Emirhan Karamuk

After our analysis of the Dare Forward 2030 plan presented by Stellantis (NYSE:NYSE:STLA), today we are back to comment on the many and latest company developments.

General Motors agreement

Starting with the latest news, today Stellantis announced it will execute a stock repurchase with General Motors (GM). Looking more in detail, the two companies have entered into an agreement for the repurchase of 69.1 million Stellantis ordinary shares which represent approximately 2.2% of the total automotive group capital on a diluted basis. General Motors is entitled to receive these shares after the exercise of the warrants originally issued by Peugeot to the US group in 2017. The warrants were issued as part of General Motors’ acquisition of the Opel Vauxhall automotive business. Moreover, following the warrant exercise, Stellantis will deliver to General Motors approximately 1.2 million Faurecia ordinary shares in addition to €130 in cash related to dividend rights paid by PSA and Stellantis. However, under the agreement, Stellantis ordinary shares will be repurchased in September 15 for a total consideration of approximately €1 billion.

ACEA news

Important to report is the fact that Stellantis will leave the European manufacturers’ association to create its own lobbying organization called the Freedom of Mobility Forum. The group born from the merger between Fiat-Chrysler and Peugeot announced that by the end of the year it will leave ACEA, the body that brings together the major manufacturers of the old continent. Stellantis did not motivate this disruptive news, however, for some experts, this could be the result of differences with the German manufacturers regarding the ban on diesel and oil in Europe.

In detail, the Freedom of Mobility Forum will be an annual meeting and its first edition will be held in 2023. The gathering will be planned and coordinated by an advisory board of experts, who will represent various stakeholders in the automotive sector, including mobility and technology providers, academics, politicians and scientists. The Forum’s aim, explains a note, is “to support Stellantis in the transition from lobbying to a more direct interaction with citizens and the parties involved, strengthened by the company’s decision to withdraw from ACEA at the end of 2022“.

Stellantis significantly pointed out that the forum will be influenced by 4 principles: 1) a 360-degree global vision, 2) insights and new automotive solutions, 3) transparency to ensure that all positions are made available to all, and 4) based on respect and collaboration.

The abandonment and the modalities of its announcement by Stellantis conceal a polemic vein towards ACEA. Although the reasons are not explicit, the informed assets trace the group’s decision to differences with the German manufacturers regarding European policies. Within our coverage, Volkswagen (OTCPK:VWAGY), Mercedes (OTCPK:DMLRY) and BMW (OTCPK:BMWYY) have backed the EU decision to ban diesel and oil cars and to start selling only BEV from 2023.

Chip crisis and lower production

Looking at the Stellantis half-year report, we can clearly conclude that the semiconductor shortage is still hitting the auto industry. And there is no solution on the horizon for the moment (yesterday, we published an analysis on STMicroelectronics (STM) in which the CEO explicitly said that semis production capacity is already fully booked to 2023). Paying the costs are the two largest Stellantis factories in Italy, Melfi and Sevel (for the commercial vehicle’s production), which in the first half of the year respectively lost 17% and 37% of production compared to January-June 2021. This is the fifth year of decline for Stellantis production in Italy, with a third of the volumes lost compared to the million units in 2017.

Over the course of 2022, due to the ongoing challenges, Stellantis has decided to close for 15 days the Italian production plants. In the meantime, the company is preparing a new plan of voluntary and incentivized exits that comes after a trade union agreement. In total, the company’s goal is 1,820 voluntary and incentivized exodus. We remind our readers that in Italy approximately 50 thousand workers are employed by Stellantis. The incentives have been provided in order to allow seniors a bridge to retirement and to give a severance pay based on age to those who are further away.

A very similar situation is happening also in Detroit factories. Stellantis announced the start of a layoff program at the Sterling Heights plant, without specifying the number of workers involved. In an email, the automaker explained that the decision was made “in order to run the plant in a more sustainable way“.

Q2 results and Conclusion

Very briefly, between January and June, Stellantis recorded net revenues of €88 billion up 17% compared to the first half of 2021 with a net profit of €8 billion up 34% compared to last year’s results. This is due to the increase in list prices, the sale of more top-of-the-range vehicles and the positive effects of the exchange rates between €/$. This offsets the drop in deliveries which fell by 7% in the first half of the year, reaching just over 3 million units. Very good numbers were also driven by North America. In detail, Stellantis’ market share increased by 40 basis points on an annual basis reaching 11.3%. Moreover, the company ranked second in the European market for sales of pure electric (BEV) and other low-emission cars. Global BEV sales increased nearly 50% year-on-year, reaching 136,000 units in the first half.

Source: Stellantis Q2 results

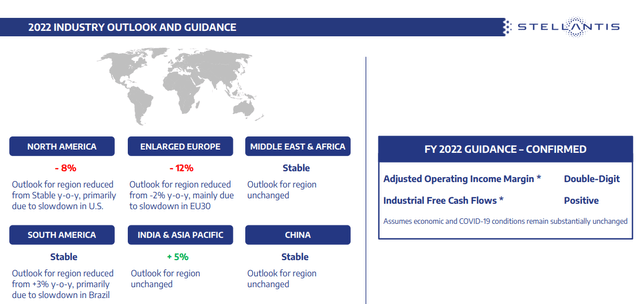

Thanks to the latest results, Stellantis was able to confirm its forecasts for the end of the year which provides a double-digit adjusted operating margin and a positive industrial cash flow.

In our opinion, these are rather conservative estimates which, however, take into account a worsening of the scenario in the global auto market. In fact, Stellantis has revised its outlook for 2022 downwards with the North American market in particular passing from a stable number to a decline of 8% and the European one from -2% to -12%.

Q2 results showed a broad-based beat versus analyst expectations. In particular, the company reached an operating margin of 14.1% and industrial cash flow of €5.3 billion, also achieved thanks to €3.1 billion in synergies. There is also strong industrial liquidity available so we expect to see improvements in the consensus on EBIT close to double digits after these better-than-expected results. Once again, we maintain our buy target at €20 per share.

Source: Stellantis Q2 results

Be the first to comment