Marcus Lindstrom/E+ via Getty Images

Investment Thesis

In my previous article on Yellow Corporation (NASDAQ:YELL), I concluded the company was overvalued on a relative basis and was not a buy-and-hold type of investment. You can read about it here. Since then, the stock is down ~40% vs a gain of ~1% for the S&P 500 and is now much cheaper relative to peers. That said, I still believe the company has poor long-term growth prospects given the intense competition, low margins, and high CapEx. For the moment, YELL benefits from favorable pricing but costs are rapidly catching up in the trucking business, which should impair the company’s ability to increase margins. On top of that, YELL reached a record amount of debt in the last quarter, which comes at a hawkish turning point in monetary policy. For the abovementioned reasons, I believe the company has limited potential to outperform the market over the next couple of months.

Recent Developments

In my previous article on YELL, I have made the point that the company was in the middle of a turnaround and the future success of this plan was hard to assess. You can read more about it here.

YELL is now in the middle of a turnaround where they are trying to improve profitability. As part of the plan, the company has already simplified the sales team by streamlining enterprise-wide sales to provide customers with a single point of contact for all brands. They have also changed the name of the company in anticipation of a company-wide rebrand to Yellow. However, the network optimization which is, in my opinion, the most crucial part of the plan is still in the process. I believe there is a good chance that the company will be able to improve profitability going forward. That being said, there are many moving pieces and I think it’s still too early to tell what degree the change will impact the company.

Since then, YELL published full-year results in February 2022. The company posted solid numbers, beating both adjusted EPS and revenue estimates. Q4 FY21 non-GAAP EPS came in at $0.20 vs. an expected negative $0.13, and revenue was $1.31 billion, a ~13% YoY increase.

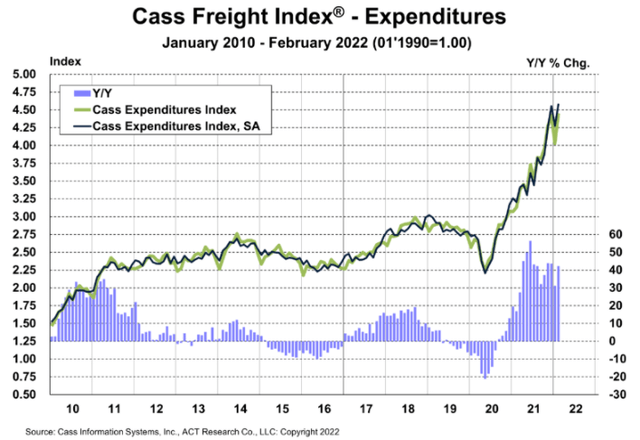

YELL continues to benefit from all-time high prices in freight transportation, which have dramatically increased since the COVID-19 pandemic. While the trend seemed to decrease in Q4 FY21, it has rebounded recently and prices remain way above pre-pandemic levels. Therefore, I expect YELL’s Q1 FY22 numbers to exceed Q1 FY19 results.

This is supported by what management described as favorable pricing during the last earnings call in recent months.

In Q4, year-over-year LTL revenue per hundredweight, including fuel increased 23.3% and favorable pricing trends have carried into Q1 of 2022. For the month of January, Yellow averaged between 8% and 9% on contract negotiations.

Darren Hawkins – CEO – Q4 FY21 Earnings Call

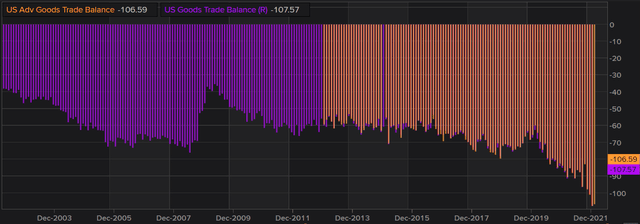

This trend in pricing is reinforced by the record US trade balance deficit. As more goods are now entering the country than ever before, the demand for YELL’s services stands to grow until supply catches up or demand decreases.

