Eoneren/E+ via Getty Images

Investment Thesis

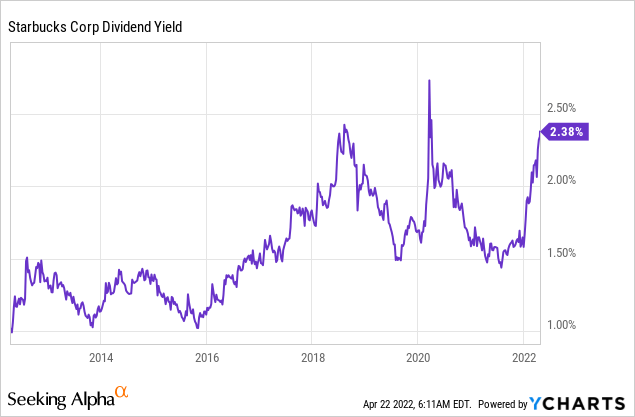

Dividend growth investors want to pick up companies with solid financials, a well-covered dividend and a revenue-and-profitability outlook that indicates a growing dividend, as high as possible seen over an extended period, and Starbucks Corporation (NASDAQ:SBUX) represents that opportunity. Trading at a starting yield of 2.4% compared to the recent decade average of just above 1.5% is of course not by coincidence. The headlines surrounding Starbucks currently occupy themselves with concerns related to inflation, unionization, the suspended share buyback program, continued regional Covid-19 effects, how a potential downturn in the economy could impact the company and also recent changes to management. However, as a dividend growth investor, one takes the long-term perspective, and backed by strong financials, Starbucks appears to be trading at an appealing valuation.

Introduction

Starbucks was one of my top 10 dividend companies to watch out for in 2022 and in my recently published portfolio performance article, I mentioned I believed Starbucks was worth a look, so here we are.

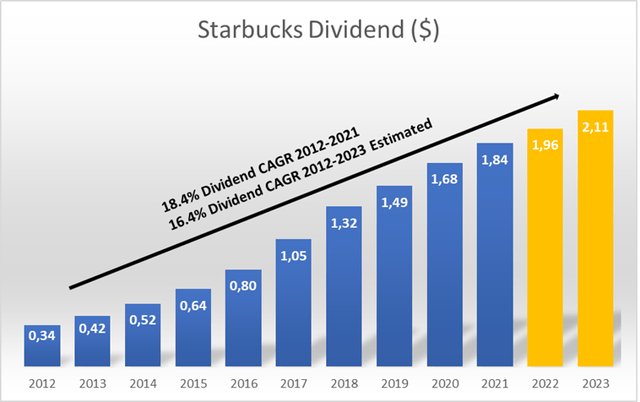

Starbucks is down roughly 30% YTD and 35% since its most recent all-time high back in mid of 2021. Trading at a forward yield of almost 2.5%, Starbucks is worth a look for those interested in a long-term possession of the stock in order to receive a growing dividend and an appreciating asset. The current yield is the highest it’s been since the onset of Covid-19 and before that, the summer of 2018. In fact, it’s the only three instances in the last decade where it has been possible to pick up Starbucks at such an impressive initial yield. The payout ratio hovers in the mid 50’s on an EPS basis and the company has managed to grow its dividend at an CAGR of 18.4% in the last decade, while also managing to grow its dividend at 15.8% annually the past decade with consensus estimates of growing it 6.5% in 2022 and 7.7% in 2023.

For dividend growth investors, Starbucks is definitely worth a look at its current stock price.

The Dividend Profile In More Detail

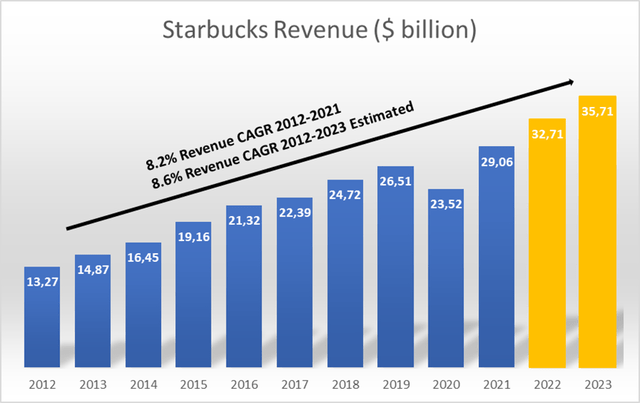

Starbucks has managed to consistently grow its top-and-bottom-line with 2022 expected to be another record year for revenue, estimated to come in at around $32-33 billion with further growth for 2023 currently expected to land at $35-36 billion.

