HJBC/iStock Editorial via Getty Images

Since our previous analysis of Amazon.com, Inc. (NASDAQ:AMZN), the company had recently announced its acquisition of 1Life Healthcare, Inc. (ONEM) (“One Medical”) for an all-cash deal of $3.9 bln. This follows after Amazon had previously expanded into telehealth with the launch of Amazon Care in Feb 2022. In this analysis, we looked into the company’s acquisition and analyzed its business in terms of its activities, revenue growth and market share and determined the impact on Amazon’s financials.

Moreover, we analyzed One Medical’s membership and its growth and compared it with Amazon’s massive user base to estimate and derive possible revenue synergies through the integration of the acquisition. Additionally, as the company previously acquired pharmacy business PhilPack in Jun 2018, we examined and determined possible synergies for Amazon’s online pharmacy business based on the average healthcare patient pharmacy spending in the US.

Lastly, we examined the hybrid models of Amazon Care and One Medical and compared the difference in terms of the delivery of care and projected the capex for Amazon’s healthcare segment.

Expansion Into Healthcare with Acquisition of One Medical

In July, Amazon announced the planned acquisition of One Medical for $3.9 bln. One Medical is

a membership-based primary care practice with nearly 200 locations across the country that also offers virtual services.

Based on the company’s press release, Amazon describes the company below:

One Medical is a human-centered, technology-powered national primary care organization on a mission to make quality care more affordable, accessible, and enjoyable through a seamless combination of in-person, digital, and virtual care services that are convenient to where people work, shop, and live. – Amazon

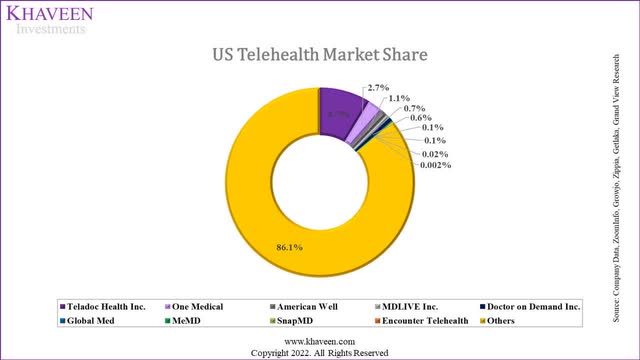

Furthermore, to determine the competitive positioning of One Medical, we compared the top telehealth companies in terms of their NPS scores, number of physical locations, pharmacy, employees and services.

Company Data, Grand View Research, ZoomInfo, Zippia, GetLatka

|

Company |

Revenue ($ mln) |

Market Share |

NPS |

Physical Locations |

Pharmacy Business |

Employees |

Services |

|

Teladoc Health, Inc. (TDOC) |

2,033 |

8.7% |

26 |

0 |

Partners CVS Health (CVS) |

5,100 |

Urgent Care, Primary Care, Chronic Condition Management, Mental Health |

|

One Medical |

623.3 |

2.7% |

46 |

182 |

Amazon Pharmacy |

3,090 |

Urgent Care, Primary Care, Chronic conditions, Mental health, Wellness and prevention, Children and family |

|

American Well (AMWL) |

252.8 |

1.1% |

20 |

188 |

Amwell Pharmacy |

1,035 |

Urgent care, Chronic Care, Children and family |

|

MDLIVE, Inc. |

156 |

0.7% |

25 |

0 |

No |

201 to 500 |

Urgent care, Primary Care, Mental Health |

|

Doctor on Demand, Inc. |

135.5 |

0.6% |

– |

0 |

Partners with 2,965 pharmacies |

1,030 |

Urgent care, Mental Health, Chronic Care, Wellness and prevention |

Source: Company Data, Grand View Research, ZoomInfo, Zippia, GetLatka, Glassdoor, Comparably, Khaveen Investments

As seen above, we calculated the company’s market share based on the U.S. telehealth market of $21 bln in 2021 according to Grand View Research. One Medical has a market share of 2.7% placing it only second behind market leader Teladoc (8.7% share) and ahead of smaller companies such as American Well, MDLIVE and Doctor of Demand. Based on the table, One Medical has the highest NPS score among the top 4 telehealth companies in the U.S. (46). This is followed by market leader Teledoc at 26 and MDLive. Thus, we believe this indicates the company’s solid customer satisfaction among clients. Moreover, only One Medical and American Well has physical locations among the top 5 telehealth companies with American Well having a higher number of locations than One Medical.

