Kativ/E+ via Getty Images

Hallador (NASDAQ:HNRG) reports sales contracts and visibility for the years 2023 and 2024. Management is also expecting an increase in the price per ton of coal, and estimates indicate free cash flow growth and decent margins. In my view, if capital expenditures and acquisitions continue, and there are more investments in the renewable industry, free cash flow will likely remain stable. I don’t believe that the current stock price represents very accurately the efforts of management and future earnings.

Hallador: Sales Contracts For 2023 And 2024, And Expecting An Increase In The Price Per Ton

Headquartered in Terre Haute, Indiana, Hallador produces coal in the Illinois Basin for the electric power generation industry. The company is also investing in the renewable industry, but so far most of its revenue comes from the sale of coal:

Company’s Website

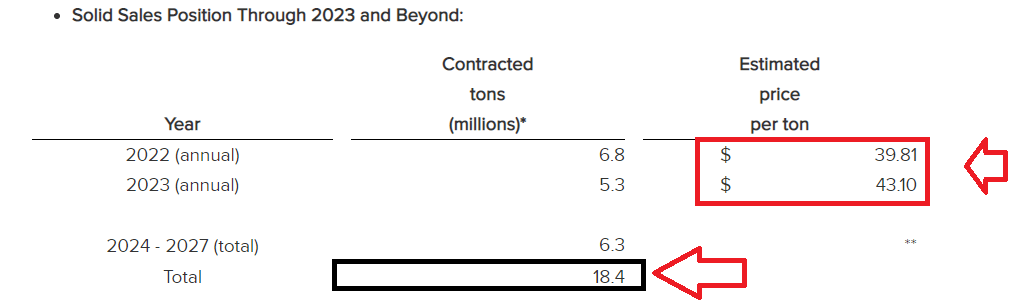

Among the most beneficial features of Hallador, I appreciate the fact that the company already reports sales contracts for the years 2022, 2023, and 2024. With contracts in mind, developing DCF models is a bit easier. Besides, I appreciate quite a bit that the company is expecting an eventual increase in the price per ton in 2023.

Press Release

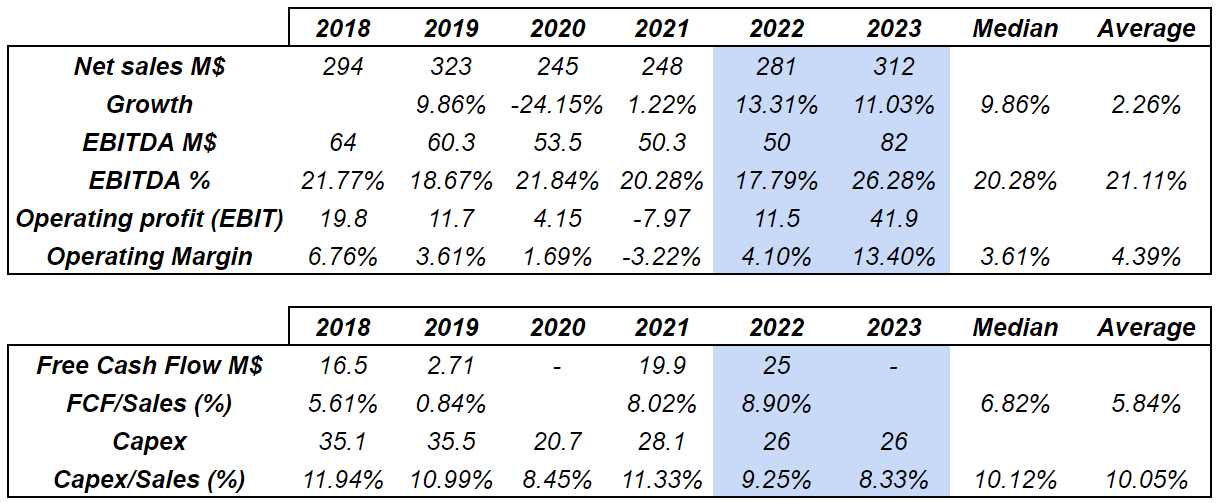

Analysts Expect Sales Growth And Free Cash Flow Margin Of More Than 5.8%

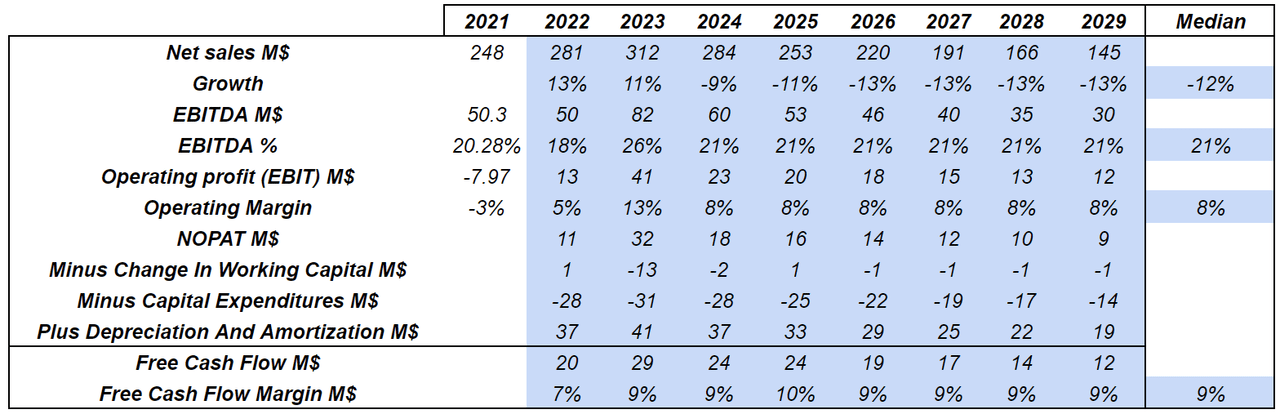

Estimates for Hallador are quite convenient. Most analysts are expecting sales growth of 13% in 2022 and 11% in 2023. The median sales growth including the figures in 2019 and 2020 is equal to 9%. Analysts also expect an EBITDA margin of 17% in 2022 and 26% in 2023. Finally, the operating margin would stand at 13% in 2023.

With respect to the company’s free cash flow, it is quite beneficial that 2022 free cash flow margin will likely stand at 8.9%. Besides, the median free cash flow margin from 2018 to 2022 is close to 7%. I don’t like looking at the past to foresee the future, but in my view, expecting a free cash flow margin close to 7% could be likely:

MarketScreener.com

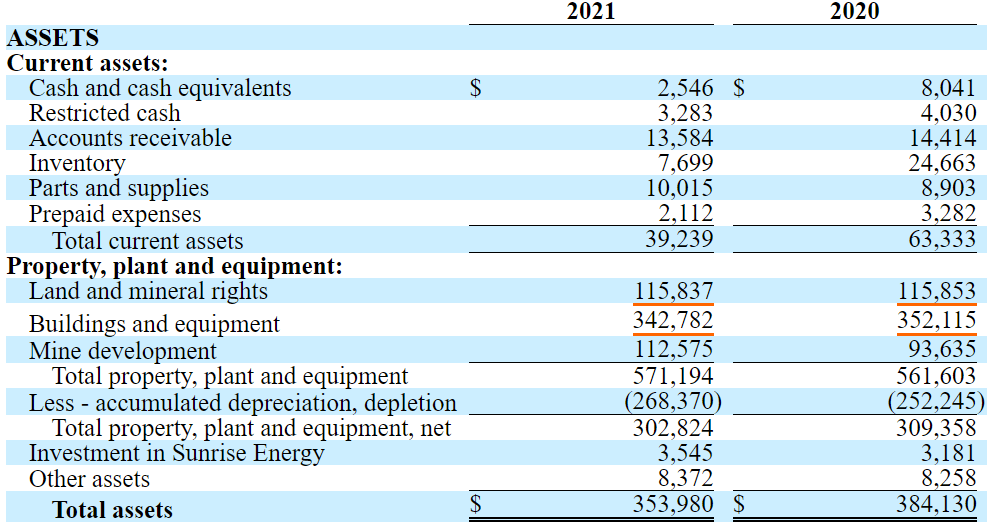

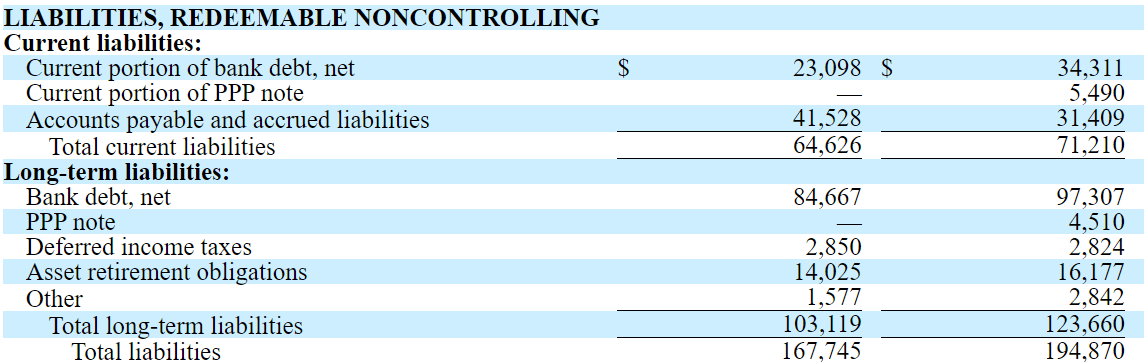

Healthy Balance Sheet

Hallador reports $2.54 million in cash, property, net plant, and equipment worth $302 million, and about $107 million in debt. In my view, if management decides to acquire other mines, or launch new renewable projects, financial institutions will likely offer financing. I am not concerned about Hallador’s total amount of leverage. Keep in mind that the company reports net debt/EBITDA close to 2x.

10-k 10-k

I reviewed the conditions of the debt. In my view, investors will not have to worry much until 2023, when Hallador has to make final payments:

Bank debt is comprised of term debt ($31.2 million as of December 31, 2021) and a $120.0 million revolver ($80.5 million borrowed as of December 31, 2021). The term debt amortization concludes with the final payment in March 2023. The revolver matures September 2023. Source: 10-k

Successful Development Of 1 Gigawatt Of Renewable Energy And Further Capital Expenditures Would Imply A Valuation Of $7

Under my base case scenario, I assumed that Hallador will be able to develop renewable energy assets and deliver it in 2015. Currently, the total amount of investments in renewable energy is not that significant. However, if management continues to invest in this market, investors will likely have more interest in Hallador. Keep in mind that the alternative energy industry is growing at a large pace than the coal sector:

Hallador is currently working to develop up to 1 Gigawatt of renewable energy through a joint venture with Hoosier Energy Cooperative to replace Hoosier’s Merom Coal Generation Station. As part of the transaction, in 2025, Hallador will develop and sell to Hoosier 200MW of energy from solar and battery storage. Source: Company’s Website – Transaction Terms

I am also quite optimistic about the expectations of management about future acquisitions and capital expenditures. Hallador is willing to invest and acquire new mines, and coal reserves, which means that the company sees a lot of future in the coal and renewable energy business models:

We plan to fund capital expenditures for our current growth projects with existing cash balances, future cash flows from operations, borrowings under credit facilities and cash provided from the issuance of debt or equity.

We have expanded our operations by adding and developing mines and coal reserves in existing, adjacent and neighboring properties. We continually seek to expand our operations and coal reserves. Source: 10-k

For the assessment of the business model, I tried to be as conservative as possible. The coal market is expected to grow at 3% from 2022 to 2027. I assumed that after significant revenue generation in 2022 and 2023, revenue growth will likely decline:

The coal market in the United States is expected to decline at a CAGR of more than 3% in the forecast period of 2020-2025. Source: United States Coal Market 2022 – 27

