baona

Centerra Gold’s (NYSE:CGAU) share price declined by nearly 20% following the Q2 financial results release. The results were disappointing due to the problems at the Oksut mine. The revenues declined to $167.7 million, or by 43% in comparison to the previous quarter. The operating cash flow declined from $28.3 million to -$3.5 million, and net income from $89.4 million to -$2.6 million. Moreover, it turned out that the Oksut mine operations will be affected for the next several quarters.

The problems at the Oksut mine began back in March, when Centerra announced a “temporary suspension” of the gold dore bar production at the Oksut mine, as mercury was detected in the gold room of the adsorption-desorption recovery plant (ADR plant). The mining operations continued, only the gold dore production was suspended. Centerra kept on processing the gold into the gold-in-carbon form. In April, the company stated:

The Company continues to evaluate options to remediate the issue at the ADR plant while undertaking an analysis to determine alternative means of monetizing gold in carbon material which could provide a temporary solution until gold doré bar production is restarted at site or over the life of mine with minimal equipment required at the ADR plant.

However, this was the last information regarding the Oksut mine situation for the next three months. And the Q2 earnings call confirmed that the long period of silence was not a good sign. Centerra found out a solution for the mercury problem, but the mercury abatement retrofit in the gold room will take until the end of this year. Moreover, subsequently, some permits will be needed before it can be restarted. And there is an even bigger problem. It turned out that Centerra doesn’t have the permits necessary to sell the gold-in-carbon to a third party. Moreover, the company has been unable to secure permits to use more activated carbon than is currently permitted. As a result, it cannot continue gold-in-carbon production. It means that the Oksut mine operations need to be suspended completely. The suspension of stacking and leaching operations was initiated on August 10. The suspension of mining and milling operations is being considered as well.

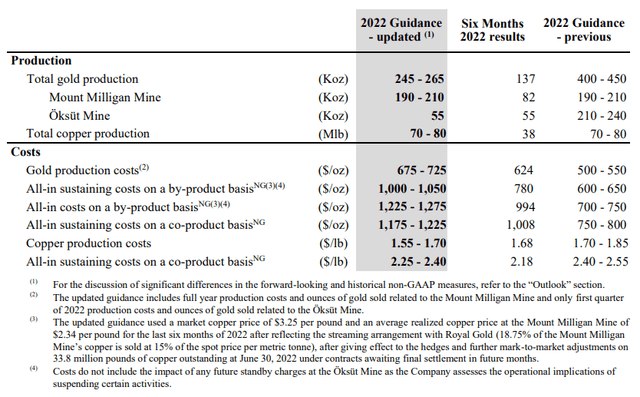

Due to the problems at the Oksut mine, Centerra updated its 2022 production and cost guidance. Only 55,000 toz gold was produced at Oksut in H1 2022, and it is expected that nothing will be produced in H2 2022. As a result, the Oksut mine production guidance was reduced from 210,000-240,000 toz gold to 55,000 toz gold. Fortunately, for Mount Milligan, the production guidance remained unchanged. So the overall Centerra’s 2022 production was revised from 400,000-450,000 toz gold to 245,000-265,000 toz gold. And the AISC should increase from $600-650/toz gold to $1,000-1,050/toz gold. The H2 cash flows will be lower than originally projected, but they should be positive. And the gold room retrofit should cost only $5 million, so there is a good chance that Centerra’s cash pile will increase further in H2. Centerra is confident enough to maintain its dividend payments at C$0.07 ($0.055) per quarter, which means a very nice 4.24% dividend yield at the current share price.

And here we come to the most interesting part of the recent developments. The negative news from Oksut pressed Centerra’s share price down by approximately 20%. Although a slight recovery followed, the share price is still only $5.19. After the closure of the deal with Kyrgyzaltyn, Centerra’s share count declined by 77,401,766 to 220,083,541. It means that Centerra’s market capitalization is $1.142 billion right now. Centerra ended Q2 with cash on hand amounting to $723.3 million and debt-free. As a part of the Kyrgyzaltyn deal, Centerra paid $85 million in July. Therefore, its current cash on hand should be around $640 million. It leads to an enterprise value of $502 million.

So the market values the Mount Milligan mine, the Oksut mine, the molybdenum assets, and all the exploration assets, including the Goldfield District Project (only recently acquired for $206.5 million), only at $502 million. Mount Milligan alone, with its annual production of around 200,000 toz gold and 70-80 million lb copper, and reserves of 1.84 million toz gold and 736 million lb copper is worth more than this.

Looking at it from a different viewpoint, Centerra has total reserves of 4.849 million toz gold and 1.366 billion lb copper. At the current metals prices, it equals 7.639 million toz of gold equivalent. So the market attributes a value of only $66 to each ounce of gold equivalent contained in reserves. This is a very low value, especially given the fact that Centerra is an actual miner, not only a developer, moreover, after getting rid of Kumtor, the majority of its assets are situated in safe jurisdictions of Canada and the USA.

Conclusion

Since late April, Centerra’s share price declined by nearly 50%. The decline was initiated by the initial reports of the issues at the Oksut mine, and later fueled by the gold and copper price weakness. The latest blow was struck by the recent Oksut mine news. The share price shortly declined below $5, only to return back to its current level of $5.19. This price is below the 10-day, as well as the 50-day moving average, and technically, the picture doesn’t look too optimistic. But fundamentally, the shares are very cheap and I wouldn’t be surprised to see them approach the resistance in the $6.5 area in the coming weeks.

For the remainder of 2022, Mount Milligan will be Centerra’s only producing mine, which will reduce the cash flows. However, it will not mean any problem for Centerra with its huge cash pile. And next year, after Oksut operations return to normal, Centerra will return back to the production rate of 400,000-450,000 toz gold per year. Moreover, the gold-in-carbon inventories contain 58,469 toz gold which will boost Centerra’s financial results as soon as the dore production resumes.

There are some risks regarding the timing of the necessary Oksut mine permits. However, Centerra is undervalued even in a highly improbable nightmare scenario of Oksut not resuming its operations. In my previous article, I envisioned Centerra’s share price doubling. Back then, it meant a share price target of approximately $14. The target remains, only the waiting will be longer. If everything goes well, there are no more negative surprises, and the gold and copper prices remain at least at their current levels, the share price of $14 could be reached sometime in H2 2023. For those waiting, Centerra offers a very nice dividend yield of 4.24%.

Be the first to comment