In addition, if the acquisition is completed, we expect One Medical to leverage Amazon Pharmacy. Besides that, Teladoc, American Well and Doctor on Demand have partnerships with pharmacies including CVS and Amwell Pharmacy. Furthermore, in terms of the number of employees, Teladoc has the highest number of employees at 5,100 followed by American Well as both companies employ doctors and nurses whereas MDLIVE and Doctor on Demand only employ doctors while American Well employs or contracts doctors by Online Care Group.

Finally, comparing the range of services among the top 5 companies, we found all of these companies to offer similar services including urgent care, primary care and mental health services. According to UCF Health, primary care physicians practice general medicine and monitor patients’ health conditions whereas urgent care is an intermediary between emergency room medicine and general medicine and “treats acute illnesses, injuries and ailments.” Additionally, other services such as chronic care are provided by Teladoc, One Medical, MDLIVE and Doctor on Demand, wellness and prevention by One Medical and Doctor on Demand as well as Children and family care provided by One Medical and American Well.

Still, we believe that based on the table above, Teladoc comes out on top as the best telehealth company with the highest revenue, market share, employees and partnership with CVS. On the other hand, we believe that MDLive is the worst among the competitors as it has the lowest employees, no partnership with pharmacies and physical locations and limited services provided.

|

One Medical Revenue Projections ($ bln) |

2021 |

2022F |

2023F |

2024F |

2025F |

|

One Medical |

0.62 |

1.02 |

1.47 |

2.13 |

3.07 |

|

Growth % |

63.94% |

63.61% |

44.40% |

44.40% |

44.40% |

Source: Amazon, One Medical, Khaveen Investments

Based on the company’s financials, One Medical had revenue of $ 623 mln in 2021 which represents 0.1% of Amazon’s total revenue. However, the company had a 5-year average growth rate of 37.9% which is higher compared to Amazon’s 5-year average growth of 28.3%. Furthermore, the U.S. telehealth market is forecasted to grow at a CAGR of 44.4% through 2028. In comparison, the global healthcare market has a CAGR of 8.9% according to Research and Markets. We projected One Medical’s revenue in 2022 based on prorated Q1 and Q2 results and based our projections beyond 2022 on the telehealth market forecast CAGR of 44.4%. We believe this assumption is appropriate as its revenue growth in the last 2 years was 60%+.

To conclude, we believe the acquisition of One Medical could be positive for Amazon based on its competitive positioning as the second largest telehealth company by market share only trailing behind Teladoc but noted it has the highest NPS score. Also, the company has physical locations and the second highest number of employees among the top 5 companies. Based on the market CAGR of 44.4%, we estimate the company to contribute $3.07 bln in revenue by 2025.

Synergies by Leveraging Amazon Massive User Base

Based on One Medical’s annual report, the company had a membership base of 767,000 member patients. In comparison, Amazon Prime had 159.8 mln users in the U.S. in 2021. We believe that Amazon could derive synergies from this acquisition by leveraging its massive user base. This view is also supported by Meghan Fitzgerald of Columbia University who explained that One Medical has a subscription model which could fit Amazon’s model.

I would imagine they’ll either add it to Prime, or there will be an upcharge to be a Prime One Medical subscriber, – Meghan Fitzgerald, health care policy professor at Columbia University

Numerous benefits of Amazon Prime include free same-day shipping on certain items and addresses; unlimited access to Amazon Music (13% market share), games, Prime Video (21% market share); discounts at Whole Foods, fast and free grocery delivery for certain locations; borrow books for Kindle and free one-year Grubhub+ membership.

Furthermore, we projected the synergies to Amazon by leveraging its massive Prime membership base. We multiplied the number of Prime members by the adoption rate of telehealth in the US to derive the number of Prime members who could use telehealth. According to McKinsey, the adoption of telehealth services in the U.S. has increased significantly to 46% in 2021 from just 19% pre-pandemic in 2019 and noted that 76% of survey respondents were interested in telehealth. Besides that, we then multiplied our estimated total Amazon Prime members synergy with the average spending per One Medical customer in 2021 ($846.88) to calculate the revenue synergies per year through Amazon Prime at $330.23 mln per year.

|

One Medical Revenue Synergies Projection ($ mln) |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

