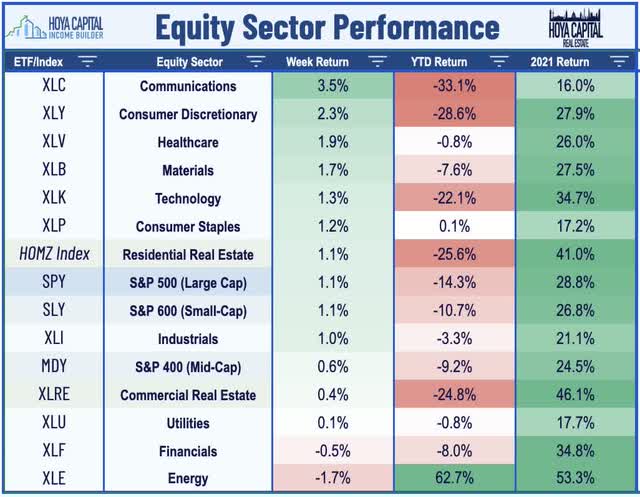

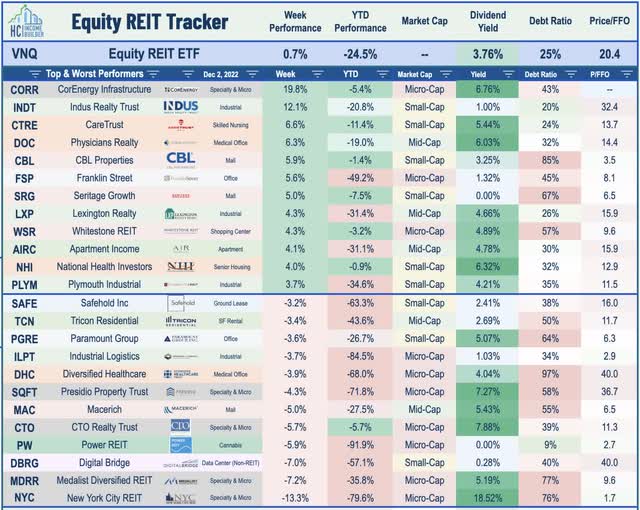

Posting its fifth weekly gain in the past seven weeks, the S&P 500 advanced another 1.1% on the week – trimming the benchmark’s year-to-date declines to under 15% – while the tech-heavy Nasdaq 100 rallied 2.0%. The Mid-Cap 400 and Small-Cap 600 posted more modest gains of 0.6% and 1.1%, respectively. Despite the retreat in rates, real estate equities were mixed this week on an unexpectedly busy week of newsflow that included several major M&A deals and signs of potential turbulence in private real estate markets. The Equity REIT Index gained 0.7% on the week with 10-of-18 property sectors in positive territory while the Mortgage REIT Index finished flat.

Combined with another encouraging inflation report, lukewarm employment data, and an increasingly bleak demand outlook across Europe and Asia amid ongoing geopolitical unrest, the less-hawkish comments from Fed Chair Powell sparked a bid for bonds and rate-sensitive assets across the credit and maturity curve. The 10-Year Treasury Yield dipped 18 basis points to close the week at 3.51% – the lowest close since September 21st – while the US Dollar Index plunged to the lowest level since June as investors trimmed their expectations of future rate hikes. The beaten-down Homebuilders continued their recovery as mortgage rates fell for a third-straight week. The 30-Year Fixed Rate Mortgage averaged 6.49% for the week – down from the recent peak of 7.08% – but still double the rates available earlier this year.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

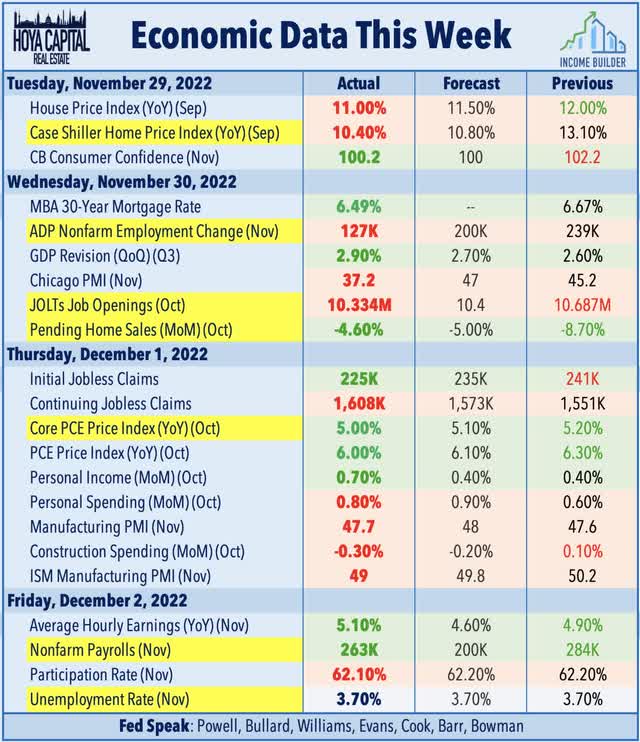

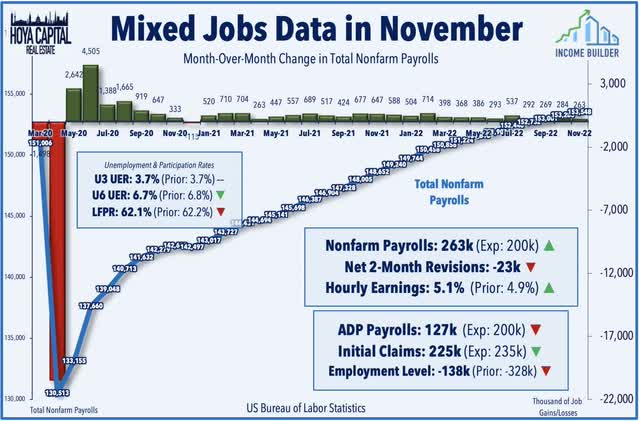

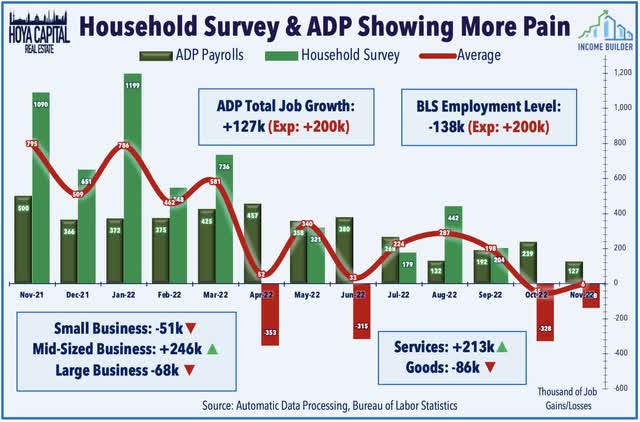

The Bureau of Labor Statistics reported this week that the U.S. economy added 263k jobs in November – the slowest pace of hiring since December 2020 but still above expectations of roughly 200k – a relatively solid report on the surface following weak ADP and PMI employment data earlier in the week alongside another wave of announced corporate layoffs and hiring freezes. Employment gains have become less broad-based in recent months, however, as job losses were recorded in retail trade and in transportation and warehousing. Notable job gains for the month were seen in leisure and hospitality, health care, and government. The unemployment rate remained unchanged at 3.7% while average hourly earnings rose by 0.6% for the month and 5.1% over the past year – slightly ahead of estimates.

Strong job gains observed in the establishment survey, however, were once again at odds with the household survey in the same report – which is used to calculate the unemployment and labor force participation figures – which showed net job losses of 138k in November – a second straight month of declines in the employment level. ADP data earlier in the week also missed estimates with more apparent signs of weakness, underscored by data showing an 86k decline in goods-producing jobs in November, offset by 213k jobs added to the service sector, while both small businesses and large businesses reported layoffs, per the ADP report. Jobless claims data was also notably weak with continuing claims rising to the highest level since February while the ISM Manufacturing PMI report showed a contraction in its employment index for the first time since the pandemic shutdowns.