Data from Seeking Alpha & 4-traders.com

Source: Seeking Alpha Financials, 4-traders consensus estimates.

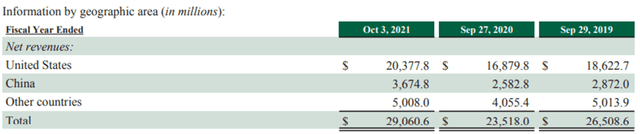

As is evident, revenue has been growing consistently with a CAGR of 8.2% since 2012 including the drop during the global pandemic shutdown, where Starbucks naturally was impacted due to its physical store footprint. If we observe the company strategy, it is still heavily focused on achieving growth, and looking to the annual report, we see the company is still growing in all three geographical buckets.

Source: Starbucks 10-K, p. 79

Inevitably, there will be a point where growth for especially the US should diminish, and the historical growth tendencies will be difficult to maintain, however, the international segment should still have plenty of runway ahead of it. One could argue that international tensions, especially related to China, should pose a problem, but I don’t personally let that sway how I perceive Starbucks as a whole. Political instability to some extent is always around, not least because of ambitions tied to individual nations, but often those are best ignored as its short-term noise in what should be perceived as a long-term holding period, at least that’s my personal perspective. It wasn’t too far ago that the US itself had a “noisy” president, but the world has moved on since, and looking back at the current US-China trade related tensions in a decade, there is a higher chance that Starbucks has grown its business, than it doesn’t have a foothold in China any longer.

The more likely short-term risk to the expected growth outlook of Starbucks is related to the fact that their product is considered a consumer discretionary, meaning that it’s non-essential for the customers but desirable in a situation where an appropriate income level allows it. As such, in a potential recession, people who experience a reduced income would most likely cut back on their daily coffee from Starbucks as opposed to everyday essentials such as hygiene related products. Naturally, this is also flagged as a risk in the company 10-K.

Data from Seeking Alpha & 4-traders.com

Source: Seeking Alpha Financials, 4-traders consensus estimates.

Starbucks has managed to grow the dividend at a breakneck pace through the last decade, having slowed down to low single digit annual growth since 2019 and expected to grow at mid-high single digits in the coming years. Given that a dividend of $1.96 for 2022 is expected to represent a pay-out ratio of 60% on a free cashflow basis, and that a dividend of $2.11 for 2023 is expected to represent a pay-out of 58% on a free cashflow basis, I’d say there is a chance the company surprises to the positive side in any of the coming years given that the growth outlook is intact which also increases earnings (assuming a stable or only slightly reduced operating margin). A pay-out ratio at those levels when measured on a free cashflow basis is a level that leaves me feeling very comfortable as an investor, especially as a dividend growth investor.

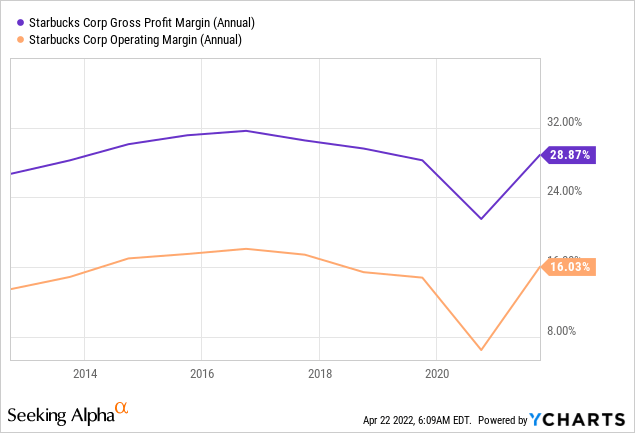

What bodes well for the dividend outlook, is that Starbucks has managed to maintain a stable profitability level for a very long period. The company relies heavily on raw materials as evident by the gross profit margin of around 28% throughout the last decade, and those raw materials fluctuate in price, but Starbucks manage to hedge themselves to a satisfactory extent. In other words, a growing revenue therefore also trickles down to the bottom-line, where we also see a very stable operating margin hovering around 16%. Therefore, it’s a fair expectation that a growing revenue equals a growing net income, which allows for a growing dividend to the tune of the revenue growth, meaning high single digits.