2027F |

|

One Medical Current Members (‘mln’) |

0.74 |

0.92 |

1.11 |

1.30 |

1.48 |

1.67 |

1.86 |

|

Growth % |

34% |

25% |

20% |

17% |

14% |

13% |

11% |

|

Amazon Prime Members Synergy |

0.39 |

0.39 |

0.39 |

0.39 |

0.39 |

||

|

Total Members |

0.74 |

0.92 |

1.50 |

1.69 |

1.87 |

2.06 |

2.25 |

|

Growth % |

34.1% |

25.4% |

62.5% |

12.5% |

11.1% |

10.0% |

9.1% |

|

Average Revenue per Member ($) |

846.88 |

846.88 |

846.88 |

846.88 |

846.88 |

846.88 |

846.88 |

|

Estimated Revenue Synergy from Amazon Prime ($ mln) |

330.23 |

330.23 |

330.23 |

330.23 |

330.23 |

Source: One Medical, Khaveen Investments

Moreover, Amazon acquired the online pharmacy company PillPack for $753 mln in 2018 and launched Amazon Pharmacy in 2020 as a prescription and delivery service. Amazon Pharmacy

allows customers to complete an entire pharmacy transaction on their desktop or mobile device through the Amazon App.

In relation to the acquisition of One Medical, we believe the deal could also provide synergies to Amazon Pharmacy. As explained by management in the quote below, the company explained the time-consuming process of visiting doctors and getting medicine from pharmacy stores.

Booking an appointment, waiting weeks or even months to be seen, taking time off work, driving to a clinic, finding a parking spot, waiting in the waiting room then the exam room for what is too often a rushed few minutes with a doctor, then making another trip to a pharmacy – we see lots of opportunity to both improve the quality of the experience and give people back valuable time in their days, – Amazon

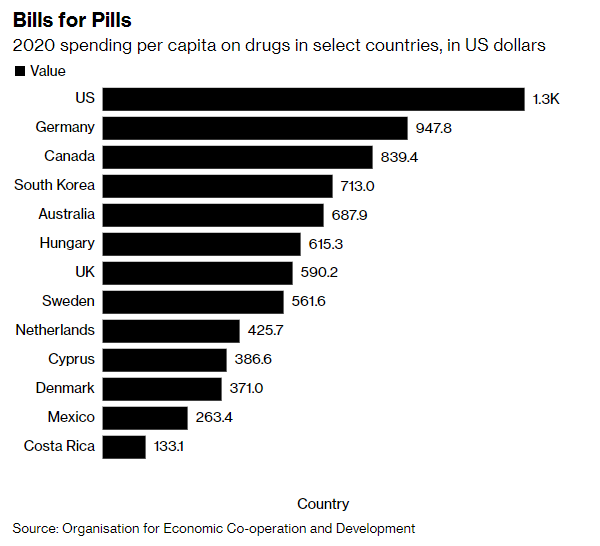

According to OECD, Americans spend an average of $1,300 per person per year on prescription medicine, the highest in the world as seen in the chart below.

Bloomberg, OECD

Based on the average spending on prescription medicine per person per year of $1,300, we multiplied this with our forecast of the total membership base in our previous point to project the synergies to Amazon Pharmacy.

|

Amazon Pharmacy Revenue Synergies Projection (‘mln’) |

2022F |

2023F |

2024F |

2025F |

2026F |

2027F |

|

Total Members (‘mln’) |

0.92 |

1.50 |

1.69 |

1.87 |

2.06 |

2.25 |

|

Growth % |

25.4% |

62.5% |

12.5% |

11.1% |

10.0% |

9.1% |

|

Average Pharmacy Spending US ($) |

1,300 |

1,300 |

1,300 |

1,300 |

1,300 |

1,300 |

|

Amazon Pharmacy Revenue Synergies ($ mln) |

1,950 |

2,193 |

2,436 |

2,679 |

2,922 |

Source: OECD, Khaveen Investments

Overall, we expect Amazon to derive synergies with its acquisition of One Medical through the potential integration with Amazon Prime with a complimentary subscription model and we estimated its synergies at $0.33 bln per year through 2026 by multiplying the total Prime US members with the adoption rate of telehealth and One Medical’s market with its historical revenue per customer. Additionally, we also believe the acquisition could provide synergies with Amazon Pharmacy and estimated its synergies based on our forecasts of its total members’ growth and the average prescription medicine spending by OECD. In total, we forecasted Amazon’s healthcare revenue to reach $9.66 bln in revenue by 2027 at an average growth rate of 26.7%.

