peepo/iStock via Getty Images

Investment Thesis

Since our previous articles on Trulieve Cannabis Corp (OTCQX:TCNNF) and Tilray Brands (NASDAQ:TLRY), there have been some interesting updates to cannabis legalization in the US. On 1 April 2022, the lower house of US Congress approved the MORE Act, designed to legalize cannabis nationwide, while also expunging previous criminal convictions and imposing a tax on the sale of all its products. Given that the Act requires a few more rounds of approval process through the House and Senate, we do not expect to see actual federal legalization soon. Even then, it remains to be seen if both companies are able to report sustained profitability and positive FCF post-legalization.

We will discuss if legalization will be a game-changer for both cannabis producers. In the meantime, we encourage you to read our previous articles on Trulieve and Tilray, which would help you better understand their position and market opportunities in the cannabis business.

Cannabis Producers Are Not Quite In The Green Yet

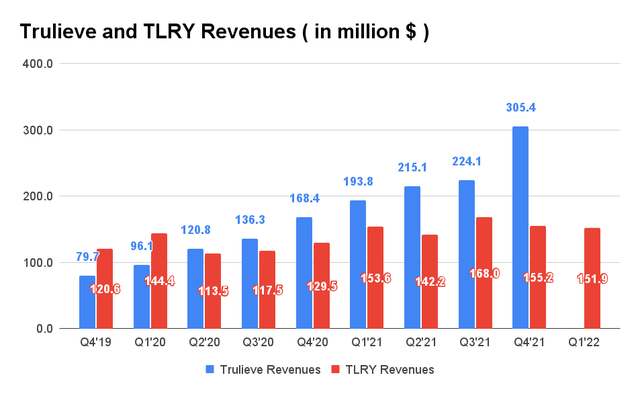

Trulieve and TLRY Revenue

Trulieve recently reported revenues of $938.3M in FY2021, representing impressive increases of 79.9% YoY. In FQ4’21, the company also reported revenues of $305.4M, representing excellent growth of 36.2% QoQ and 81.3% YoY, partly attributed to the acquisition of Harvest Health in October 2021. Trulieve was also able to report such favorable growth due to its consumers’ robust demand for medical and recreational cannabis from its 162 dispensaries across eight states, thereby efficiently utilizing its 4M square feet of cultivation and processing capacity.

On the other hand, despite its diversified product segments, including hemp, cannabis (both recreational and medical), and alcohol, in multiple countries such as the US (hemp and alcohol only), Canada, Germany, Israel, amongst others, TLRY only reported revenues of $151.9M in Q1’22 (FQ3’22), representing a decline of -2.1% QoQ and -1.1% YoY. It may appear that TLRY needs the federal legalization of cannabis in the US, in order to record similar demand and growth to Trulieve, given that the US accounts for the majority of the cannabis market at 80.6% in 2021. However, it could also be that demand from the EU simply needs a little more time to ramp up, given that many countries have yet to legalize cannabis.

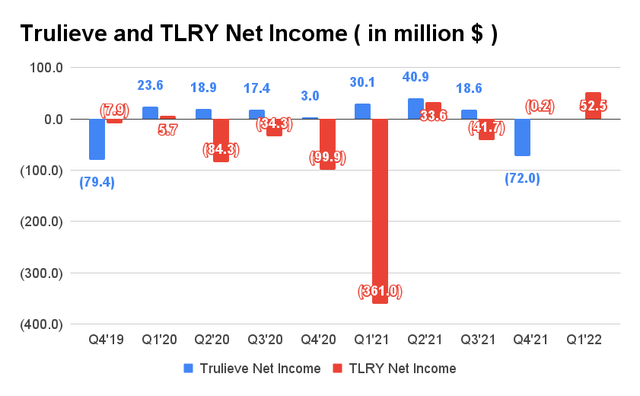

Trulieve and TLRY Net Income

If we were to study both companies’ net incomes, it is apparent that TLRY has yet to achieve sustained profitability in the past two years despite the COVID-19 cannabis boom. The company only started to report a net income of $52.5M in Q1’22 (FQ3’22), partially attributed to its expanding presence in the EU, including through its medical cannabis in Germany. However, assuming that TLRY is able to sustain its demand from the EU market, we expect this year to be the season of growth for the company. TLRY has also indicated that the EU presents a potential $1B market opportunity for its projected $4B revenue by 2024 in its latest earnings call.