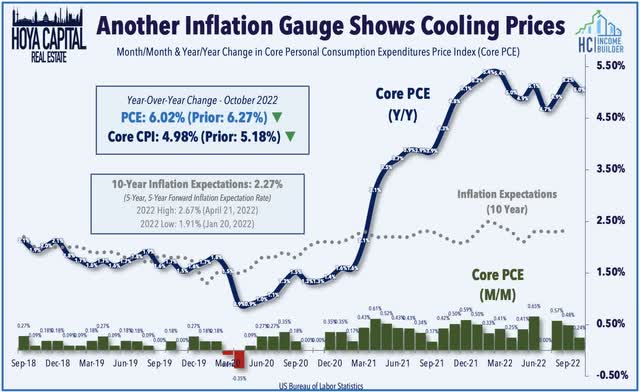

Following the cooler-than-expected CPI and PPI reports in the prior two weeks, there was more “good news” on the inflation front this week. The Commerce Department reported that the Core PCE Index – the Fed’s preferred measure of inflation – rose less than expected in October at a 4.98% annualized rate. The same report showed that Personal Income rose 0.7% in October – ahead of the 0.4% estimate – while spending rose 0.8%, driving the saving rate to just 2.3% – the lowest in seventeen years as credit card balances swell to pre-stimulus levels. Importantly, however, while the nominal level of credit card and short-term consumer debt will surely generate some negative headlines, credit card debt as a percent of personal incomes – 4.2% in October – is still below the 2010-2019 average of roughly 4.4%.

The historically-swift surge in mortgage rates this year continues to pour icy-cold water over the previously-red-hot U.S. housing sector. The Case-Shiller US National Home Price Index – which lags current market conditions by about 3 months – declined 1.0% in September from the prior month – the third-straight month-over-month decline and the largest single-month decline since November 2011. On a year-over-year basis, home values were still 13.0% higher than September 2021. Low inventory levels should help to contain the potential downside in home values – particularly if mortgage rates moderate into year-end or if employment markets remain healthy – but an increasing number of housing markets in the U.S. are now seeing home price declines for the first time in a decade. Data from Zillow (Z), meanwhile, showed that roughly half of the Top 60 markets recorded negative month-over-month growth in October with particularly sharp slowdowns in West Coast markets.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

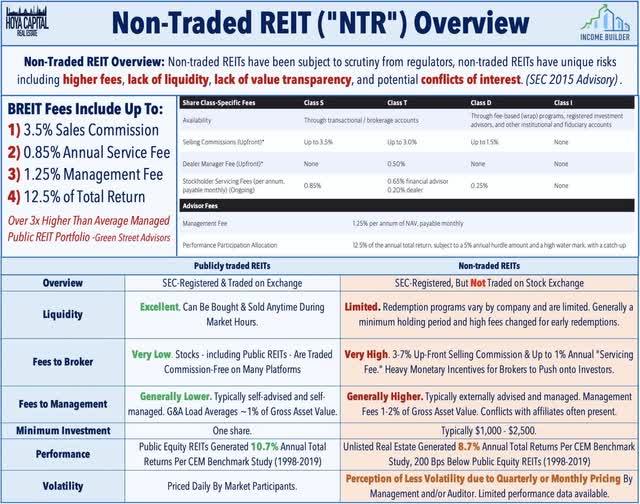

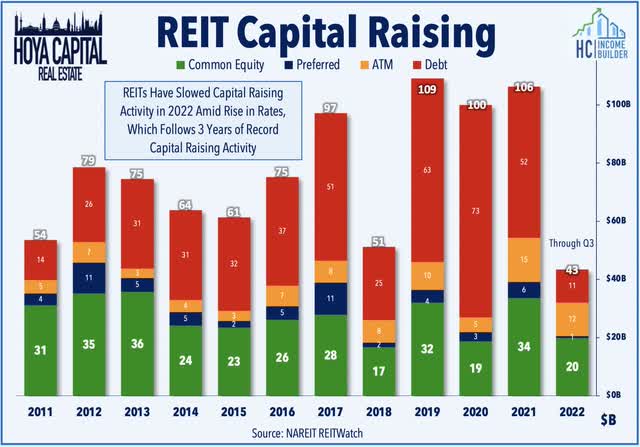

Real estate asset manager Blackstone (BX) was the focus this week after it’s massive $70B nontraded REIT platform – BREIT – announced that it has begun limiting withdrawals after a wave of redemption requests that exceeded its monthly and quarterly limits. An issue that we predicted in our State of the REIT Nation Report last month, BREIT reported that its Net Asset Value has increased 9.3% this year through October 31 – claiming roughly 40% outperformance over the public REIT indexes in that period despite paying “top-dollar” to acquire a half-dozen public REITs over the past two years whose closest public REIT peers are trading lower by an average of 30% this year. Naturally, investors have seized on the opportunity to redeem shares at these premium valuations – some of which have reallocated to public REIT shares trading at significant discounts. We’ve discussed the risks of non-traded REIT (“NTR”) space across many reports over the past half-decade and continue to watch the area for signs of stress given their typically-high leverage and sensitivity to investor fund flows – which we expect could eventually become an area that’s “ripe for picking” for the more conservatively-managed REITs.