From a dividend growth investors perspective, the small hair in the soup is the fact that Starbucks on April 6th suspended its share buyback program. Intraday the stock fell as much as 6%, as the change to the $20 billion combined dividend and share buyback program expected to run between 2022-2024 was communicated. Subtracting the expected dividend during that period, and we were looking at something close to $12 billion in repurchasing, which can be a great way to support EPS growth if utilized well, but also leaves less capital for growing the business organically or via acquisitions.

With the Q2-2022 performance set to be released in early May, investors will have to listen carefully to management as to how they expect to put the released capital to work. Furthermore, as I’ll discuss later, there is the question of unionization within Starbucks and can be perceived as hypocritical for a company to say it can’t pay its workers a fair amount if it can allocate a double digit billion amount for repurchase of own shares within just a couple of years. As such, suspending the program might actually turn out to be a positive action on behalf of Starbucks even though the market responded negatively. As a matter of fact, this is also some of the headlines communicated by new CEO Howard Schultz in his letter to Starbucks employees as the reasoning behind suspending the program on his first day back in the chair. Howard Schultz has already served twice as CEO of Starbucks from 1986-2000 and again from 2008-2017. Going down memory lane, Mr. Schultz was brought back at CEO at the height of the financial crisis, in a time where the company was also struggling with employee working conditions. He and the board approved a major settlement, and he revisited the geographical footprint of Starbucks in order to close down some of the stores in the network while also pushing the agenda for strengthening the brand via increased usage of fair-trade products and ethical sourcing. If any CEO has the clout to revamp the business once more in a period of employee unrest, it would be Mr. Schultz who can lean on his credentials and immediate trust within the organization. Normally, a CEO returning not only once, but twice, would be a warning sign to me as an investor as I’d start doubting if there is a dependency on a single individual to ensure a business is running smoothly and whether the board is actually capable of identifying the right replacement, however, in this given situation I see logic reasoning behind Mr. Schultz taking the reins once more.

By end of day however, I would hope that Starbucks is able to reinstate its share repurchase program down the road eventually.

The only thing raising my eyebrows when looking at Starbucks is the balance sheet change in the wake of Covid-19, which has led to a significant expansion in long-term debt. However, not something to the extent a growing business can’t handle or that causes the dividend to be even remotely at risk in its current form.

In summary, Starbucks is a business in great health with a strong/fair outlook for growth and a dividend that I would consider very safe when measured on a free cash flow basis and which is also poised to grow in many years to come.

Unionization – The Big Question mark

The big question mark currently surrounding Starbucks is the forming of unions, how it will turn out, how far it will spread and how it will financially impact Starbucks. Being a native from a country where the unionization is probably at one of the highest across the globe, I see a great upside from the employee perspective, but as prospective shareholders we could be more inclined to have interest in how it may impact company financials.

With more than 380,000 employees globally and roughly 180,000 employees in US company operated stores, the impact could be significant.

On the back of Covid-19, work pressure and skyrocketing inflation, it’s no wonder employees can see a benefit in organizing themselves to ensure better working conditions and potentially also better pay. US workers should already have benefitted from a recent raise if they had experience equivalent to two years, and also due to the labor shortage. Starbucks could be offering better pay, however, with bargaining as a collective force as opposed to individually resulting in more operational costs for Starbucks, putting pressure on the margins I discussed earlier. Furthermore, it could also change workplace policies such as minimum staffing schedules and limitations on how many orders one individual employee should be able to handle within a given working hour, as especially rush hours can be strenuous on workers.

I would expect the movement to spread and engulf Starbucks in the US as a whole but that could of course take a long time, however, the financial impact is extremely difficult to estimate given it carries assumptions of future fixed hourly rates, especially as the baseline of individually negotiated rates would be unknown. On top could be the previously mentioned changes to minimum staffing, which would require additional staffing, and so it goes, but an impact counted in two- or three-digit millions of dollars wouldn’t be unrealistic with the basis being back-of-the-napkin math.