Talking of supply, the last year was a record year in terms of capital expenditures. YELL spent over ~$500 million on new equipment. As a result, the company has lowered the average fleet truck life by 2 years, while improving fuel efficiency and reducing maintenance costs. To give you an idea of the size of the CapEx program, it exceeded the amount the company spent on equipment in FY19 and FY20 combined. This can prove to be a great decision if freight prices remain high. However, I believe the strategy could backfire if there is a slowdown in the economy over the next months and demand decreases, given the fact that this CapEx program increased debt by over $300 million in the last year.

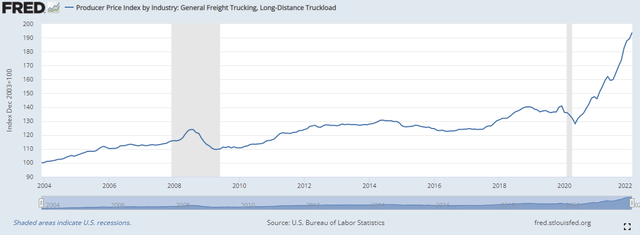

At the same time, freight trucking is one of the industries most severely impacted by inflation. If we look at the industry’s PPI over the last 20 years, not only is it facing record-high inflation, but prices paid by trucking companies to run their business are materially higher compared to the pre-COVID-19 era. As a result, gross margins didn’t increase significantly despite favorable pricing. In fact, YELL’s FY21 gross margin was actually lower compared to FY19.

On top of that, there are a number of signs pointing out the US economy is overheating. As we are now entering a cycle of rate hikes, I personally believe that consumer sentiment will likely decrease going forward, which will negatively impact trucking and YELL.

Valuation

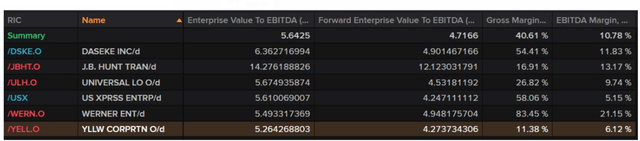

Based on 50.7 million shares outstanding, and a price of $7.6 per share, the company has a market cap of approximately $385.32 million. If we add $1.24 billion in net debt, we get an enterprise value (EV) of ~$1.62 billion. The difference between the enterprise value and the market capitalization is simply too large for me and indicates that YELL is highly leveraged. If liquidity dries up in the credit market, this can turn very ugly for YELL shareholders.

If we compare it to a basket of peers, YELL seems to be fairly valued, trading close to the basket’s average EV/EBITDA multiple. However, I personally think that YELL should trade at a discount to peers given its lower margins. While the stock is now much cheaper than it used to be back in December 2021, I still believe other peers are offering a better value for money than YELL at the moment.

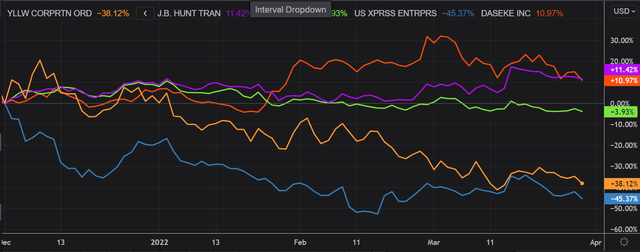

If we take a look at the price performance of this basket of stocks since December 2021, it is interesting to see that YELL had one of the most severe drawdowns. In my opinion, the market sees YELL as a riskier play in this industry, with poorer prospects relative to competitors.

Key Takeaways

Given the severe competition, low profitability, and expensive CapEx, I continue to believe the firm has sluggish long-term growth prospects. YELL is now profiting from favorable pricing, but expenses in the freight industry are quickly increasing, which could limit the company’s potential to improve profits. Furthermore, YELL hit a record level of debt in the latest quarter, coinciding with the Fed’s hawkish pivot in terms of monetary policy. For the reasons stated above, I believe YELL will continue to underperform the market and other peers over the next months.

Be the first to comment