|

Amazon Healthcare Revenue Projections ($ bln) |

2023F |

2024F |

2025F |

2026F |

2027F |

|

Telehealth (One Medical) |

1.47 |

2.13 |

3.07 |

4.43 |

6.40 |

|

Synergies (Amazon Prime) |

0.33 |

0.33 |

0.33 |

0.33 |

0.33 |

|

Synergies (Amazon Pharmacy) |

1.95 |

2.19 |

2.44 |

2.68 |

2.92 |

|

Total |

3.75 |

4.65 |

5.84 |

7.44 |

9.66 |

|

Growth % |

23.9% |

25.5% |

27.5% |

29.7% |

Source: Khaveen Investments

Higher Capex Spending Through Hybrid Care Model

This acquisition follows after Amazon launched Amazon Care in 2019. Clients of Amazon Care include companies such as Silicon Labs, TrueBlue and Whole Foods Market, Precor and Hilton (largest client with 141,000 employees). In 2021, Amazon Care had 40,000 workers enrolled in the program. Amazon Care provides a hybrid care offering combining virtual care and in-person services, this means that patients can access both virtual and in-person healthcare services as described below in the following quote.

Services include video care, in-app text chat with clinicians, mobile care visits, prescription delivery from a care courier and in-person care, where Amazon Care can dispatch a medical professional to a patient’s home for services ranging from routine blood draws to listening to a patient’s lungs. – Fierce Health Care

In comparison, One Medical also adopts a hybrid model combining in-person and virtual care. However, the difference with Amazon Care is that One Medical has 182 primary care locations across the U.S. Though, One Medical is currently in 12 major US markets compared to Amazon which is expanding to 20 new cities in 2022.

We are also seeing employers further recognize how our primary care hybrid in-person and virtual based model can deliver differentiated clinical outcomes and value-based care results, addressing backlogs of deferred care to prevent avoidable morbidity and cost down the road. – Amir Dan Rubin, Chair & Chief Executive Officer

In our view, while there is limited information on Amazon’s plans for One Medical in terms of its business model, whether it will adopt One Medical’s unique hybrid model combining virtual and in-person care at physical locations or change its model based on Amazon Care only where it still retains a hybrid model but limited to patient’s homes for in-person care, we believe that Amazon could adopt One Medical’s hybrid business model with physical locations for in-person service delivery. This is because of the several advantages we believe Amazon would have by adopting in-person.

According to Harvard Health Publishing, one of the disadvantages of telehealth virtual care is that not every medical visit can be done remotely as patients would still need to go to physical locations to perform certain tests such as imaging and blood tests and for more hands-on diagnoses. For example, in the case of Teladoc, the company implemented diagnostic testing which allows lab tests to be ordered from Quest or LabCorp or hospital labs. For example, patients would be required to visit physical locations to perform a strep test, blood count or X-Ray. Once the test is completed, patients would follow up with physicians on the telehealth platform. In comparison, based on its website, One Medical has on-site labs across its offices. Thus, we believe this could be more convenient for Amazon’s patients by offering a more seamless experience by accessing their physical locations and performing tests on-site.

Moreover, another advantage of in-person visits is that they are better children according to Mira due to it being easier for physicians to monitor the growth and development of children. In relation, it claimed that 25% of parents still visited their children’s care providers for in-person visits because they still needed to examine the child and for additional services including vaccinations or lab tests. As explained in the first point, based on our comparison of the top 5 companies, only One Medical and American Well, which both have physical locations for in-person visits, are the only companies providing specialized children and family care services. Thus, we expect Amazon to continue offering this type of care through One Medical and could be a possible factor for it to retain its physical locations model.

Finally, another factor we believe Amazon to retain and integrate One Medical’s hybrid model is due to the strength of Amazon’s financials. Compared to One Medical which had negative cash flow margins of a 5-year average of -9.6%, Amazon had positive free cash flows which highlight its cash generation strengths and could leverage it to expand One Medical’s physical locations. As stated, One Medical is in 12 major U.S. cities in comparison to Amazon Care which is expanding to 20 new cities this year. Thus, we expect the company to achieve a larger market size by expanding its footprint with its physical locations. In terms of margins, however, we expect the expansion to weigh negatively on Amazon’s profit margins due to the additional costs that would be incurred for operating physical locations.

