Imgorthand

The accumulation stage is a breeze. Build the greatest portfolio value that you can, while investing within your risk tolerance level. That is to say, more money buys or creates more retirement income. In retirement we need to manage the risks of lengthy bear markets and abrupt changes in economic conditions. Seeking Alpha readers love their stocks. And certainly, a stock-heavy portfolio can bring additional risks for the retiree. That said, we can build a sensible stock portfolio for retirement.

There can be a major advantage to separate the accumulation and decumulation stages. Be armed with more money and more options in retirement. In my opinion the self-directed investor should also seek the help of a retirement specialist. You might consult with an advice-only planner. A proper retirement plan goes well beyond the investments that you hold. We need to know what goes where (account types and pensions), how much to hold in the various account types, and the sequence of harvesting to gain the most tax efficiency and most durable income. Throw in estate planning, charitable giving and more.

There are so many retirement considerations that are just as important as the investments that we hold.

The all-weather stock portfolio

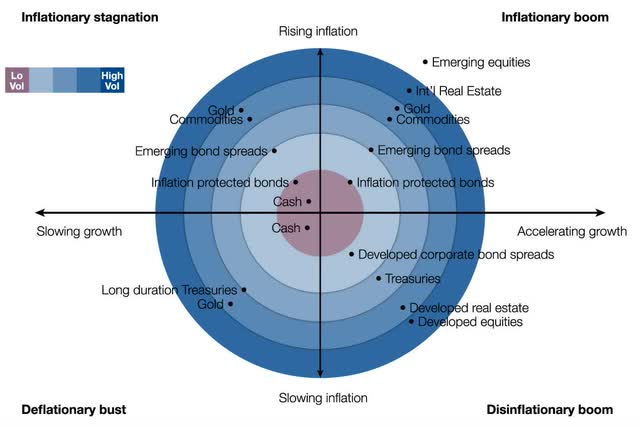

Readers may be familiar with the all-weather portfolio. The portfolio models will be ready for most anything – with at least some assets that will perform no matter what are the economic conditions of the day. We will be somewhat prepared for inflation and deflation that is then affected by the level of economic growth or contraction.

There’s always something working goes the theory for the all-weather portfolio models.

A good starting point for the all-weather portfolio is the venerable Permanent Portfolio. That model includes only one asset for each economic quadrant. Stocks. Bonds. Cash. Gold.

Traditionally, we will pull from the basket of stocks, REITS, bonds and commodities to find that balance. Here’s a wonderful graphic from ReSolve Asset Management.

Assets for economic conditions (ReSolve Asset Management )

Not included in the chart is types of stocks for economic conditions. For example, consumer staples stocks are known to be a decent performer during periods of economic weakness and during inflation. Energy stocks are known to be the only sector with a very reliable record during periods of inflation and stagflation.

Given that many investors prefer stocks over bonds, gold and commodities, we will use stock substitutes.

Here is an outline of a study from Man Institute that details the types of stocks and sectors that worked in various economic conditions.

Essentially we are going to look for bond replacement and commodities replacement stocks. We are going to use types of stocks to help protect from extended bear markets (recession and non-recession) and from inflation and stagflation and deflation.

Today’s investor is mostly familiar with the disinflationary low growth environment that we’ve been in since coming out of the stagflation era of the 70’s and early 80s. As the decade of the 2020’s points out, we need to be prepared for ‘anything‘.

Assets for disinflationary growth

U.S stocks and international stocks (markets).

Telco’s, utilities and pipeline dividends

Most robust: Consumer discretionary, retailers, technology, healthcare and financials stocks

Assets for slow growth and low inflation

U.S. and international stock markets

Most robust: Technology, industrials, healthcare and energy stocks

Assets for deflation

Telco’s, Utilities and pipeline dividends

Consumer staples, consumer discretionary, healthcare stocks

Assets for robust inflation and stagflation

Energy stocks

REITs

The bond substitute retirement portfolio

The key is to hold more defensive stocks, after all we are replacing the bonds. Certain sectors are known to hold up better in bear markets, and during recessions. In this post I looked at the defensive sectors for retirees. My research certainly aligns with that of Man Institute and others who have studied sectors and economic conditions.

