Stadtratte/iStock via Getty Images

Intro

We wrote about StealthGas Inc. (NASDAQ:GASS) post the company’s first-quarter earnings in June of this year where we witnessed a meaningful increase in the company’s earnings. Unfortunately, shares were not able to push on post the announcement and presently find themselves roughly 30% down since the first quarter earnings print.

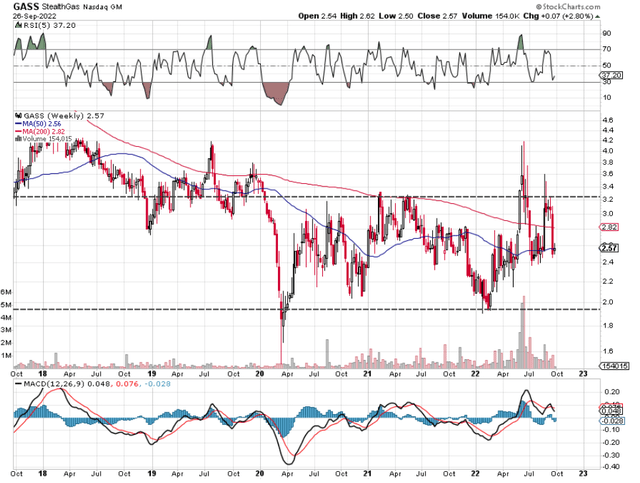

StealthGas Inc. is a classic value play where investors need to continue to remain ultra patient to have the opportunity to realize some meaningful gains with this play. Just look at the technical chart. Shares for the most part have been trading in a narrow enough range for more than two years now. Furthermore, the stock’s latest down move means StealthGas’ 50 week moving average (200-day moving average) is currently being tested. Suffice it to say, if this key support level is breached here shortly, shares could easily revert to their 2022 lows of under $2 a share. Caution.

StealthGas Technical Chart (Stockcharts.com)

Q2 Tailwinds

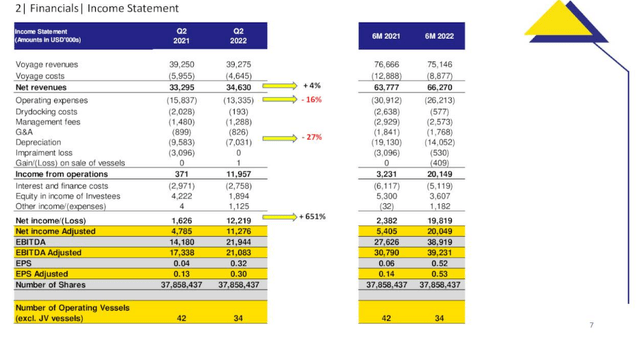

Bulls may believe that the chances of this happening are remote especially given the strong earnings results once more in the company’s second quarter. The bullish fundamentals we witnessed in the charter market continued into the second quarter and voyage revenues based on a lower running fleet rose by $3 million sequentially in Q2. Furthermore, it is now becoming obvious on the income statement (see below) due to being a core LPG play how costs are changing for the better. The reason being is that net income came in at $12.2 million which was an excellent result compared to past quarters. Although the upcoming third quarter is seasonally weaker ($0.15 per share GAAP Estimate), bottom line earnings are still expected to grow by well over 100% this year. This trend obviously will have ramifications with respect to strengthening the balance sheet, generating cash flow, and potentially growing the company faster than in previous times.

In fact, given the company’s bullish trends in Q2, value investors may be tempted to get long at this juncture due to how cheap StealthGas’ shares presently are. Shares now trade with a forward GAAP multiple of 3.95, a forward sales multiple of 0.7, an ultra-low book multiple of 0.2, and a trailing cash flow multiple of 1.98. Furthermore, StealthGas’ trailing operating margins come in close to the 20% mark (28% higher than the historic average) which again demonstrates how profitability continues to improve in the company.

StealthGas Income Statement Post Q2 Earnings (Seeking Alpha)

Forward-Looking Risks

We live though in extraordinary times which is why we will continue to take our read off the company’s share-price action on the technical chart (since this is a summation of the shipper’s known fundamentals). The reason for our caution is self-explanatory. StealthGas operates in a very open industry where any one of multiple external factors could easily derail operations quite significantly.

- The zero covid-policy in China for example is a big threat to LPG demand going forward. LPG demand saw a boost due to the lifting of restrictions but nobody knows how long this will last. China is the world’s biggest importer of LPG so murmurs about a slowing Chinese economy are not what bulls want to see here. In saying this, India with its capacity and growth rates could take a leading position but again we are seeing some potential headwinds in the works here. Prices for LPG cylinders have already risen sharply in recent months which means demand could taper off significantly if indeed this inflation continues. The worst outcome from StealthGas’ perspective would be economic recessions in both of these countries combined with very high inflation. This would really turn the screw on demand which would affect StealthGas’ share price adversely.

- Following on from the above, we have written about the high fixed cost nature of this business and how essentially leverage is a double-edged sword. If trading conditions co-operate, for example, StealthGas has the operating leverage now within its fleet to really take advantage of a spike in LPG demand. Whether this demand emerges in the near term is unknown at this stage. What if it doesn’t emerge though and trading conditions become a lot tougher? Remember, the company still has 5 pending drydockings in this fiscal year not to mind how additional crew costs can ramp up quickly if tough covid conditions were to return. Lower-than-expected revenues and higher costs could easily hurl shares towards their 2022 lows which is why investors need to remain cautious here.

Conclusion

Although StealthGas reported bumper earnings in Q2 on lower costs, the market remains unconvinced here. Future demand remains very difficult to predict which is why we will continue to take our cue off the technical chart. We look forward to continued coverage.

Be the first to comment