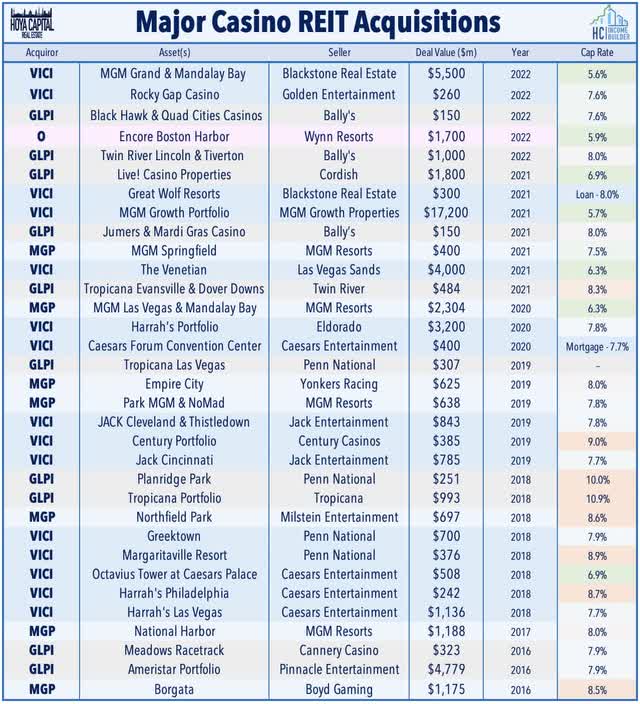

Casino: On cue, Blackstone announced that it reached an agreement to sell its 49.9% share in the MGM Grand Las Vegas and the Mandalay Bay Resort to VICI Properties (VICI) in a $5.5B deal that gives VICI full ownership of the properties. Under the terms of the deal, Blackstone will receive $1.27B in cash while VICI will assume Blackstone’s share of roughly $3B in debt. VICI intends to fund the deal with cash on hand and proceeds from existing forward equity sale agreements. The transaction – which has an implied cap rate of 5.6% – is expected to be immediately accretive to AFFO/share and will generate annual rent of $310M next year and escalate at a fixed 2.0% rate through 2035 and up to 3.0% thereafter. Elsewhere in the casino sector, Realty Income (O) announced that it closed on its previously-announced $1.7 billion acquisition of the land and real estate assets of Encore Boston Harbor Resort and Casino from Wynn Resorts.

Industrial: We also saw some major M&A activity in the industrial property sector as INDUS Realty (INDT) rallied more than 12% this week after Centerbridge Partners and GIC Real Estate proposed to acquire the industrial REIT for $65 per share, a 13% premium to INDUS stock’s closing price of $57.28 last Friday. INDUS – previously known as Griffin Industrial Realty before its REIT conversion back in 2021 – is a small-cap REIT that owns 42 industrial/logistics buildings aggregating 6.1 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina, and Florida. INDUS’ board said it will review the proposal “to determine the best path forward” that “maximized value for all of the company’s shareholders.” Centerbridge currently owns approximately 15% of the Company’s common stock. For GIC, the deal would be its second major acquisition of the past quarter following its $14B takeover of net lease REIT STORE Capital (STOR) back in September which is expected to close in the first quarter of 2023.

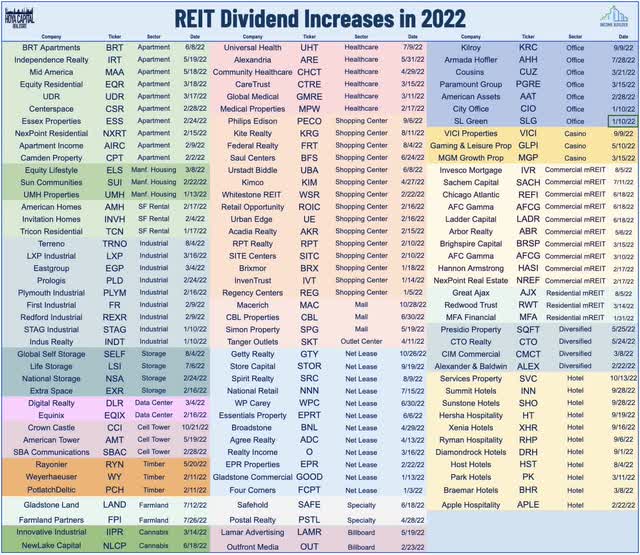

Another week, another wave of REIT dividend hikes. Net lease REIT Essential Properties (EPRT) hiked its quarterly dividend by 2% to $0.275/share while Healthcare REIT Universal Health Realty (UHT) hiked its quarterly dividend by 1% to 0.715/share – each raising their dividends for the second time this year. We’ve now seen more than 120 REITs raise their dividend this year – roughly matching the full-year record-high total from 2021. As noted in our State of the REIT Nation report last month, REIT payout ratio ratios remain below the long-term historical averages, implying that REITs have significant ’embedded’ dividend growth that should be unlocked over the coming quarters – or will at least serve as a buffer to protect current payout levels if macroeconomic conditions take an unfavorable turn.

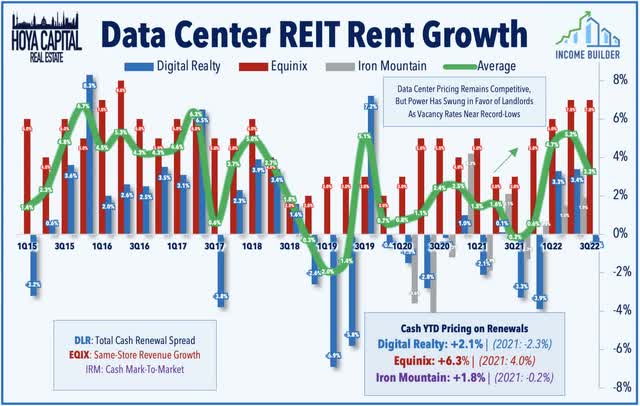

Data Center: Equinix (EQIX) rallied 2.5% this week after it announced plans to build a new International Business Exchange in Malaysia with an initial investment of $40M, which is scheduled to begin operations in Q1 2024. Elsewhere, Digital Realty (DLR) tapped the debt market this week, pricing a public offering of $350M of 5.55% notes due 2028. This week, we also published Data Center REITs: Patience Pays Off which discussed our updated outlook and recent portfolio trades in our dividend-focused portfolios. Ironically, just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from hyperscalers, rental rate trends have meaningfully improved. Competition from the hyperscale giants – Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) – have been a well-established risk and with negotiating power tilting back towards landlords, there appears to be enough economic value to be shared.

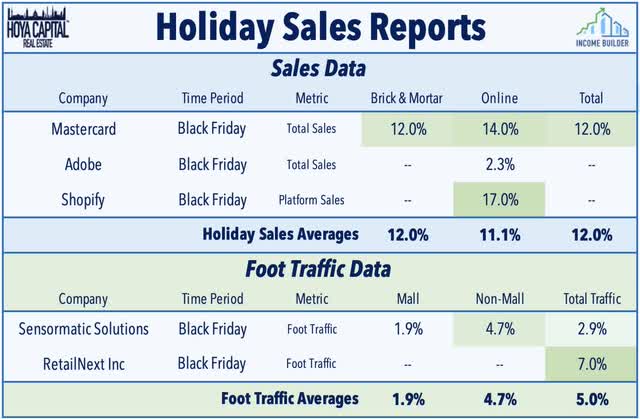

Mall: This week, we published Mall REITs: The Bleeding Has Stopped which analyzed holiday spending and foot traffic reports from the critical Black Friday weekend. Per data from Sensormatic and RetailNext, total in-store foot traffic was up by about 5% year-over-year on Black Friday, but traffic at indoor malls was more muted than at strip centers and other non-mall locations. Mastercard reported that in-store sales were up 12% from last year while online sales rose 14%, while other firms have seen more muted sales growth including Adobe, which reported online sales growth of 2.3%. Mall REITs – which endured a dismal stretch of underperformance from 2015-2020 – enter the critical holiday season on surprisingly stable footing as resilient consumer spending has offset broader macro-headwinds. Store openings continue to outpace store closings in 2022 by the widest margin in decades and following nearly three years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords.

