iambuff

The S&P 500 fell for a fourth day in a row yesterday, slowly burying our chances for a Santa Claus rally in a pile of coal. That makes Chairman Powell the Grinch who stole Christmas with the intent of capping the two-month rally that lifted the index 17% off its October low. He obviously didn’t like the loosening of financial conditions caused by the stock market’s recovery, and his hawkish rhetoric has rejuvenated the bears who seem intent on having a recession next year. Despite what is bound to be the worst year for the stock market since the global financial crisis in 2008, the growing consensus on Wall Street is convinced that next year will be worse. I have never seen such certainty in an outlook for a coming year in my 30 years as a financial professional.

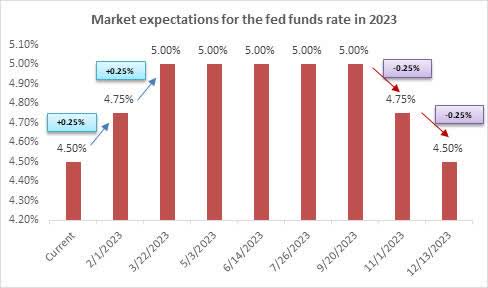

Evidently, the Fed will raise interest rates two more times during the first quarter, as inflation remains elevated and the rate of economic growth slows to stall speed. That will produce a recession by this summer, as corporate profits collapse and the S&P 500 grinds to new bear-market lows. This will provoke the Fed to cut rates by year end, instigating a rebound from much lower levels during the second half of the year. Therefore, investors should dump stocks today and buy bonds, so that they can reverse that process this summer before the market starts its recovery in the fall. It sounds so simple.

Edward Jones

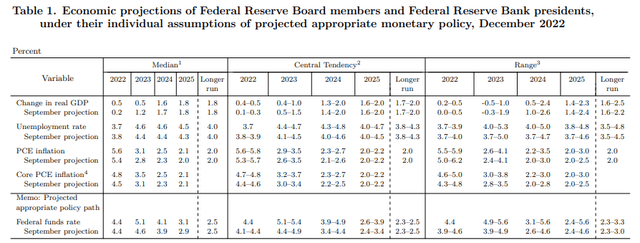

The problem I have is that this outlook is based largely on what Chairman Powell and members of the Fed have said they intend to do. Those intentions are based on their own outlooks, which are detailed in their Summary of Economic Projections. Last week’s update revealed that they expect the economy to grow 0.5% next year, while the Fed funds rate peaks at approximately 5.1%, the unemployment rate rises to 4.6%, and the rate of inflation falls to 3.1%. If these projections are accurate, then Wall Street’s outlook may also be accurate, but therein lies the issue.

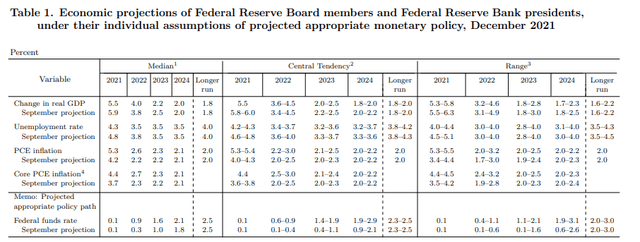

The bears keep telling me to listen to the Fed, follow the Fed, and not fight the Fed, as though this institution is all-knowing and in complete control of the situation. How would that have worked out one year ago? In the Fed’s Summary of Economic Projections for 2022 it forecasted that the economy would grow 4%, the rate of inflation (PCE) would be just 2.6%, and that it would raise short-term interest rates just three times by 25 basis points each to just under 1%. The Fed could not have been more wrong on every metric last year.

It is important to remember that the Fed’s statements and outlooks are more rhetoric than they have the potential to be in reality. They are about managing expectations, which is a game they have largely won on the inflation front. As for reality, the Fed has a horrible track record of predicting just about everything, which includes its own actions. I think its 2023 projections will be no better than the ones for 2022, which makes them a poor baseline for a market outlook. I am working on my own between now and year end, which will be based solely on the trends I see in the high-frequency data on hand.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment