2d illustrations and photos

Thesis Overview

I recommend going long Clear Channel Outdoor Holdings, Inc. (NYSE:NYSE:CCO) as it has a huge market opportunity ($189bn TAM). It is a business that is undergoing a digitization transformation process that will improve its growth and profit profile. The trend of out-of-home (OOH) advertising capturing share from traditional advertising mediums should continue to support CCO over the coming years.

Company Description

CCO is an OOH advertising company with a scaled presence in the United States and Europe. CCO delivers clients’ marketing campaigns locally, nationally, and internationally, utilizing more than 500,000 advertising displays across 26 countries, enabling advertisers to engage with consumers when they are OOH through its portfolio of out-of-home advertising displays in many of the world’s most desirable markets.

The business model is simple. CCO owns the permit and display structure for a typical billboard, leases the ground location for a long period of time (typically 10 years), and rents the display to advertisers for varying periods of time (usually less than 12 months). CCO routinely submits bids to the relevant municipal authorities to guarantee continued access to public spaces like airports and public transportation systems. Compared to billboards, profits are lower in public space formats because there is more competition and contracts need to be renewed every five to twenty years.

As of FY21, CCO has revenue exposure of 52% in the US, 45% in Europe, and 2.6% in other countries.

Thesis Discussion

Huge TAM

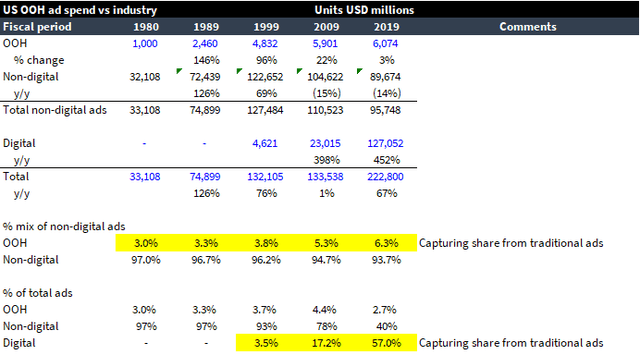

The TAM is significant for CCO. TAM for OOH users is estimated to be $195 billion, with OOH spending representing 5% ($9 billion) in 2021. There are $186 billion in opportunities for the industry to continue capturing market share. In order to gain more insights, I dissected where OOH captured shares using data points from the US advertising industry, and from where it would continue to capture shares in the future.

Own model, OAAA, MAGNA, Bureau of Labor Statistics

Over the years, OOH has maintained a consistent share of the overall media mix pie in the United States, accounting for roughly 3% to 4% of total advertising spend (before 2019). For the past two decades, OOH and the Internet have been the only share gainers and absolute growers as traditional media has donated share. I believe that there is still a lot of room for OOH to take market share away from other traditional advertising mediums. In Asia, for example, OOH spend accounts for 15% and 12% of advertising spend in the Philippines and Singapore, respectively.

The OOH advertising industry and CCO are also making significant strides in programmatic advertising, particularly as advertisers transition from static to digital billboards, allowing inventory to be reserved and purchased online. Programmatic advertising enables the purchase of digital OOH via auction. In the long run, I believe that a programmatic approach will result in significantly higher efficiencies in the OOH sector (algorithms that automatically optimize and distribute ad budgets). All of these advertising spend advancements that boost advertiser ROIs will also assist OOH in capturing a much larger portion of the media mix pie.

CCO has a portfolio of assets that provide extensive reach to consumers

The majority of CCO’s global asset portfolio is made up of the following:

- billboards, a well-known medium for communicating big brand messages with a wide audience;

- street furniture displays, which typically target urban city centers;

- airport displays, which target customers with long “dwell times” and multiple exposures for frequent campaigns; and

- other transit displays, like bus and rail displays, which offer prominent exposure in communities.

Aside from the traditional inventory, CCO offers a growing selection of digital screens, which feature print out-of-home ads. Digital screens typically feature advertisements for multiple clients and can change messages throughout the course of a day.

Billboards in the United States are, in my opinion, one of the most important assets that CCO has access to. It is important to note that there will most likely be no more billboards built along highways. Even if there is competition to build a new one, it would have to overcome several regulatory hurdles, aided by the U.S. 1965 Highway Beautification Act. This means that larger players with long-term contracts to use billboards will have a structural advantage over smaller players.

Putting more flavor into CCO’s extensive reach, CCO is present in 41 of the top 50 designated market areas (DMAs) in the United States, as well as all of the top 20 DMAs. Its European portfolio includes 17 countries (16 European countries plus Singapore), with a focus on densely populated metropolitan areas. CCO’s broad reach enables it to provide advertisers with broad reach and frequency across the country.