I’ve added the big Canadian banks as they have perhaps the most stellar record for paying dividends (mostly increasing) over a hundred years and more.

The key is to give the retirement portfolio a defensive tilt.

Defensive bond substitute stocks – 60%

Utilities / Pipelines / Telecom / Consumer Staples / Healthcare / Canadian banks

Growth assets – 20%

Consumer discretionary, retailers, technology, healthcare, financials industrials and energy stocks

Inflation protectors – 20%

REITs 10%

Oil and gas stocks 10%

Not listed in this inflation-protection section is consumer staples, healthcare, utilities and pipeline stocks. Those stocks can do double duty. They work during times of market stress (corrections/recessions) and they can often deliver modest inflation protection as well.

One might also consider other commodity stocks such as those from the agricultural sector, such as Nutrien (NTR).

And remember, rebalancing your portfolio on schedule is key.

Final considerations – gold and commodities

While you may opt for a stock/cash portfolio, it may be wise to consider gold and commodities, even if in very modest amounts.

Nothing is as reliable and explosive for inflation as commodities. The most optimal balanced portfolios include gold.

A 5% allocation to each gold and commodities may go a long way to protecting wealth.

An inflation bucket might then look like:

- Gold 5%

- Commodities 5%

- Energy stocks 5%

- REITs 5%

A cash wedge is not a bad idea

It helps your cause during stock market declines, stagflation and deflation. See that ReSolve chart (above).

Given that, a retiree might go off the stock-only-script modestly with 5% weighting to each – gold, commodities and cash. It’s quite likely that the 15% allocation will come in very handy one day.

Positive trends for defensive stocks

The healthcare sector is well-positioned thanks to aging populations and the increased demand for healthcare. Also, the utilities sector (XLU) will take advantage of the increased electricity demand created by the transition to ‘greener’ energy. The environmental movement might be the most powerful economic force on the planet.

Pipeline stocks should still thrive for quite some time as the need for natural gas increases. And because we’ve bungled the energy transition, oil demand might keep increasing and production can’t keep up – due to lack of investment.

Telecom is THE modern utility. As populations grow, each home and business has to be hooked up to the internet. Most of the household members will have a smartphone in hand.

Consumer staples are the long-standing heavyweight champ of recession-friendly stocks. We still have to eat and drink and brush our teeth.

When the balanced portfolio worked quite well

Keep in mind that a sensible balanced global portfolio did the trick for retirees during the last two major bear markets of the dot-com crash of the early 2000s and the great financial crisis of 2008-2009 and beyond.

How Retirees Made It Through the Last 2 Recessions

From that post you can see that the Vanguard approach of quality companies, stable dividends and international diversification did the trick. And those portfolio models includes a bond component.

That said, those were two recessions during a period of mostly disinflationary low growth. There was no rampant inflation or deflation. We cannot assume that we will return to a disinflationary environment.

Currently, we are experiencing stagflation.

The retirement stock portfolio holdings

Our personal (for my wife and me) retirement portfolios follow much of the stock allocation strategy outlined in this article. We do not hold REITs as we have significant (and more than ample) exposure by way of personal properties.

You’ll find the holdings of our U.S. stock portfolio and the Canadian Wide Moat 7 in this first half of 2022 stock update post. We also hold a modest amount of bonds, gold and commodities – I feel that is prudent. You may not share that opinion.

My personal retirement portfolio is up over 6% year over year.

I will be back soon with a post that shows our personal stock allocation. I will also offer other stock candidates (beyond our holdings).

In the comment section, please offer up your ideas on the stocks that will best create the retirement stock portfolio. You might see them show up in the next post.

And keep in mind, this post is not advice. Think of it as ideas for consideration.

Thanks for reading.

Dale

Be the first to comment