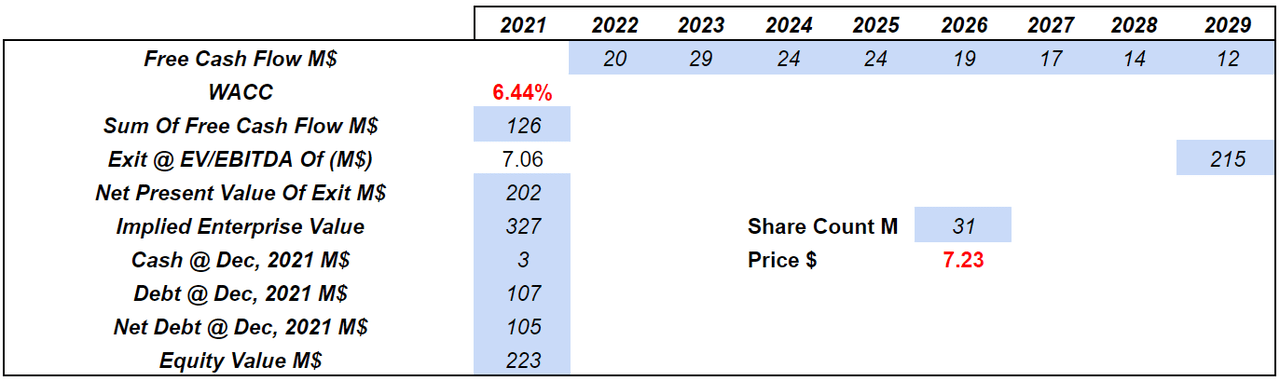

I assumed 2029 sales close to $144 million, 2029 EBITDA margin of 21%, and median operating margin of 8%. It means that the net operating profit after tax will likely stand at close to $33 million and $9 million from 2022 to 2029. Finally, from 2022 to 2029, I obtained free cash flow of $20-$12 million.

YC

In my capital asset pricing model, I assumed a cost of equity of 7%, cost of debt of 6%, and a beta of 0.76. My results include a weighted average cost of capital of 6.44%, which implied a sum of free cash flow of $126 million, and equity value of $223 million. Finally, the fair price would be $7.23.

YC

There Are Some Risks From Concentration Of Clients, Negotiation Of Contracts, GHG emissions, And Environmental Regulations

Hallador reports five main customers, which for some investors may be a small number. In my view, if Hallador loses one or two clients, the decline in net sales could be quite substantial. As a result, expectations of free cash flow could diminish, which could lead to a decrease in Hallador’s valuation:

During 2021, we derived 95% of our revenue from five customers (10 power plants), with each of the five customers representing at least 10% of our coal sales. If in the future we lose any of these customers without finding replacement customers willing to purchase an equivalent amount of coal on similar terms, or if these customers were to decrease the amounts of coal purchased or the terms, including pricing terms, on which they buy coal from us, it could have a material adverse effect on our business, financial condition and results of operations. Source: 10-k

If the price of coal increases, certain Hallador’s partners may try to renegotiate contracts. According to the annual report, certain long-term contracts include the possibility of early termination. If management does not successfully negotiate with other parties, termination of contracts could lower production, and lead to a decline in cash flow too:

Some of our long-term contracts contain provisions that allow for the purchase price to be renegotiated at periodic intervals. Any adjustment or renegotiation leading to a significantly lower contract price could adversely affect our operating profit margins. Accordingly, long-term contracts may provide only limited protection during adverse market conditions. In some circumstances, failure of the parties to agree on a price under a reopener provision can also lead to early termination of a contract. Source: 10-k

Hallador could also suffer significantly if stakeholders are convinced that the company is not in compliance with new environmental regulatory rules. In the worst-case scenario, the management may lose investors and debt financing opportunities. Fines from governments and lawsuits could also substantially impact Hallador’s EBITDA figures:

Companies that do not adapt or comply with evolving investor or stakeholder expectations and standards, or are perceived to have not responded appropriately to ESG issues, regardless of any legal requirement to do so, may suffer reputational damage and the business, financial condition, and stock price of such companies could be materially and adversely affected. Source: 10-k