According to the analysis I conducted above (using data from the US as a sample), advertisers have been devoting a larger portion of their advertising budgets to out-of-home advertising (over the past few decades). I believe that a big part of this shift is the need to reach as many customer touchpoints as possible, especially with so many avenues competing for consumers’ eyeballs/mindshare today (i.e., Facebook, Instagram, YouTube, and even the upcoming Netflix).

Digitization of advertising displays drives higher revenue growth and margins

For a long time, OOH advertisements were printed on static media, and switching from one ad to the next was a laborious process. Recently, companies like CCO have begun replacing static print billboards with dynamic digital panels that can switch between different ads every few seconds. Because of the improvements in mobile tracking, savvy digital marketers now have a plethora of options for digital attribution, planning, and analytics (covered further below in connection to RADAR). New programmable possibilities have also helped these alternate options flourish.

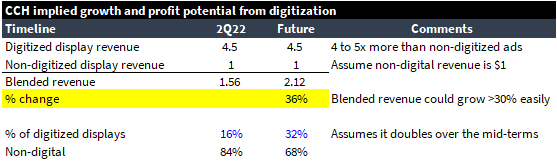

The benefits of digitizing the outdoor advertising display channels are far from just benefiting the advertisers. For CCO, it improves revenue by 4 to 5x and generally yield ~30% IRR over the lease term. This is important to note as the increase in revenue would increase profits by a larger magnitude given the fixed cost of leases. As of LTM 2Q22, only ~4.7% of CCO’s displays are digitized, which means there is a significant runway ahead for CCO to continue reaping the benefits of digitization, hence accelerating revenue and profit growth. Below is an illustrative analysis to show the potential impact on revenue as CCO digitizes more displays moving forward.

Own model, Company Filings

Overall, as suggested by the increase in revenue, digital OOH fetches far higher prices than conventional print billboards (4 to 5 times more). In return, ROIs for marketers have surged because of digital and programmatic OOH solutions since OOH advertising now offers comparable trackability and analytics to digital advertising, a win-win situation.

Implementation of the RADAR system improves the ability to measure performance

The significance of data transfer via mobile devices is growing. As people move about their day, their mobile phones record where they go and how they get there. To take advantage of the rising significance of mobile data, CCO developed RADAR, a unique suite of mobile data technologies for analyzing, measuring, and optimizing out-of-home advertising campaigns.

For CCO, this meant using RADAR to geofence their entire territory with viewability grids so they could track who was seeing their outdoor advertisements. The collected information can be used by CCO to evaluate and analyze exposed OOH audiences by gaining insights into consumer movements and behaviors through the use of mobile location data.

This is a significant breakthrough because it allows for the granular evaluation of the effectiveness of advertising campaigns. I believe that as digital billboards become more prevalent, demand from marketers will increase for the reasons stated above.

Valuation

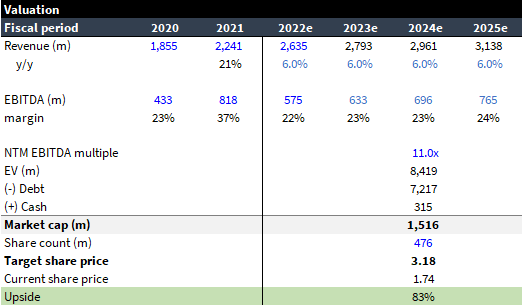

In my model, I estimate sales to rise at the higher end of management forecast at 6% CAGR and EBITDA margins to achieve 24% in FY25e, delivering $765 million EBITDA, which is in line with the higher end of management guidance.

CCO currently trades at ~10x forward EBITDA, which is near its 10-year average. Given that CCO’s business quality is expected to improve moving forward due to digitization, leading to better revenue growth and profitability, I assume CCO will trade 1 multiple turn higher than today: 11x forward EBITDA.

With the above assumptions, I believe CCO could be worth ~1.5bn market cap or $3.18/share, implying an 83% upside over the next 2 to 3 years. I would point out that CCO is an extremely levered company (~10.5x net debt/EBITDA as of LTM 2Q22), hence any slight change in enterprise value or paydown in debt has a huge impact on equity value.

Own model

Key Risks

International businesses’ shorter contracts could lead to unpredictability in results

CCO’s smaller overseas billboard company offers the majority of its contracts for 1-2-week durations, with contracts often lasting substantially less time than in the United States. This increases revenue unpredictability and reduces visibility into the billboard business’s long-term viability.

CCO is an extremely levered business

While I am optimistic about the goal of deleveraging while creating significant cash flow, I am concerned that leverage will stay high for some time. The increased debt has a significant influence on equity value; any fall in enterprise value as a result of profit margin compression or sales decline would devastate the stock price.

Conclusion

To summarize, I believe this investment opportunity exists because the market does not value the long-term growth and profit profile, which is understandable given the market’s recent dislike for highly leveraged (high IR environment) and macro-economy dependent companies. CCO is a deep value and mid- to long-term play that has the potential to be a multi-bagger if it continues to develop as I predicted.

Be the first to comment