Thus, we believe Amazon would retain and integrate One Medical’s hybrid model with both virtual care and in-person care at physical locations. In comparison, we believe Amazon’s Whole Foods acquisition is similar as the company not only adopted technologies such as delivery and online ordering but also continued to expand its physical footprint with 54 stores opened worldwide since its acquisition in 2017 (472 stores) and with 40 new stores planned across the U.S. We projected Amazon’s healthcare capex growth based on One Medical’s historical capex per revenue at a 5-year average of 11.9% from 2022 onwards on our total revenue projections for Amazon’s healthcare segment.

|

Amazon Healthcare Capex Projections ($ mln) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

2027F |

|

Amazon Healthcare Revenue (One Medical) |

176.8 |

212.7 |

276.3 |

380.2 |

623.3 |

1,020 |

3,753 |

4,650 |

5,837 |

7,443 |

9,655 |

|

Amazon Healthcare Capex (One Medical) |

14 |

10.8 |

54.4 |

63.7 |

63.6 |

121.6 |

447.6 |

554.6 |

696.3 |

887.9 |

1,152 |

|

Amazon Healthcare Capex as a % of Revenue |

7.9% |

5.1% |

19.7% |

16.8% |

10.2% |

11.9% |

11.9% |

11.9% |

11.9% |

11.9% |

11.9% |

|

Amazon Total Adjusted Capex |

11,955 |

13,427 |

16,861 |

40,140 |

61,053 |

43,749 |

54,634 |

63,156 |

73,048 |

83,063 |

92,839 |

|

Amazon Capex as a % of Total Revenue |

6.7% |

5.8% |

6.0% |

10.4% |

13.0% |

7.9% |

8.4% |

8.5% |

8.5% |

8.5% |

8.5% |

|

Amazon Healthcare Capex as % of Total Capex |

0.8% |

0.9% |

1.0% |

1.1% |

1.2% |

Source: One Medical, Khaveen Investments

All in all, despite both Amazon Care and One Medical offering a hybrid model of in-person and virtual care, One Medical has a distinct model providing in-person care in physical locations across the US compared to Amazon Care which only dispatch personnel to patients’ homes. Thus, as the company acquires One Medical, we expect the company to adopt One Medical’s hybrid model approach with the potential benefits including enabling patients to perform diagnostics with on-site labs and providing a larger range of healthcare services such as family and children care.

Additionally, referring to its acquisition of Whole Foods, we noted that Amazon had infused the business with a technological edge while continuing to expand its physical footprint across the U.S. Thus, we believe the company could incur higher capex assuming it combines the hybrid model with its acquisition to increase its coverage in the U.S. We projected Amazon’s healthcare segment capex at a 5-year average of 11.9%, reaching $1.15 bln by 2027.

Risk: Competitive Threats

In the emerging telehealth market, we believe Amazon’s expansion into this market could be faced with competitive threats. For example, pharmacy retail chain Walgreens (WBA) had also expanded into telehealth through partnerships with care providers to connect them with its Walgreens Find Care platform. Besides Walgreens, other competitors include CVS through its subsidiary Aetna Inc. Walmart (WMT) (Video Doctor Visits and MeMD acquisition) had also expanded into telehealth and adopted an omnichannel strategy leveraging their brick and mortar locations. Thus, we believe this could pose a risk to Amazon’s expansion into the telehealth market as these competitors leverage their physical locations through an omnichannel approach.

|

Companies |

Number of Physical Locations |

|

Walgreens (WBA) |

8,965 |

|

CVS (CVS) |

9,749 |

|

Walmart US (WMT) |

5,335 |

|

Amazon (One Medical and Whole Foods) |

1,769 |

Source: Walgreens, ScrapeHero, Walmart, One Medical, Khaveen Investments

CVS, Walgreens and Walmart have a significantly higher number of physical stores across the US compared to Amazon (One Medical). However, as discussed in the 3rd point, we expect Amazon to integrate its hybrid business model and leverage its strong cash flows to expand its locations. Based on our capex projections and the average capex per location of $3.48 mln from our capex forecast of $121.6 mln in 2022 over the average reported planned location increase of 35 in 2022, we estimated its locations to increase by 1,076 in 5 years to a total of 1,258 through 2027. In addition, we also added the number of Whole Foods stores in the U.S. (511) for a total estimate of 1,769 physical locations for Amazon.

