NeonShot/iStock via Getty Images

Revolve Group: A Growth Company with Resilience in the Face of Adversity

Like many other growth companies, Revolve Group (NYSE:RVLV) has suffered significantly. The shares dropped as much as 77% from its all-time high in November of 2021 to its 2022 low at $20.17 last month. We believe RVLV is an amazing company and will consider it a buy once it reaches the $20 level. Revolve Group isn’t like most of these other growth companies though. Even though its share price got slaughtered along with other growth companies, Revolve Group’s biggest distinction was that it was able to resume growing after Covid-19 tailwinds ended. This is in huge contrast to other growth companies like Oatly Group (OTLY), which saw a significant decrease in gross profits and a big increase in operating loss.

Revolve Group is a fashion retailer which targets Millennials and Gen Z. Millennials and Gen Z are increasingly buying products/services based on whether they feel connected with the values of that brand. The company mostly sells medium-to-high-value items. This could make the business a bit more recession-proof as they have a high net worth target audience.

Revolve’s Strong Q3 2022 Results Despite Challenging Macro Environment

Q3 2022 was another great quarter for Revolve. Comments of the 2 co-CEO’s say it all. As can be seen below:

We delivered another profitable quarter with double-digit growth in net sales in the third quarter of 2022, despite the increasingly challenged macro environment. Furthermore, we generated meaningful growth in cash flow year-over-year, further bolstering our already strong balance sheet.” – Karanikolas

“With our profitable business model and strong balance sheet, we are excited about our continued investments in our brand and technology that we believe will enable us to further capture market share in pursuit of our very large global market opportunity,” – Mente

The numbers below are from the Q3 Presentation, unless otherwise mentioned

- Total net sales (Q3): $268.7 million, an increase of 10% YoY

- Gross profit (Q3):$142.4 million, an increase of 6% YoY

- Gross margin (TTM): 54.57% decrease of 0.38% according to Seeking Alpha.

- Net income (TTM): $80.2 million

- Diluted earnings per share (EPS) was $0.16, a year-over-year decrease of 27%.

Yes, some of these numbers are not great. We would have preferred to see a higher net income and higher (EPS), but when we take the current macro conditions into consideration I believe these are still great results and this indicates for me that RVLV shows resilience.

In addition, Revolve is already a profitable company, which we love to see for a growth company. With a current (PE) (FWD) ratio of 30.77 it is still relatively expensive, but for a company with the potential of Revolve, we believe this is definitely not too high to make a first initial investment. Furthermore, RVLV has a pristine cash position of $244 mln, which is almost 14% of its current market cap. This is a nice cushion to have in times of macro-economic troubles.

If we make some comparisons with peers (according to Seeking Alpha) we can see the following. We use the following peers SIGNA Sports (SSU), Xometry (XMTR), Dada Nexus Limited (DADA), Farfetch Limited (FTCH) and Vivid Seats (SEAT).

| RVLV | SSU | XMTR | DADA | FTCH | SEAT | |

| Gross Profit Margin | 54.57% | 22.48% | 37.85% | 36.45% | 45.41% | 78.80% |

| Net Income Margin | 7.41% | -25.97% | -21.58% | -25.41% | 71.44% | 3.66% |

| ROA | 14.66% | -9.87% | -8.90% | -48.61% | -13.30% | 6.69% |

| Return on Total Capital | 18.50% | -19.28% | -8.82% | -23.42% | -35.19% | 8.59% |

(Image created by the author with data from Seeking Alpha)

In my personal opinion, Revolve is doing great across the board. Farfetch Limited is an interesting competitor, but Farfetch is still unprofitable, which is why we believe Revolve is a much better pick. We can’t really call Vivid Seats a peer as it is in a whole different industry.

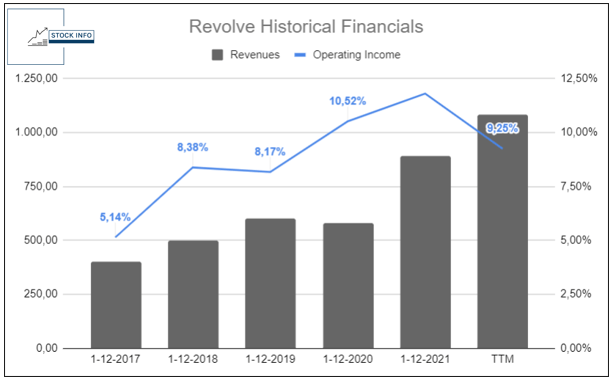

If we zoom out a little and look at the long-term performance of RVLV we see this. As you can see below, Revolve has been able to grow revenues aggressively. Revolve Group has a 5Y Compounded Annual Revenue Growth Rate (CAGR) of 16.76%, which is absolutely magnificent when we take into consideration that RVLV was already profitable 5 years ago. In addition, the 5-year Operating Income (CAGR) is 19.14%, which is very impressive.

Stock Info with Seeking Alpha Data (Seeking Alpha)

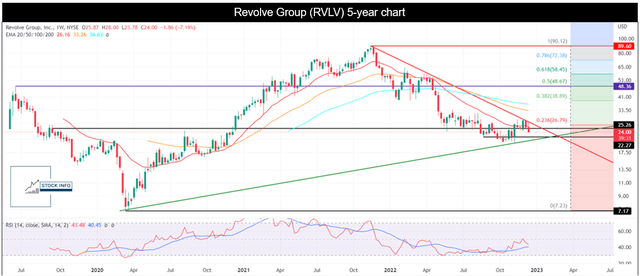

By considering all of these figures, it becomes clear that Revolve is a compelling investment opportunity. The company has demonstrated profitability and strong growth in various areas, and has also been successful in expanding its clothing lines and securing brand partnerships. Overall, RVLV presents a promising investment opportunity. While the price-to-earnings ratio of 30 may appear high at first glance, it is not uncommon for high-quality companies to have a higher valuation. Additionally, considering the potential for continued growth that Revolve has ahead of it, we do not view this valuation as excessively expensive. If the stock were to decline further to the $20-$21 range, it would represent a very attractive level based on the charts provided in this article. At $20 per share, the price-to-earnings ratio would be 25, which would be considered a good value given the company’s fundamentals. If the stock were to fall to $16 per share, the P/E ratio would be an exceptionally low 20, making it an extremely attractive opportunity for an investment in a company with strong growth potential like Revolve.

Revolve Group’s Unique Influencer Marketing Strategy

As branding has become more and more important for retail companies, RVLV has focused on a unique strategy to engage their target customers. Revolve Group saw the opportunity in Influencer Marketing and implemented this successfully. Revolve even has a specific Influencer program through which influencers can apply to become an influencer for the company. The influencers working for Revolve and their other brands like FRWD are called brand ambassadors. RVLV believes strongly in this way of marketing as it is the best way to reach their Millennial and Gen Z customers. In 2021 Revolve launched this brand ambassador program, which resulted in the onboarding of over 30,000 members and drew a waiting list of 10,000 additional applicants. The program grew rapidly, becoming one of RVLV’s top traffic sources, generating incremental net sales, and yielding dynamic data insights. as stated in this press release. Marketing through influencers puts Revolve in a unique position to gather useful data about their target customers. This way the company is able to target its customers at the right time with the best clothes through its impressive data-analytics system.

Revolve Model (Instagram of Revolve)

As such, RVLV was able to develop a loyal community that the younger generation loved and trusted. Revolve Group currently has 3 segments, Revolve, Revolve Man, and FWRD. Revolve, which is the biggest segment is focused on woman’s apparel, meanwhile, FWRD is described as: ” your ultimate online destination for all things luxury, featuring the world’s most-coveted designers.”

The company sells over 70,000 apparel, footwear, accessories and beauty styles and on average launches 1,300 new styles per week. In addition, the company has over 30 owned brands on its website, which each focus on different types of customers. Currently, the average customer spends around $300 a quarter on Revolve clothing.

Some more metrics show that Revolve is able to continue its growth trajectory even with the current macroeconomic headwinds.

- Active customers increased by 84,000 during the third quarter of 2022, growing to 2,249,000 as of September 30, 2022, an increase of 34% YoY.

- REVOLVE segment net sales were $222.1 million, an increase of 9% YoY.

- FWRD segment net sales were $46.6 million, an increase of 17% YoY.

- Domestic net sales increased 10% year-over-year and international net sales increased 12% YoY.

The Dynamic Duo Leading Revolve Group to Success

Revolve Group has an interesting management team. It is one of the few companies that operates with 2 CEO’s. The pair worked together at NextStrat. Mike Karanikolas worked as a Software engineer while Co-CEO Michael Mente worked for NextStrat as an analyst. The rest of the management can be seen by clicking HERE. Karanikolas mostly focuses on finance and logistics, while Mente is focused on merchandising, user interface and, above all, Revolve’s industry-leading influencer marketing strategy. This last part – the Influencer marketing strategy – is what made this company different from its competitors and they still reap the benefits of it today.

The pair has an amazing track record with Revolve, as they were able to utilize consumer analytics and influencer marketing to propel an e-tailer from obscurity into a billion-dollar success, two decades after they left NextStrat in the aftermath of the dotcom bubble.

Unfortunately, there haven’t been any insider transactions worth mentioning. The only insider transactions that happened were option exercises with an according sale. This still indicates that insiders aren’t actively selling, which is a positive point. We would gain additional confidence if the insiders would start buying company stock. As we mentioned in our article on Corsair Gaming (CRSR), “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise,” which is a beautiful quote by Peter Lynch.

Navigating the Challenges of a Recession: The Case of Revolve”

As we are all aware of the looming recession has an effect on all kind of stocks. A decline in consumer spending can pose significant risks for companies like Revolve. When consumers reduce their spending, it can lead to a decrease in demand for the company’s products, which can result in lower sales and revenue. If the decline in consumer spending is significant and prolonged, it could also lead to financial problems for the company, such as difficulty in meeting debt obligations or difficulty in maintaining profitability. It is worth noting that Revolve has a strong cash position, accounting for 14% of its market capitalization as previously mentioned. Additionally, a decline in consumer spending may lead to increased competition as other companies try to attract customers, which could put pressure on Revolve’s market share and profitability. In summary, a decline in consumer spending can have a negative impact on a company’s sales, revenue, and profitability, and may lead to increased competition and financial challenges if profits would decline. Fortunately, As a retailer that primarily sells medium-to-high-value items, Revolve should be somewhat insulated from the impact of a recession. This is because the company targets a high net worth audience, which may be less affected by economic downturns than lower income consumers.

Technical Analysis

As can be seen in the chart below, RVLV suffered in 2022. The company lost close to 75% of its value since its all-time high back in November of 2021. This indicates RVLV has suffered as much as a lot of other growth companies while it is in much better condition, as I hope is clear if you have read this far. If we take a look at the chart we see that the company has been in a significant downtrend, but we are close to seeing a break-out either on the upside or downside. The red trendline resistance is the one to watch. A breakout above that line could make the stock move toward $30+ fairly quickly. The blue 200DMA line would become the most notable resistance then. But, of course, due to the rough conditions the market is in, we could see more downside in the market for the next few months, which could affect RVLV stock. The green trendline support is a must-watch in our opinion and is the level to hold. This is also where I would become very interested in buying if the company is able to hold this level.

If we take a look at the long-term chart of RVLV, we can see that the company only started trading back in 2019. The company initially fell, which happens most of the time with IPO’s. The bottom arrived in 2020, during peak Covid-19 fears. Afterward, the stock skyrocketed and went up over 10x from its pandemic low due to Covid-19 tailwinds. Ever since then, it has been on a decline, which is partially deserved as the stock definitely was overvalued at its peak. Long-term, we believe that the company can reach its all-time highs again. Currently, the 20WMA is acting as significant resistance. Again, the green trendline is where we would like to see the stock hold and where we would consider taking a position. We believe that the $20-$21 price range, which represents the pre-COVID-19 highs, is becoming increasingly attractive. This also aligns with the current green trendline support.

Conclusion: Revolve Group is a Buy with Long-Term Growth Potential

We believe that Revolve is a company operating in a niche market in which it is still ahead of its competitors. Revolve has a large following of loyal fans, which keeps on expanding. In addition, growth companies have been getting slaughtered this year (mostly justified as valuations went through the roof), but we believe this return to the mean creates interesting opportunities. In our opinion, Revolve group is one of them. This is a growth company, which has still a lot of growth ahead of itself. We believe that if the company is able to continue to execute, and is able to weather the storms of the current recession, then it will thrive in the upcoming years. This is why we currently give it a buy rating, as we believe the company is a solid long-term hold. We believe that everything around the green trendline support is a nice initial buy. If the stock would fall towards the $15-16 level, which would correspond with a 20 (PE), it is incredibly attractive in our opinion, in which we would back up the truck (if nothing has changed fundamentally). In that case, we would rate the company a Strong Buy. As of now, we believe the company is an attractive buy, but we believe the stock can become even more attractive. This is why we believe the company is currently worthy of a buy rating.

Be the first to comment