Farhan Nashrullah/iStock via Getty Images

About 7 months ago, our view was that Apple (NASDAQ:AAPL) was dead money for at least 4 years. The stock was at $166 when the article was published and now trades at $140, so far living up to the dead money theory. My investment thesis still predicts the tech giant won’t see any upside until at least FY26 due to the constant push out of key new products.

Product Delays

Apple is finally getting hit by market realization that the iPhone maker will indeed face a difficult period, topping the COVID-19 pull forwards from the prior years. The stock wasn’t accurately priced for this scenario where revenue growth was the potential to turn negative following a quarter with reported growth at only 1.9%.

Besides, what Apple investors really need is for the new hyped products to hit the market and drive growth. Since the March article, the tech giant has only pushed back the launch of a VR/MR headset into 2023 and the Apple Car has seen no traction.

Meta Platforms (META) just released their Quest Pro mixed reality device with a $1,499 price tag. The company will start shipping the product in October in time for the holiday season, while Apple still has no official release date.

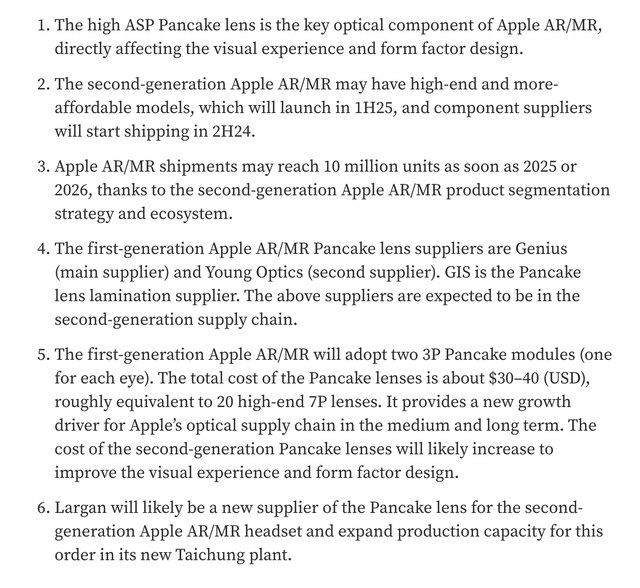

Influential Apple analyst Ming-Chi Kuo has the new AR/MR headset being released in January 2023. The date is quickly approaching, with no signs Apple is actually ready for launching the new product category due to repeated issues. Mr. Kuo lists the following updated on the AR/MR product category:

Source.: Ming-Chi Kuo Medium page

A key point from the analyst is that the second-generation AR/MR device release may not occur until the 1H’25. The analyst predicts a product expansion with lower end models with component suppliers shipping in the 2H’24.

The huge two-year delay from the possible original product launch will place Apple far behind the path of Meta. Apple effectively won’t have anything other than a “Pro” device for at least 2.5 years from now and 3 years after by original dead money due to an elevated stock price from his overly hyped product.

While Kuo predicts Apple might sell 10 million units in 2025 or 2026, one would probably assume this number isn’t reached until FY26. At an ASP of $1,000, Apple would sell about $10 billion worth of AR/VR devices. Considering Meta originally hit around 10 million units with an ASP in the $400 range, Apple would be lucky to achieve this high ASP at those volumes. An ASP cut in half reduces the revenue levels to $5 billion in FY26.

The other major catalyst is Apple Car and the company isn’t making any progress while EV competitors are starting to ramp up fast. The tech giant appears so late to the market with no official production plans here, while even Lucid Group (LCID) produced 2,282 vehicles in Q3 alone. Apple is following the playbook of other products the company has entered, but a late entry into the EV sector may leave limited manufacturing capacity and demand for an Apple product.

One still has to question how Apple is going to compete in a market already rampant with aggressive new entrants plus the historical auto manufacturers aggressively moving into EVs and self-driving technology. In the smartphone market, Apple innovated a new product that vastly improved the ones being sold at the time. The auto sector doesn’t have any demand or need for a new entrant, with players like Tesla (TSLA) already aggressively driving into EVs and AVs. The Apple Car would’ve made much more sense as a catalyst, if Elon Musk didn’t exist and already have driven the auto manufacturers to invest aggressively into new innovations.

FY26 Doesn’t Show Much Improvements

By FY26, the hot new AR/VR and Apple Car categories probably have the potential for delivering $5 billion in annual revenues, at most. Even under some aggressive growth targets for 4% to 5% revenue growth annually during this period, Apple will still hit nearly $450 billion in annual revenues by FY25.

These key new categories will only produce 1% of annual revenues and will be immaterial to the business in most regards entering FY26. Analysts have revenues topping $475 billion that year and these estimates no doubt already including revenues for AR/MR devices.

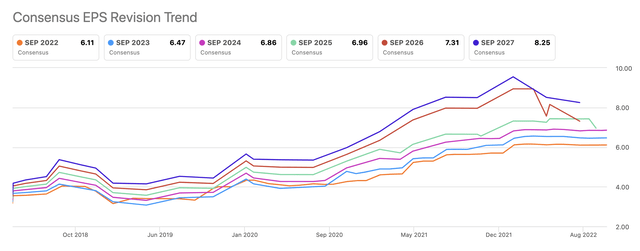

Analysts forecast FY26 EPS targets now down at $7.31. The stock still trades at nearly 20x EPS targets for 4 years out despite falling $25 in the last 7 months.

The market is starting to realize that analyst estimates are far more accurate historically outside of the Covid pull forward period. An investor shouldn’t expect these EPS numbers to be wildly low and the major catalyst from AR/VR devices and the Apple Car aren’t going to drive the stock higher. Since the start of the year, average analyst EPS targets have either flatlined or fallen for all of the years out through even FY27

Takeaway

The key investor takeaway is that Apple is still expensive at $140 for the earnings expected in FY26. My original prediction was that the tech giant’s stock would be lucky to trade above $166 in 4 years, and now the data is clear that Apple won’t even top $140.

Investors need to come to grips with the new reality for the iPhone manufacturer.

Be the first to comment