As for Trulieve, though the company recorded a net income of -$72M in FQ4’21, it is due to a one-time expense incurred from the acquisition of Harvest Health. Excluding the $105.4M compensation, Trulieve would have easily recorded a net income of $33.4M for the quarter, representing excellent growth of 79.5% QoQ and 1113% YoY. For FY2021, Trulieve would have also reported a net income of $123.4M, representing an impressive increase of 95.8% YoY. As a result, the company continues to maintain its strong leadership position in the US cannabis market with robust profitability.

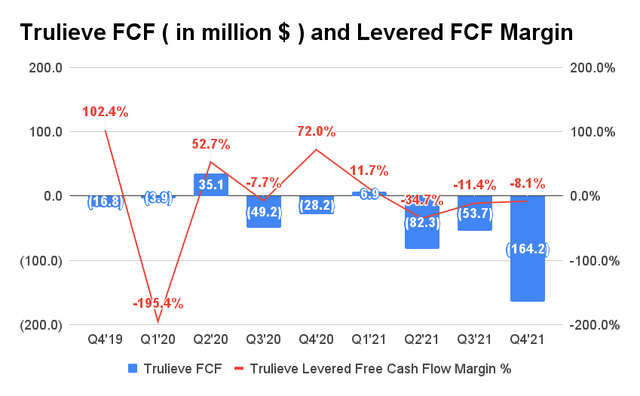

Trulieve FCF and Levered FCF Margin

Given that both companies are still aggressively expanding their presence, they have yet to report positive Free Cash Flow (FCF) yet. Since FY2020, Trulieve increased its retail network by 216% YoY and manufacturing capacity by 207% YoY, as of 30 March 2022. These are done through a mix of organic expansion and acquisitions throughout the year, leading to a 209% growth in capital expenditure in FY2021. In addition, the company had announced its plan to expand its presence in Connecticut, Maryland, West Virginia, and Georgia. Assuming US federal legalization by the end of the year, we expect Trulieve to increase its capital expenditures nationwide through additional stores and manufacturing capacity. Therefore, we do not expect Trulieve to report a positive FCF just yet.

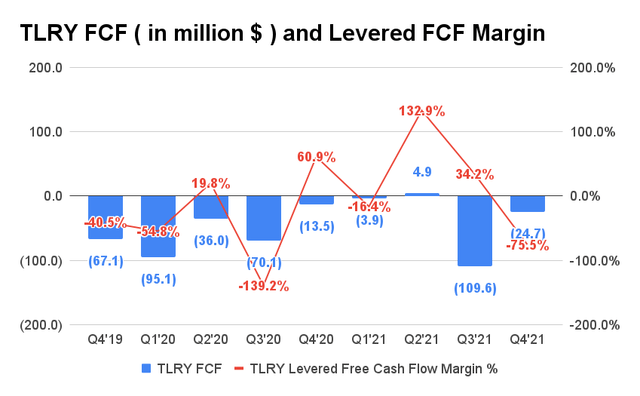

TLRY FCF and Levered FCF Margin

As for TLRY, the company has been busy expanding its presence in the EMEA in 2021, significantly in Germany and Israel, leading to the growth in its regional revenues by 37% QoQ. In addition, TRLY also operated two GMP facilities in Portugal since 2019 and Germany since 2021. As a result, the company increased its capital expenditure by 24% YoY from $590.46M to $732.45M, through its investments in land, production facilities, and equipment. In addition, assuming the US federal legalization by the end of the year, we expect TLRY to potentially ramp up its production to meet additional demand from the US market. As a result, TLRY is also not expected to report positive FCF by 2024.