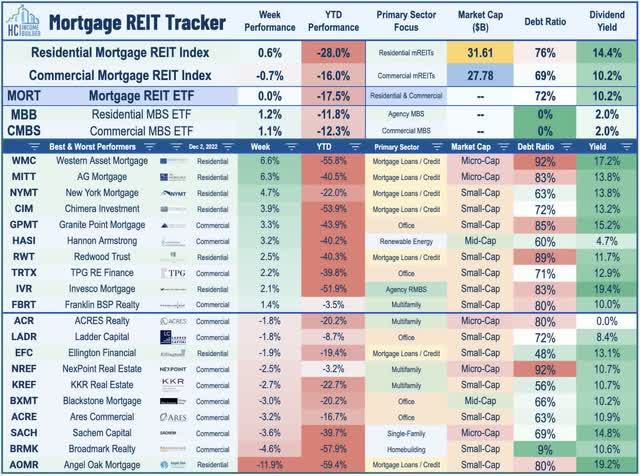

Mortgage REIT Week In Review

Mortgage REITs were mixed this past week with the iShares Mortgage REIT ETF (REM) finishing fractionally higher to extend its rebound from the October 10th lows to 27.0%. While it was another quiet week for mREIT-specific newsflow, we saw a continued bid for mortgage-backed bonds as the iShares MBS ETF (MBB) rallied more than 1% to trim its year-to-date declines to under 10% on a total return basis – a notable rebound from the lows in early October when the index was on pace for annual declines that were nearly 8x worse than its next weakest year. Credit-focused small-cap mREITs led the way this week with Western Asset (WMC) and AG Mortgage (MITT) each advancing more than 6% while Angel Oak (AOMR), Broadmark Realty (BRMK), and Sachem Capital (SACH) were among the laggards this week.

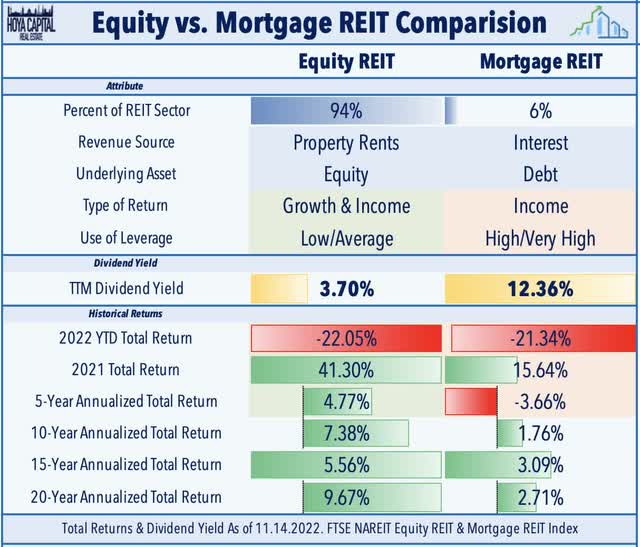

Last week we published Mortgage REITs: High Yields Are Fine, For Now. Mortgage REITs – which were left for dead amid a historically brutal year across fixed-income markets – have posted an impressive recovery in recent weeks amid a long-awaited bid for bonds and after earnings results were not as weak as feared. Mortgage REITs are now outperforming Equity REITs for the year on a total return basis, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio. Despite paying average dividend yields in the mid-teens, the majority of mREITs were able to cover their dividends as improved earnings power from wider investment spreads offset book value declines, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