However, the impact would be mostly felt short- to mid-term, as Starbucks could combat the negative operational expense impact on the mid- to long-term through e.g., automation where tasks allow or a general revision of company cost structures to secure profitability, such as through revisiting the geographical footprint to close stores where the return doesn’t match the expected ROIC. This would be a lever, that has previously been exercised by the new CEO back in the wake of the financial crisis, and while the world was different back then, it would only make sense for Starbucks as a group to secure profitability within a given range defined by management. Another company facing the same change is Amazon (AMZN), but here they may automate fulfilment processes to a large extent, which isn’t the same with Starbucks. As such, I believe Starbucks can do less, but the natural consequence of increased operational expenses would be to launch a cost cutting program to reduce the long-term effects on Starbucks profitability.

I don’t invest to bet on a swing trade or a short-term spike in valuation, and I don’t perceive unionization as harmful to the long-term thesis.

Valuation

Starbucks can’t be expected to replicate its previous CAGR within both revenue and dividend, however, it is still in its early innings of international expansion and consensus expectations are clear – growth continues. As such, I believe one of the best ways to illustrate why Starbucks is worth picking up for dividend growth investors right now, is its dividend yield in a historical context.

There are headwinds related to the recent CEO change, suspended share buyback program, unionization and a looming potential recession for a company that offers a discretionary product. However, on the whole, Starbucks delivered positive EPS for all years through 2006-2010 where the financial crisis engulfed the world, and the dividend is very safe with the current pay-out ratio as already laid out earlier. Short-term noise aside, I see Starbucks at an interesting starting yield, and the starting yield matters greatly when observing the development on a decade long horizon. In the recent decade, Starbucks has been trading with an average initial yield just above 1.5%, well away from the starting yield today.

With a market cap around $90 billion, it’s the same as it was back in 2016 all the way through 2018. Currently trading with a forward P/E of 24, the stock was typically trading at a P/E close to 28-30 during the years leading up to Covid-19. Given the revenue can’t grow at the same pace going forward, I don’t believe Starbucks deserves to trade at such a long-term market premium, however a company able to grow its top line by high single digits for many years to come could carry a small premium compared to the general market, and given the profitability outlook, I expect the company will grow into its valuation offering appreciation potential besides the growing dividend.

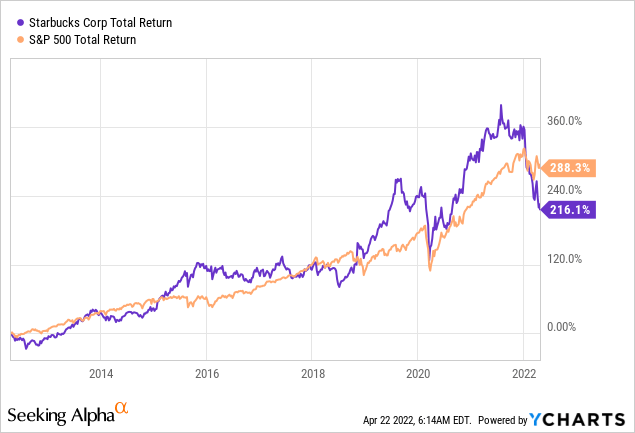

For a significant part of the recent decade, Starbucks managed to outpace the SP500 from a total returns’ perspective, however, that has changed recently, and the turmoil causing headlines currently may impact the short-term performance for Starbucks, and as such I would exercise patience if initiating a position at the current levels as it’s not immediately clear the stock won’t have to decline further to find its bottom. However, once more I’d like to underline that I personally look to the long-term.

Conclusion

Starbucks is trading well off its most recent high, being down 30% YTD due to uncertainty related to inflation, unionisation, continued regional shutdowns such as currently in Shanghai, change of leadership and the fact the company is offering a discretionary product in a time where a recession may not be that far away.

However, Starbucks has solid financials, a good outlook related to growth and a payout ratio of 47% when measured on a free cash flow basis. Starbucks continuing to grow its dividend at high single digits for many years to come appears realistic with current consensus expectations being a 6.5% hike for 2022 and 7.5% hike for 2023, but there is the chance that management surprises to the positive side, not least given the existing strong coverage of its dividend. Trading at a rarely seen starting yield at almost 2.4%, compared to the recent decade average of just above 1.5%, the current opportunity should be interesting to dividend growth investors with a long-term horizon.

Be the first to comment