knowlesgallery/iStock Editorial via Getty Images

What if Micron (NASDAQ:MU) said more with its actions and financials than it did with its management “mouth”? If it did, you could ascertain some “between-the-lines” forecast for the next fiscal year. Luckily for investors, the management of every company does this, but it isn’t easy to find. For Micron, however, it’s much more in the open than one realizes. As Micron’s management is called out for not seeing the massive pullback in retail as it guides for terrible growth in the coming quarters, it comes as no surprise investors are highly skeptical the same team can forecast the recovery. But when management puts its money where its mouth is, it’s hard to ignore. The problem is the opportunity only lasts for a short amount of time. This is why Micron’s stock price in the low-50s and high-40s is at a real-time bottom and why investors should be accumulating heavily here, averaging as the price dips.

I waited a few weeks before publicly publishing this article while my subscribers got my in-depth thoughts within a few days of Micron’s FQ4 earnings report. My main reason was to let the proverbial dust settle on all the Micron outrage and “sell now” articles. Unfortunately, they have wasted their breath telling readers the exact opposite strategy to adopt when Micron is in this very rare window. And by rare, I mean the share price and the real-time information only stay in this undisturbed state for a very short amount of time, and it only comes around once every few years.

This article builds on my writing from just before earnings, where I analyzed what the bottom looks like, both in valuation and in practice, with earnings cuts still to come.

I expect Thursday’s earnings report to quicken [the] process [of earnings estimate cuts] further, getting analysts aligned with management’s near and medium-term outlook.

And this is what happened. It helps form the bottom. But to find the other end of the bottom where recovery starts forming takes a bit more foresight and digging.

Therefore, your investor eye must shift further down the road.

Going from seeing the bottom before the financials are guided to seeing the recovery before the financials are guided is an essential shift in strategy to be in step with smart money and not chasing the market later. After all, the market is forward-looking by two-to-three quarters. Right now is a crucial intersection and why a majority of contributors, while well-intentioned, are entirely missing the next move to capitalize on Micron and its stock – when investors should be buying, they are telling them to sell.

The difference is I’m forward-looking and use all available information, including the company’s own words and subsequent actions, to make timely decisions and not react as most others do. Having the financials confirm what the market’s already priced in doesn’t help investors know the next step; it merely validates something they didn’t even warn against.

With Micron’s FQ4 report and the massive amount of color for FQ1 and FQ2, I can move past the bottom and look to the recovery. The vast amount of information management shared during its earnings report gave investors everything they needed to find the full fiscal year expectations for revenue.

Don’t believe me? Well, there’s no magic. I just connect the dots.

One Line Item To Rule Them All

CapEx is an insight into revenue.

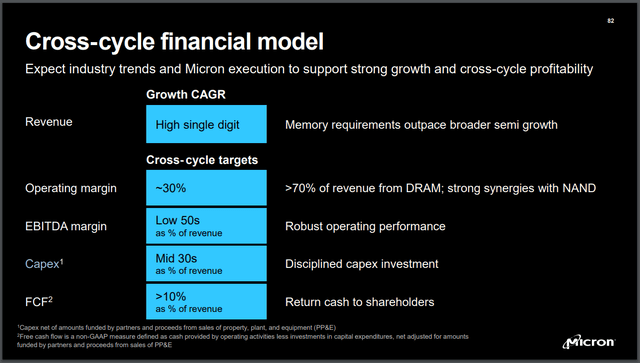

Not because I say so, but because management has repeatedly said it targets mid-30s percent of revenue for CapEx spend, cross-cycle. Using this accounting metric allows me to back into the entire fiscal year’s guide. And, because management outlined both FQ1 and FQ2, it allows me to find what the second half of FY23 holds.

Micron’s 2022 Investor Day Presentation

Management has repeated this CapEx guidance in recent years and does a decent job at hitting the target. CapEx is targeted to be at a mid-30s percent of revenue over the ups and downs of the memory cycle. Therefore, I don’t necessarily expect FY23 to abide by that. However, on average, Micron’s CapEx as a percent of revenue hovers around 37%, though FY22 was 39%.

| Fiscal Year | Revenue | CapEx | % of Revenue |

| FY22 | $30.76B | $11.98B | 38.9% |

| FY21 | $27.71B | $9.72B | 35.0% |

| FY20 | $21.44B | $7.95B | 37.1% |

| FY19 | $23.41B | $9.11B | 38.9% |

Management guided for FY23 to have $8B in CapEx spend.

You can see where I’m going with this.

