Toltek/iStock via Getty Images

Ingredion (NYSE:INGR) is dependent on the price of corn for its more legacy products and the price of stevia. The issue is that acreage is at its limits, with more acreage only really possible from Brazil which is in a dry spell and grows acreage through deforestation. Wheat prices are rocketing and so are the prices for corn. All are reaching all time highs and this is going to be an issue for ingredients companies. With fertilizer prices also rising, there will be continued lift on the prices of the commodities as farmers try to maintain their margin. Ingredion is meaningfully off its highs, but we are pretty concerned about the situation going forward nonetheless. All vectors are pointing down for Ingredion, and we wouldn’t be ready to buy the dip on this stock even though it’s performed well for us in the past.

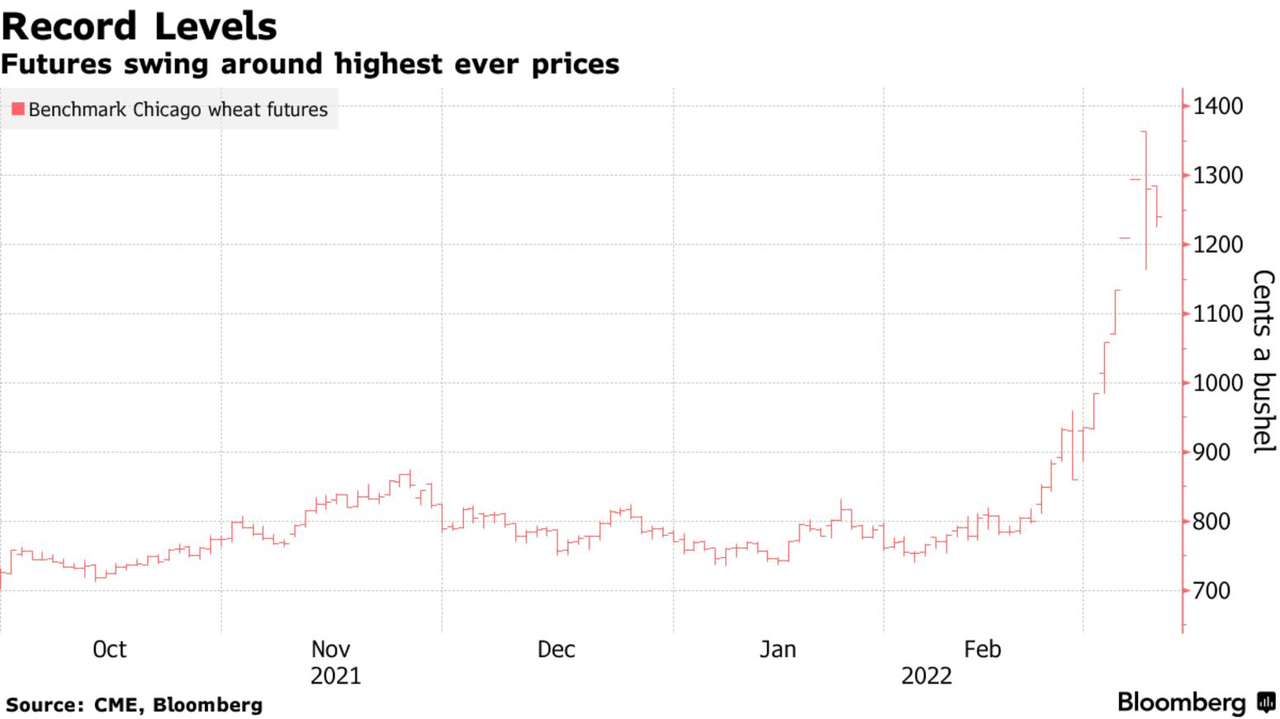

The Commodities Situation

The commodities situation is pretty rough right now. Ukraine and Russia, now knocked out of the market, account for a quarter of the world’s grain exports. There really isn’t any room to grow acreage either. US farmers are pretty much at their limit in terms of acreage, having focused on commodities like soy in the soybean rebound over the last couple of years, and EU farmers plant their wheat crops in the winter, so that train has left the station. The only alternative source of acreage growth in the markets would be Brazil, which is firstly in a dry spell, and also would only be able to grow acreage through deforestation. While deforestation hasn’t stopped anyone before from increasing acreage, there is limited room to grow to deal with the increase in grain costs.

