Sundry Photography

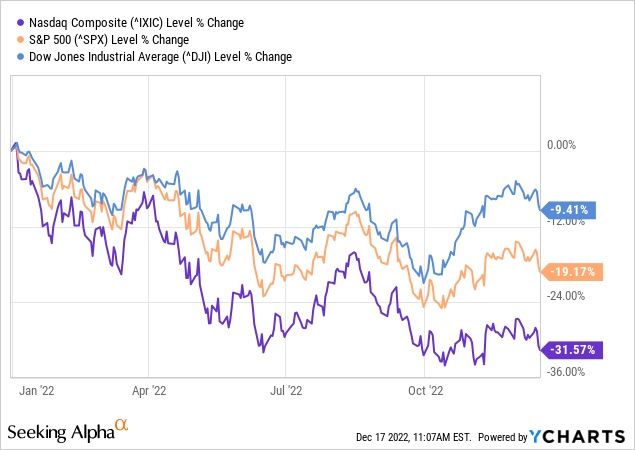

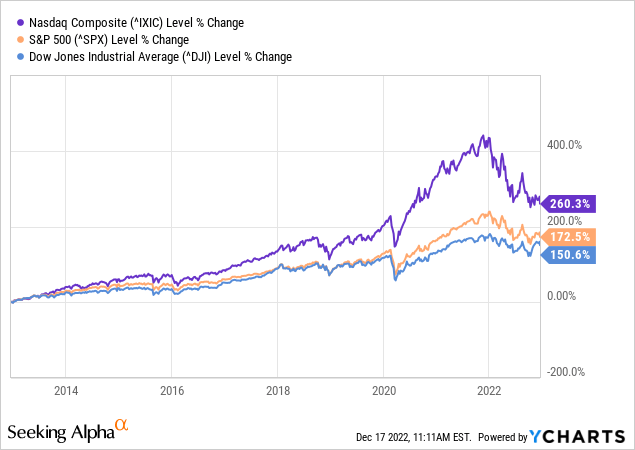

This year has been mainly unkind to investors, despite some successes. All three indices have experienced bear markets, and tech has borne the brunt after flying high in 2020 and 2021.

However, we don’t invest in year-to-date returns. Would it surprise you that the Nasdaq (QQQ) has outperformed the S&P 500 (SPY) and Dow Jones Industrial Average (DJI) over the last three years, five years, and ten years? It has, as shown below.

I know you’re probably sick of hearing this, but it illustrates the adage that time in the market is much better than trying to time the market. And, of course, this maxim is supported by studies and data.

Remember, stocks represent an ownership interest in a company, and the long-term value will be based on the company’s success, not short-term market gyrations.

Where are we headed?

Sometimes it can be hard to keep a level head and perspective with the daily dire headlines blaring. Predicting when the Federal Reserve will again “shock the market” is exhausting and unnecessary for long-term wealth accumulation.

This is the first of the last two articles I will publish on Seeking Alpha before the new year. This one is on tech, and the next will feature my favorite long-term picks across sectors.

Both will focus on a common theme summed up beautifully by one of the greatest hockey players ever:

I skate to where the puck is going to be, not where it has been. – Wayne Gretzky.

The companies featured are future-driven, and I have recently initiated or increased holdings in each. Your unique situation, goals, and risk tolerance dictate whether they are appropriate for you.

It’s feasible that the market will drop in the first half of 2023; many predict it. I definitely don’t have the hubris to call a bottom. But I’ve been adding to my favorite companies as the market dips.

Sometimes buying early on the way down looks like being wrong, but it isn’t. – Billionaire investor Seth Klarman.

Enough intro; let’s dive in.

Analog Devices, Inc is fusing the physical and digital worlds – and delivering cash to shareholders.

We all use dozens of analog integrated circuits, or “chips,” daily, whether we are aware of it or not. Analog chips capture real-world data, like speed or temperature, and translate it for digital use. Industries from medical, aerospace, automotive, clean energy, data centers, and consumer electronics depend on them.

Cars are loaded with semiconductors these days, and the need is increasing. Electric vehicles use even more than ICE vehicles, and the average number of analog chips per vehicle is expected to increase by 26% in 2023 over 2021.

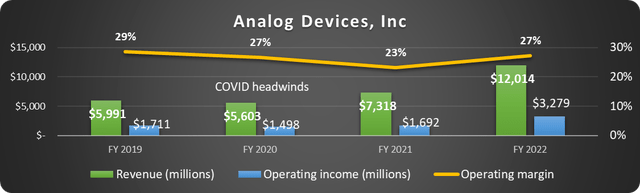

With over 75,000 products and 25,000 customers, Analog Devices, Inc (ADI) is thriving. The company reached $12 billion in sales for fiscal 2022 on 64% growth (much of this growth due to the accretive acquisition of Maxim Integrated). Sales have doubled since 2019, and margins are terrific, as shown below.

Data source: ADI. Chart by author.

ADI derives most of its revenue from the industrial (51%) and automotive (21%) sectors, so it isn’t dependent on the wild swings experienced in consumer electronics.

Outstanding for dividend-growth investing

Cash generation is the name of the game for ADI. The company’s operating cash flow reached 37% of revenue in fiscal 2022, and the free cash flow margin was 31%. For every dollar earned in top-line sales, 31 cents went into the company’s coffers.

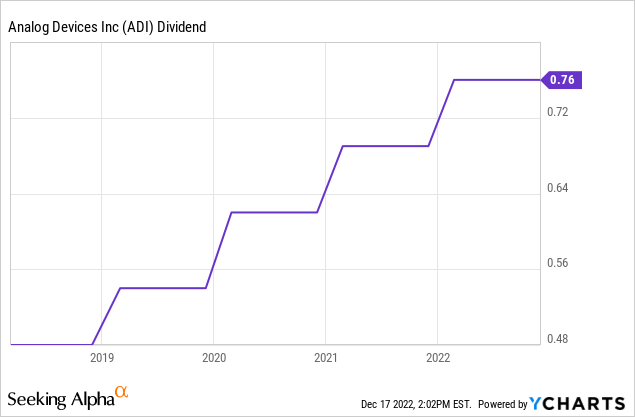

ADI’s long-term plan calls for 7-10% compound annual growth (CAGR) and a 100% return of free cash flow to shareholders through dividends and share buybacks.

The dividend has grown annually since 2004 and pays $0.76 quarterly now, yielding just under 2%. Don’t be put off by the relatively small yield. Because of the rising payout, long-term investors should enjoy a much larger yield on cost. Shareholders should get another raise in Q1 2023.

The stock trades with a price-to-earnings ratio of 31.5, under its 5-year average of 35.

Despite the economy, the company expects more success in 2023, with guidance for $3.15 billion in sales on a 33% operating margin.

ADI isn’t a growth stock that will make us overnight millionaires, but it makes a compelling case for long-term investment.

Palo Alto leads the way in cybersecurity

Cybersecurity is a massive undertaking. Businesses of all kinds, governments, infrastructure providers, and even school districts, need leading solutions. Our reliance on the cloud and hybrid workforce increase demand.

Palo Alto Networks (PANW) was a firewall provider with larger aspirations just a few years back. Management has done a tremendous job transforming it into a next-gen cloud and network security leader, with 82% of sales now subscription based. Palo Alto is a favorite of the largest companies in the world, with 50% of the Global 2000 as customers.

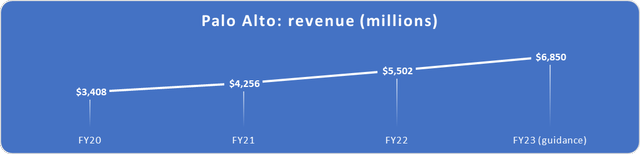

The company’s growth has outpaced a fast-growing industry, as shown below.

Data source: PANW. Chart by author.

Multiple positive key indicators

The economy may cause a pullback in IT spending in 2023, but Palo Alto’s key performance indicators ((KPIs)) point to accelerating growth long-term.

- Sales growth has increased from 18% in fiscal 2020 to 29% in fiscal 2022. Palo Alto expects another 25% increase in fiscal 2023 – a slight slowdown in percentage, but a larger increase in dollars.

- The remaining performance obligation (RPO) reached $8.3 billion last quarter on 38% YOY growth, and billings rose 27%. These leading indicators are outpacing sales growth, suggesting positive long-term trends.

- Cash from operations hit $2 billion on a 36% margin in fiscal 2022. This is buoyed by $1 billion in stock-based compensation (SBC); however, the company also repurchased $900 million in stock.

- Q1 fiscal 2023 marked the second consecutive quarter of GAAP profitability.

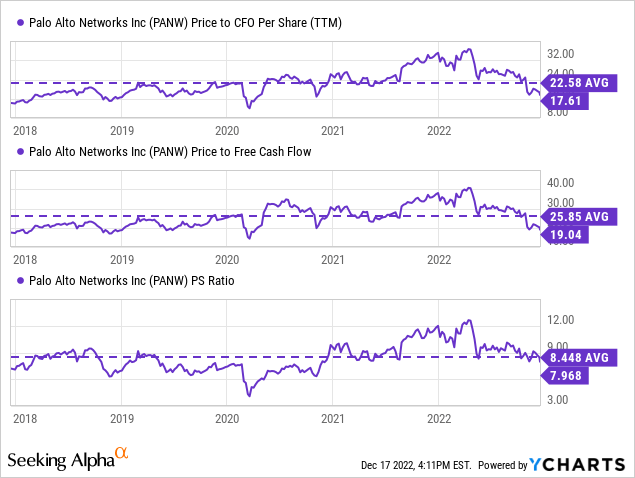

As shown below, the stock trades at favorable cash flow multiples and just under its 5-year average sales multiple.

Palo Alto’s growth, imminent GAAP profitability, and vision make a strong case for our investing dollars.

Could tightening ad budgets benefit The Trade Desk long-term?

Marketing is a dynamic field these days. Advertisers must reach consumers through modern media like streaming television (think Netflix or Disney+), video (like YouTube), mobile devices, and websites.

Reaching the targeted audience is critical and likely to get even more important as advertising budgets tighten. Marketers must reach their consumers with less waste, which means harnessing data and automating the process.

The Trade Desk’s (TTD) platform accomplishes this for clients.

All signs point to a recession in 2023, and advertising stocks have taken a beating. A recession could mean slower growth for The Trade Desk next year. But, tighter budgets could also highlight The Trade Desk’s innovative platform leading to long-term outperformance.

Tremendous growth and healthy cash flow

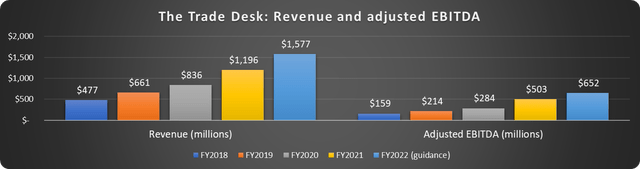

On the financial front, sales reached $1.1 billion through Q3, with 36% growth. The company has been slightly profitable for many years and produces a healthy dose of cash from operations – $375 million, or 35% of sales, so far this year.

Shown below are the company’s rapid revenue and adjusted EBITDA growth.

Data source: The Trade Desk. Chart by author.

The balance sheet is strong, with $1.3 billion in cash and short-term investments and no long-term debt.

A note on stock-based compensation

The Trade Desk uses lucrative SBC to reward founder and CEO Jeff Green. This is a big reason the company produces a lot of cash yet doesn’t show significant GAAP profits. Green’s stock options vest over many years based on successively higher stock price targets. Many investors are uncomfortable with this level of compensation. So it’s important to highlight this so we can make an informed decision.

If The Trade Desk succeeds wildly, few will question this in five years, but that is no guarantee.

Is The Trade Desk overvalued?

Growth stocks are notoriously difficult to value. Price-to-earnings ((P/E)) ratios are useless for a high-growth stock with little GAAP earnings. A discounted cash flow model involves numerous assumptions that drastically change the perceived fair value. But we can try.

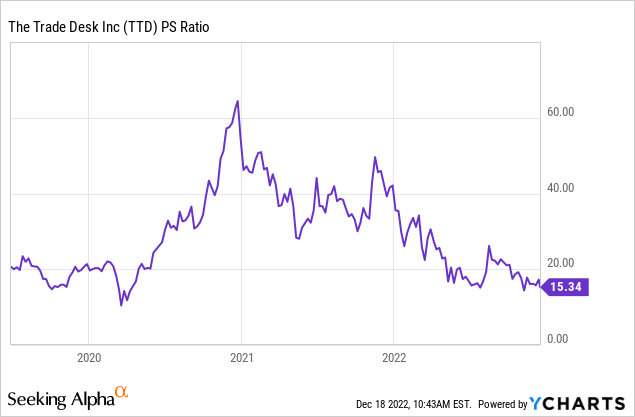

The stock price has been decimated this year, falling 50%. This puts the price-to-sales ((P/S)) ratio below its pre-pandemic level, as shown below.

Meanwhile, the business is undoubtedly stronger than it was three years ago. This suggests three things:

- Risk appetite has dried up;

- The market is pricing in a significant advertising slowdown; and

- The price may have overcorrected to the downside if the company continues to succeed.

What’s next for The Trade Desk?

Connected television is a mammoth growth driver as more services introduce tiered ad-based subscription plans. International growth is a focus, as this fertile market accounts for just 14% of current sales. Retail media, or shopper marketing, is also a growth driver.

Walmart (WMT) partnered with The Trade Desk to build Walmart Connect, and Albertsons and The Trade Desk initiated a strategic partnership in June 2022.

Advertising is going through a transformational shift, and PepsiCo is excited about the impact data-driven advertising is making,” said Shyam Venugopal, SVP of Global Media and Commerce Capabilities at PepsiCo. “The partnership between The Trade Desk and Albertsons Media Collective is enabling brands to drive better control and decision making, as well as greater transparency across our media buys to give us the ability to leverage first-party data to reach the right consumer. – The Trade Desk news release.

The Trade Desk’s management is well compensated, and they have delivered results so far. The company can flourish, and shareholders will be rewarded if it does.

What about Big Tech?

Speaking of digital advertising, nothing is more important than being on page one of Google Search. Search advertising is vital because these consumers are ready to buy. Why else would I be searching for a 24″ quiet stainless dishwasher? “Google” is a verb for a reason. This gives Google-parent company Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) significant pricing power even in a recession.

My previous article featured a point-counterpoint argument about whether to sell the company or add after the stock’s 30% drop. I’ve been digging since and keep returning to one key: cash flow.

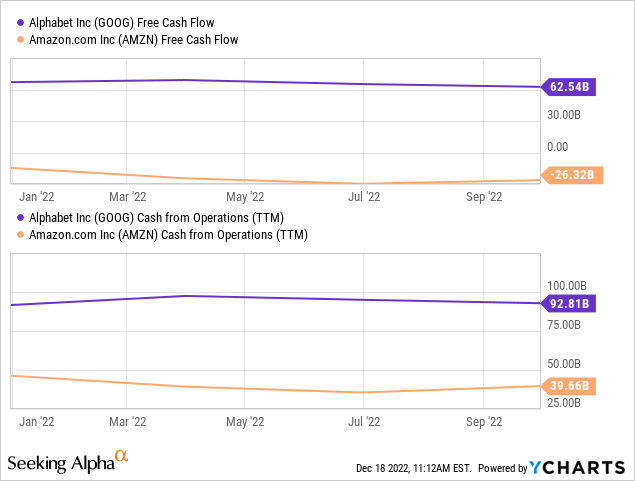

Google continues to rake in dollars despite the stock price’s 30% drop, losses from Google Cloud, advertising headwinds, and labor costs. It is juxtaposed with Amazon (AMZN), which also has significant headwinds, below.

Amazon has hemorrhaged cash because the retail business is shallow margin. Even small bumps in the road crush profits. AWS is its saving grace; however, it looks like it will also face a slowdown.

How are Alphabet’s results this year?

The company’s YTD results are respectable, not spectacular.

Revenue is up 6% to $69.1 billion, hampered by the strong dollar. In constant currency, revenue gained 11%. Google Search (+13%) and Google Cloud (+39%) lead the charge.

Operating income is steady YTD at $57 billion, but the margin has declined from 31% to 27%. The margin decline is worrisome; however, it is still well above the 2018 (24%), 2019 (22%), and 2020 (23%) figures.

A big reason for the decline in margins is the hiring spree that increased the workforce by 24%, or 37,000 employees. Unfortunately, layoffs will likely come soon.

What’s next?

CEO Sundar Pichai has vowed to make Google 20% more efficient. The attention to controlling costs is terrific news for shareholders.

Google Cloud continues to grow like a weed but posts operating losses each quarter. Cloud revenue has exploded from $8.9 billion in 2019 to $24.5 billion over the last twelve months. Growth will likely slow in 2023 as companies cut back on spending, but this segment has tremendous long-term potential.

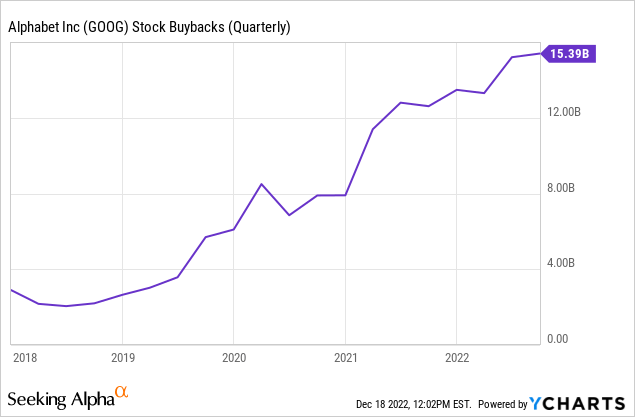

Google announced a $70 billion increase to its stock buyback program this year and has repurchased $44 billion in stock so far – well ahead of last year’s pace, as shown below.

This will support shareholders and leverage future returns as the company can take more shares off the market while the stock price flounders.

The balance sheet is a fortress, even after using this cash for buybacks. Cash and investments sit at $116 billion, with long-term debt of $14.7 billion. This suggests the buyback program should continue in earnest.

I don’t know precisely when Big Tech will rise from the doldrums, but when Alphabet stock does rise, I expect the initial rally to be swift.

These stocks present diverse opportunities in the tech space. Please remember to consider your risk tolerance, dollar-cost average, and do due diligence.

I wish everyone the best this holiday season and a healthy and prosperous 2023.

Remember what Buffet said, “The stock market is a device for transferring money from the impatient to the patient.”

Be the first to comment