Therefore, we can apply the CapEx guide toward a full-year revenue guide. At a 37% average, $8B in CapEx means $21B in revenue. Let’s take a range as a percent of revenue also. A high revenue estimate using 32% and a low revenue estimate using 40% means $20B-$25B in FY23 revenue.

Now, to be fair, CEO Sanjay Mehrotra gave this interesting piece of color on the FQ4 earnings call when explaining how much they really wanted to cut CapEx in the face of this “unprecedented” time:

CapEx would be lower if it were not for more than doubling our construction CapEx, year-over-year to support the supply growth required to meet the demand for the second half of this decade, as well as investment for EUV lithography systems to support 1-gamma node development.

This means the cross-cycle mid-30s percent target may be slightly off as it reached a spending floor. To account for this, I’ve created an absolutely bearish case for “real” CapEx spend by reducing it to an amount management likely wanted if the spend wasn’t already allocated. A cool $1B off would suffice, cutting CapEx by a further 12.5%. This forces the equation I’m using to back into the revenue range to fall naturally. Using the same range of percent of revenue as my prior calculation gives us a revenue range of $17.5B-$21.9B.

The midpoints of the bear case and the base case are now $19.7B and $22.5B, respectively. So I can now work forward to find out what 2H FY23 holds for the company in terms of revenue. Considering the guide of $4.25B for FQ1 and the color around FQ2 being very similar in terms of revenue, I have the first half already in hand at $8.5B.

In fiscal Q2, we currently expect revenue to be in a similar range as fiscal Q1…

Mark Murphy, CFO, FQ4 ’22 Earnings Call

This means the first half will come in at roughly $8.5B. Subtracting this from both my bear case and base case means there’s anywhere from $11.2B to $14B waiting for the company in the second half. This definitively points to a recovery in the second half using management’s cross-cycle guidance for CapEx as a percent of revenue and the 30% reduction in CapEx spend from FY22.

If this is the case, earnings estimates have corrected too far the other way. Considering the first half of the fiscal year is the CapEx-heavy side, and there are expectations for up to 65% growth in revenue from 1H to 2H, the earnings estimates need to come back up.

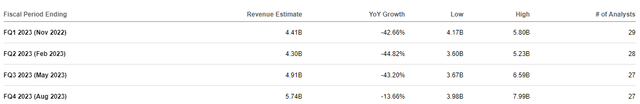

Micron Latest Revenue Estimates (Seeking Alpha)

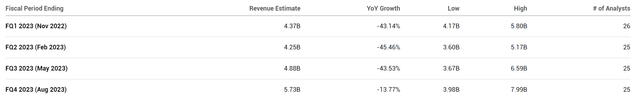

Second-half estimates have been pushed down to $10.65B, $550M below my bearish revenue estimate. If these estimates are even just slightly overcorrected, then the stock is due for an immediate rebound. But I know they have overcorrected because the second half quarters have already come up $50M from when I shared these thoughts with my subscribers last week. Here’s the screenshot from about a week ago.

Micron Revenue Estimates From October 5th (Seeking Alpha)

We’re only talking about the May quarter, now eight months out from the end of the said quarter. And we’re only a little less than six months away from getting guidance on that quarter. This is a quick about-face if the rebound is as described based on the company’s investments through CapEx.

Words Are Of Little Value, Dollars On The Other Hand…

Many of us consider the forecast of any semiconductor management to be of little value through words and conference calls. None of them saw the downturn in retail coming as hard and fast as it did. However, these companies plan financially for what they really believe to be forecast. It’s a “watch what I do, not what I say” deal. In Micron’s case, the narrative of “expect[ing] a recovery in volumes and revenues in the second half of the fiscal year” matches its CapEx guidance and first-half revenue guidance.

Even with the most bearish take on CapEx and using numbers well beyond the cross-cycle spend targets, Micron still shows a significant increase in 2H FY23 revenues. Consensus estimates have overcorrected meaningfully and have been proven in just the two weeks since earnings.

If you notice, Micron has not neared its 52-week low since reaching it three weeks ago, while others like AMD (AMD) and Nvidia (NVDA), as only two examples, have plunged straight through theirs. If we haven’t seen the bottom in Micron, we’re very close to it, both time-wise and price-wise. The company cannot cut CapEx any more than it has, which sets up DRAM and NAND bit growth to be at the lowest it has ever been. Therefore, even if demand remains weak, it won’t be so weak to be below single-digit bit growth for the entire year. CapEx speaks louder than any words.

Be the first to comment