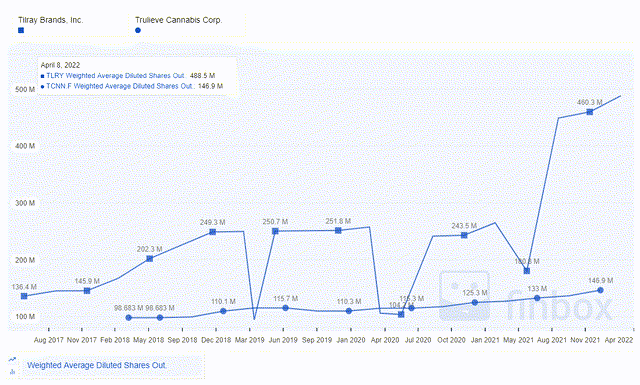

Trulieve and TLRY Share Dilution

Moving forward, we expect both companies to continue to rely on a mixture of debt leveraging and share dilution, in order to fund their aggressive expansion and growth. As of April 2022, Trulieve and Tilray have a total debt and warrant liabilities of $862M and long-term debt of $121M, respectively.

So, Is TLRY Stock A Buy, Sell, or Hold?

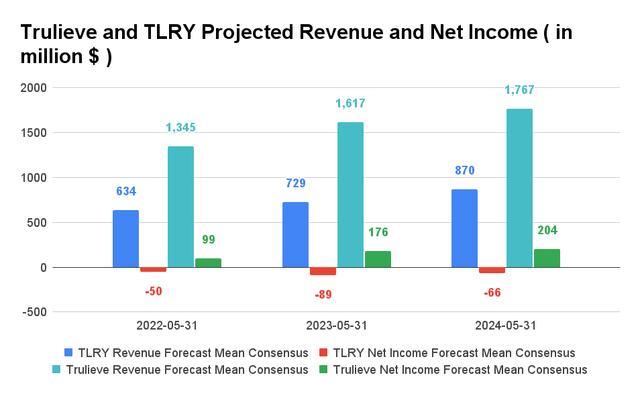

Trulieve and TLRY Projected Revenue and Net Income

Since our last analysis of the two companies, consensus estimates have remained somewhat consistent for TLRY’s projected revenue, which is expected to grow at a CAGR of 17.15% over the next two years. However, Trulieve’s projected revenue has been downgraded by over 30%. The revised projected revenue growth for Trulieve is now at 14.62% over the next two years, instead of the previous 28.88%. Interestingly, its net income is expected to remain at the same level, probably due to economy of scale and improved margins. In addition, the fact remains that Trulieve has managed to remain profitable despite its aggressive expansion and acquisitions in 2021. Given its stellar execution, we expect Trulieve to continue its excellent performance once the federal government legalizes cannabis nationwide.

For FY2022, Trulieve guided revenues in the range of $1.3B to $1.4B, representing excellent growth of 49.2% YoY. As for TLRY, consensus estimates that TLRY will report revenues of $634M for FY2022, representing an increase of 23.5%, which meant that the company would have to report revenues of $158.96M in FQ4’22. Nonetheless, TLRY is still not expected to report profitability in the next two years, given the slower rate of legalization processes in the EU. Even if legalization in the US happens, we still do not peg much hope to TLRY’s revenue growth and profitability, given how its partner in the US, MedMen (OTCQB:MMNFF), has yet to report positive net income and FCF yet.

Trulieve is currently trading at an EV/NTM Revenue of 3.25x, lower than its historical mean of 4.33x. TLRY is also trading at an EV/NTM Revenue of 5.44x, lower than its historical mean of 7.42x. Due to its strong execution and aggressive expansion, consensus estimates have rated Trulieve as a strong buy, given that the stock is trading at $20.50, down 60% from its 52 weeks high of $51.70.

On the other hand, TLRY remains a speculative buy, given the potential growth in the EU legal cannabis market, which is expected to grow from $486.2M in 2021 to $863.1M in 2025, at a CAGR of 15.43%. Given that TLRY is trading near the bottom at $6.48 on 7 April 2022, down 70% from its 52 weeks high of $21.43, the stock may be a potential buy for bottom fishing cannabis investors. However, given its performance, we expect to see the stock retrace further to new lows before recovering upon a positive catalyst, such as the eventual federal legalization in the US. Nonetheless, we must admit that TLRY has the potential for massive revenue growth, given its strong presence in the EU and strategic ownership of multiple alcohol businesses that are complementary to its cannabis business.

Therefore, we rate Trulieve stock as a Buy and TLRY stock as a speculative Buy.

Be the first to comment