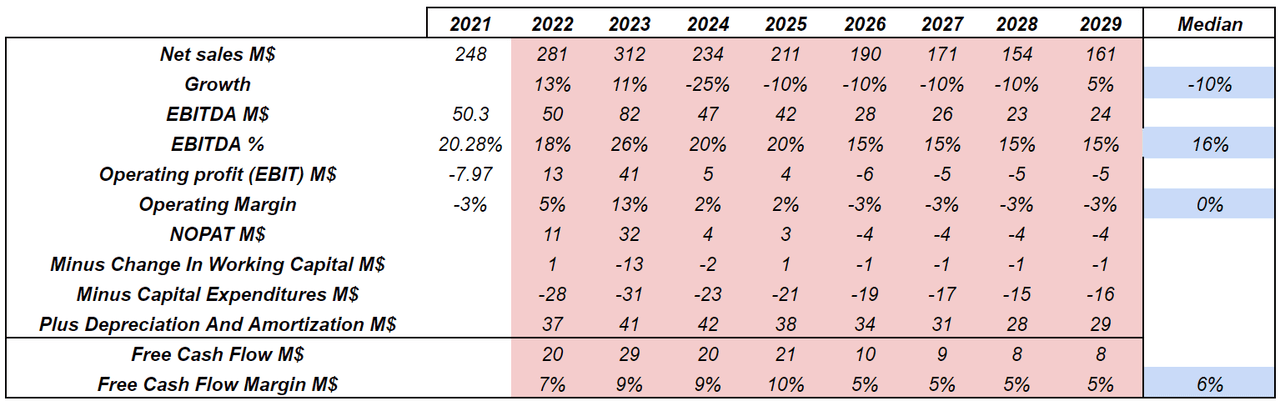

Finally, under this dramatic case scenario, I would also envision certain issues from regulation of GHG emissions. If regulators decide to ban coal to promote other sources of electricity, the demand for the company’s products will likely decline:

Future environmental regulation of GHG emissions also could accelerate the use by utilities of fuels other than coal. In addition, federal and state mandates for increased use of electricity derived from renewable energy sources could affect demand for coal. Source: 10-k

Under the previous dramatic events, I envision a median sales growth of -10% from 2025 to 2029, and an EBITDA margin of almost 15%. The results include free cash flow not larger than $30 million from 2022 to 2029, and free cash flow margin close to 5%.

YC

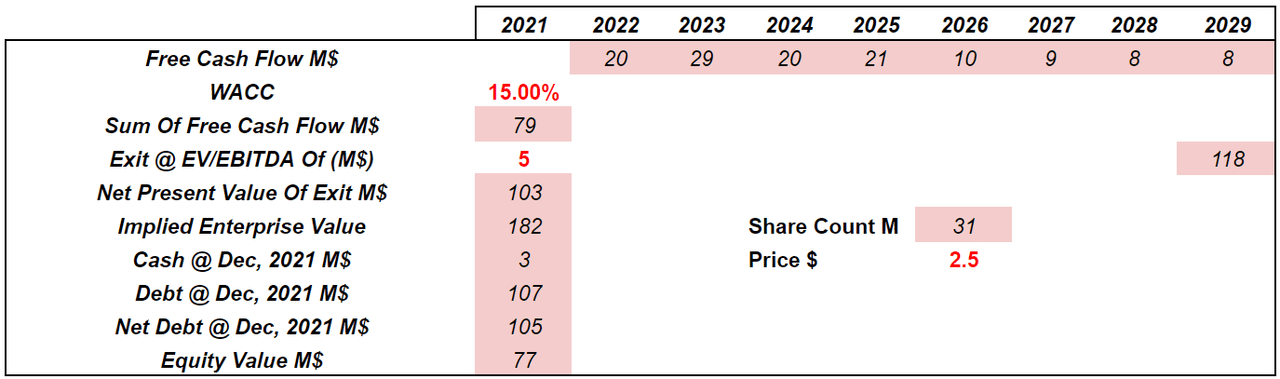

If we assume a weighted average cost of capital of 15%, an exit EV/EBITDA of 5x, and net debt of $105 million, the implied share price would stand at close to $2.5.

YC

My Takeaway

Hallador does not only report sales contracts for the years 2023 and 2024, management is also expecting an eventual increase in the price of a ton of coal. Estimates are also quite beneficial about the future free cash flow generation in 2023 and 2024, and the company is investing in renewables. In my view, a conservative assumption of free cash flows until 2029 indicates that the current market price fails to match Hallador’s true value. If the company continues to invest in capital expenditures, and makes minor acquisitions of assets, the stock price will trend north.

Be the first to comment