Valuation

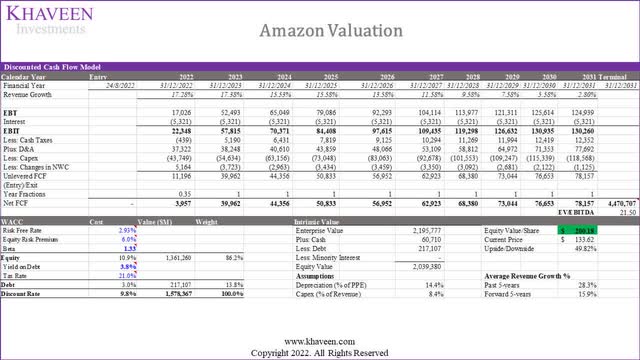

We updated our projections for the company from our previous analysis of Amazon with our estimated revenue contributions for Amazon’s acquisition of One Medical and revenue synergies as derived from the points above. Overall, we expect Amazon’s revenue growth to accelerate with a forward 3-year average of 15.9% compared to our previous analysis of 15.7% with our estimated revenue contributions for Amazon’s healthcare segment.

|

Revenue Projections ($ bln) |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Online stores |

222.1 |

243.60 |

269.61 |

294.84 |

323.17 |

|

Growth % |

12.53% |

9.69% |

10.68% |

9.36% |

9.61% |

|

Physical stores |

17.08 |

18.20 |

19.02 |

19.88 |

20.77 |

|

Growth % |

5.21% |

6.60% |

4.50% |

4.50% |

4.50% |

|

Retail third-party seller services |

103.4 |

129.2 |

157.0 |

188.5 |

226.8 |

|

Growth % |

28.47% |

25.03% |

21.49% |

20.05% |

20.32% |

|

Subscription services |

31.77 |

39.49 |

48.47 |

58.77 |

70.44 |

|

Growth % |

26.01% |

24.32% |

22.73% |

21.25% |

19.86% |

|

AWS |

62.202 |

75.9 |

93.0 |

113.1 |

137.5 |

|

Growth % |

37.10% |

22.00% |

22.51% |

21.70% |

21.51% |

|

Advertising services |

31.16 |

41.93 |

52.70 |

63.46 |

74.23 |

|

Growth % |

57.59% |

34.56% |

25.68% |

20.43% |

16.97% |

|

Other |

2.18 |

2.7 |

3.3 |

4.0 |

4.9 |

|

Growth % |

29.52% |

22.30% |

22.30% |

22.30% |

22.30% |

|

Telehealth (One Medical) |

0.62 |

1.02 |

1.47 |

2.13 |

3.07 |

|

Synergies (One Medical) |

0.33 |

0.33 |

0.33 |

||

|

Synergies (Amazon Pharmacy) |

1.95 |

2.19 |

2.44 |

||

|

Total |

469.82 |

551.00 |

646.78 |

747.22 |

863.61 |

|

Total Growth % |

21.69% |

17.28% |

17.38% |

15.53% |

15.58% |

Source: Amazon, Khaveen Investments

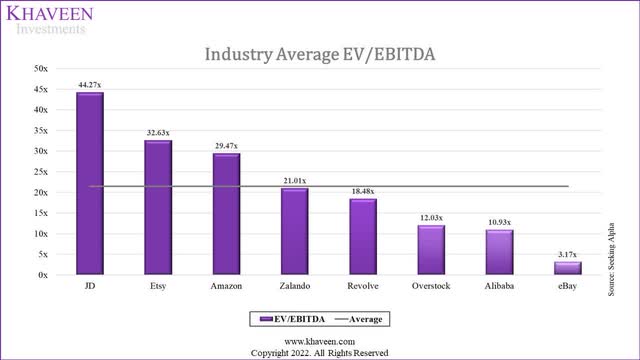

We valued the company with a discounted cash flow (“DCF”) as we continue to expect the company to generate positive FCFs with a forward 3-year margin of 4.72%. For the terminal value, we based it on the average internet retail industry EV/EBITDA of 21.5x.

Seeking Alpha, Khaveen Investments

Based on a discount rate of (9.8%), our model shows Amazon shares are undervalued by 49.82%.

Verdict

To conclude, following the recent announcement of the planned acquisition of One Medical by Amazon for $3.9 bln, we examined the company and determined its competitive positioning in second place behind Teladoc based on market share, but noted its highest NPS among the top 5 companies. Moreover, we forecasted its synergies with the potential integration with Amazon Prime as both have a subscription model as well as synergies with the potential integration with Amazon Pharmacy.

In total, we estimated its revenue from the healthcare business to reach $9 bln by 2027 at an average growth rate of 26.7%. Lastly, we believe the company could incur higher capex spending with the hybrid model adopted by One Medical and projected its capex based on a 5-year average of 11.9%.

Overall, we valued the company with a higher price target of $200.18 with higher revenue growth at a 5-year average of 15.9% compared to 15.7% previously as well as a higher EV/EBITDA average based on the e-commerce industry and maintain our Strong Buy rating for the company.

Be the first to comment