Corn is also quite an important export from the war-ravaged areas of Ukraine, and not much had been able to leave the ports before the war erupted. With Russian control likely on almost all of the Ukrainian port cities eventually, their disintegration from western economies is going to mean that the west won’t be seeing those exports into our trading bloc. So we expect no reprieve.

Wheat Prices (Bloomberg)

Corn Prices (Tradingeconomics)

While wheat and corn have both hit all-time highs recently, pretty much all crops are going to see rising prices. Naturally, when a massive amount of fertile earth is put out of commission by war, it doesn’t matter what was growing there, it’s going to affect all the grain prices that could have grown in that climate in the medium-term, assuming the war continues to mean lacking exports from Ukraine. With Putin not likely to back down before he can claim some kind of military victory, likely after Mariupol and Odessa are firmly taken, and with rebuilding efforts at the top of the agenda in the post-war situation, it could be a while till we see things recover there, maybe even a year or two.

The Consequences for INGR

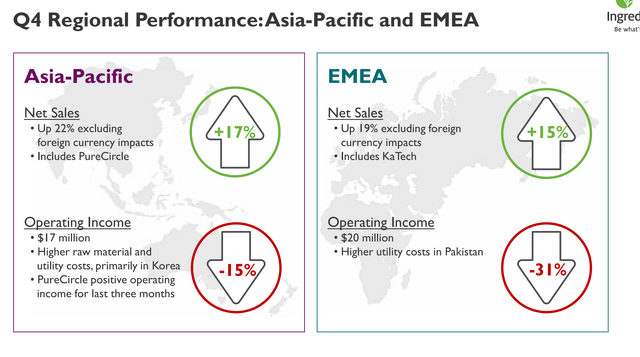

YoY increases in corn prices in Q4 give us a taste of what is to come for Ingredion’s results. The operating profits have declined across the board due to these input cost increases.

Operating Income Declines (Q4 2021 INGR Pres)

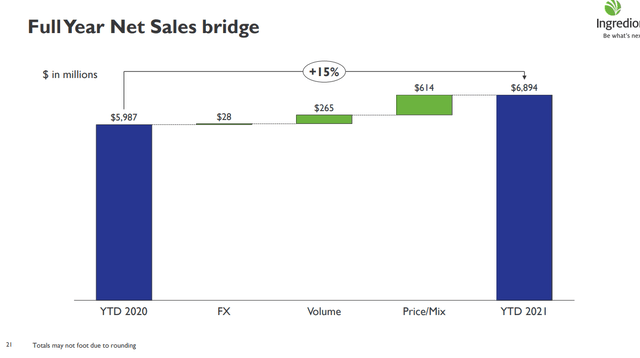

North and South America are just as bad as EMEA. With stevia being just as valid as an alternative crop for farmers who are growing wheat and corn in the US, the stevia prices can be expected to increase too. Thankfully, stevia based products tend to be more specialty with pricing power, with corn prices really tanking the more commodified Ingredion segments. The Pure Circle evolutions, where it’s beginning to turn a profit on greater scale, is meaning some nice pricing and mix effects that Ingredion can be proud of.

Nice Mix Effects (Q4 2021 INGR Pres)

However, across the board, we expect that the Q4 results will be a good representation of what is to come in 2022, if not worse with all grain prices having reached what appears to be new plateaus due to the supply side situation.

The company currently has an EV of around $7.2 billion with EBITDA of $900 million in 2021. With a forecast decline of at least 25% in EBITDA for 2022, and perhaps even something similar in 2023, the forward multiple is around 9.5x. That’s too high for a business that is running head-first into a commodity inflationary environment. We couldn’t even justify holding here, but we do watch the stock due to its excellent inorganic growth track record and hope that it lands in the forget bin over the next year for us to make money on it again.

Be the first to comment