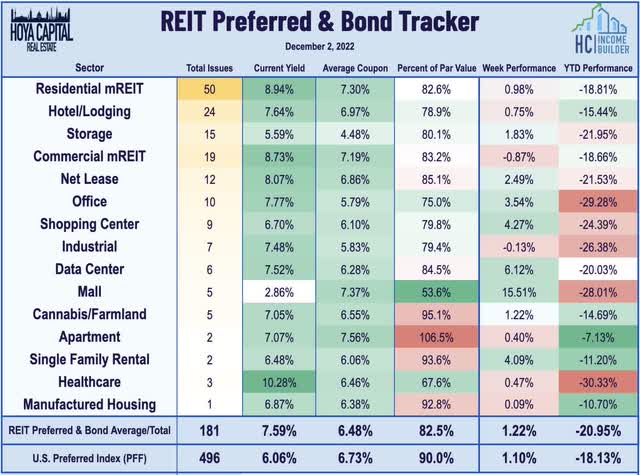

REIT Capital Raising & REIT Preferreds

The REIT Preferred Index (PFFR) advanced 1.2% this week, slightly outperforming the broader iShares Preferred ETF (PFF) which ended the week higher by 1.10%. Notable leaders on the week included the preferreds of hotel REITs Hersha Hospitality (HT), data center operator DigitalBridge (DBRG), and office REIT Vornado Realty (VNO) Notable laggards included the lone preferred issues from Sotherly Hotels (SOHO), iStar (STAR), and AG Mortgage (MITT). This week, Braemar Hotels (BHR) announced that the offering for its Series E & M Redeemable Preferred Stock will now close on February 17, 2023. Since the launch of the offering on July 9, 2021, the Company has raised $300M through the offering which was used to acquire the Mr. C Hotel in Beverly Hills, the Ritz-Carlton Reserve Dorado Beach, and will be used to acquire the Four Seasons Resort Scottsdale.

A trio of apartment REITs tapped the debt markets this week with AvalonBay (AVB) pricing $350M of 10-year notes due 2033 at a 5.00% fixed interest rate. By comparison, AVB issued $700M of 10-year notes last September at a 2.05% interest rate. Elsewhere, Centerspace (CSR) closed on a $100M one-year floating-rate term loan priced at SOFR+ 1.20%-1.75% based upon its leverage ratio. NexPoint Residential (NXRT) announced the closing of 18 property mortgage refinancings for total gross proceeds of $807.6M – representing roughly 48% of the Company’s total outstanding debt. Notably, NXRT’s interest rate (SOFR + 155 bps) improved from prior terms. Elsewhere, Park Hotels (PK) announced an amended and expanded unsecured credit facility with its total capacity rising to $950M from $900M and its maturity extended to December 2026 from December 2023.

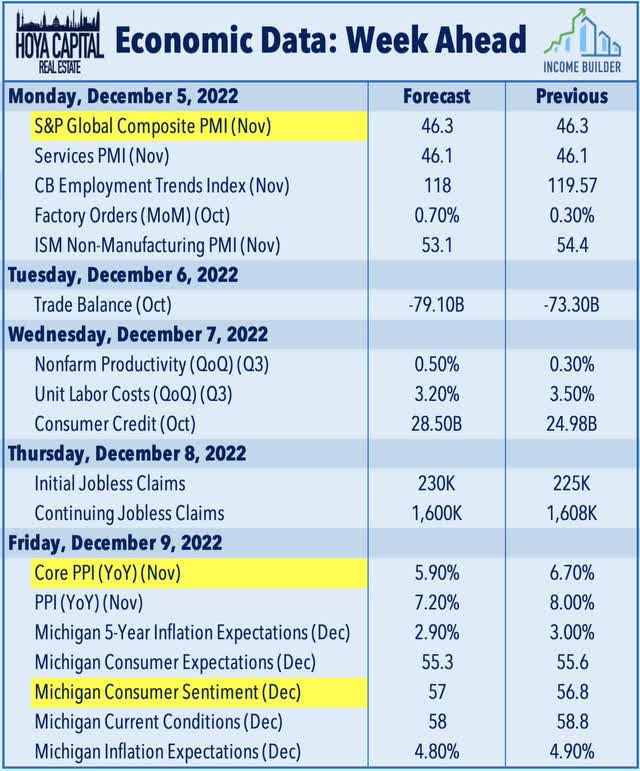

Economic Calendar In The Week Ahead

The economic data and earnings calendar slows down a bit in the week, headlined by the Producer Price Index on Friday which investors – and the Fed – are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline PPI is expected to moderate to a 7.2% year-over-year rate while the Core PPI is expected to decelerate slightly to 5.9%. On Friday, we’ll also get our first look at Michigan Consumer Sentiment for December. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential “wage-price inflation spiral” through elevated consumer wage expectations. We’ll also see a handful of Purchasing Managers Index (“PMI”) reports throughout the week from S&P Global and the Institute for Supply Management. Both of these major surveys posted readings below the breakeven-50 level in their preliminary November data.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment